With the market going sideways for the past few months, both US and Canadian markets are on their way to close 2018 in negative territories. There are lots of fluctuations as many investors realize they don’t have the stomach to ride such markets.

Each year, I make the publication of a book titled “Best Dividend Stocks”. This requires several weeks or hard work reading and researching financial statements. The purpose of this book is not to make you sell your portfolio and make you switch to this one.

The purpose of this book is to create a portfolio-like list of stocks in various sectors to provide both stock value appreciation and dividend growth perspectives. Additional research and analysis are required before making any trades. I’m neither your broker nor your financial advisor.

I’ve started this “tradition” in 2012 and pick American Stocks (20) and Canadian Stocks (10) that, combined together, I believed will beat the market. Each company has been analysed and handpicked per the DSR investing model.

What you are about to read is an excerpt of this book. Each stock has been considered according to stock market lessons learned from 2018. I’ve included 4 US “safe” picks for 2019. DSR members received the full 30 picks. Even better, they received them in December, not late in January ;-)

BLACKROCK (BLK)

Business Model & Recent Comments

BlackRock is not only the world’s largest asset manager by assets under management (AUM), but it is also a dominant leader in one of the fastest growing investment products: ETFs. As low-cost fees and passive investing solutions tend to grow stronger, more money is being transferred toward BLK. BlackRock offers investment products in all asset classes enabling it to generate fees regardless of whether investors are bullish or bearish.

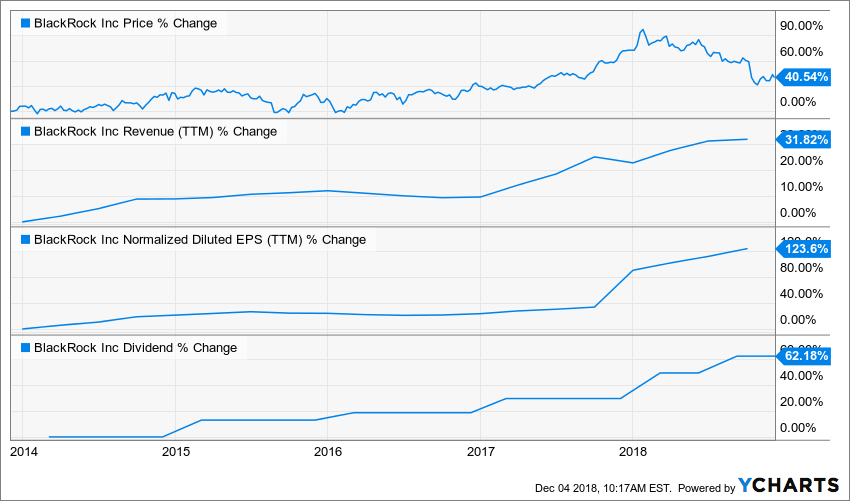

BLK didn’t impress the market with its recent modest revenue growth. Shares were once close to $600/share earlier this year, but now have crossed below the $400 level for the first time since the spring of 2017. Weak AUM is still on the table. Q3 net outflows $3.11B vs net inflows of $20B in Q2 and inflows of $96.1B a year ago. You can see investors are nervous about the market as equity had outflows of $17.3B, fixed income had inflows of $22.9B, multi-asset had inflows of $3.23B, and alternatives had inflows of $1.74B. This is definitely a time to add some BLK to your portfolio.

Investment Thesis

BlackRock is a winner and a keeper for decades to come. BLK net inflows of assets under management continue to increase quarter after quarter. In other words; there is always new money coming in. The company is a leader in a growing investment field (ETFs), and has a strong relationship with several institutional clients. Institutional investors are more inclined to stay with their providers for several years than switching from one company to another in the short term.

Potential Risks

The main problem is BLK has been on an incredible run on the stock market. No matter how much you love it, BLK will be among the biggest losers if a market correction occurs. It could also be a victim of its own success. The market is going into cheaper and more efficient investing products. BLK’s actively managed products could suffer much while its less-profitable products (ETFs) will grab market share.

Dividend Growth Perspective

The company has shown an impressive dividend growth rate for the past 7 years. Over the past 5 years, BLK maintained a 10%+ annualized dividend growth rate. Even better, the current payout and cash payout ratios are well under control. We expect a high single-digit dividend growth rate going forward even if the payout ratio permits low teens growth rates.

