Summary

- Trying to get back on track after some rough years

- Impressive acquisitions lineup history and still more to come

- Dividend growth isn’t locked in, but still possible

This article has been written by Olivier Gelinas for Dividend Monk.

Here’s a company that you will probably find around your household. From food products to personal care, Unilever (UL) is everywhere. While the company has dealt with a lot of criticism in the past few quarters, it is slowly picking up the pace. Dividend increases mixed with a strong management will might just cut it for the stock (and its investors). With a strong acquisition business strategy, Unilever does show some potential and growth which I like very much in a defensive stock. However, there are still some red flags that still bother me before I can safely add it to my portfolio.

Understanding the Business

Unilever PLC is a consumer goods retailer and a giant one. Its main competitor on the market is P&G, if that gives you any idea. The company operates in three distinct segments, which almost fully cover all consumes’ basic needs: personal care, home care and foods & refreshment segments. Prior to 2018, the last segment was treated as two different sectors but were combined to offer a better global sight and stronger growth altogether.

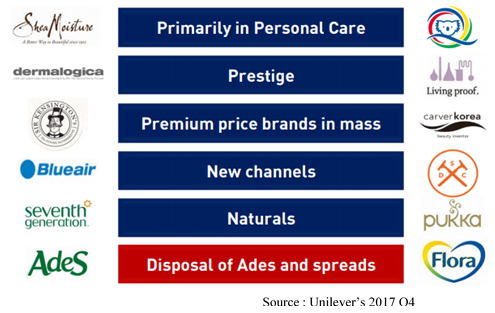

UL’s business strategy is mainly focused on quantity delivery, price establishment and non-organic growth by acquisitions. While the first two are standards in the global retail industry, they completed (or on their way to) 22 acquisitions in the last 3 years. A division was also sold, as announced in late 2017, to the private equity company KKR. The spreads division was tossed aside for a nice $8B by UL, in order to better focus on more profitable segments.

Management’s ambitions aim for a 3%-5% growth until 2020. The company reported revenue of €53.71B in 2017, which included the spreads division at that time. The company employs around 160,000 workers in order to support those operations.

Growth Vectors

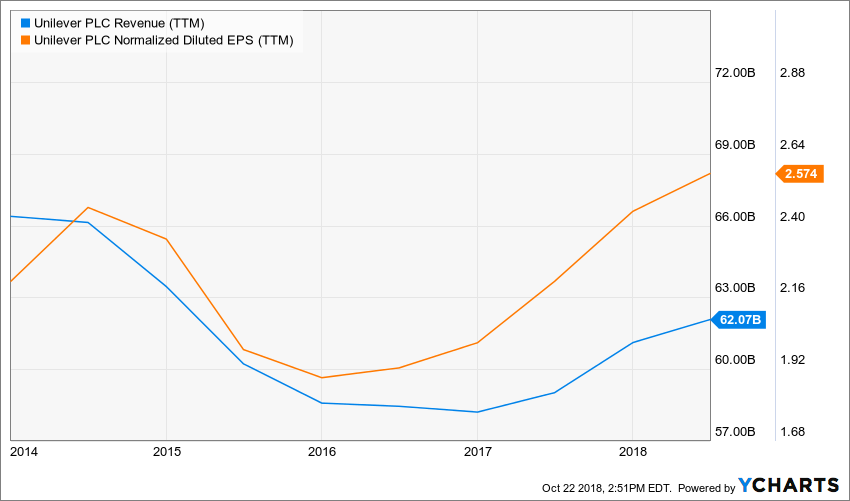

Source: Ycharts

UL has now recovered from the 2016 dip, coming from harsh conditions on the market. One of the reasons fpr that recovery resides in their ability to target potential acquisition opportunities or disposals of their own segments in order to make room for future growth. At the beginning of 2018, UL announced the acquisition of Equilibra, the sale of their spreads division and the acquisition of Quala and Schmidt’s Naturals. A lot of non-organic growth can be captured here, if the business can successfully incorporate the targets operations in theirs.

Another growth potential is located in one of their geographic regions. Asia and emerging markets underlying sales growth was 6.6%, with a whole 4.3% coming from volume only. The company sees some more potential as this market seem to be buying products even with an increasing price tendency.

