United Parcel Service, Inc. (NYSE: UPS) is the largest package delivery service in the world.

-Seven Year Average Revenue Growth Rate: 5.5%

-Seven Year Average Annual EPS Growth Rate: 4%

-Seven Year Average Annual Dividend Growth Rate: 9.6%

-Current Dividend Yield: 3.01%

-Balance Sheet Strength: Moderate

UPS faces tailwinds from e-commerce but headwinds from global economic certainty. $76 is calculated to be the fair value, but I’d look for a margin of safety of 10% before investing.

Overview

UPS was founded in 1907, and has since grown into a company that employs more than 400,000 people, and ships over 15 million packages per day to more than 220 countries and territories around the world. They also offer logistics services in 195 countries, as well as long-haul and less-than-truckload shipping in North America.

In 2011, 60% of company revenue came from the U.S. Domestic Package segment, 23% came from the International Package segment, and 17% came from the Supply Chain and Freight segment.

Ratios

Price to Earnings: 19

Price to Free Cash Flow: 12

Price to Book: 10

Return on Equity: 50%

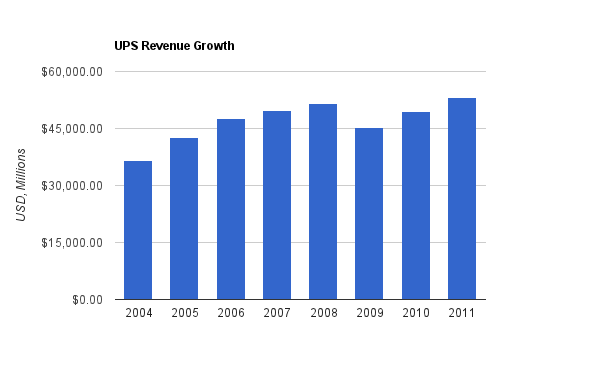

Revenue

(Chart Source: DividendMonk.com)

UPS increased revenue at an annualized rate of nearly 5.5% per year. Revenue growth was strong and consistent until the financial crisis and recession, which resulted in a dip in revenue for the company.

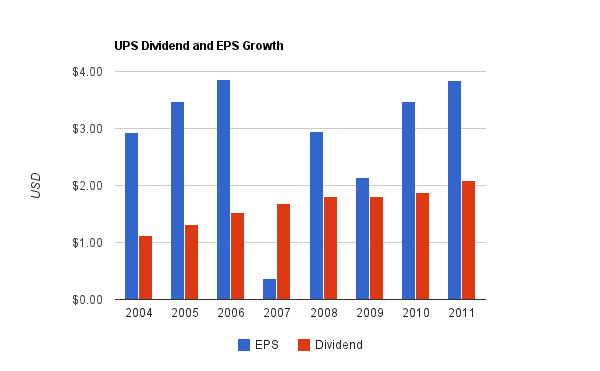

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS growth was 4% on average per year over this period. UPS has restated earnings and has put forth significant adjusted earnings compared to GAAP earnings. For example, UPS cites 2007 as their peak year of profitability according to their adjusted accounting.

So EPS growth over this period is low, but rather erratic.

As for the stock dividends, UPS stock offers a yield of 3.01%, and a dividend payout ratio of around 55%. Although it may not be a concern for general investors or value investors, the fact that UPS failed to increase its dividend in 2009 is a red flag for dividend growth investors who specifically seek out companies that grow their dividends each and every year like clockwork for decades.

Nonetheless, UPS did achieve dividend growth of almost 10% per year over this period, and the most recent increase was also nearly 10%.

The company also performs significant share buybacks. Over the trailing twelve month period, the company has repurchased around $2.4 billion worth of shares and around $2 billion in dividends, for a total shareholder yield of over 6%.

The quintessential problem with share repurchases is apparent here, however. The amount of money spent on share purchases spiked in 2007, which coincidentally was the around the peak stock price. Then, the amount of money spent on share repurchases dropped dramatically in 2008 and 2009, when shares were at a bargain price. Now, as the stock price has rebounded, share repurchases have resumed significantly. This of course isn’t a coincidence though; when times are good and companies have cash, they have plenty to spend on repurchases. But when times were tough for UPS in the recession, the dividend couldn’t be increased that year, and the company had to significantly reduce share repurchases. So time and time again, it comes up that share repurchases are proportional to stock price, and companies buy high and don’t buy low.

Balance Sheet

UPS has significantly increased their leverage in recent years by more than tripling their debt. The total debt/equity ratio is now over 150%. However, the interest coverage ratio is over 15, which is extremely strong. The company also has over $6 billion in cash equivalents sitting on their balance sheet in preparation for the TNT Express acquisition.

Overall, the financial position of UPS isn’t quite as strong as it used to be, but the interest coverage ratio demonstrates their overall prudence and safety with regards to leverage. I consider their balance sheet to be of moderate strength, and their solid credit rating looks reasonably well deserved.

Investment Thesis

In the 2011 annual report, CEO Scott Davis outlined the goal of UPS to increase EPS by 10-15% annually over the long-term and achieve free cash flow numbers larger than net income. The projection was for EPS of $4.75-$5.00 for 2012.

