So…. Would you really sell in May and go away? It is tempting to follow this saying after such a great start to this year. Believe it or not, there are still some great opportunities on the market. As the Q2 earnings season is starting, the market once again has its fair share of nervous breakdowns. It’s up to you to capture them. I’ve made several changes in our buy list to make sure you don’t miss a single opportunity!

Here are a few companies that popped on my radar recently.

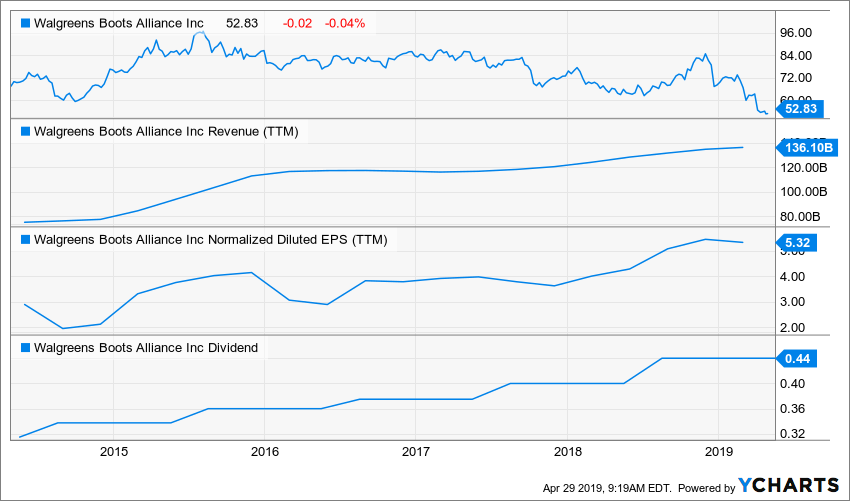

Walgreens Boots Alliance (WBA)

Source: Ycharts

What’s the story?

It’s no surprise that WBA has been kicked around by the market. Investors are worried about the lack of future growth. Management has reviewed their guidance in their latest quarter and killed the stock with that announcement of minimal growth. At the current level, WBA is priced for no growth…ever. While the pharmacy retailer faces increasing competition (mass grocers, Amazon and the likes eye the pharmacy retail sector), many wonder if WBA has what it takes to stay on top of the food chain. With a yield over 3% for the first time since 2012, it’s time to fill your portfolio with this solid dividend grower.

In April, WBA disappointed the market with decreasing EPS and revenue. Management has identified many headwinds and the company was late to adjust. FY2019 Guidance: Non-GAAP EPS: growth expected to be roughly flat at constant currency rates from growth of 7% to 12%. Revenues: $34,528M (+4.6%); Retail Pharmacy USA: $26,257M (+7.3%); Retail Pharmacy International: $3,082M (-7.1%); Pharmaceutical Wholesale: $5,738M (-0.3%). It will take time (and patience) to recover from this bad quarter. However, the fundamentals of this company remain strong.

The Company in a Nutshell

- WBA is facing important margins pressure coming from pharmacy benefit managers (PBMs).

- With such very low payout ratios, WBA has enough room to share the wealth with shareholders.

- The Amazon disruption will be the darkest cloud over WBA’s head for a while.

Business Model

After a merger with Alliance Boots in 2014, Walgreens became Walgreens Boots Alliance and opened growth opportunities across the world. WBA counts over 10,000 stores covering about 75% of U.S. population. Its business is divided in three segments: Retail (U.S.), Retail International, and Pharmaceutical Wholesale. U.S. retail stores are the most important part of WBA business model. 67% of this segment’s revenues are coming from the pharmacy component and 33% coming from the retail.

Investment Thesis

As the largest retail pharmacy in the U.S., WBA benefits from the size and scale to navigate through troubled waters. It’s omnipresence on U.S. soil is its best defence against Amazon and other ecommerce threats. Through the acquisition of half of Rite Aids’ stores, WBA increase its generic drug purchase power. With more margins, WBA will be in a good position to become one of PBMs preferred pharmacist. PBMs hold an important power over retailers as they have the ability to drive lots of traffic toward one banner or another. WBA will continue to enjoy tailwinds from the 2018 tax reform and will apply a $1B cost cutting program to become more efficient.

