Recently, two stocks have been brought to my attention by DSR members for different reasons: Booz Allen Hamilton (BAH) and Altria (MO). BAH has a very strong dividend triangle, shows great potential and can easily figure as a long-term investment for investors. About 50% of its revenue come from the defense sector, which means a stable source of income.

On the other hand, MO’s recent stock price drop has been seen as an opportunity by some. I respectfully disagree with these investors. First of all, you should never buy a stock only based on valuation. Second, Altria has very few growth vectors. Sometimes, holding the Dividend King title is just not enough. Basically, Altria is stuck with highly profitable products with less and less consumers to buy it.

But let’s start with the good news!

Buy Opportunity: Booz Allen Hamilton (BAH)

- Dividend Yield: 1.55%

- Market Cap: 11B

Booz Allen Hamilton Holding Corp is a provider of management consulting services to the U.S. government. Other services offered include technology, such as cloud computing and cybersecurity consulting, and engineering consulting. The consulting services are focused on defense, intelligence, and civil markets. In addition to the U.S. government, Booz Allen Hamilton provides its management and technology consulting services to large corporations, institutions, and non-profit organizations. The company assists clients in long-term engagements around the globe.

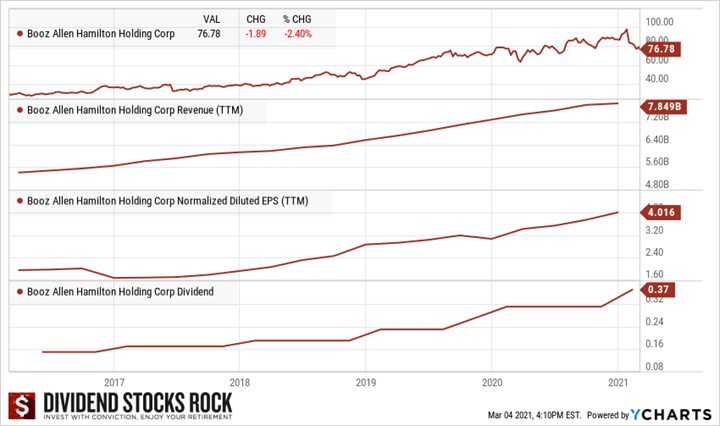

Latest Quarter

BAH reported a robust quarter with a strong earnings jump. Revenue also increased to $1.90B from $1.85B in Q3 of fiscal 2020, the consulting firm said. Booz Allen said the period saw slower-than-expected revenue growth due to the impacts of the COVID-19 pandemic and the presidential transition. The company still reported a 6.1% year-on-year rise in total backlog to $23B. With the improved results, Booz Allen announced a $0.06 increase in the quarterly dividend to $0.37/share, payable March 2 to shareholders of record as of Feb. 12.

Investment Thesis

With an army of more than 24,000 consultants, BAH is the market leader in U.S. government management and technology services contracting. BAH is showing strong organic growth (double-digit for 2020) as the demand for the talents in BAH fields of expertise are growing. As BAH specialized in highly specific fields, it has built a strong reputation that is hard to overcome. In other words, BAH has built its own barrier to entry against smaller competitors. Most of its clients will stick with BAH during a recession as they value BAH expertise. BAH fits very well with the DSR investing model and most of its business is recession-resistant. If you plan to hold it for a while, this is a buy.

Sell Side: Altria (MO)

