Have you ever thought, “Wow, it’s so easy for this company to make money, everyone uses its product or service.”? That’s the network effect. It’s a type of economic moat that protects some companies.

The network effect snowballs as the company offers more value to its customers and its customer base grows.

For example, as more people use Google to search, Google gets more from those searches, which it uses to improve future search results (debatable at times, I know) and to sell ads. As search results become better, even more people use Google. Facebook, or Meta as it is now called also benefits from the network effect. Who would go on Facebook to share their stories or to reach out to others if most of their friends and family weren’t on the platform?

Not all networks are the same

There are three categories of network effects:

- One-sided network effects: This relates to a single group of company customers or group of platform users. The more customers or users the company has, the stronger its growth, providing more value and leading to more new customers. Meta and Google fall in this category.

- Two-sided network effects: This relates to two groups of company customers or participants. For example, there is a close relationship between the number of people looking for a place to rent and the number of people renting their place on Airbnb. The more sellers there are on a platform, the more choices customers have, leading to more customers coming, which in turn attracts even more sellers. Visa and Mastercard are in this category.

- Complementary network effects: This relates to separate companies mutually benefitting from each other’s growth. For example, the more Apple grows its iPhone sales, the more RF filters Broadcom sells, and the more 4G and 5G wireless chips Qualcomm sells.

Today, I want to spend time on my two favorite “network effect” stocks.

Visa & Mastercard

The best examples in the dividend world are probably Visa (V) and Mastercard (MA) who have built a duopoly. In the beginning, not all merchants accepted credit cards and those who did were not accepting all credit cards. As more people started using Visa and Mastercard, more and more merchants accepted their cards. Fast forward: V and MA process billions of transactions per year. The best part is that they earn a fee for each of those transactions. Try to create your own credit card company today and get merchants to accept your card, and you will fully understand the benefit of having developed that network.

Visa (V)

The Visa IPO happened just before the 2008 market crash. V offered a unique opportunity to investors as its stock traded at approximately $11. Today, the stock is trading at approximately $275/share, and it should continue to increase in value for at least another decade.

V’s key to success was building the widest and most secure network in the transfer of funds. Visa partners with major financial institutions across the world, and customers pay a commission for each transaction. Having already established its network, Visa benefits from the strong tailwind that is the clear trend favoring electronic payments.

Visa is one of the few companies that remain insulated from inflationary and macroeconomic concerns thanks to its balanced exposure to payment categories. Visa is well positioned to thrive in a wide array of scenarios. Finally, Visa’s entry into crypto demonstrates that the company is ready to adopt any changes in the industry!

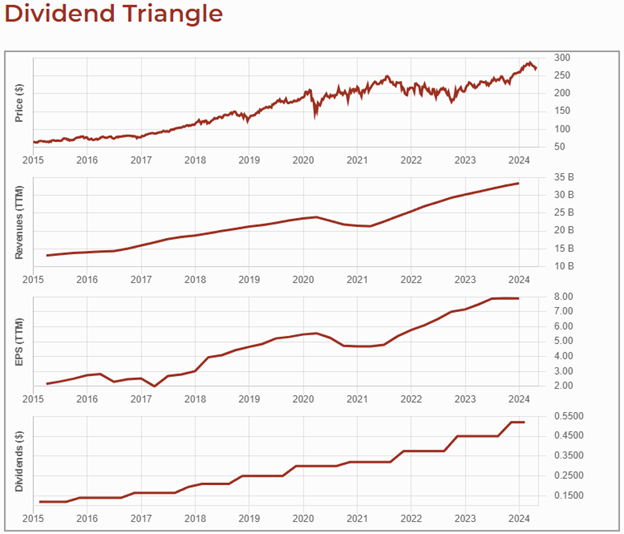

Below, you see the Visa stock price, revenue, earnings per share, and dividend payment trend for the last 10 years. Steady growth across the board, hardly affected even by an event as disruptive as the pandemic.

Find more companies with “unbeatable” business models

At Dividend Stocks Rock, we have a clear strategy: we focus on dividend growth stocks. We handpick companies showing a strong dividend triangle (e.g. revenue, earnings, and dividend growth potential) and make sure we understand their business model.

Using the combination of these dividend triangle metrics, we created the Rock Stars list and we update it monthly. Since we consider other metrics in addition to dividend growth, it’s a stronger list than the dividend aristocrats list.

Enter your email below to get the list for free.

Mastercard (MA)

The beauty of Mastercard’s business model is the strength of its brand and its network. When you pull your card out to make a purchase, you certainly don’t want the cashier to question the integrity of your form of payment. For this reason, you use either a Visa or a MasterCard… or both!

MasterCard is a company that focuses on growth and diversification. Management has a robust plan in place, all of it aimed at increasing digital payment services. The current economic slowdown or potential recession will drive consumers to buy online, using their credit cards.

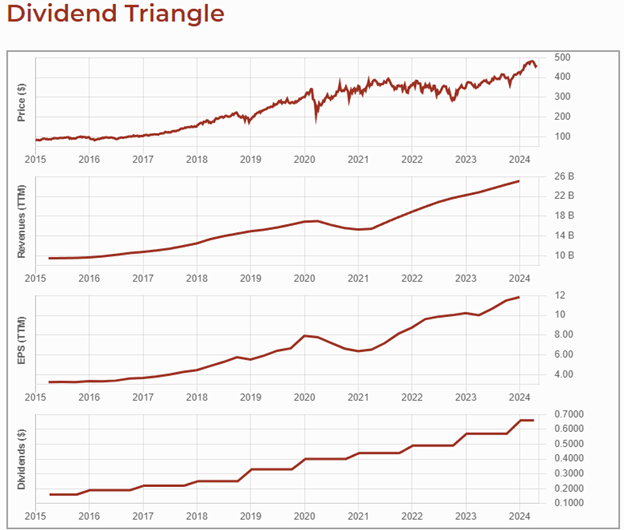

MA has been very generous with its shareholders with massive dividend increases and ongoing share buyback programs. Finally, MA’s volume-driven business acts as a buffer against inflationary pressures and supply chain shortages. It too has a strong dividend triangle.

Get great stock ideas every month with our free Rock Stars list!

Can all companies enjoy a network effect?

Unfortunately, not all companies can build such an impressive business model and generate impressive results!

For example, companies in commodity sectors or those offering undifferentiated products, such as basic materials, traditional manufacturing, and some energy companies, don’t benefit significantly from network effects. If everybody wants to buy gold, gold miners will just sell more of it, but there’s no moat protecting their business.

These businesses compete on price and operational efficiency rather than the increasing value that additional users or participants would bring to a platform or service.

Companies offering services have a better chance of having a network effect. The more the business model can increase the number of users of the services, the larger the network effect will be. Sometimes, the effect is so strong that it creates a business model nearly impossible to replicate such as Visa and Mastercard.

Leave a Reply