How do you sniff out dividend cuts before they happen, and avoid the worst? Spare yourself the unpleasantness of a dividend cut, and of the inevitable stock price drop that comes with it. Learn what to look for…

I won’t say it enough: high-yield stocks are prone to dividend cuts. Every time it happens, it comes with a dual impact:

I won’t say it enough: high-yield stocks are prone to dividend cuts. Every time it happens, it comes with a dual impact:

- Loss of income (dividend cut)

- Loss of capital (stock price decline)

Remember: many struggling companies see their stock price decline, therefore increasing their yield before there is a dreadful dividend cut.

Horror stories

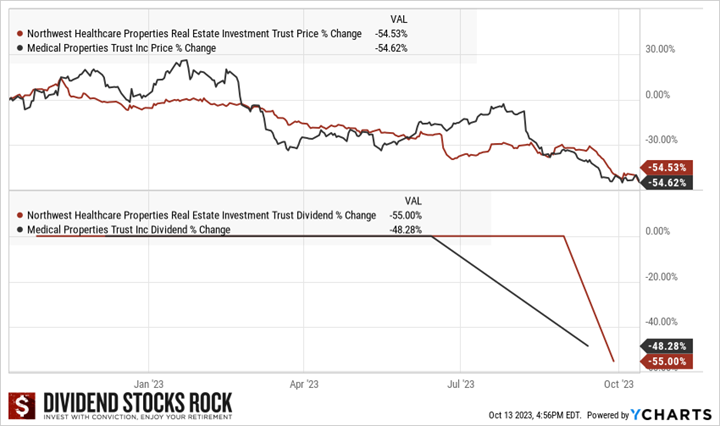

In February 2023, we announced the sale of our shares of Medical Properties (MPW) from our DSR portfolio to “be on the safe side”. In August, MPW announced a dividend cut. Shareholders lost over half of their investment (-55% year-to-date) and 48% of their income. We warned members several times about the poor quality of Northwest Healthcare Properties (NWH.UN.TO). The REIT cut its distribution and shareholders were left with a 55% loss on both sides (income and capital!)

Dividend cuts have a catastrophic impact on your portfolio. They can even cripple your retirement plan.

Avoid dividend cuts

You can’t avoid all dividend cuts, but you can prevent most of them. Also, you can minimize the impact of each cut on your portfolio.

Below is a list of items to observe to sniff out dividend cuts amongst your generous payers.

Ensure your investment thesis is backed by numbers

A story about why you love a stock is great. Having numbers in line with your story is a lot better.

Get rid of stocks with poor dividend triangle. To learn what the dividend triangle is all about, listen to this podcast. A high yield with no revenue, EPS growth, or dividend growth can’t stay in your portfolio. One-time poor results are not necessarily a cause for alarm, but a persistent trend is.

There are perfectly acceptable reasons for a one-time or temporary drop in revenue or EPS, or for a slowing down of dividend growth. Always investigate situation like these during your quarterly portfolio review to see the cause of the disappointing performance; perhaps there was one-time payment for a lawsuit settlement, a temporary closure of locations due to unforeseen events like a pandemic or storm damage, etc.

Sniffing out dividend cuts if great but you also have to create a large enough paycheck for yourself. To learn how…download our Dividend Income for Life Guide!

Avoid high payout ratios

If payout ratios or around or above 100%, it’s probably time to run. However, there are circumstances when a high payout ratio isn’t that alarming: companies can suffer temporary setbacks or one-time events not likely to occur again, for example, product recalls, lawsuit settlements, or natural disasters affecting production capacity.

Also, for some industries, the classic payout ratio is not the best metric to see what is really happening; be mindful to look at the correct metric. For more on that, read Different Payout Ratios – Quick Tour.