- Dividend Yield: 7.00%

- Market Cap: 92B

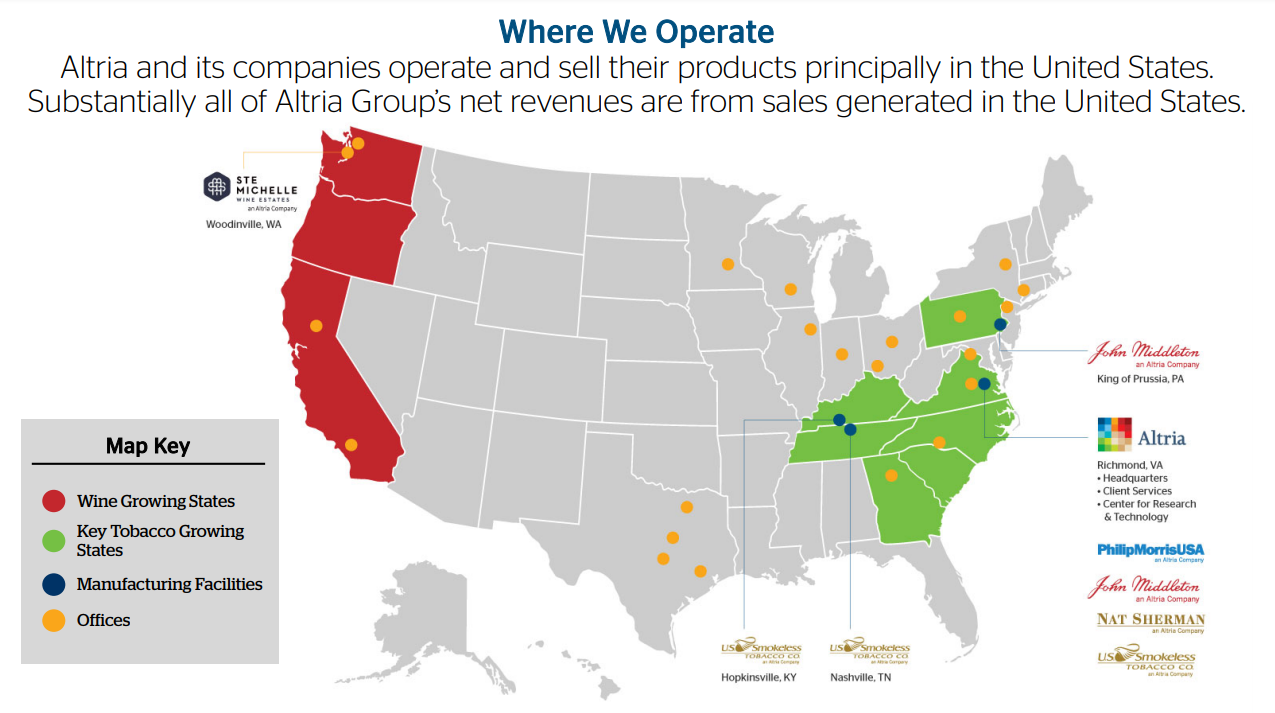

Altria comprises Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Ste. Michelle Wine Estates, Nu Mark, and Philip Morris Capital. It holds a 10.2% interest in the world’s largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number two spot in machine-made cigars. The company’s Marlboro brand is the leading cigarette brand in the U.S. with a 40% share.

Latest Quarter

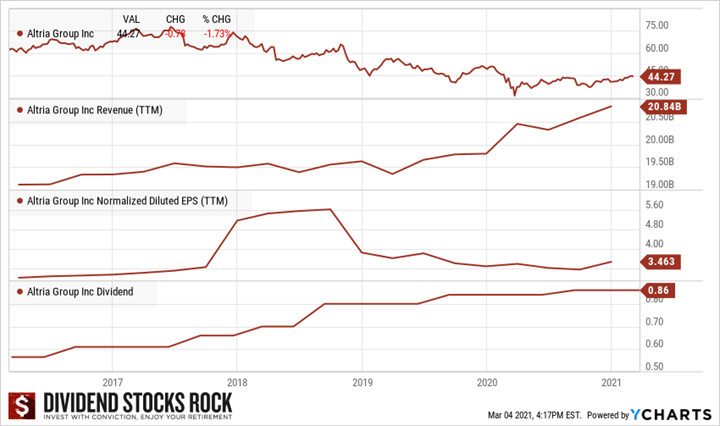

MO posted modest growth (5%), but earnings declined 3%. Cigarette volume was up 3.1% and cigars volume shot up 15.0%. The company’s smokeless volume was up 0.5%. This doesn’t look like a strong growth vector after all. Altria’s Board authorized a new $2 billion share repurchase program, which Altria expects to complete by June 30, 2022. Management expects to deliver 2021 full-year adjusted diluted EPS in a range of $4.49 to $4.62, representing a growth rate of 3% to 6% from an adjusted diluted EPS base of $4.36 in 2020.

Investment Thesis

I know I’m not going to make friends here. Altria has been cherished by many dividend growth investors for decades. About 2-3 years ago, we rated Altria as a “sell” at DSR. I didn’t like the company and couldn’t find out how it could grow in the future. Now that the stock price has lost about 35% of its value from its 2018 level, is it time to jump back in? No. Just, NO!

Not too long ago, MO was trading around $70 and it is now in the $40s. Many investors saw an opportunity to catch a dividend payer with a flawless dividend history. However, investors are coming to realize the cigarette market isn’t healthy (duh?). Smokers are decreasing in the U.S. and management is looking for diversification. With 90% of its revenue coming from smokable products, MO isn’t close to diversification yet. An 8%+ yield is attractive, but smoking isn’t cool anymore, and MO’s future is cloudy at best. Vaping now has its own share of problems as well. It’s not looking good for this long-term Dividend King.

A Word on Sector Allocation

Investing more than 20% in a single sector will reduce your diversification and possibly increase the volatility in your portfolio. You may live or die by the sword. You don’t need to do that.

Before selling a stock and replace it by another, make sure to review your sector allocation. You don’t need to invest in all 11 sectors to be sucessful. Focus on sectors you understand and feel comfortable with (e.g., fluctuation/volatility, business model, what impacts their business, economic cycles, etc.).

The two dividend-paying companies discussed today are from two different sectors and are not necessarily interchangeable in a portfolio. Please due your own due diligence.

Re MO, you’re forgetting the marijuana growth vector. MO has distribution channels that little cannabis startups only dream of, and if any company is better connected to government regulators, I don’t know of it. I think it will head back up this year toward its previous highs, and buying now locks in a generous dividend.

This article is how old?? Mo has been going gangbusters the last few days and is now at $51.

MO is a ling term dud. While you do get good income, however, it get flushed by drop in principal. Avoid it. Replace it T which like MO gives good yield, not much prospect for price appreciation, but at least the prices is relatively stable within a $25-$33 range.