In uncertain markets, I like to go back to basics—and Sherwin-Williams is as fundamental as it gets.

It’s a company that literally coats the economy: from residential repaint jobs to industrial-scale coatings, the demand for paint doesn’t go away.

And for dividend investors? It brings a layer of reliability you can count on.

The Backbone of Sherwin: A Solid, Splash-Proof Business Model

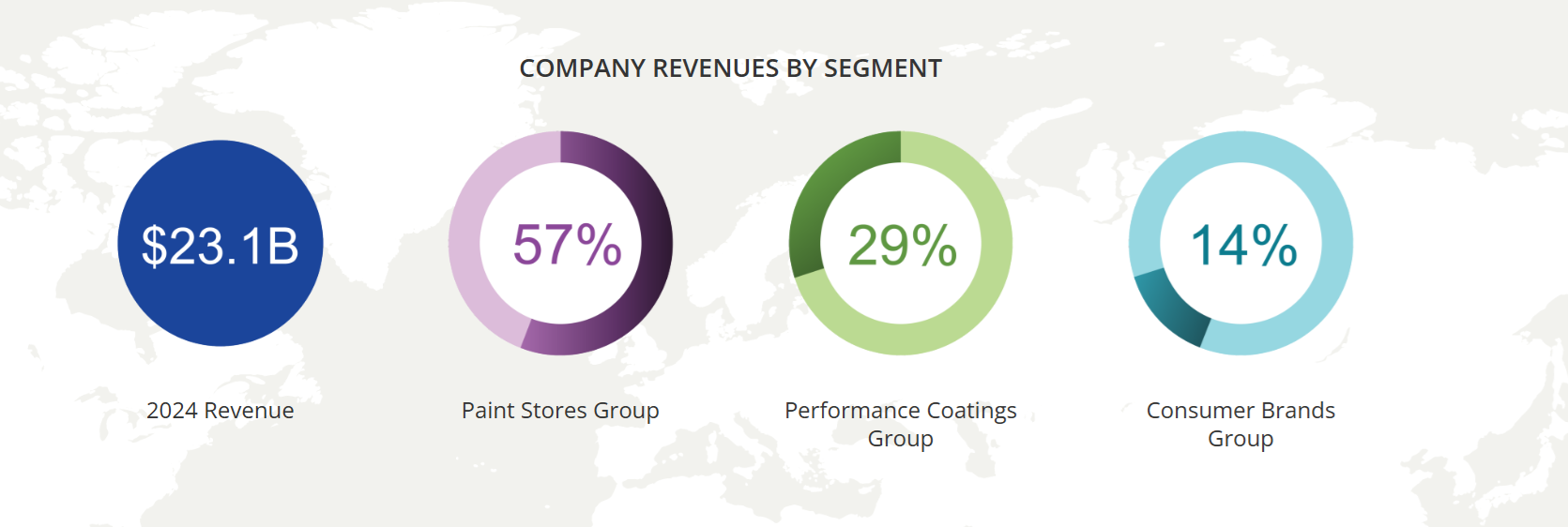

Sherwin-Williams (SHW) isn’t just another paint company. It’s the paint company. With operations across the Americas, the Caribbean, Europe, Asia, and Australia, this giant supplies everyone from your neighborhood DIYer to massive industrial manufacturers. When you think of Sherwin-Williams, think of an empire with three powerhouse divisions:

-

Paint Stores Group: The boots-on-the-ground team with company-operated stores serving contractors and homeowners alike.

-

Consumer Brands Group: Where you’ll find everything from wood finishes and varnishes to caulks and adhesives—those household names sitting on shelves in home improvement stores.

-

Performance Coatings Group: Industrial coatings galore, covering everything from your kitchen cabinets to manufacturing equipment.

This diversified model means Sherwin-Williams isn’t putting all its brushes in one bucket. Whether housing markets are booming or slowing, this business beast finds a way to keep the cash flowing.

The Big Picture: Bull vs. Bear on the Wall

Bull Case: Consistency Meets Quality

Here’s why Sherwin-Williams deserves a spot on your watchlist (or even better—your portfolio): it’s got a fortress of a business model, strong pricing power, and a sticky relationship with professionals who need its products to get the job done.

