When you reinvest dividends, you dramatically increase your annual returns and total wealth. When you invest in companies that pay out some of their income in the form of dividends, you should reinvest the dividends to maximize returns, until it comes time to let your dividend stocks be part of your spendable income.

Should You Reinvest Dividends?

When you reinvest your dividends, you get a massive advantage compared to not reinvesting your dividends.

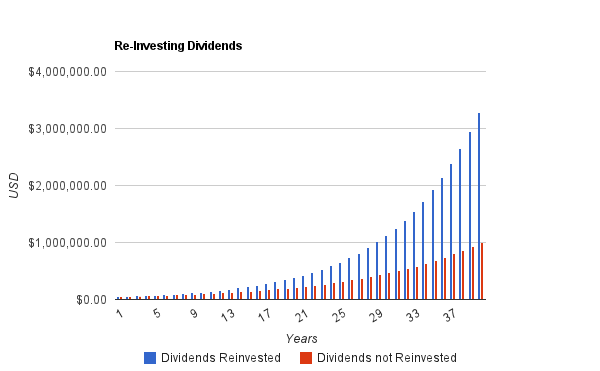

Consider an example. Suppose there exists a company that offers a 3.33% dividend yield, and grows dividends and earnings per share at an average rate of 8% per year. After a working lifetime of investing, or around 40 years, what would the difference be?

As can be seen in the chart, when you reinvest dividends, you get an enormously different final result. Both of these examples start with a $50k portfolio, and the investor that spent dividends only grew his portfolio by an average of 8% per year, which resulted in a portfolio of around $1 million by the end. The other investor that reinvested dividends, at a 3.33% yield, grew her portfolio at over 11% per year and ended with over $3 million. Of course it would never be this smooth, but the math holds true under more volatile scenarios as well.

What it comes down to is, when you reinvest dividends, your total returns are approximately equal to the sum of EPS growth of the stock and the average dividend yield over the period. But when you don’t reinvest dividends, your total returns are only approximately equal to the EPS growth. This extra few percentage points, say between 6% and 9%, or between 9% and 12%, mean a huge difference over a decade or more of compounding.

Automatic Vs. Manual Dividend Reinvestment

There are a few ways to reinvest dividends.

First, you could use a Dividend Re-Investment Plan (DRIP). Some companies allow you to buy stock directly from them, and then when they pay a dividend, it automatically goes to buying more shares for you, even in terms of fractional shares. There are brokers now which allow you to automatically reinvest dividends in those accounts as well. This can be an advantage, because it happens automatically and eliminates the possibility of investor error. But in overvalued markets, it means you’re buying more shares of overvalued stock, when it would be preferable to put it in another asset class. Keep in mind that when you reinvest dividends, you still do owe the tax on that dividend income unless it’s in certain retirement accounts.

Second, you could let your dividends pool in an account, such as in a brokerage account, and then manually reinvest the dividends that you receive. For example, if you put in $1000 per month into your dividend portfolio to buy more stocks, and you currently receive $200 a month in dividends from numerous companies, then you could take this total of $1200 per month and use it to buy more stock.

Either one is okay, though personally, I prefer to manually reinvest dividends. This keeps my total number of transactions to a fairly small number per year (fewer but larger transactions).

Enjoy Dividend Income Later

When you reach the stage where you’d prefer to use your dividends to supplement your income, you can simply stop reinvesting the dividends and start spending them! Dividend income is an excellent source of diversified, inflation-resistant income.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies: