Summary

- One of the only 9 U.S. REITs with at least one “A” credit rating

- A highly diversified REIT in terms of tenants, industries, geographies and property types

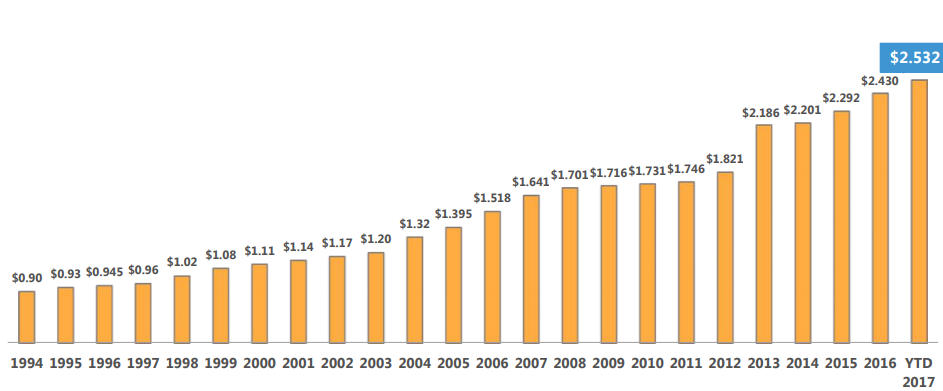

- 24-year track record of regularly increasing the dividend

Investment Thesis

Realty Income Corporation is the largest net lease real estate investment trust (REIT) in the U.S.The REIT is highly diversified and enjoys a regular stream of cash flows from investment grade tenants. Realty Income deserves to stay in a dividend income investor’s portfolio not only because it has paid dividends for almost five decades, but also because it has a steady cash flow stream from diversified properties and quality tenants, maintaining high occupancy levels consistently which never dropped below 96%.

Understanding the Business

Founded in 1969, Realty Income Corporation (O) is a real estate investment trust (REIT) that engages in the asset management of commercial properties in the U.S. It earns regular revenue in the form of rental income from properties in diverse locations and quality tenants.

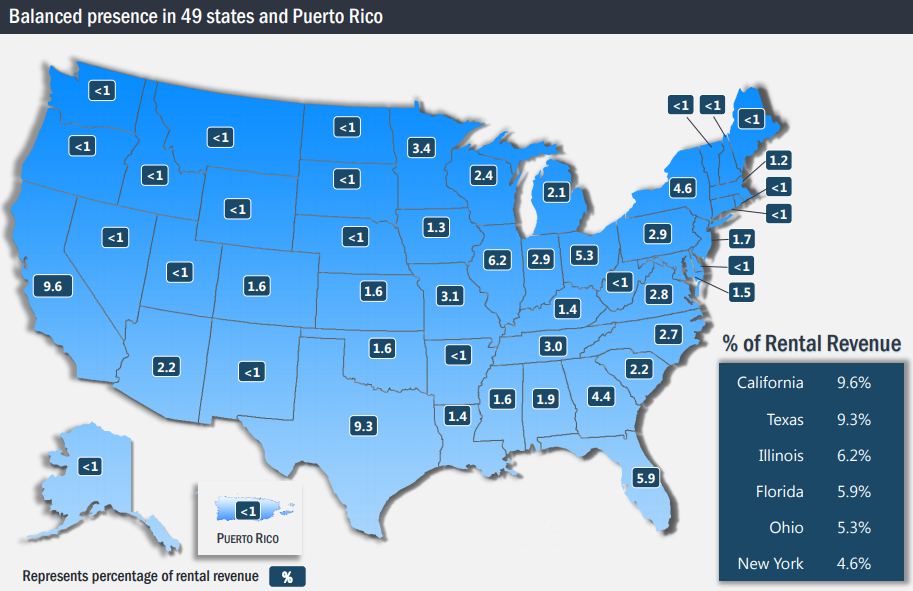

The Realty Income’s property portfolio can be broadly classified into retail (80% of revenue), industrial (13%), office (5%) and agriculture (2%). The company’s portfolio consists of more than 5,000 properties across 49 states. Realty Income today has around 251 commercial tenants from over 47 different industries.