VALUATION

Dividend Growth Rate Years 1-10: 9.00% Terminal Dividend Growth Rate: 7.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $954.02 | $632.02 | $471.20 |

| 10% Premium | $874.52 | $579.35 | $431.94 |

| Intrinsic Value | $795.02 | $526.68 | $392.67 |

| 10% Discount | $715.52 | $474.01 | $353.40 |

| 20% Discount | $636.02 | $421.34 | $314.14 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

DISNEY (DIS)

Business Model & Recent Comments

The king of content has been part of my top consumer stocks list for a while now. In 2006, It bought Marvel for $4 billion. Six years later, Disney sealed another $4 billion deal with the Lucasfilm purchase. Today, we can divide Disney into two separate businesses. Media networks include ESPN, ABC and many FOX assets while Disney branded businesses include parks, movies and consumer products. Both segments show strong vectors.

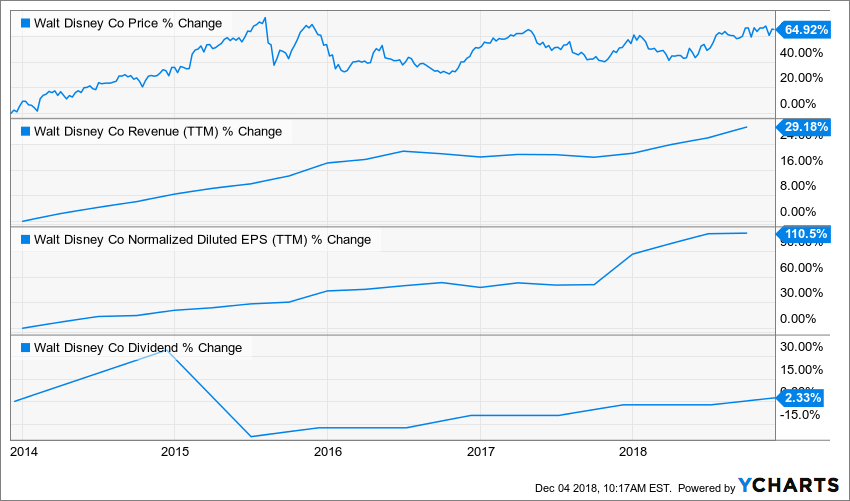

Disney has been doing better on the market lately as investors are finally getting a grasp of Disney’s business plan: acquire more content (Fox), diversify (streaming) and multiply their streams of income. The investment thesis will get out of the never-ending “ESPN is losing subscribers” and we will talk about future growth again. Please note the dividend hasn’t been cut in 2015 as suggest the graph. It’s because DIS went from an annual dividend payment to a semi-annual distribution mode. Management recently announced another raise by 5%. We expected more, but management probably needs more cash flow to integrate Fox assets and launch its streaming services.

Investment Thesis

Through the acquisition of Pixar, Marvel and Lucas Film, Disney has built a never-ending universe of blockbuster movies. The company pursued the same strategy while buying FOX assets. There is already an Avatar section in their theme park. In 2019, DIS expects to launch two different streaming services; a sport channel and an entertainment application. We don’t see Disney competing against Netflix, but rather completing NFLX product offerings. Most families and sports enthusiasts will likely pay an extra $10 a month to access more content and keep both DIS and NFLX services. In the meantime, DIS will count on numerous super heroes and Star Wars movies to boost its income.

Potential Risks

While the DIS media network (driven by ESPN) is a strong cash cow, the steady decline of cable subscribers is worrying the market. For this reason, each piece of news confirming the issue brings the stock price down. While streaming services are only expected in 2019, any rumors around it will affect the stock price. As the FOX deal is done, now it’s up to management to fully integrate those assets. As interest rates rise, a recession could hurt family budgets for vacation, and they may skip Disney’s theme parks.

Dividend Growth Perspective

Don’t get fooled by the dividend line in the graph as dividend payment policy went from once to twice a year. Over the past 5 years, DIS almost doubled its distribution as dividends went from $0.86 annually to $0.84 every 6 months. With a current payout ratio around 20%, DIS should keep its distribution growth in the high single to double digits for many years to come. The streaming service starting in 2019 will be another cash cow to support the ever-increasing dividend.

