Summary

-Intel is a large and complex tech company that seems to be transitioning to a value stock.

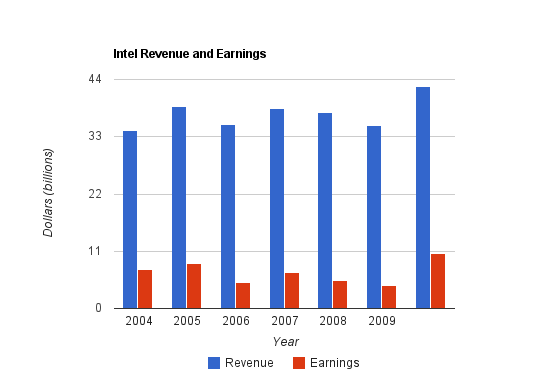

-Revenue, earnings, and cash flow have been erratic.

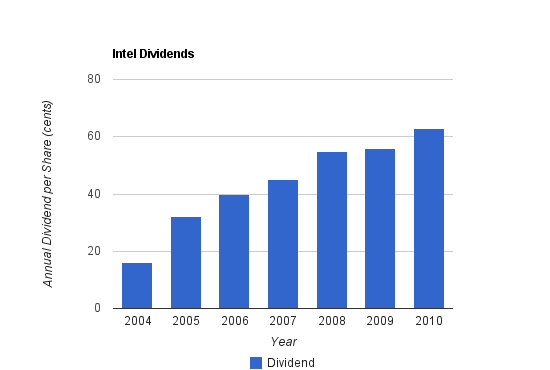

-The current dividend yield is approximately 3% with a low payout ratio.

-The dividend growth rate over the past few years has been in the double digits.

-The balance sheet is very strong.

-With a P/E of less than 12, the question is, is Intel a value play or a value trap?

Overview

Intel (NADAQ: INTC), is the world’s leading semiconductor company and produces some of the most technologically advanced products in the world. According to a recent press release, the company makes over 10 billion transistors per second.

Operating Segments

Intel is currently divided into nine operating segments:

PC Client Group

Data Center Group

Embedded and Communications Group

Digital Home Group

Ultra-Mobility Group

NAND Solutions Group

Wind River Solutions Group

Software and Services Group

Digital Health Group

Geographic Revenue Breakdown:

In 2009, Intel derived 55% of revenue from the Asia-Pacific region, 20% from the Americas, 15% from Europe, and 10% from Japan. In comparison, back in 1999, Intel derived 23% from Asia-Pacific, 43% from the Americas, 27% from Europe, and 7% from Japan.

Revenue, Earnings, Cash Flow, and Metrics

Intel has been in a period of slow and erratic growth.

Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $42.735 billion |

| 2009 | $35.127 billion |

| 2008 | $37.586 billion |

| 2007 | $38.334 billion |

| 2006 | $35.382 billion |

| 2005 | $38.826 billion |

| 2004 | $34.209 billion |

Over this period between 2004 and 2009, Intel experienced less than 1% revenue growth. The trailing-twelve-month period, however, shows a substantial rebound.

Even taking a step back and looking at Intel’s progress over a longer period, however, the company has not grown so well. Revenue in 2000 was $33.7 billion and 9 years later in 2009, the revenue was $35.1 billion.

Earnings Growth

| Year | Earnings |

|---|---|

| TTM | $10.566 billion |

| 2009 | $4.369 billion |

| 2008 | $5.292 billion |

| 2007 | $6.976 billion |

| 2006 | $5.044 billion |

| 2005 | $8.664 billion |

| 2004 | $7.516 billion |

Earnings growth over the 2004-2009 period has been deeply negative. The trailing-twelve-month period, however, has seen a large rebound.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| TTM | $14.547 billion |

| 2009 | $11.170 billion |

| 2008 | $10.926 billion |

| 2007 | $12.625 billion |

| 2006 | $10.620 billion |

| 2005 | $14.823 billion |

| 2004 | $13.119 billion |

The cash flow pattern follows the same general pattern as earnings, although the numbers are significantly less erratic.

Metrics

Intel has return on equity (ROE) of 10.75. Intel stock currently has a P/E of 11.5 and a P/B of 2.7.

Dividends

Intel currently yields approximately 3% and pays out approximately a third of its EPS as dividends.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $0.63 | 2.90% |

| 2009 | $0.56 | 2.90% |

| 2008 | $0.5475 | 2.20% |

| 2007 | $0.45 | 1.70% |

| 2006 | $0.40 | 0.90% |

| 2005 | $0.32 | 0.40% |

| 2004 | $0.16 | 0.40% |

The annualized dividend growth from 2004 to 2010 has been over 25%. The most recent increase was 12.5%, and the increase before that was only 2%. The increase for 2011 will be to $0.18 per quarter, which is nearly 15% over the current year.

Balance Sheet

Intel has a very strong balance sheet. The current ratio is over 3, and total debt to equity is a tiny 0.05. Goodwill and intangible assets make up a fairly small part of total shareholder equity.

Investment Thesis

Intel is clearly a value stock now. The primary question, however, is whether it is a value play or a value trap.

Bad News for Intel

Intel has not experienced an easy decade. The millennium started with the tech crash. During the middle of the decade, Intel experienced strong competition from AMD and had a couple of years of disappointing performance until it solidified its leading position. More recently, Intel has largely missed out on the mobile computing wave because its processors are powerful but not as energy efficient as some competing products. Intel currently has a huge market share of personal computers which, according to many, is not a particularly good area to be in with the rise of both mobile computing and cloud computing. Intel is essentially comparable to Microsoft in this aspect, except on the hardware side.