Source : Realty Income Investor Presentation

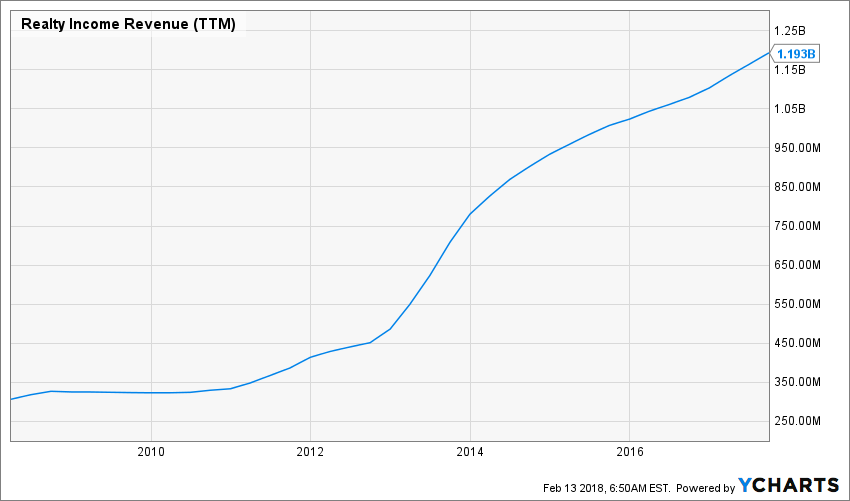

Revenues

Source: Ycharts

The REIT owns and purchases freestanding, single-tenant properties in key locations.Location is the key to the success of a REITbusiness and Realty Income’sproperties in key markets and strategic locations is one of the main reasons for its strong revenue growth.The properties have a high occupancy ratio of more than 98% which indicates the success of its portfolio strategy. In addition, Realty Income typically enters into triple net leases (where tenants pay maintenance, taxes, and insurance costs) with initial lease term of 15 years with provision for annual escalations. The REIT also has a sound track record of lease roll overs. It re-leased 181 properties with expiring leases (by the end of Q3’17), out of which 164 were to same tenant (89%).

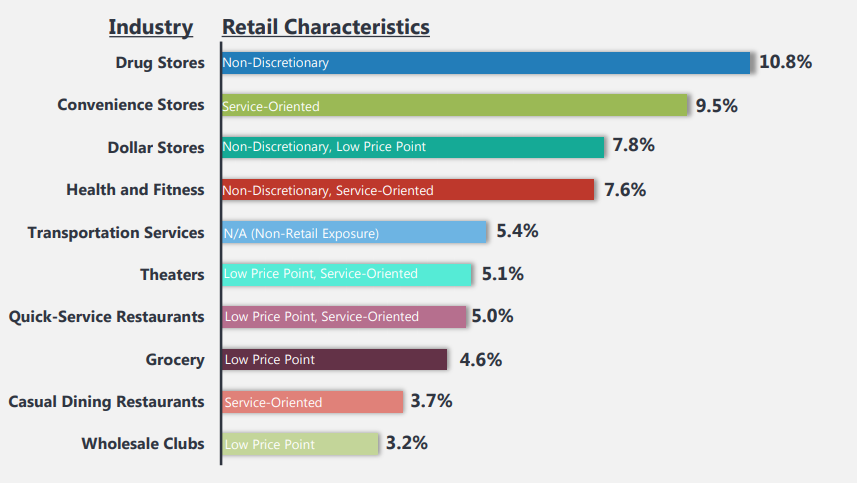

Its tenants can be grouped into 47 activity segments and 27 other non-reported segments. This provides a good diversification of revenues. More than half of the REIT’s rental revenues come from its top 20 tenants (like Walgreens, FedEx, Dollar General etc.). This insulates the REIT from changing consumer behaviour. Ten out of these tenantsalso have investment grade ratings. All these factors improve cash flow visibility and add to diversification.

Source : Realty Income Investor Presentation

In addition, Realty Income is also expanding its footprint through acquisitions and added 505 new properties worth a whopping $1.86 billion in 2016 alone.

