Summary

-Clorox is a leading consumer products company with a variety of strong brands.

-Average four-year revenue growth: 5%

-Average four-year earnings growth: 8%

-Average four-year cash flow growth: 12%

-Current dividend yield: 3.50%

-Dividend growth: 13%

-The balance sheet is a big weak spot, with liabilities almost matching total assets.

-Taking into account the strong company performance and their weak balance sheet, I find the current P/E of a bit over 13 to be fair. I feel that long-term risk-adjusted returns of an investment in this stock are likely to be reasonable.

Overview

Clorox (NYSE: CLX) is a leading consumer products company. It was founded in 1913 and now has over 8000 employees. At one point during the middle of the 20th century, it was purchased by Procter and Gamble (PG), but the corporation was forced to sell Clorox due to fears that it would lead to a lack of competition.

2010 Sales Breakdown

| Segment | Net Sales Percentage |

|---|---|

| Cleaning | 33% |

| Household | 30% |

| International | 21% |

| Lifestyle | 16% |

Total 2010 revenue was $5.534 billion. Each of these categories includes a variety of strong brands, and some of them are listed below.

Cleaning:

Clorox

409

Pine Sol

Greenworks

Tilex

Household:

Fresh Step

Kingsford

Glad

International:

Poett

Javex

Nevex

Lifestyle:

Brita

Burt’s Bees

Hidden Valley

Revenue, Earnings, Cash Flow, and Metrics

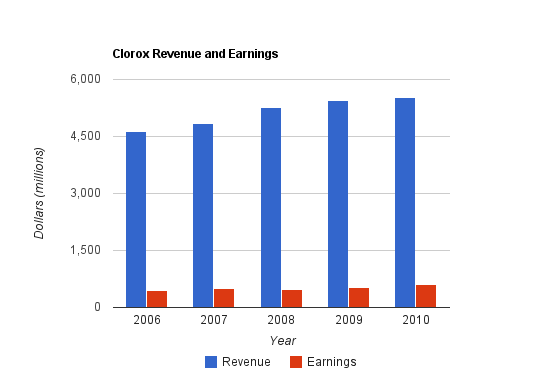

Clorox has had moderate steady growth over the past few years.

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $5.534 billion |

| 2009 | $5.450 billion |

| 2008 | $5.273 billion |

| 2007 | $4.847 billion |

| 2006 | $4.644 billion |

Over this period, revenue has grown by nearly 5% annually, on average.

Earnings Growth

| Year | Earnings |

|---|---|

| 2010 | $603 million |

| 2009 | $537 million |

| 2008 | $461 million |

| 2007 | $501 million |

| 2006 | $444 million |

Over this period, earnings have grown by 8% annually, on average.

During this same period, EPS grew from $2.90 to $4.24, which represents an annualized growth rate of 10%.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $819 million |

| 2009 | $738 million |

| 2008 | $730 million |

| 2007 | $709 million |

| 2006 | $522 million |

Cash flow growth over this period averaged 12%, but a low year in 2006 skews the results a bit.

Metrics

Return on Assets is 14%, and Return on Equity is off the charts due to the extremely high leverage.

The P/E ratio is a little over 13, and the P/B ratio is very high which is again due to the leverage.

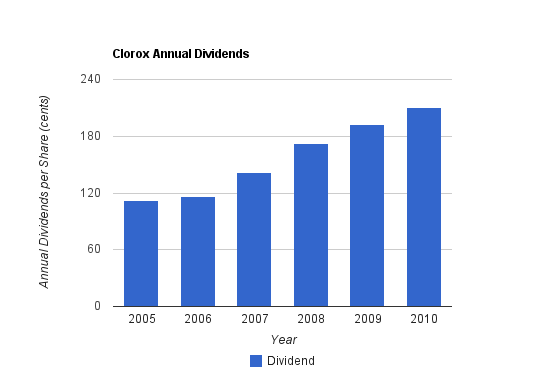

Dividends

Clorox is a dividend aristocrat with a strong history of dividend growth. Calculations for the following chart are based on the calendar year rather than the fiscal year. The current dividend yield is 3.5% with a payout ratio of around 45%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $2.10 | 3.40% |

| 2009 | $1.92 | 3.60% |

| 2008 | $1.72 | 2.90% |

| 2007 | $1.42 | 2.30% |

| 2006 | $1.16 | 1.90% |

| 2005 | $1.12 | 1.90% |

Clorox has grown its dividend by an average of 13% over the last five years. The most recent quarterly dividend raise was from $0.50 to $0.55, which is a 10% raise.

Balance Sheet

The balance sheet is an unattractive aspect of Clorox, because their total liabilities nearly equal their total assets. The balance sheet is among the worst in the industry. The total debt/equity ratio is extremely high, because the shareholder equity is nearly zero. Furthermore, goodwill and intangible assets greatly exceed the tiny amount of shareholder equity.

The interest coverage ratio is approximately 7.5, which means Clorox is safely covering its debt. Still, this is a lower value than I’d like to see in a long-term investment.

Investment Thesis

In the latest annual report, Clorox identified four “megatrends” that it uses to evaluate growth opportunities. These megatrends are:

-health and wellness

-sustainability

-multicultural

-affordability/value

Clorox has been unleashing and acquiring several natural products, in line with the health and wellness and sustainability megatrends. These brands, like Burt’s Bees and Greenworks, are riding on consumer’s desires to use more natural products that have less harsh chemicals, avoid animal testing, and meet various requirements. Both of these brands have been successful and Clorox is aggressively advertising and promoting them.