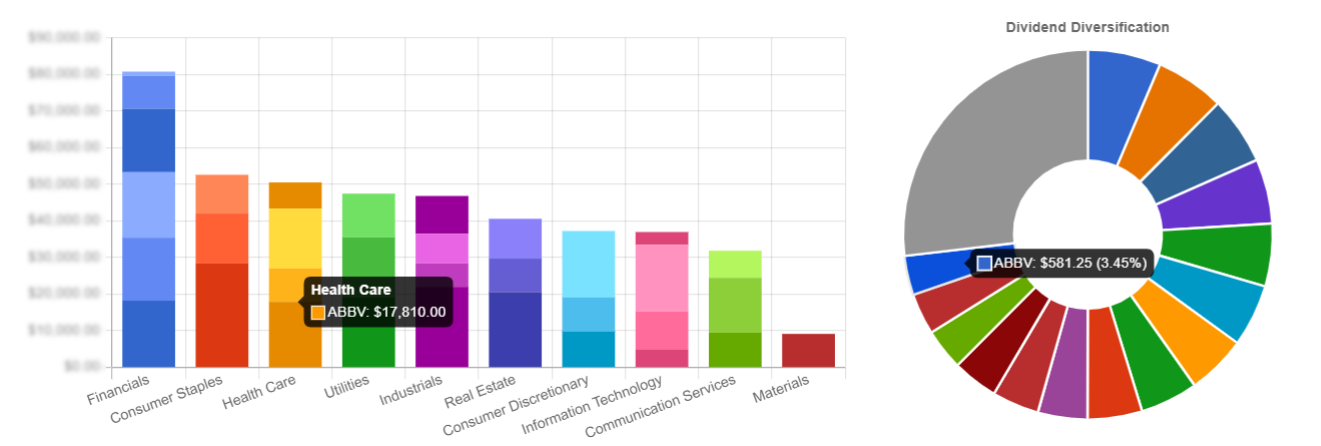

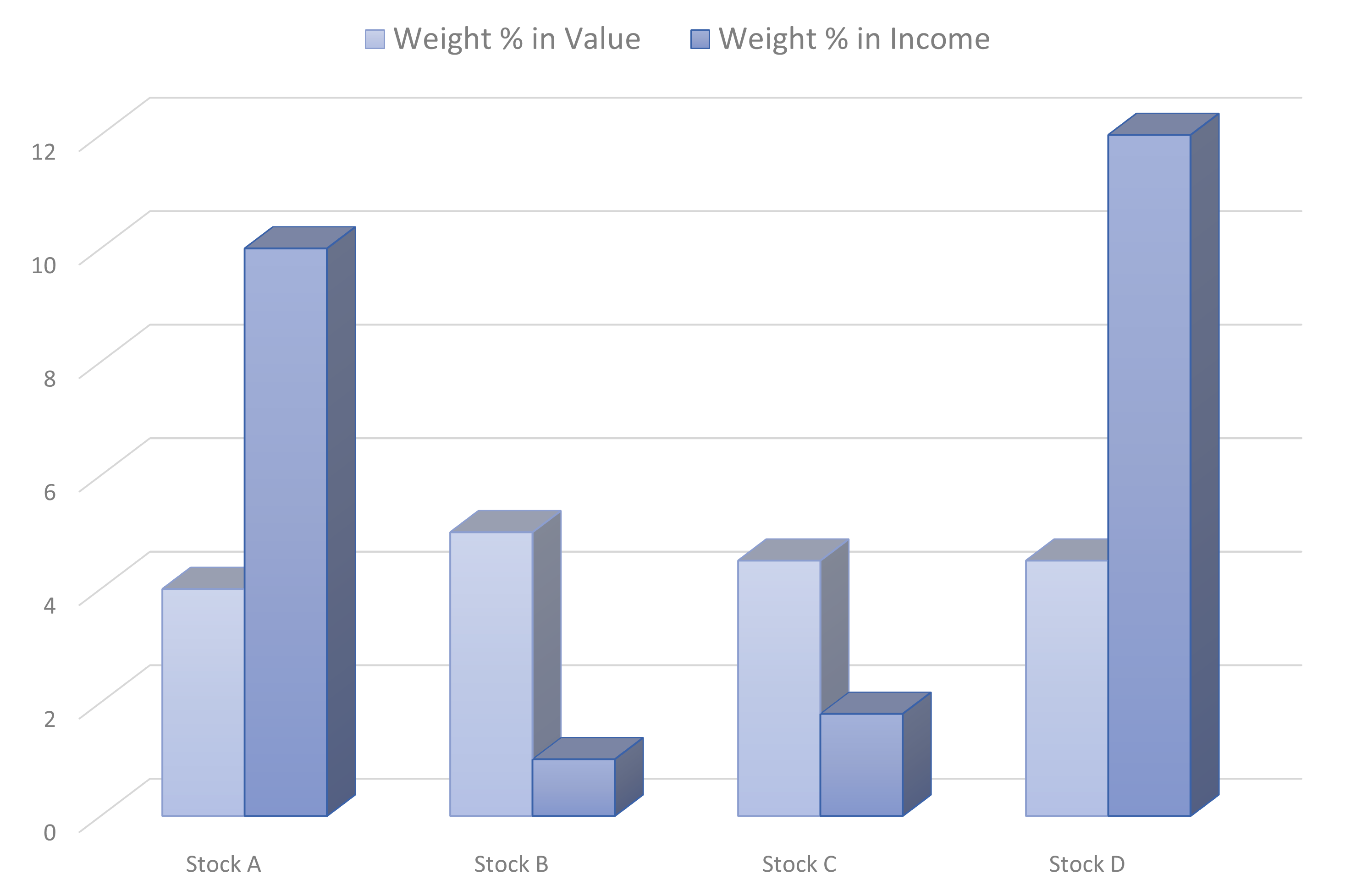

Adjust the weight of your high-yield stocks

Review the weight of each stock in your portfolio, i.e., the proportion each one represents, both in value and in dividend income. Having enough diversification in your positions and sources of income means that, should you be the victim of a dividend cut, it’ll have less of an impact on your overall portfolio and be less painful. DSR members can use the DSR PRO dashboard to quickly see both weight in value and dividend income.

If some of your positions represent too much of the overall value of your portfolio, even if it is due to something positive like a substantial share price increase, you might want to sell a few shares and reallocate the funds in other positions. Some investors like equally weighted allocation of stocks, for example, if they have 20 stocks, each one has a weight of 5%; of course, that changes as share price fluctuates. I usually allocate an equal weight to a new position, but I voluntarily increase the weight of my favorites. I try not to exceed 10% for a single stock.

Diversify your dividend income

If some of your stocks represent too high of a percentage of your overall dividend income, a dividend cut for these stocks would hurt your return significantly. Again, it might be time to sell a few shares and reallocate the funds.

Here’s an example to show the difference between weight in value and in dividend income:

- If $200,000 invested in Apple generates $1,200 in dividends/year (0.6% yield), and

- $100,000 invested in Enbridge generates $6,500 in dividends/year (6.5%)

- The exposure to Enbridge, in value, is half that of Apple. As a source of income through, the Enbridge exposure is over 5 times that of Apple.

Not too many stocks in one sector or with the same business model

If you have four office REITs, you expose yourself to major damage in your portfolio. Similarly, there is no use in holding five Canadian banks that have very similar business models. If you want a few stocks in a sector, choose them from different industries within the sector, for example residential and industrial REITs, or for the financial sector, a bank, an asset management company, and an insurance company.

Find great stocks to create your own paycheck. Learn how in our Dividend Income for Life Guide!

Avoid concentration in sectors sensitive to interest rates

Capital-intensive businesses, those that invest heavily in projects and infrastructure, are more exposed to higher interest rates. They will be the first ones to fail their shareholders. Examples of capital-intensive businesses include energy companies, utilities, telecommunications, REITs, and industrials. If your portfolio is heavily focused in these, rebalance it with stocks in less capital-intensive sectors or industries, like financials, consumer staples, or consumer discretionary.

Final thoughts

As the market has dropped in 2022 and is quite volatile in 2023, most dividends are still alive (and growing), and many companies now offer a yield above 4%. This is a great opportunity to invest more money or simply make sure to reinvest your dividends in money-printing machines.

This doesn’t mean you should pick anything that shows a good dividend triangle and a decent yield. When looking at metrics, ask yourself if the past 3-5 years of financial performance have a good chance to be replicated over the next 5 years. Some companies just surfed on a temporary tailwind while others have been around for a long time and have a proven business model. You want to pick among the latter.

[…] Similarly, if a company is crumbling under a heavy debt burden, its revenue and profit are falling, and/or its free cash flow is not enough to pay the dividend, cutting the dividend is the responsible thing to do. For retirees though, a dividend cut is at best upsetting, disturbing, and at worst a danger to their quality of life. Also remember that dividend cuts are often accompanied by a drop in the stock price, so investors lose on both dividend income and stock value. Ouch! See Sniff Out Dividend Cuts. […]