Republic Services Inc. (RSG) is the second largest collector and disposer of trash in North America.

-Seven Year Average Annual EPS Growth Rate: 6.2%

-Seven Year Average Annual Dividend Growth Rate: 20%

-Current Dividend Yield: 3.34%

-Balance Sheet Strength: Quite Leveraged

Republic Services is quite leveraged, but the stable cash flows from this dominant position in an essential industry lead me to conclude that while the current valuation is not excellent, investing in the company should result in reasonable long term returns for investors.

The current price of $28/share looks fair.

Overview

Republic Services Inc. (NYSE: RSG) is the second largest collector and disposer of trash in North America, with a market capitalization of over $10 billion. Throughout the last decade, and continuing after the large acquisition of Allied Waste Industries, the company has built a good track record of paying dividends.

Collection Services

In 2011, 75% of company revenue came from collection services. The company utilized its 334 collection operations to collect trash in 39 states. For collection services, 40% of revenue comes from commercial customers, 35% comes from municipal and residential customers, and 25% comes from industrial customers.

Transfer Services

Transfer stations serve as the intermediate step between collection sites and landfills, and Republic Services owns or operates 194 transfer stations. For the most part, this is for internal company use, but they also charge other trash hauling businesses to dispose their trash collection here as well, which accounts for 5% of total company revenue.

Disposal Services

Republic Services owns 194 active landfills and is responsible for 130 closed landfills. The company disposes of collected trash here, and also generates 13% of company revenue by charging fees for other companies to dispose trash in these landfills.

Recycling Services

Republic Services generates additional revenue through the 74 materials handing facilities that it owns or operates. Commodity costs can substantially affect profitability for this segment of the business.

Ratios

Price to Earnings: 18

Price to Free Cash Flow: 13.5

Price to Book: 1.36

Return on Equity: 7.4%

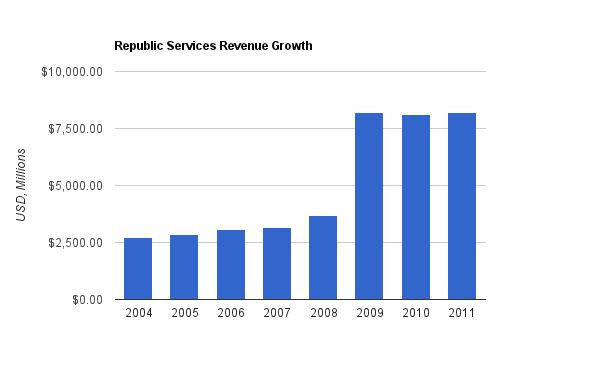

Revenue

(Chart Source: DividendMonk.com)

The jump in revenue in the chart is due to the acquisition of Allied Waste Industries. In 2008, Republic Services (the third largest trash collector in the country) acquired Allied Waste Industries (the second largest trash collector in the country), and kept the Republic brand. Republic Services had to use considerable share dilution to make this purchase.

As can be seen in the chart, revenue growth was pretty solid, but then after the recession and the acquisition, revenue went fairly flat. Waste Management has similar flat business conditions.

Trash hauling is a recession-resistant business because it’s such a necessary service. However, economic recessions can result in less construction and less industrial output, which decreases trash volume.

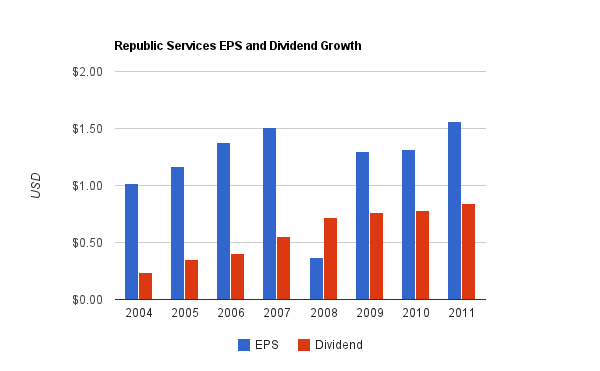

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS grew at a rate of 6.2% over this period. During this time, RSG diluted the share base to make an acquisition, dealt with the financial crisis and recession, and paid a regularly growing dividend. So all things considered, EPS growth has been quite reasonable.

The dividend grew at a almost 20% per year over this period, but much of that growth occurred early. The most recently announced annual increase was 6.8%. The dividend payout ratio is under 60%, which is lower than that of Waste Management.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 3.34% |

| 2012 | 3.20% |

| 2011 | 2.70% |

| 2010 | 2.60% |

| 2009 | 3.00% |

| 2008 | 2.30% |

| 2007 | 1.60% |

| 2006 | 1.60% |

| 2005 | 1.50% |

| 2004 | 0.90% |

The current yield of 3.34% is higher than it has been historically, with exceptions for dips in late 2008 and early 2009 where the yield was temporarily higher than it is currently.

Republic Services regularly performs share buybacks as well. In 2011, the company had $830 million in free cash flow, and spent $420 million on net share repurchases and $309 million on dividend payments to shareholders. The company bought back around 4% of its market cap in shares and paid a dividend of a bit under 3% for that period. Looking over the 10 year history, the number of shares outstanding decreased substantially until the Allied Waste acquisition, when the share count radically increased. The number has been declining again as the company has resumed these repurchases.

Balance Sheet

Republic Services has a total debt/equity ratio of 90%, and there’s more goodwill on the balance sheet than there is total equity. Total debt/income is over 12, meaning that at current levels if RSG directed all net income towards debt repayment, it would take roughly 12 years to pay off. The interest coverage ratio is around 3.5, which is a bit low for my liking.