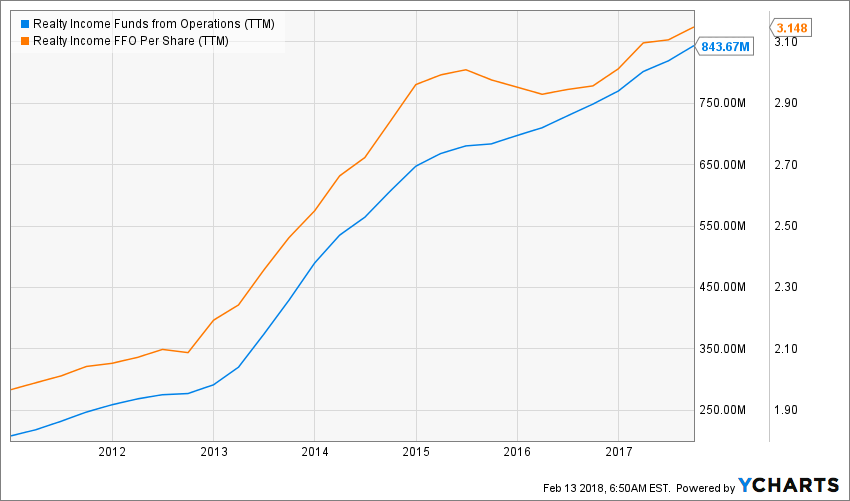

Earnings

Source: Ycharts

Realty Income earns a regular and secure stream of income since its properties are let out under long term leases (remaining lease term of 9.7 years) to a well-diversified customer base from the non-discretionary service industry.

Assets have grown to 5,062 properties from 630 properties in 1994. A solid investment grade balance sheet and strong cash flow generations have enabled the company to raise its AFFO per share by 5% (in 2016) in spite of aggressive acquisitions.

Management expects 2017 AFFO per share of $3.03 – $3.07, representing annual growth of 5.2% – 6.6%.

Dividend Growth Perspective

Source: Ycharts

Realty income is one of only five REITs that is a member of S&P High Yield Dividend Aristocrats index. It is also part of the Dividend Achievers list. Realty Income has grown dividends at a CAGR of 4.6% since its listing in 1994. The REIT has paid monthly dividends for 49 years in a row.Its payout ratio is high at 84% and it last raised its payout by 4% y/y.

The REIT’s highly predictable and diversified sources of cash flow ensure highly stable and growing dividends.

Source : Realty Income Investor Presentation

Potential Downsides

Realty Income holds a large proportion of retail properties in its portfolio. The retail sector is under increased pressure from rising e-commerce threat which has caused many large brick and mortar stores to down shutters.However, Realty Income is quite insulated from this risk as 97% of its total portfolio is protected against retail e-commerce threats and economic downturns.

An increasing interest rate environment is not favourable for REITs. By entering into long-term leases, Realty Income is more sensitive to rising interest rate. However, Realty Income has performed better than most of the other REITs, during a period of steadily rising rates.

Valuation

Source: Ycharts

The stock has slumped 14% so far this year and is trading 22% below its 52 week high.

A conservative balance sheet with investment grade ratings ensures access to low cost of capital. The REIT maintains a higher level of EBITDA margin which has never dropped below 90% since 1998.

I have also used the Dividend Discount Model to determine a fair value for O. Given Realty income’s investment in future acquisitions, its past dividend growth streak and a solid balance sheet, it will continue its payout growth.Realty Income has grown dividends at an average 5% in the past, hence I have assumed a dividend growth rate of 5% in the initial period and reduced it to 4% going forward. As for the discount rate, I never use under 9%. The output shows that the stock is undervalued currently.

Input Descriptions for 15-Cell Matrix INPUTS

Enter Recent Annual Dividend Payment: $2.63

Enter Expected Dividend Growth Rate Years 1-10: 5.00%

Enter Expected Terminal Dividend Growth Rate: 4.00%

Enter Discount Rate: 9.00%

Discount Rate (Horizontal)

Margin of Safety 8.00% 9.00% 10.00%

20% Premium $88.96 $70.96 $58.96

10% Premium $81.55 $65.04 $54.05

Intrinsic Value $74.13 $59.13 $49.14

10% Discount $66.72 $53.22 $44.22

20% Discount $59.31 $47.30 $39.31

Final Thought

Realty Income is focussing its growth from retail and industrial properties. It has a reliable cash flow from multiple sources and investment grade tenants. It invests in properties operating in attractive industries conducive to economic growth.

The REIT has recorded a growth of 16.4% CAGR in annual shareholder returns since its listing, outperforming other equity REITs and indices.It also offers a reliable dividend income stream which makes it attractive for long-term investors and has earned itself the brand of“the monthly dividend company” due to its long record of paying monthly payouts.

Disclosure: I do not hold O in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply