Southern Company (NYSE: SO) is one of the largest utility companies in the United States, and serves 4.4 million customers more than 43 gigawatts of power in the Southeastern states.

-Seven Year Average Revenue Growth Rate: 5.8%

-Seven Year Average EPS Growth Rate: 3%

-Seven Year Average Dividend Growth Rate: 4%

-Current Dividend Yield: 4.26%

-Balance Sheet Strength: Rather Solid for a Utility

Southern Company is well-positioned to continue to provide growing dividend income, but at the current price, the total rate of return potential likely is limited to the mid-to-high single digits. Risk-adjusted returns appear somewhat reasonable, but from a total return perspective, the stock price is a bit on the high side.

Overview

Southern Company is one of the largest utility companies in the United States. The company serves more than 4.4 million customers in Florida, Georgia, Mississippi, and Alabama. The company operates through the entities:

Alabama Power

Georgia Power

Mississippi Power

Gulf Power

Southern Power

Southern Nuclear

SouthernLINC Wireless

In 2000, the company generated 78% of its power from coal, 4% from oil and gas, 16% from nuclear, and 2% from hydro. In 2010, the company generated only 52% of its power from coal, a sizable 30% from oil and gas, and a constant 16% from nuclear and 2% from hydro.

Current projects include the first new U.S. nuclear reactors in decades, which could substantially grow their nuclear production staring around 2016-2017, as well as a recent acquisition of the Apex Solar Project, a 20 megawatt solar installation in Nevada, which could lead to more and larger solar projects by the company.

Ratios

Price to Earnings: 18.5

Price to Free Cash Flow: Erratic

Price to Book: 2.2

Return on Equity: 13%

Revenue

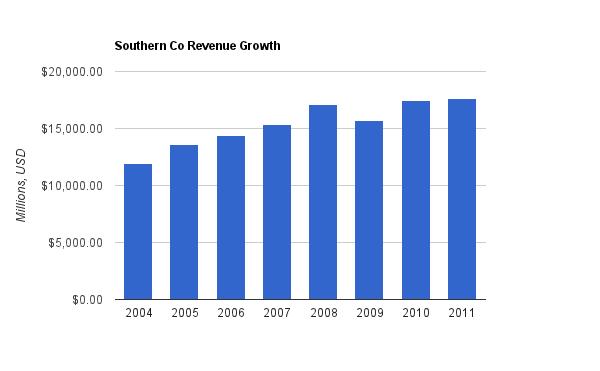

(Chart Source: DividendMonk.com)

Revenue grew at around 5.8% per year over this period, which is rather substantial. Part of the reason is, Southern Co issues shares, which can slightly accelerate total growth of the company at the cost of shareholder dilution.

Earnings and Dividends

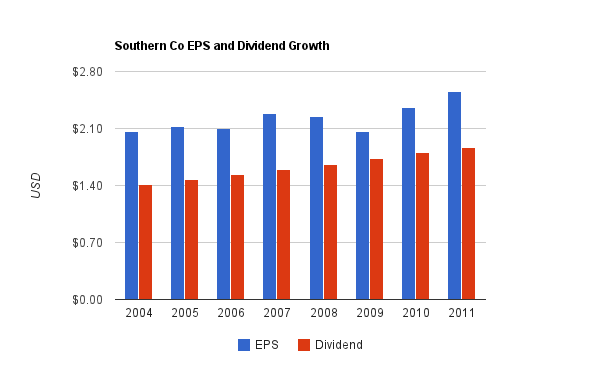

(Chart Source: DividendMonk.com)

EPS growth was erratic over this period, and averaged only 3% per year over the last seven years. Dividend growth, on the other hand, was approximately 4% per year on average, and the company has increased the dividend for 11 consecutive years. The dividend payout ratio is approaching 80%, implying that dividend growth will have to settle at the pace of EPS growth to maintain a stable payout ratio at some point.

In terms of profitability, due to large capital expenditures, free cash flow has been erratic and mostly negative over the last five-year period.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 4.26% |

| 2012 | 4.2% |

| 2011 | 4.8% |

| 2010 | 5.3% |

| 2009 | 4.5% |

| 2008 | 4.1% |

| 2007 | 4.3% |

| 2006 | 4.2% |

| 2005 | 4.4% |

| 2004 | 4.7% |

The current yield of 4.26% is primarily in line with, and slightly on the lower side of, the average dividend yield for the recent period.

Balance Sheet

Southern Company has a total debt/equity ratio of 120%, and a total debt/income of around 10x. The interest coverage ratio is approximately 5x.

Overall, these numbers are quite solid for a utility. Utilities require substantial leverage in order to get decent returns on equity with their huge asset costs, but they balance out this leverage with some of the most stable cash flows of any industry.

Investment Thesis

Southern Company is one of the largest and most stable of utilities in the United States. On top of that, they’re located in the Southeast region, which has some of the strongest economic growth. Part of it is fueled by the population growth of Georgia and Florida that has exceeded average U.S. population growth:

According to Southern Co, electricity consumption is expected to increase 27% in the Southeast by 2030. Roughly speaking, assuming no change in market share, that leads to more than 1.3% annual growth in electricity provided by the company, which when combined with inflation growth leads to mid-single-digit revenue growth. Any geographic expansion, acquisitions, or increase in market share would be on top of that.

Risks

Southern company’s heavy (but diminishing) reliance on coal for energy production is a political liability for environmental reasons. Similarly, their long-term nuclear construction project has a degree of controversy to it. On one hand, nuclear energy is a fairly clean source of cost-effective energy, and the loans for the construction are supported and backed by the federal government. Nonetheless, certain environmental groups have unsuccessfully attempted to stop this first U.S. nuclear construction project in decades, especially after what occurred in the aftermath of the Japanese tsunami.

Share dilution is a slow risk. The company consistently issues shares, and so the outstanding share count has increased from around 715 million to around 875 million over the last ten years. EPS growth and dividend growth will therefore need to grow more slowly than company-wide net income growth. For example, between 2004 and 2011, the company grew its total annual dividend payout by almost 6.9% annually, but the per-share dividend only grew by around 4% annually.

They also face catastrophe risk, standard regulatory risk, and the free cash flow isn’t particularly strong.

Conclusion and Valuation

Southern Company has particularly solid operations, in a good market, and with a solid balance sheet.

The question, then, is what is the fair price to pay? Part of this is subjective; what rate of return should an investor expect from a conservative utility?

A key method to work with here is the Dividend Discount Model, because the company has large, reliable, and growing dividends.

Based on the $1.925 paid in dividends over the last four quarters, an estimate of 4% dividend growth, and using a 10% discount rate, the fair value of the stock would be only around $33, which is significantly lower than the current price of around $46. And this assumes 4% growth, which means EPS growth would have to pick up slightly to keep that rate sustainable.

In some ways, a preferable method for this stock would be to work backwards, and determine what rate of return can be expected for the current stock price. With $1.925 in dividends and 4% dividend growth, a discount rate of around 8.3% would be needed to determine that the current stock price of around $46 is fair, which also happens to be the sum of dividend growth and the dividend yield, currently. Roughly speaking, 8.3% is the current long-term rate of return an investor in this stock could expect unless the growth rate or earnings multiple changes substantially.

If the long-term dividend growth rate is only 3%, then the discount rate would have to be as low as 7.3% to consider the current price fair.

If a bit over 7-8% seems to be a fair risk-adjusted rate of return for Southern Company, then it’s reasonably priced. I consider the stock to be a fair hold for those looking to keep growing and steady dividend income, but it’s likely not an optimal pick for investors in the wealth accumulation phase, and overall, I view it to be moderately overvalued.

Full Disclosure: As of this writing, I have no position in SO.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Thanks for the analysis of this company. I will definitely throw this stock on my watchlist. I never 100% welcome a fall in the market, but when one does happen I will pick up some shares!