Potential Risks

WBA is under high pressure. Mass grocers and retailers are getting into the pharmacy playground (not to mention a possible attack from Amazon). As PBMs pressure drugstore to provide the lowest price, retailers turn around and expect to get more from nonpharmaceutical products. This is how WBA is getting stuck between a rock and a hard place. It won’t be a walk in the park, but we believe WBA can succeed in this environment. Plus, risks have already been factored in share price.

Dividend Growth Perspective

In 2018, WBA announced its 43rd consecutive year with a dividend increase. This long streak makes WBA part of Aristocrats. WBA raised its dividend by 10% in 2018 and a similar increase is expected in 2019. I guess management acted cautiously while integrating Alliance Boots. Now that this is done, you can expect a few more double-digit growth years ahead.

VALUATION

Dividend Growth Rate Years 1-10: 8.00% Terminal Dividend Growth Rate: 6.00%

| Price on 01/29/2019: $71.51 | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $133.06 | $88.14 | $65.70 |

| 10% Premium | $121.97 | $80.79 | $60.23 |

| Intrinsic Value | $110.88 | $73.45 | $54.75 |

| 10% Discount | $99.79 | $66.10 | $49.28 |

| 20% Discount | $88.70 | $58.76 | $43.80 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

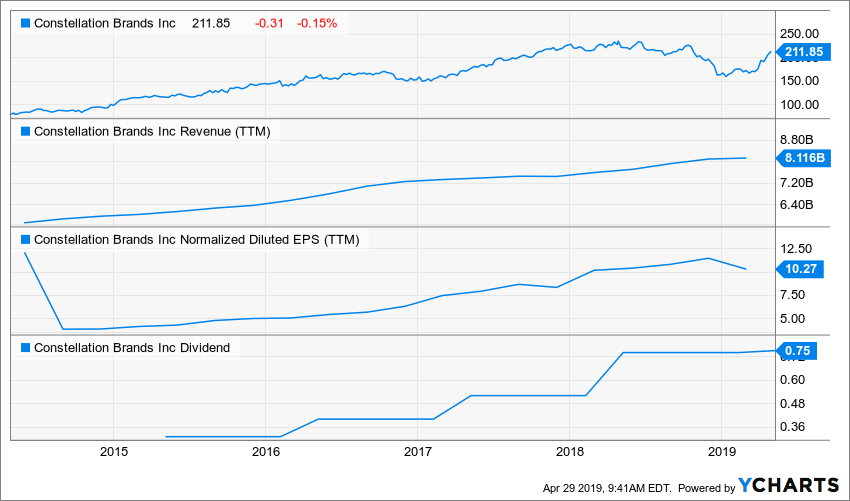

Constellation Brands (STZ)

source: STZ

What’s the story?

STZ was already one of our Best 2019 dividend growth stocks (you can find it in the newsletter section if you missed it). The market was worried about STZ stake in Canopy Growth (WEED.TO or CGC). As the cannabis industry is highly volatile, STZ earnings are affected accordingly. Since the beginning of April, the stock is back on a strong uptrend. Latest earnings eased investors’ concerns, and now everybody is looking forward to the next quarter to keep smiling. It’s not too late to catch this one.

In April, STZ beat both EPS and revenue expectations and STZ posted a small dividend increase. Results were driven by the Modelo and Corona brand families. The beer business was the top U.S. share gainer during the winter holiday season driven by Modelo Especial, Corona Premier and Corona Familiar. Q4 shipment volume was strong and exceeded expectations primarily due to timing. STZ will concentrate on its strongest brands and agreed to sell ~30 brands from its wine and spirits portfolio and related facilities to E. & J. Gallo Winery for $1.7B. This sale does not include its Robert Mondavi, Prisoner Wine, Kim Crawford, Ruffino, Meiomi and SVEDKA Vodka brands.

The Company in a Nutshell

- STZ owns more than 100 brands and 40 wineries.

- The company invested $4B in Canopy Growth (CGC or WEED.TO) in late 2018.

- While the alcoholic beverage market could move slowly, the cannabis market is poised for strong growth.

Business Model

Founded in 1945, Constellation Brands Inc is engaged in the beverage industry. Its core products are alcoholic drinks such as beer, wine and other spirits. Constellation Brands is a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, Italy, and Canada. Constellation is the No. 3 beer company in the U.S. with high-end and iconic imported brands such as Corona Extra, Corona Light, Modelo Especial, Modelo Negra and Pacifico. The company employs around 10,000 workers. STZ is among the rare consumer defensive stocks showing a good value. You can download the full list here.

Investment Thesis

If you want to enjoy the cannabis growth without suffering from its fluctuation, an investment in STZ could be a good move. STZ has adapted its business model with a major shift toward high-end beer after management realized sales would eventually stagnate for “common beers”. With 6 of the top 15 imported brands, STZ is #1 for high-end beer in the U.S. and #1 among imported beer companies in the U.S. STZ uses its venture capital arm, Constellation Ventures, to make strategic acquisitions or investments like its stake in Canopy Growth. STZ recently announced the sale of non-core brands to refocus on growing ones. Smart move.

Potential Risks

It is hard to find flaws looking at a business that was quick to realize the beer future and made the right shift at the right time. Will STZ be as clairvoyant with its investment in the cannabis industry? While STZ is less volatile than Canopy Growth, it doesn’t mean it will be an easy ride. Also, STZ may be one of the key high-end beer players in the industry, it now faces competition from 6,000+ microbreweries. Consumers tend to try different beers instead of sticking to one. It will be difficult to dominate this rapidly changing market.

Dividend Growth Perspective

STZ is a young dividend payer showing only three years of dividend growth history (first dividend paid in 2015). However, during this short period of time, STZ went from $0.31/share to $0.75/share. You can expect double-digit growth for several years to come as it enjoys a very low payout ratio. The dividend discount model can’t justify the current price, but we believe growth coming from the cannabis industry justifies the gap between the DDM value and its full potential.

VALUATION

Dividend Growth Rate Years 1-10: 10% Terminal Dividend Growth Rate: 6%

| Price on 04/23/2019: $207.32 | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $269.11 | $177.23 | $131.40 |

| 10% Premium | $246.68 | $162.46 | $120.45 |

| Intrinsic Value | $224.26 | $147.69 | $109.50 |

| 10% Discount | $201.83 | $132.92 | $98.55 |

| 20% Discount | $179.40 | $118.15 | $87.60 |

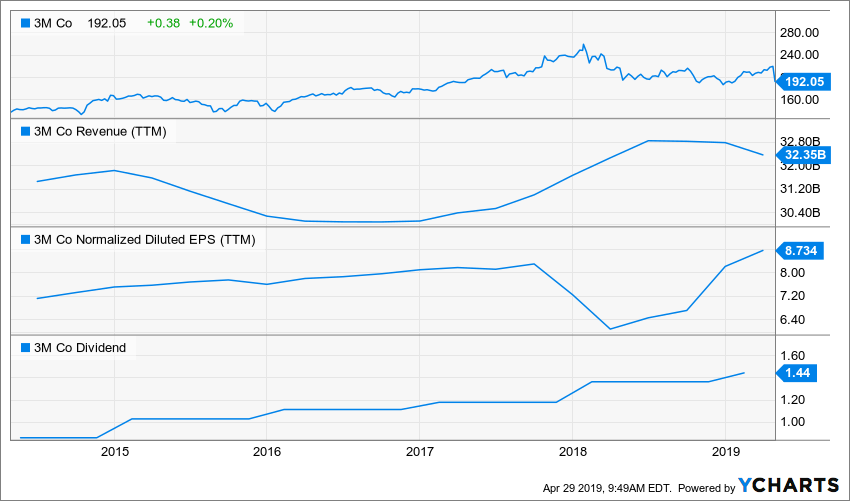

3M Co (MMM)

Source: Ycharts

What’s the story?