In July 2012, UPS announced that due to global economic weakness, they grew earnings and revenue but missed analyst predictions, and lowered EPS projections for the full year of 2012 to $4.50-$4.70. Domestic U.S. results were rather good, with increased revenue and operating profit. It was the international segment that resulted in weakness, with the company citing European debt concerns and weakness in Asian exports as the key reasons.

The upcoming “fiscal cliff” in the U.S., where defense cuts are set to occur and tax increases are potentially rebounding up to the levels that existed in the 1990’s, is also cited as a reason for uncertainty.

UPS is a tightly controlled operation as it is. They maintained some profitability throughout the fiscal crisis, and continue to be profitable today. As an example of the detail in which they look for improvements in efficiency, UPS optimizes routes to avoid turning left as much as possible, because left turns aren’t nearly as efficient as right turns, and the system-wide savings are millions of miles and millions of gallons of fuel.

The company also has a significantly wide moat due to scale and the network effect. A few years ago, DHL had to pull out of the U.S. domestic shipping market after losing billions trying to compete with UPS and FedEx. UPS also has an advantage over FedEx, because UPS is the larger of the two and more specifically, their operations are more unified. Rather than operating a largely disconnected ground and air delivery service, the receiving and drop-off points for UPS are almost wholly integrated. This shows up on the bottom line, with UPS having significantly higher profit margins than FedEx.

UPS Growth Opportunities:

-Small acquisitions and capital expenditures in health care space increase UPS’s ability to compete in the healthcare delivery area. They have built 33 dedicated health care facilities with 5 million+ square feet of space for warehousing and distribution of health care supplies.

-Improvements in efficiency, including improved use of sensors, improved sorting of small packages, and keyless entry into their 100,000+ vehicle fleet.

-The large acquisition of TNT Express will boost the top line. The company expects to close the acquisition in the fourth quarter, while regulators review the deal. TNT Express is headquartered in the Netherlands, and UPS is paying nearly $7 billion to significantly increase their operations in Europe, Africa, and the Middle East.

-Economic growth in Latin America should act as a long-term tailwind.

-Although Asian exports were a weakness in the recent quarter, UPS is strengthening its position in China by opening air hubs and increasing their shipping capacity.

-Rapid increases in e-commerice means more business-to-consumer shipping. A larger and larger part of the overall retail pie is being shipped from warehouses to customers rather than on trucks within retail logistic systems which end in consumers picking up the products at the store. There is greater need for customers having more control and visibility regarding their incoming shipments, which UPS seeks to meet with “UPS My Choice”. There is also greater need for efficiency of returns, because customers must ship back the product rather than drive back to a store, which UPS seeks to meet with “UPS Returns”.

-Geographic expansion. The likely TNT Express acquisition by UPS is a showcase of the intention of UPS to continue to expand globally. In their 2011 annual report, they described their global expansion strategy as follows, and also described their efforts in China as a prime example of this:

We typically follow a pattern of entering a market through importing and exporting, expanding domestically with a partner or alliance, and then ultimately acquiring domestic operations where we see value and return.

Risks

The key risk to UPS is the overall health of the global economy, which recently resulted in lackluster quarterly performance for the company. Poor global economic strength means less intercontinental shipping. Because UPS has so much fixed infrastructure and assets, relatively mild decreases or increases in volume and revenue have a larger impact on the bottom profit line.

Energy costs are always a risk of course, and currency fluctuations can act as a headwind or tailwind for their international segment. In recent quarters, they were a headwind.

Although UPS clearly has an entrenched position, FedEx is a strong competitor in the U.S. domestic shipping market, and UPS faces strong competition internationally where they don’t have the same advantage of scale as they have in the United States.

UPS has a quarter million employees under collective bargaining agreements. Some of the agreements run through July 2013 while others run through July 2014.

Conclusion and Valuation

The company has significantly entrenched operating positions and a strategy for global expansion. They face tailwinds from e-commerce but headwinds from global economic uncertainty.

If revenue growth continues at 5% per year or more, and the net profit margin remains fairly static, then net income could increase at 5% or so per year going forward. If the company buys back 3% of its market capitalization each year, then EPS would be boosted roughly by another 3% to upwards of 8% or so. This is in comparison to the 2011 CEO projections of 10-15% EPS growth. Considering that the net profit margin is below its peak, and revenue could potentially increase faster than 5% in an optimistic scenario, I view 10+% EPS growth as plausible but optimistic.

Using the dividend discount model, the current yield along with the assumption of 8% dividend and EPS growth and an 11% discount rate, results in a stock valuation of around $76/share, which is almost exactly in line with the current stock price. Even in a no-growth scenario, the shareholder yield of around 6% could result in mid-single-digit returns.

Although there is a strong competitive position for the company, the uncertainty in the global economy, and the showcase of their weak but still profitable performance during the bottom of the recession shows that there is significant risk for the business. The stock price looks fair, but I’d hold off buying unless there was a 10% margin of safety to these figures.

Full Disclosure: As of this writing, I have no position in UPS.

You can see my dividend portfolio here.

Investment Income Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

[…] 5. UPS: Fair at $76 but Without Margin of Safety @ Dividend Monk. […]