VALUATION

Dividend Growth Rate Years 1-10: 10.00% Terminal Dividend Growth Rate: 8.50%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $479.42 | $159.53 | $95.56 |

| 10% Premium | $439.47 | $146.23 | $87.60 |

| Intrinsic Value | $399.52 | $132.94 | $79.63 |

| 10% Discount | $359.57 | $119.65 | $71.67 |

| 20% Discount | $319.62 | $106.35 | $63.71 |

DOW DUPONT (DWDP)

Business Model & Recent Comments

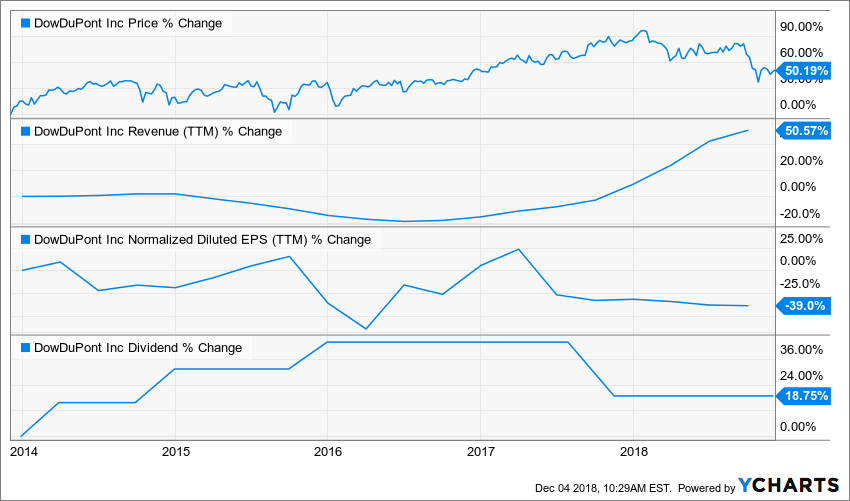

DowDuPont is the result of the merger of Dow and DuPont into a behemoth with over $80 billion in sales. The company has three global divisions: Agriculture, Materials Science and Specialty Products. The company, which combines the complementary portfolios, resources and capabilities of Dow and DuPont, intends to separate into three independent publicly traded companies by June 2019.

This is where Corteva Agriscience will offer germplasm, biotech traits and crop protection products. Through the merger, Corteva will gain strength through synergies and their distribution network. Dow will concentrate on material science with robust technology, asset integration and scale. Dow’s success will come from low costs of operation. On top of synergies coming from the merger, Dow enjoys low natural gas costs to feed its operations. DuPont will focus on speciality products with their solid R&D capabilities. With a sizeable portfolio of patents, I think DuPont is well positioned to service many industries, notably military and defense through its Kevlar products.

Investment Thesis

I think more value will be unlocked upon the split in 2019. This is why I think it’s the right timing to get some shares in your portfolio. Once the split is done, all numbers will be clear for all investors. The chances are that all three of the stocks will be fairly priced.

There is always a risk to buy shares of a company that is about to make an important move. However, considering the next transactions will create three leaders in three different markets, I think it will be hard to be wrong in accumulating shares now.

Potential Risks

There have been many concerns about trade wars and tariffs. Obviously, the soybean market has been affected as China put this sector into the war zone. If such macro economics continue to heat-up, chances are we will land in a recession. Companies like DWDP don’t really do well during down cycles. Considering investors are quite nervous these days, some of them may try to cash their profits and run before it happens.

Uncertainties about potential synergies have been brought up by some analysts. We all agree there will cost savings, but the key numbers are yet to be known. Uncertainties are never good in the market. This is why the stock is down 20% at the moment. I think it’s a good entry point.

Dividend Growth Perspective

At this stage, it is nearly impossible to determine what kind of dividend will be paid after the split that is planned for June 2019. But shareholders can rest assured that there will be dividends paid considering the history of both companies.