MMM and large mutual funds have the same problem; they got so big it’s hard to show sustainable growth all the time. MMM is so diversified that it is often stuck with growing according to the world GDP. As the economy is slowing down in Europe and Asia, MMM is struggling to post growth. 2019 guidance has recently been cut and since the market has its nose stuck to the wall, it cannot see past the next near-term quarters. With the recent drop in price, MMM is now offering you a 3% yield. Not bad for a Dividend King.

In April, MMM shares plummeted on earnings day as the company posted disappointing numbers on top of announcing a lower 2019 outlook. With 2,000 job cuts as part of their restructuring moves, they say it will save $225M-$250M/year. Q1 sales fell 5% Y/Y to $7.86B, as industrial sales sank 6.6% to $2.9B, safety and graphics sales slipped 4.2% to $1.7B, and health care sales edged 0.3% higher to $1.5B. But what really hurt the stock was MMM cutting guidance to $9.25-$9.75 from $10.45-$10.90. This stock price drop now creates a unique opportunity for patient investors to buy a fine company while the company temporarily sits on the bottom of the tank.

The Company in a Nutshell

- 3M Company is definitely more diversified than a balanced mutual fund.

- MMM has been increasing its dividend each year since 1959!

- Roughly 50% of its products are consumable, which implies a very high rate of repeat business.

Business Model

3M produces products like Scotch tape, projector systems, Post-it notes, Tartan track, and Thinsulate. This is a conglomerate that produces products for many industries and for both personal and business use. Their manufacturing, research, and sales offices are all over the world. This company is part of our top dividend industrial stocks. Click here to download the full list.

Investment Thesis

3M’s competitive advantages are legendary. Industrial clients are reluctant to abandon such a world class company for any competitors as they know MMM will deliver quality products. 3M shows one of the strongest business models among the dividend kings and its dividend growth potential will continue to be one of its most interesting characteristics for investors. By becoming the leader in R&D in many sectors and offering efficient products that work, 3M has created an unique economic moat that can’t be matched by its competitors. An investment in MMM is like buying the most solid money printing machine you will ever see. You can use industrial cyclical slump happening from time to time to add more shares.

Potential Risks

This is not a company to buy in the hope of showing double digit returns, but this is a company you can buy and sleep well at night. The price drop in 2018 is a good indication that too much hope around such large company could end-up in a disappointing result. MMM remains the same, but unreachable expectations from the market could hurt the stock price.

Dividend Growth Perspective

3M has been paying dividends to its shareholders for over a century and shows more than 50 consecutive years of increase. Over the past couple of years, MMM has been even more

generous with their dividend increase and the payout ratio has jumped over 50%. Still, there is plenty of room for management to increase it in the future. Shareholders can expect high-single digit dividend growth going forward.

VALUATION

Dividend Growth Rate Years 1-10: 7% Terminal Dividend Growth Rate: 6%

| Price on 02/12/2019: $203.68 | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $399.49 | $265.45 | $198.47 |

| 10% Premium | $366.20 | $243.33 | $181.93 |

| Intrinsic Value | $332.91 | $221.21 | $165.40 |

| 10% Discount | $299.62 | $199.09 | $148.86 |

| 20% Discount | $266.33 | $176.97 | $132.32 |

Final Thoughts

While many stocks seem overvalued right now, we can still find great companies at great price. Let’s not forget that the market is going up is also because companies are making more money. It’s not just pure speculation. I think those three companies are great example of what you can find on the market at a cheap price.

If you made it this far, let’s be honest; you liked what you read. Now it’s time to make sure you don’t miss our next analysis and you subscribe to the Dividend Monk Newsletter by clicking on this link to make sure you don’t.

Disclaimer: We do hold WBA, STZ and MMM in our Dividend Stocks Rock portfolios.

Monk –

Funny you mention Constellation Brands.. I’ve always thought about owning them.. getting closer to pulling a trigger. Great list you have!

-Lanny