When it comes down to the balance sheet, I view trash collectors in the same group as utilities. They’re companies that generate very consistent cash flows and they own assets that are very hard to replicate (landfills), but they require considerable assets and leverage. So while Republic Services is rather leveraged, it is considered investment grade. The balance sheet is a bit of a weak spot, and a bit more leveraged than competitor Waste Management, but still in reasonable territory. Debt maturities are nicely spread out.

Investment Thesis

The waste industry is a highly fragmented industry save for the two dominant companies, Waste Management and Republic Services. Combined, these companies account for comfortably over half of all U.S. trash revenue, with no other competitors coming anywhere close to those numbers.

It’s not just the size of their operations; it’s what they own. Landfills are a competitive advantage for both companies against smaller competitors. Opening a landfill is tricky business in terms of how much capital is needed and how much red tape must be moved through. By owning these long-lasting undesirable assets, Waste Management and Republic Services are vertically integrated. Smaller competitors often pay these businesses to dispose waste into their landfills.

The industry itself has faced some headwinds. The weak economy has resulted in stagnant trash volumes. In addition, because residents and businesses are becoming more sensitive to the environmental effects of their disposed materials, or because they wish to save money by going through less material, there has been more creativity associated with avoiding trash volume or recovering useful materials. More recycling, more reuse, and more efficient original use of materials, can all detract from trash volumes.

For a trash company that does not make use of this trend, it can hurt the bottom line. Both Waste Management and Republic Services have strong recycling operations. In addition, Waste Management has large operations associated with turning waste into energy for powering the equivalent of over a million homes. Republic Services faces these headwinds of flat trash volume but also has opportunities for expanding what they can do with the trash they collect.

The company has some other areas of growth or cost savings as well.

-They are consolidating/standardizing their fleet of vehicles to operate what they call “one fleet”. The more standardized their fleet is, the more money they can save with repair, maintenance, parts inventories, automation, and so forth.

-They are consolidating call centers.

-They are expanding recycling capabilities.

-They are gradually repositioning their fleet to run on natural gas.

-They can perform small tuck-in acquisitions to increase the density of their trash collecting routes, which can improve efficiency.

Risks

RSG’s core industry of trash is always going to be necessary, but the company does face risks.

They are susceptible to energy prices for powering their vast army of vehicles and operations. The company hedges against this to cover much of the risk, but not all of it. According to their June 2012 presentation at the Global Industrials and Basic Materials Conference, a $0.10 increase in the cost of fuel results in a decrease of $0.01 in EPS.

Changes in other commodity costs can affect the bottom line of their recycling operations.

While they are in a conservative industry, they are still susceptible to economic weakness because trash output decreases during times of economic recession. Focuses on environmental sustainability, and business initiatives to produce less trash, can also potentially reduce volume for the company.

Republic Services also faces risks in the form of contract losses to competitors if they don’t manage their business well.

Conclusion and Valuation

In conclusion, I view RSG as a leveraged and currently flat investment, but one that operates in a very necessary industry as the #2 competitor, way ahead of all other competitors.

In a fairly mild scenario, where the company grows revenue by 2% over the long term, and where margins are static, the net income would also grow by 2%. If the company buys back 3-4% of its market cap each year, then EPS could grow by 5-6% over the long term. If the dividend payout ratio remains static, then dividend growth would approximately match this rate.

Using these estimates in a dividend discount model, and using a 10% rate of return as my target, I calculate that the stock is worth less than $24/share, meaning the current price of over $28/share is more than 16% overvalued. However, if the target rate of return is dropped to 9% to account for the relative safety of this kind of business, then I estimate that $31/share is fair, implying that the current price is undervalued by around 10%.

Now, this is a fairly conservative scenario. Due to dividends and share repurchases, 6% or 7% of the annual returns are internal, and don’t rely on any growth. They just rely on maintenance of the current position and revenue/profit numbers. The 2% revenue growth used for this estimate is fairly pessimistic; it could imply 0% volume growth and 2% pricing growth to keep up with inflation, or could imply 2% volume growth and 0% pricing growth (meaning price deterioration after inflation is accounted for). Or around 1% of each. If volume picks up a bit, and if pricing remains consistent with inflation, revenue growth could exceed this figure and lift the EPS growth and fair value up.

Overall, the downside looks fairly mild, the current stock price of a bit over $28/share looks reasonable for high single digit returns, and there is potential upside if trash volume picks up for this industry.

A solid approach for investors interested in this industry may be to buy both Waste Management and Republic Services. That reduces some of the risk associated with losing or gaining customers between the two. Together they represent more than half of the industry, are far and away larger than their competitors, and offer decent dividend income.

Full Disclosure: As of this writing, I have no position in RSG or WM.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Matt,

Thanks for the analysis of RSG and WM. Overall, I share your conclusions that these are mediocre investments. They won’t knock it out of the park, but the downside appears limited. They certainly fill a certain niche and probably deserve a spot in most conservative dividend growth portfolios.

I share your thoughts on buying both WM and RSG if one were to own anything in the waste disposal space. That really limits potential for losses as you own both juggernauts. I think it’s akin to owning both PEP and KO.

Great stuff as always. Much appreciated.

Best wishes!

Good write up, but personally I think the company has too much debt for me to be confident in the long-term about the dividend. I’d fear some sort of crisis or problem that reduced cashflow, and then debt will always come first. But that’s just on a skim, I don’t really know the sector in the US at all, and it looks sort of fair-to-slightly cheap compared to its historical valuations.

Appreciate the recent links, incidentally. Please do drop me a line if you ever analyse a UK stock (or write any new and country-independent article) as I’d be glad to include it in my round up. :)

Very energetic article, I loved that bit. Maybe there is a part Two?