VALUATION

Dividend Growth Rate Years 1-10: 5.00% Terminal Dividend Growth Rate: 6.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $88.61 | $59.28 | $44.60 |

| 10% Premium | $81.23 | $54.34 | $40.89 |

| Intrinsic Value | $73.84 | $49.40 | $37.17 |

| 10% Discount | $66.46 | $44.46 | $33.45 |

| 20% Discount | $59.07 | $39.52 | $29.74 |

APPLE (APPLE)

Business Model & Recent Comments

Apple Inc. designs, manufactures, & markets mobile communication & media devices, personal computers, portable digital music players, and sells a variety of related software, services, accessories, networking solutions & third-party digital content. Apple is still dependant on its’ smartphone business, but other segments (services) are taking on more importance each quarter.

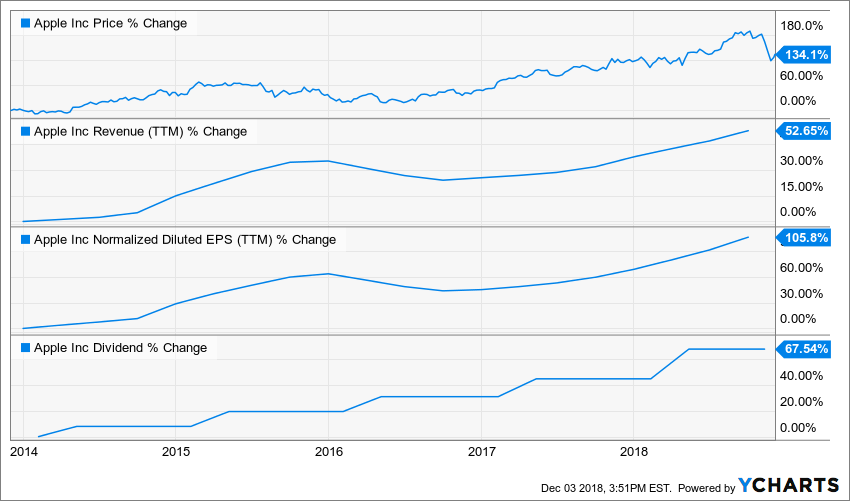

AAPL iPhone segment represents between 50 and 60% of its revenue depending on the quarter. Its second largest division is its services with close to $10B in revenue per quarter (Q4 2018). The recent stock price drop presents a great opportunity to pick up some shares if you have been late to this party.

Investment Thesis

There is definitely a continuing interest for Apple’s premium products (at a premium price!). Both revenues and earnings are moving higher and higher at the same pace! Apple’s first growth vector remains its iPhone. It is also growing its services division at a double-digit pace. Services such as Apple Pay, Apple Music and Apple TV are just the beginning. The more people buy iPhones, the more they are inclined to use services attached to them. Management has also started to be more shareholder friendly with strong dividend growth and additional share buybacks. While analysts may downgrade AAPL, it is still among our favorite picks.

Potential Risks

There are not many dark clouds coming over Apple at the moment. The company enjoys strong growth vectors and the company keeps showing strong sales. However, there are no technology companies sheltered from innovation. Apple protects its core product with a strong product ecosystem and additional services. Yet, the coming of a new popular phone hurting AAPL sales is always a possibility.

Dividend Growth Perspective

During the last 5 years, AAPL has shown double-digit annualized dividend growth. Don’t be fooled by the low yield as AAPL will double its dividend every 7 years going forward. Both payout and cash payout ratios are very low. With strong sales growth and consistent earnings progress, the company should keep up their double-digit dividend growth for many years to come.

VALUATION

Dividend Growth Rate Years 1-10: 10.00% Terminal Dividend Growth Rate: 8.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $451.48 | $224.26 | $148.58 |

| 10% Premium | $413.85 | $205.57 | $136.20 |

| Intrinsic Value | $376.23 | $186.88 | $123.82 |

| 10% Discount | $338.61 | $168.19 | $111.43 |

| 20% Discount | $300.98 | $149.50 | $99.05 |

Looking for more ideas?

In December, I’ve hosted a webinar where I share 5 US and 5 Canadian dividend stock picks for 2019. More than 800 investors registered to the webinar. You can watch it for free here (email required for registration).

Disclaimer: I’m long AAPL, BLK, DIS and DWDP in my Dividend Stocks Rock portfolios

Leave a Reply