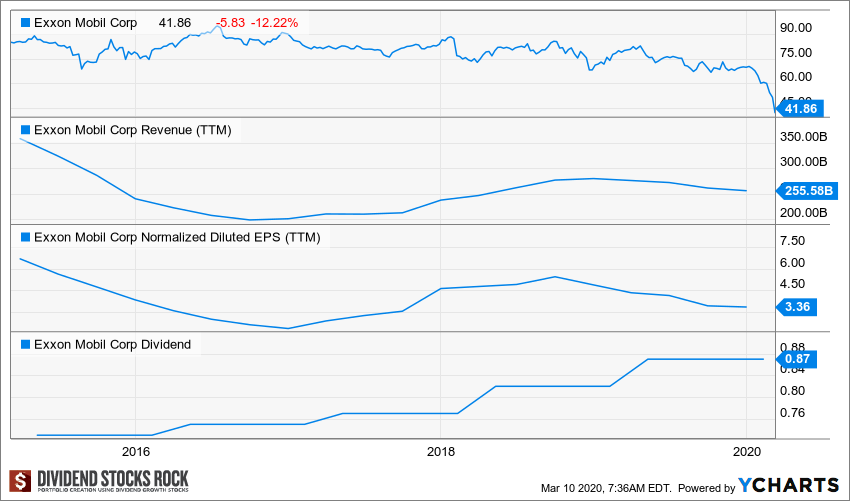

Last week, I’ve explained why there is such an energy MLP’s sell-off. This week, the market got hit by another oil price war. With the OPEC going full production mode, we are on for another oil meltdown. The impact is worst than what happened in 2014 simply because this event is happening at the same time as the growing fear of a recession, thanks to the corona virus.

Thanks to this market frenzy, you can now get this Dividend Aristocrat / Achiever with a yield of 7% now!

Time to buy Exxon Mobil

Business Model

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2018, it produced 2.3 million barrels of liquids and 9.4 billion cubic feet of natural gas per day. At the end of 2018, reserves were 24.3 billion barrels of oil equivalent (including 4.2 billion for equity companies), 65% of which are liquids. The company is the world’s largest refiner with a total global refining capacity of 4.7 million barrels of oil per day and one of the world’s largest manufacturers of commodity and specialty chemicals. It operates its business divisions in North and South America, Europe, the Middle East, North and sub-Saharan Africa, and the Asia-Pacific.

Investment Thesis

XOM is a money-making machine. Cash flow from operations covers much more than dividend payments and the company is now ready to enjoy a strong oil market. Accordingly, Exxon’s massive investment in oil sand production in the past was not cheap, but surely boosted XOM’s long-term reserve. It allows the company to show about 50% of its 2019 production to come from long-term reserves. This should be a great cash flow source and should support future dividend payments. The company has gone through many challenges throughout its history and shows a stellar dividend history.

Potential Risks

While XOM has proven its ability (many times) to navigate through troubled waters, the company remains dependent of commodity price fluctuations. We see how the oil price affects its share price once again. You may want to catch this high dividend yielder but beware as a 7% yield is one of the top 3 red flags telling you a company could be a bad pick.

The XOM business model requires continuous reinvestment in new projects to find additional oil. It is a capital-intensive business. Future projects may not be as profitable considering the current state of the oil industry. Profitability also depends on where the oil barrel is trading at.

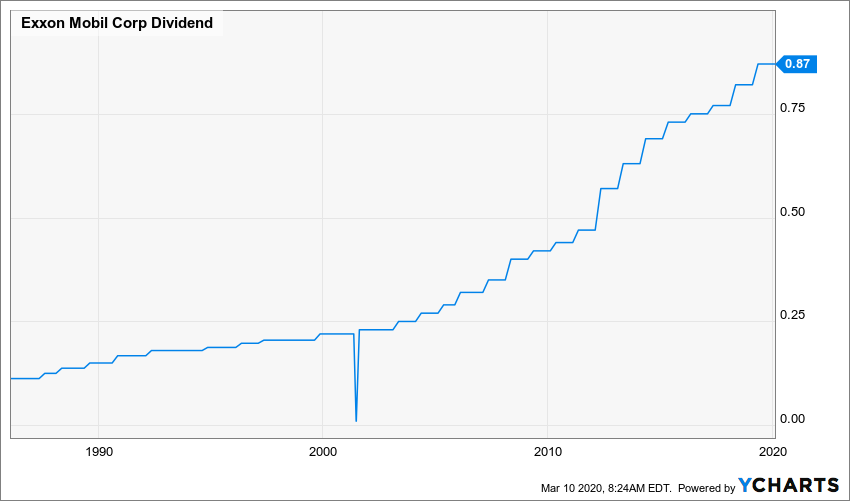

Dividend Growth Perspective

XOM successfully adapted to a challenging environment. Dividend investors have no reason to worry and should enjoy the relatively high yield. XOM proved it could keep its dividend increase alive even with a low oil barrel price. Shareholders should expect a steady ~4-5% dividend increase each year for the long term, but the next increase may be less generous for obvious reasons. We have recently changed our dividend discount model numbers to reflect the current situation.

Valuation

Speaking of which, we have reviewed the dividend discount model using lower dividend growth rate and a higher discount rate to reflect additional risk around this investment. You will find interesting that even with a 4% dividend growth rate and an expected return of 10%, XOM shows a great upside potential. (you can use the Dividend Discount Model spreadsheet here)

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.48 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 4.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 4.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $86.86 | $72.38 | $62.04 | |

| 10% Premium | $79.62 | $66.35 | $56.87 | |

| Intrinsic Value | $72.38 | $60.32 | $51.70 | |

| 10% Discount | $65.15 | $54.29 | $46.53 | |

| 20% Discount | $57.91 | $48.26 | $41.36 | |

Please read about the dividend discount model limitations before drawing any conclusions.

I don’t think we will see XOM trading over $60 rapidly. As long as the oil barrel is trading at such low level, XOM will go through lots of volatility. However, it’s not the first time Exxon Mobil see its share price dropping rapidly. It creates great opportunity for investors who didn’t have the chance to include XOM in their portfolio.

High Yield Stocks That Will Do Better than MLPs

If you are looking for more ideas to generate income in your portfolio, I’ve compiled a great list of strong dividend growers. Each year, I compile 20+ stocks that are expected to do better than the market. In 2019, my US picks outperformed the market by 7% and my Canadian picks did 10% better than the TSX. You can download 6 of my top 20 for 2020 right here:

Disclaimer: I do hold shares of XOM in our Dividend Stocks Rock portfolios.

This is a good article. Unfortunately, I already have a large XOM position. So for now, I am going to sit out some of the volatility but I do hope to be able to strengthen the position before it is too late. Thanks for sharing this article.

Hey Jason,

Yeah, we all have to remain patient in these troubled times. XOM remains a play in the energy sector. Unfortunately, this sector is going a bit crazy right now…

Cheers,

Mike

Will we see it hit below 35$ a share?

We’ll see in a few months :-) everything is possible!