Recently, Intel announced plans to acquire McAfee, and this is the largest acquisition in Intel’s history. Whether this falls under “good news” or “bad news” is for the reader to decide, but based on the stock valuation, this news has investors jittery, and for good reason.

McAfee is a large provider of security software. Intel hopes to turn McAfee into a wholly-owned Intel subsidiary, and to integrate McAfee’s software into Intel’s hardware lineup to achieve synergies.

First of all, this acquisition shows Intel taking a serious detour from its hardware route. Whereas Texas Instruments (TXN) has been focusing and streamlining its business, Intel has taken the opposite approach and has been diversifying its business. Intel has called this a transition from a PC company to a computing company.

Secondly, the price that was paid does not seem particularly justifiable unless several assumptions of synergies are completely accurate. Intel agreed to pay $48/share, which represents a 60% premium to McAfee’s already rich stock price at the time. This deal is planned to be an all-cash transaction, with Intel paying $7.68 billion, net of cash for $6.8 billion. McAfee currently has about $175 million in net earnings, depending on which full-year period is used.

Paying $6.8 billion for $175 million in earnings translates into a P/E of about 40. McAfee has doubled its revenue between 2005 and the current trailing-twelve-month period, and over that same time period has grown earnings from roughly $140 billion to roughly $180 million. This is revenue growth of approximately 18%, and earnings growth of approximately 5%. The PEG ratio based on company earnings for this investment from Intel’s standpoint, then, is 8. In order for this purchase to be worthwhile, Intel is going to have to derive some serious growth from McAfee or some translational growth in improved hardware/software synergy.

Good News for Intel

The company seems to be reaching a point where growth investors are fleeing and value investors are stepping in. A translation like this may result in a fairly undervalued stock price.

Intel has continued to invest heavily in this recession. The company is opening up a new multi-billion dollar research and development facility in Portland, Oregon, and is re-tooling four other US locations to develop 22nm chips (from 45nm and 65nm). Intel produces microprocessors with 45nm process technology and 32nm process technology, and will be producing with 22nm process technology in 2011.

Internet traffic has a 40% annualized growth rate, with video and file sharing leading the bandwidth growth. With smaller chips and more mobile devices being connected to the internet, Intel realizes that security is of immense importance. In less than 3 years, Malware in McAfee’s databases has more than quadrupled.

That’s why Intel considers its three pillars to be energy efficient performance, internet connectivity, and security.

Intel’s current enterprise solutions can save 90% on energy costs compared to older technology, and Intel has become aware of its need to keep its mobile products extremely energy efficient. Their server solutions are in place to take advantage of cloud computing trends.

In addition, Intel predicts growth from cloud computing, mobile computing, the embedded market, and connected TVs.

Risks

Intel faces economic risk as a cyclical company, along with currency risk, and the constant risk of technical obsolescence.

Litigation is a common risk for Intel. 2009 results reflected a $1.45 billion fine from the European Commission due to claimed violation of competition laws. $1.25 billion was paid to AMD to settle all legal issues between the two semiconductor companies. In addition, both the U.S. Federal Trade Commission and New York Attorney General filed antitrust suits against Intel.

Conclusion and Valuation

In conclusion, I feel that Intel deserves a fairly low valuation until it can demonstrate that:

a) Its acquisitions and general capital allocation are beneficial for shareholders in the long-term and

b) It can gain market share in the mobile computing arena

In the meantime, however, I feel that Intel is fairly priced and pays a good dividend. With a great balance sheet, huge research and development capabilities, and a diversified business, Intel seems to have more going for it than against it. It’s a safer pick than many tech companies, but I alert investors to the fact that this is an immensely complicated company and that intelligently investing in Intel requires significant understanding of the industry as well as strong opinions about their current path.

Full Disclosure:

As of this writing, I own shares of TXN, but not INTC or MSFT.

You can see my full list of individual holdings here.

Further reading:

Costco Wholesale (COST) Dividend Stock Analysis

Texas Instruments (TXN) Dividend Stock Analysis

Kimberly-Clark (KMB) Dividend Stock Analysis

Chevron Corporation (CVX) Dividend Stock Analysis

Compass Minerals International (CMP) Dividend Stock Analysis

I think your conclusion and valuation of Intel is quite accurate. The fact that they haven’t really been able to tap into the whole mobile computing area is a nice little area for potential growth, but I’m not so sure about the McAfee acquisition, either. You listed the major factor, in mind, that really makes them risky right now: their high risk for litigation.

Sweet post. Good discussion of positive and negative sides. My plan when i landed in a tech-analysis was to read the “conclusion and valuation” and skip the rest.. but the post caught my interest:)

Very nice analysis! I think Intel is a little too pricey now to get in. I bought in at 19$ and missed my chance in the low 18$ as I did not have cash on hand. I am not sure it’s a buy and forget but they have nicely grown their dividends.

I think that the stock is looking really good right now especially with the 3% plus yield.

Great analysis Matt.

Like Passive, the allure of the dividend is attractive. I think Intel will diversify over time (they have to, to survive) and I think long-term investors will be rewarded for this journey. If I had more cash in my RRSP, I would buy Intel at the right price. (RRSPs are the only home I keep my U.S. dividend-payers.)

Cheers,

My Own Advisor