What will 2020 bring us as investors? More dividends! In the next 10 days, I’ll be sharing my favorite dividend picks to start the year with a bang! Today I identify 3 strong dividend paying companies that didn’t do so well recently. Here’s your chance to grab some shares at a good price.

The selection methodology of those companies is explained in this article:

What a Dividend Growth Investor Buys in 2020?

Now, let’s pick stocks that will do the same for 2020:

Hasbro (HAS)

Market cap: 13.70B

Yield: 2.70%

Revenue growth (5yr, annualized): 2.33%

EPS growth rate ((5yr, annualized): -4.32%

Dividend growth rate (5yr, annualized): 15.44%

Hasbro has recently been added to our Mike’s Buy List after posting a bad quarter with below expectations numbers and issued weaker guidance than expected. When you look at how Hasbro stock reacted on the market upon good and bad news, you will notice this is a volatile stock. Double-digit movements (up or down) happened several times in the past couple of years. The company must deal with both the trade war and a brick & mortar retail slowdown (notably the Toy’s R Us bankruptcy).

If there is a company that will benefit from a commercial agreement in the trade war, it’s Hasbro. In a perfect world, the arrival of Frozen II and Star Wars IX will boost Hasbro’s sales and the trade war will end. If this happens, you can expect Hasbro to bounce back to it’s previous highs in terms of market price per share. In the meantime, the company’s cash payout ratio is below 50% and the company should generate growth with the recent acquisitions of Power Ranger (2018) and Entertainment One (2019). The latter is an online platform providing media content. It could be a good way for Hasbro to diversify its sources of income and capture a part of the online world. Management knows what they are doing as one of their divisions is directly involved in digital gaming.

Constellation Brands (STZ)

Market cap: 36.12B

Yield: 1.65%

Revenue growth (5yr, annualized): 10.77%

EPS growth rate (5yr, annualized): 12.32%

Dividend growth rate (5yr, annualized): 19.33% (since 2015)

You surely are aware of STZ as it has been on our Mike’s Buy List for some time now. Over the past two years, many DSR members have asked me how to participate in the marijuana “train” and ride with it without crashing right after the first turn. After all, high speed trains are not made to drift. But this is what’s happening with the marijuana industry today. First, there was much hype related to the legalization in Canada. Then, literally thousands of companies started to grow cannabis plantations across the country. This was supposed to be the next “natural resource” worth more than gold and oil combined. I even made a short-term play on Canopy Growth (WEED.TO) in early 2018. I closed it for a nice 50% profit using a stop sell during my vacation. I knew this was a risky play and it was not advertised on DSR because this is not what we do here. What we do is pick companies with strong a business model and a stable and growing income. When Constellation Brands decided to boost its investment in WEED.TO (or GCG on the U.S. market), I thought it was a safer way to ride that trend. As it is the case with many investments, one must be patient…

Keep in mind that STZ is a lot more than its 40% stake in Canopy Growth. The company counts on a strong beer, wine and spirits business. Management expects high single digit growth from its beer business (64% of its revenue) and mid single digit growth for the wine & spirits industry (36% of sales). While the market expects a short-term return on Canopy Growth, STZ is playing the long game and sees much growth for the next decade with this investment.

AbbVie (ABBV)

Market cap: 134.25B

Yield: 5.32%

Revenue growth (5yr, annualized): 10.49%

EPS growth rate ((yr, annualized): 10.23%

Dividend growth rate (5yr, annualized): 19.22%

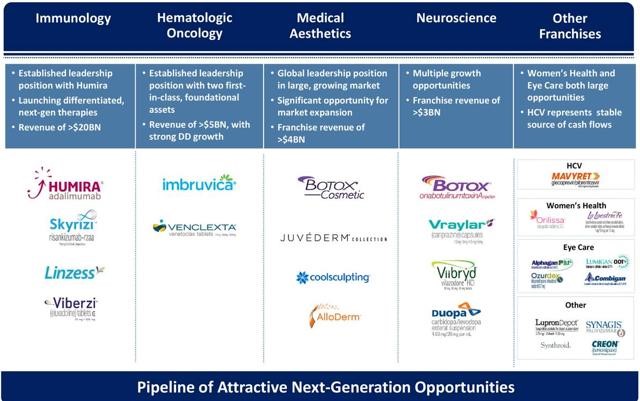

AbbVie has done a great job at recovering from its bottom of ~$65 in August 2019. Still there are lots of room to grow again as the stock is only half-way through its peak of $125. Don’t get too excited; we don’t think ABBV could surge by 45%+ in a single year. However, AbbVie will provide you with a solid yield (around 5%) and a strong dividend growth policy. The company has bought some time by extending patents on Humira up to 2023. This is enough to generate strong cash flow and hope that its strong pipeline will generate new blockbusters.

The idea behind buying Allergan is first to diversify ABBV revenue source… and find more tricky ways to extend its patents. AGN, similar to ABBV, legal department is known for its “creativity.” Issuing a trademark for Botox was very smart. Will it always hold the road? That’s another story. Nonetheless, ABBV dependence to Humira revenue would drop from 60% to 40% once AGN is integrated.

The second reason to buy AGN is obviously to create synergy. Management expects the transaction to contribute 10% accretion to EPS over the first full year with more than 20% at peak level (ABBV presentation page 4). By combing its labs, marketing, and legal department, ABBV intends to realize about $2B in cost reduction in year three. This additional cash flow will likely be used to pay off its debt, but also to support dividend growth as mentioned by management. This is music to my ears.

Find out about 6 companies that will crush 2020

Each year, I compile 20+ stocks that are expected to do better than the market. In 2019, my US picks outperformed the market by 7% and my Canadian picks did 10% better than the TSX. You can download 6 of my top 20 for 2020 right here:

Disclaimer: I hold shares of STZ and HAS

Monk –

Solid 3. I’ve been curious on Constellation for some time. I’ll have to look at the dividend growth rate history more, but love the industry.

-Lanny

I thought it would have done well in 2019, but the whole “weed saga” made investors forget about STZ strong beer brand portfolio. A good timing to grab some shares IMO.

cheers,

Mike