Summary

- Telefonica is the incumbent fixed-line and wireless telephone operator in Spain.

- TEF is a leader in convergence, where it cross sells fixed-line and wireless telephone services.

- TEF dividend growth profile is difficult to determine as currency has a major impact on dividends paid.

In this decade, telecommunications took a major role in our everyday routine. Whether it’s from simply watching TV, surfing the net or streaming your favorite shows, you’re depending on a well-delivered service time after time. Telefonica (TEF) saw this trend coming and is now a major player in its industry. The 95-year-old business delivers sustained financial results, as well as payout for their faithful investors. The telecom industry is not the easiest one, pushing every player to take their game up a notch, which is precisely what TEF is in the process of doing. For investors, it’s a waiting game.

Source: Pixabay

Understanding the Business

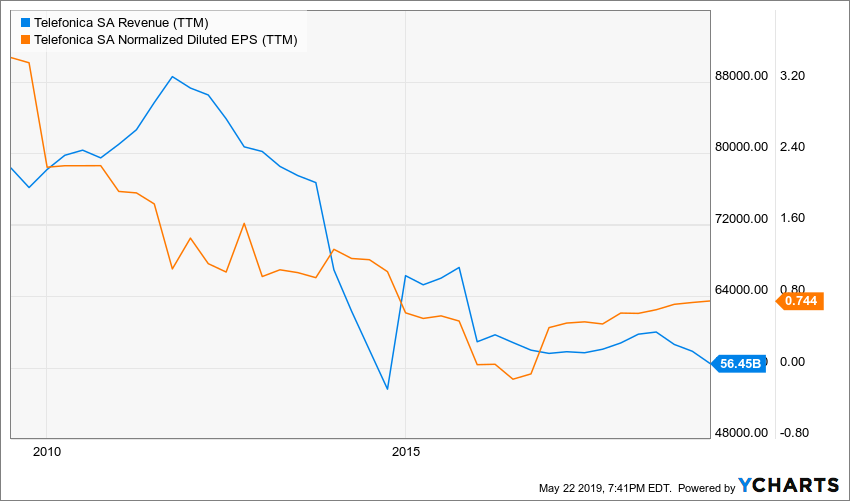

While TEF is not widely spread in North America, it’s a whole other reality in Europe and Latin America. The communication company operates in 17 countries, serving 343M customers, from which 79% are from mobile services. TEF also reported €48.69M, a 6.4% decrease compared to 2017. They also benefit from a geographic diversification, which is sustained year after year. Four brands are run by the company: Telefonica, Movistar, Vivo and O2.

Source: Telefonica 2017’s Factsheet

Telefonica relies on a well-structured business model comprised of four platforms. Physical assets, IT & Systems, Products and Services, as well as Cognitive Power. Each of them is fueled by the management vision for the company, as well as expected growth through their segment.

TEF employs nearly 123,000 employees to support their operations around the globe. They also placed 9th in the Dow Jones Sustainability Index of 2017 and won World’s Most Admired Companies 2017 from Fortune’s ranking.

Growth Vectors

As with many communication businesses, their main vector stays within their available technology. Going back to their platform business model, TEF invested massively to modernize, digitalize and personalize their customers’ experience. Benefiting from a wide geographic diversification, the company is in the process of reallocating resources to capture better technology. Physical assets are bought, as well as specialized professionals in order to further develop their customer basis.

In the last few years, the company also invested in other companies through minority ownership. They are now in a process of revising some investment, as they did for the recent sale of their stake in Seguros de Vida y Pensiones Antares, an insurance company for a €161M consideration.