We love companies with wide moats and recurring demand. Sherwin’s distribution network and vertically integrated model give it a leg up on the competition. Add in disciplined capital allocation, growth through acquisitions, and global expansion on the horizon? That’s a recipe for long-term dividend growth.

Bonus points: they’ve been growing that dividend like clockwork. That’s music to the ears of any dividend growth investor.

Bear Case: Cracks in the Paint?

It’s not all smooth coverage. With over 4,900 stores, SHW may be nearing growth limits in the U.S.

With their high dependence on Professionals, if contractor activity slows, sales growth may decelerate. The business is still cyclical, especially tied to housing and industrial markets. The revenue trend is slowing down at the moment. Declining home sales due to high interest rates and economic uncertainty could affect demand, especially in the DIY segment.

Also, let’s not ignore raw material costs. Sherwin’s heavily reliant on petroleum-based inputs, so if prices shoot up, margins could get squeezed.

Competition is fierce too—names like PPG Industries (PPG) and RPM International (RPM) aren’t sitting still.

What’s New? Expansion Meets Headwinds

SHW recently announced an important acquisition in Brazil.

It will acquire BASF’s Brazilian architectural paints business, including the well-known Suvinil brand, for $1.15B in an all-cash transaction. Suvinil is a leading player in Brazil’s paint industry, generating $525M in annual sales and operating two production facilities.

Sherwin-Williams has forecasted a lower-than-expected annual profit, citing continued demand softness that might persist into late 2025 or beyond. Their Q4 2024 revenue growth was a mere 0.2%, hinting at potential stagnation.

Finally, SHW is facing significant changes in analyst ratings and market sentiment. Some analysts (CFRA, Jefferies) recently downgraded the stock.

We still see SHW as a core holding that should benefit any long-term investor.

Dividend Triangle in Action: All Three Points Are Holding Strong

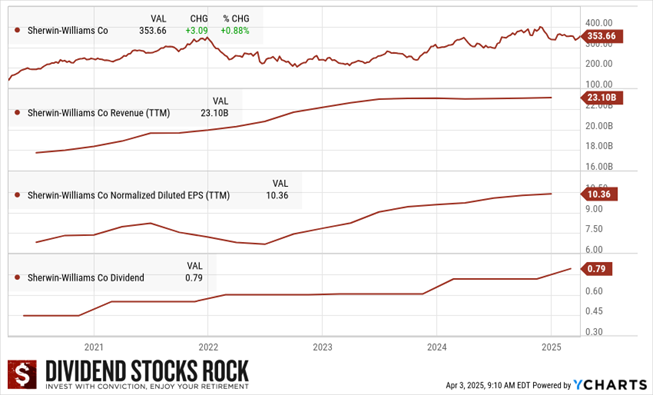

If you’re familiar with Dividend Stocks Rock, you know we live and breathe by the Dividend Triangle—revenue growth, earnings growth, and dividend growth. It’s our quick-and-dirty test to see whether a company has what it takes to keep rewarding shareholders for the long haul.

Here’s how Sherwin-Williams stacks up:

-

Revenue: This trend has been consistent over the last five years, although it has stagnated in recent quarters.

-

Earnings per Share (EPS): EPS reflects solid margin expansion and smart cost management, even during inflationary periods. After a slight dip in 2022, Sherwin bounced back.

-

Dividend: Payments continue to climb. While not high-yield, Sherwin-Williams shines with its reliability and double-digit dividend growth, supported by cash flows, not wishful thinking.

Bottom line: You’re looking at a financially healthy, growing business that consistently rewards shareholders.

Final Brushstroke: Steady, Not Flashy—and That’s a Good Thing

Let’s be honest—Sherwin-Williams isn’t going to double overnight. But it doesn’t need to.

This is a rock-solid, wide-moat, dividend-growing machine. The kind of stock that quietly compounds over time and helps you sleep well at night. You won’t get a juicy yield here, but you will get consistent dividend hikes, steady cash flow, and a proven management team.

Leave a Reply