The company has been attempting to increase its relevance among Hispanics, which represent a quickly growing portion of the U.S. population. Clorox also has operations around the world, developing products relevant to specific regions.

Some brands can blend several megatrends. Brita water filters, for example, help consumers save money by eliminating water bottles, and this also has an appeal among those conscious about conservation of natural resources.

The company has been gradually increasing revenue, volume, earnings, cash flow, advertising, research and development, and of course, the dividend. This appears, in almost all ways, to be a strong, steady march towards continued long-term growth and profitability. The company has a portfolio of brands appealing to a wide audience, and I agree with their concepts of megatrends and feel that they have aligned the company with those trends very well.

The debt, however, limits their flexibility in dealing with competition and taking advantage of opportunities.

Risks

Clorox faces risks of high commodity costs, and the industry it operates in is extremely competitive. Clorox’s highly leveraged position gives it more risk than industry peers. Due to its international presence there is also currency risk.

Conclusion and Valuation

In conclusion, I think Clorox is a great company with an excellent dividend history. Unfortunately, Clorox’s balance sheet leaves a lot to be desired, and at this valuation, I think better opportunities exist. Still, I doubt that investors looking back from well into the future would be disappointed if they were to invest today, so it’s not necessarily a bad investment. The dividend growth rate coupled with the current dividend yield is quite impressive. The market capitalization of less than $9 billion means its large enough to have pricing power, international exposure, and financial safety, and yet small enough to have years and years of impressive growth if it’s managed well.

Full Disclosure:

As of this writing, I have no position in CLX, and I own shares of PG.

You can see my full list of individual holdings here.

Further reading:

Intel Corporation (INTC) Dividend Stock Analysis

Costco Wholesale (COST) Dividend Stock Analysis

Texas Instruments (TXN) Dividend Stock Analysis

Kimberly-Clark (KMB) Dividend Stock Analysis

Chevron Corporation (CVX) Dividend Stock Analysis

Great analysis, once again. Their dividends are definitely impressive. :)

Interesting analysis and reasonable conclusion as usual:)

Btw, have you looked at Wells Fargo? Buffet has large ownerstake in that company (usually a good sign). Morningstar seems bullish on it:

http://www.morningstar.com/Cover/videoCenter.aspx?id=349202

Based on the assumption that WFC can return to their previous profit margins and ROA it seems like a fine bargain. Probably a big IF however.. cant be easy to incorporate a giant like Wachovia.

Hi Defensiven,

Thanks for the video. I assume Wells Fargo will do well. If I were to invest in a big bank, it would be them. But I consider big banks to be out of my comfort zone as an investor, at least at the current time. With such scale and complexity, even full time analysis have trouble wading through them.

I think you’re right about Wells. I took a leap of faith to buy shares of the Royal Bank the other day, but can I really follow the flow of its revenue? Not really. You’re right about your reservation relating to Clorox’s debt. But not all businesses, I suppose, are equal on that front. Clorox has such name brand recognition with its products that it can count on revenue that should be more or less dependable and regular. A company like Boeing wouldn’t have that consistent, regular luxury. Great analysis–as always!

Hello Matt!

Yes their operations are very diverse and hard to grasp. They dont seem as stable as id like either, they needed state aid in 2008 aswel as a major new issue of shares in 2009

But I find it hard to drop that berkshire has 20% of its stock portfolio in WFC. Buffet probably sees leadership excellence.

Buffett had quote that went something along the lines of, “if you don’t know jewelry, at least know the jeweler”. In other words, if you don’t understand every aspect of the company, make sure you at least trust management.

Buffett loves Wells Fargo. But he also loves banking in general. His circle of competence includes banks, insurance companies, and consumer products companies. I definitely pay attention to what’s in Berkshire’s portfolio, but I make sure I understand my own investments pretty well (and I feel that running a blog and making my opinions public makes me even more accountable). I’m comfortable with consumer products, insurance, health care, energy, some tech, and some miscellaneous.

Andrew,

When it comes to Clorox, I think it’s a great company. The only question for me, when it comes to investing in Clorox, is what valuation is appropriate? 13x earnings is pretty good if the company had less debt. With its debt load, I’d be more comfortable with a P/E closer to 11 or even 10 to have a better margin of safety. Though, as I said, I doubt anyone investing in Clorox at the current price would regret that decision years later. It depends in part on what rate of return an investor is targeting.

Perhaps price shouldn’t be of consideration when lowering standards. Buffett says that he’d prefer a wonderful business at a fair price than a fair business at a wonderful price. Considering the debt, that puts this business somewhere around “good” rather than “wonderful”–based on the kind of fundamentals Buffett espouses. So….we could say that the price level acts more as a distraction, tempting us, perhaps, to look at a business that might not safely meet our tenets. Perhaps, in Buffett-speak again, we should wait for another pitch. We can, after all, find businesses just as solid, with less debt, and a price that’s similar, right?

Exactly.

As I mentioned in the conclusion, at this price, I think better opportunities exist.

I have other pitches I want to swing at, even if this pitch seems decent.