Dividend Growth Perspective

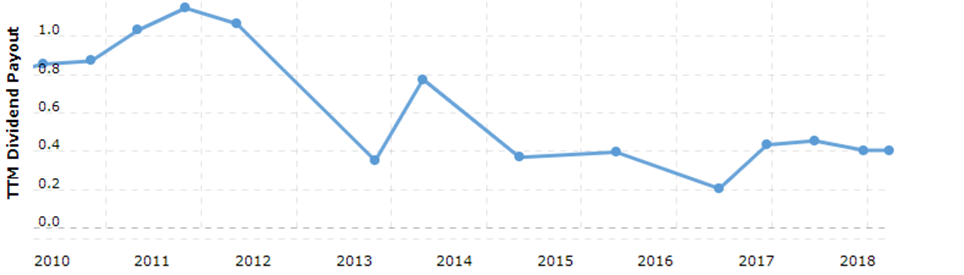

When looking through TEF dividend history, we can’t actually see any clear pattern. They have delivered semi-annual dividends of €0.20/share in the last 2 years and are probably going for the same payout in 2019.

Source: Macrotrends

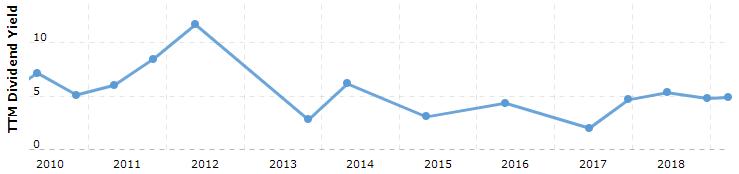

This won’t come as a surprise for anyone to see such a hectic chart. Closely following dividend payouts, the yield generated by TEF now stabilizes at around 4.7%. Comparing this figure with other telecom services, it is quite similar. Industry average shows a 4.64% value, confirming that TEF is apart from the mass.

Source: Macrotrends

Taking a quick look at TEF’s payout ratio, it is now at 57%. Industry average can be witnessed at a 39%, meaning that perhaps TEF is having trouble finding new investment opportunities or reinvesting in its operations. It is not an alarming sign, but if the situation persists, competition might eventually come on top, slowly taking in market shares.

Potential Downsides

The major risk the company faces resides in one of its strength: geographical diversification. While this type of diversification limits the contagion effect when bad luck occurs, it also increases the monitoring of economic and politic environment in each of them. Events like the Brexit, economic tensions between Europe and China, political uncertainties in Catalonia and Argentina’s financial imbalance, all pose a threat to TEF operations. Whether it’s from penetration of new market, sustaining actual market share or simply to abandon businesses in some countries, TEF sales can quickly take a hit.

In addition, the company needs to stay in line with its currency exposure hedging. As of December 2018, 73.6% of the Group’s financial debt was linked to fixed interest rates, with 18.7% in denomination other than the euro. With economic concerns rising globally, interest rates are expected to fluctuate in the upcoming quarters, adding to the monitoring struggles of TEF.

When we look at the communication dividend sector list, we realize that many of them offer great dividend yield, but little to no growth. Vodafone (VOD) even surprised the market by cutting off their dividend not too long ago. This tells us that giant telecoms with giant debts could also go sideways and fail their promise to shareholders.

Valuation

As it was the case for Nestle (NSRGY), we have used the dividend discount model with a dividend converted in USD. This certainly has an effect on its valuation.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $0.46 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 2.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 2.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $8.04 | $7.04 | $6.26 | |

| 10% Premium | $7.37 | $6.45 | $5.73 | |

| Intrinsic Value | $6.70 | $5.87 | $5.21 | |

| 10% Discount | $6.03 | $5.28 | $4.69 | |

| 20% Discount | $5.36 | $4.69 | $4.17 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Final Thought

As it is the case for many telecoms with a high yield, TEF has little to offer besides its distribution. Since you are facing currency fluctuations with TEF, you might want to consider Canadian telecoms instead. Companies like Telus (TU) or BCE (BCE) trades on the NYSE and offer stronger dividend growth. Telus management has notably announced a dividend growth policy of 7% to 10% through 2022. There are definitely better opportunities in North America if you are looking for telecoms!

Disclosure: We do not hold TEF in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply