The Company in a Nutshell

- Aging population and new regulations will be important growth vectors for the next decade.

- This REIT shows a well-diversified portfolio across various senior and healthcare real estate locations.

- People live longer and those aged 80 and above spend 4 times more on healthcare per capita than the average.

We rarely have the opportunity to pick a high-yielding stock showing consistent dividend growth and a stable business model, but this is exactly the case with Ventas (VTR). This healthcare REIT has been surfing on demographic tailwinds and continues to reward their shareholders with juicy dividend payments. Let’s take a look at Ventas to see if it could fit your portfolio.

Business Model

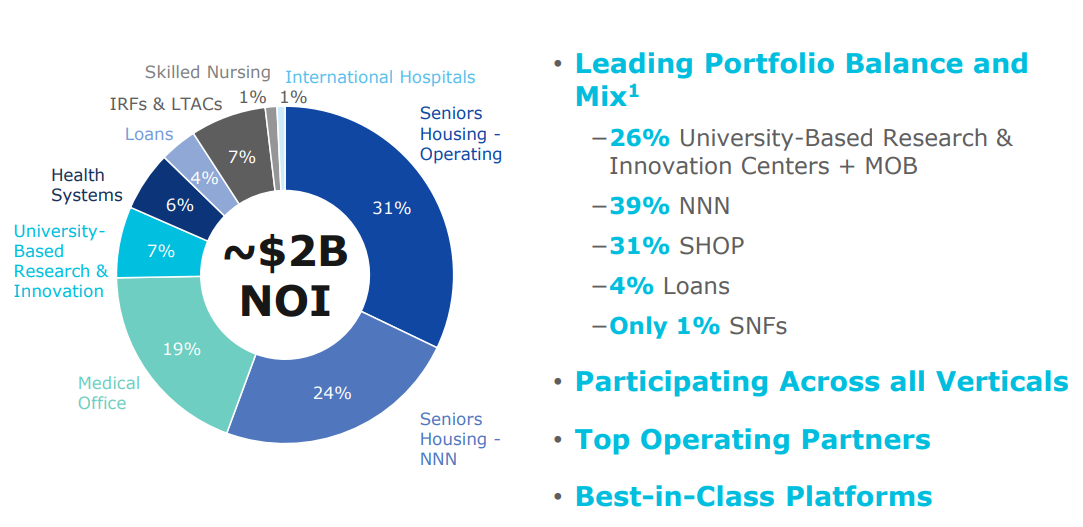

Ventas Inc is a real estate investment trust. The company is part of our top REITs list with a dividend yield of 5%+. It holds a diversified portfolio of senior housing communities, skilled nursing facilities, medical office buildings, life science buildings, and hospitals. With a highly diversified portfolio of approximately 1,200 senior housing units, as well as healthcare and research properties in the United States, Canada and the United Kingdom, Ventas is excited to operate at the intersection of two powerful and dynamic industries – healthcare and real estate.

Source: VTR investor presentation Nov 2018

Growth Vectors

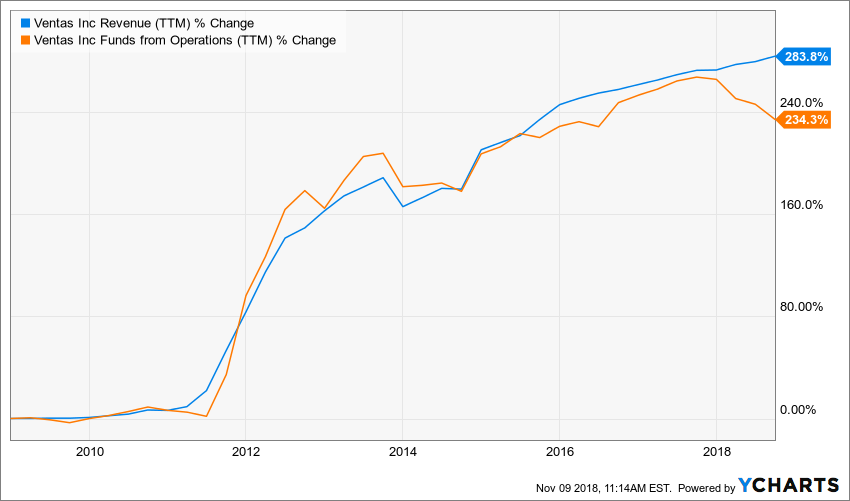

Source: Ycharts

When we think about healthcare REITs, we automatically think about the aging pollution and regulations pushing those companies a little higher each quarter. The demand is growing and it is not about to end as the population is not only aging, but is also living longer.

VTR made the decisions to dispose of its skilled nursing facilities through the spin-off of Care Capital Properties (which eventually merged with Sabra (SBRA)). The REIT preferred to invest $1.75B in Ardent Health Services and another $1.5B to purchase Wexford life science. The idea was to integrate a complete healthcare infrastructure into its business model. This is how VTR has built one of the most diversified healthcare REITs.

Potential Risks

While current regulations are helping companies like Ventas, we know all too well that this could turn around quickly. As baby boomers get older and the need for healthcare services increases, the Government will have difficult decisions to make. Nobody wants to talk about it, but healthcare systems are costly and people are living longer. Therefore, the means +of financing this system will have to be changed going forward. Those changes will create uncertainties in the healthcare REIT business.

Also, VTR is not alone in this market; lots of healthcare REITs have risen in the past decade. Competition is increasing and healthcare real estate offers may eventually grow faster than the demand. What will happen in 15 years when the baby boomers are nothing but memories in our history books?

Dividend Growth Perspective

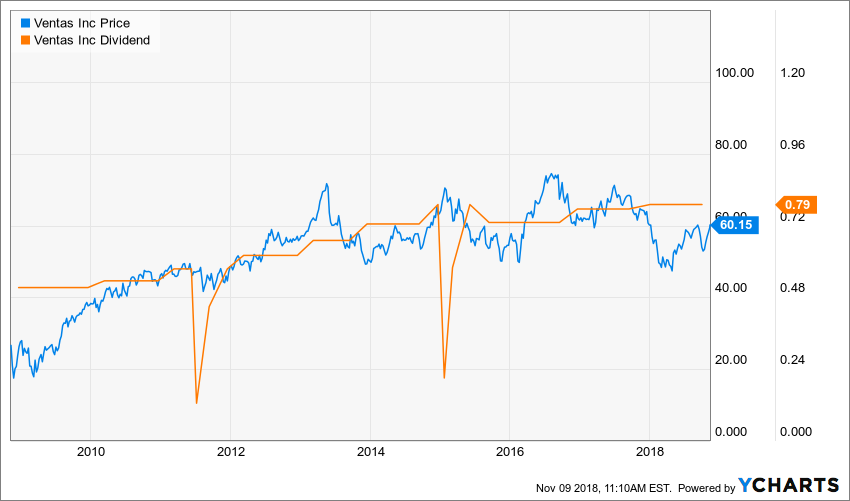

With a 5% yield, Ventas will please most income seeking investors. With an FFO payout ratio around 80%, VTR has enough room to continue growing while increasing its dividend payment. VTR has continuously increased its dividend since 2011. Therefore, it is only a few years away from becoming a dividend achiever.

Source: Ycharts

The dividend growth isn’t impressive with a total of 9% (total, not annualized!) over the past 5 years, but this is enough to cover inflation. Companies showing a 5%+ yield and a business model enabling management to increase their payout each year are rare. We believe VTR is one of them. We expect VTR to continue raising its payments by low single-digit growth rate.

VTR meets our 7 dividend growth investing principles.

Valuation

After looking at VTR’s dividend perspective, we are quite optimistic that we’ve found a great high yielder. Unfortunately, we are not the only investors who figured out that Ventas was a good pick to build an income portfolio.

When we used the dividend discount model, we couldn’t find any value at the current price. The problem is that VTR’s dividend growth rate has been consistent, but anemic. With a dividend growth rate of 2%, you need a discount rate (expected rate of return) below 8% to show a value at $60.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.16 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 2.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 2.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $64.46 | $55.25 | $48.35 | |

| 10% Premium | $59.09 | $50.65 | $44.32 | |

| Intrinsic Value | $53.72 | $46.05 | $40.29 | |

| 10% Discount | $48.35 | $41.44 | $36.26 | |

| 20% Discount | $42.98 | $36.84 | $32.23 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Final Thoughts

An investment in VTR is for its dividend and its stability. As the demand for a solid REIT paying over 5% is strong, Ventas seems fully (over) priced. Ventas has built strong partnerships with top operators and will enjoy demographic and regulation tailwinds for a while. This REIT has sold its skilled nursing facilities and replaced them with senior housing, medical office buildings, life science buildings and hospitals. VTR has made several acquisitions in the past few years and expects to generate synergies from them. The company has continuously grown its dividend since 2011 and shows a great protection against inflation. Don’t expect much stock price appreciation going forward and you will be happy to enjoy a solid 5% yield.

If you made it this far, let’s be honest; you liked what you read. Now it’s time to make sure you don’t miss our next analysis and you subscribe to the Dividend Monk Newsletter by clicking on this link to make sure you don’t.

Disclaimer: We do not hold VTR in our Dividend Stocks Rock portfolios.

Featured image source: Pixabay

Leave a Reply