Dividend Growth Perspective

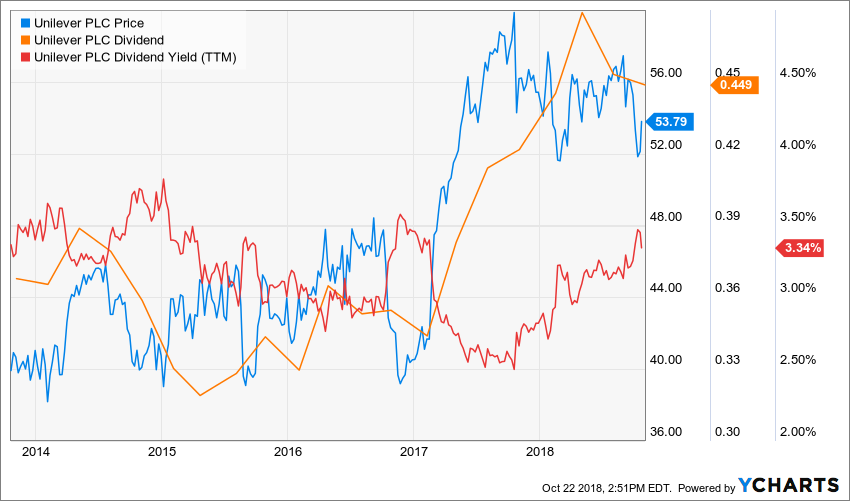

The company is paying its dividend in pence, there fore it has to be converted in US dollar. The truth is, that figure fluctuated greatly in the past few years, showing lots of volatility in FCF. If the management can achieve their growth target, this might relieve some of this tension. At the moment, I am not entirely convinced about a long term dividend growth.

Source: Ycharts

From a yield point of view, UL isn’t too bad. Hovering around the 3% mark, which is a normal level for defensive stocks. Investors shouldn’t expect this metric to go sky-high since growth in the industry is somewhat limited and hard to grab a hold of.

Potential Downsides

I will set aside the industry’s downside for this one, as everyone probably knows, it is a rough one with margins getting pressured by competitors and price hikes by manufacturers. The first real issue I see with UL’s business is its own management board. Many decisions (or announcements) faced great opposition. The obvious elephant in the room event is their plan to move their London headquarters to form a single HQ in Rotterdam. Which, let’s say it, completely displeased shareholders. Markets are predicting an early retirement for CEO Mr. Polman, but that’s a whole other topic.

Unilever also faced a takeover attempt from Kraft Heinz back in 2017. This event shook the management in place, in which they answered back quickly and in a stiff manner. This could be the reason why they decided to move their headquarters. Another factor, which did not please everyone, was the share buyback program. A total of $6b of shares could be bought from investors. This raises eyebrows as to why the company would lay down such cash to buy their highly valued stock on the markets.

Valuation

To be trading at 2.6x their PE, the company does have some value to offer. Of course, you won’t see any huge difference in the upcoming quarters since it’s a defensive stock. In order to find out if the bet is worth it, let’s use a DDM.

Source: Ycharts

The below valuation factors in a 9% discounting rate and an annualized dividend payment of $1.79. Please note here that this figure is hugely debatable since it takes account of the currency exchange, which fluctuates greatly. The model is completed by a 5% dividend growth in the short run and a 6% for longer run.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.80 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $104.70 | $70.04 | $52.70 | |

| 10% Premium | $95.98 | $64.21 | $48.31 | |

| Intrinsic Value | $87.25 | $58.37 | $43.92 | |

| 10% Discount | $78.53 | $52.53 | $39.53 | |

| 20% Discount | $69.80 | $46.70 | $35.14 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

The intrinsic value of the stock is pretty much in-line with markets expectations of a $55-sh price.

Final Thought

Unilever showed some signs of encouraging growth lately. Sales volumes are going up and so is the sale price per item. Of course, all of this comes after some major management mistakes which pushed some big and powerful investors to show opposition. With everything factored in, I would definitely wait on this stock. Volatility is still looking out on the company’s figures, which I highly dislike.

For an investor seeking an income out of UL, I would say, you’re better off using their products than their stocks. Dividend history isn’t there to back up a strong buy signal in my opinion. But hey, if you do buy it and burn yourself by doing so, their product lineup has got you covered!

If you made it this far, let’s be honest; you liked what you read. Now it’s time to make sure you don’t miss our next analysis and you subscribe to the Dividend Monk Newsletter by clicking on this link to make sure you don’t.

Disclosure: We do not hold UL in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Featured Image Source: Pixabay

Leave a Reply