Summary

- Robust presence in the global Diabetes care market, with 27% market share

- Extensive geographical presence, strong product pipeline and 90 years of R&D expertise

- Emerging market and new products are key growth drivers

This article has been written by Sneha Shah for The Dividend Guy.

Investment Thesis

Healthcare stocks offer a safe dividend stream for investors given their nearly recession-proof nature. The sector offers immense potential owing to a growing senior population that drives demand for medical products.

Novo Nordisk is a leading global pharmaceutical company having a strong leadership position in diabetes care. About 27.7 million people use its diabetes care products worldwide. The company has developed strong R&D expertise and a strong product pipeline pumping out market leading medicines. It is also slowly but steadily expanding its footprint in emerging markets, given the pricing challenges that healthcare companies are currently facing in the USA.

Given Novo Nordisk’s leadership, the company stands in a good position to benefit from a growing population suffering from chronic diseases like diabetes, obesity and others.

Understanding the Business

Novo Nordisk is a global healthcare company. Headquartered in Denmark, Novo Nordisk has operations in 79 countries and markets its products in more than 170 countries. The company has over 90 years of experience in diabetes care and other serious chronic conditions such as haemophilia, growth disorders and obesity.

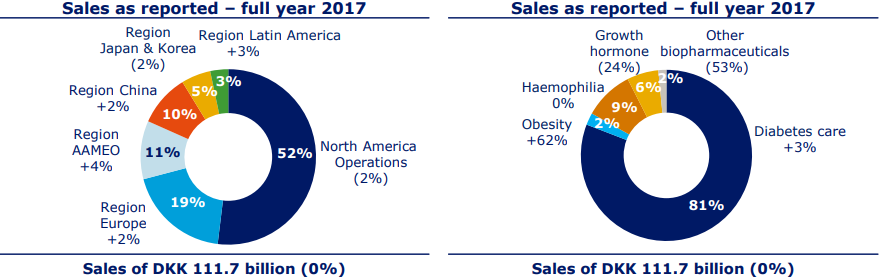

By geography, North America constitutes its largest market accounting for 52% of total sales in 2017, followed by Europe (19%), AAMEO region (11%), China (10%), Japan, Korea (5%) and Latin America (3%).

By product line, diabetes care is the largest revenue generator accounting for 81% of 2017 revenues, followed by haemophilia (9%), growth hormones (6%), obesity (2%) and other biopharmaceuticals (2%).

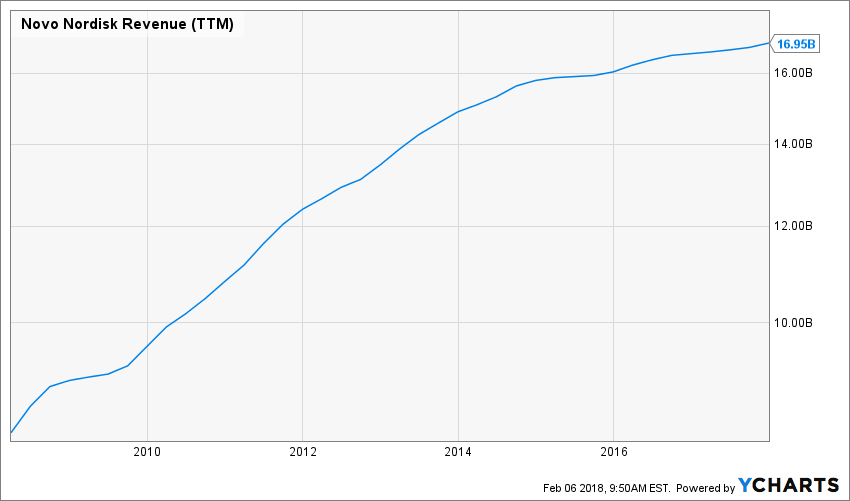

Revenues

Source: Ycharts

Novo Nordisk commands a 27% market share in diabetes care and 45% in insulin volume market share. It is the only company with a full portfolio of novel insulin and GLP-1 products. Diabetes care and obesity have become widespread in the U.S., with an increasing diabetic population in the U.S. and Novo Nordisk stands to benefit from this trend.

Tresiba and Victoza (drugs for diabetes care) are the largest growth drivers, growing by 85% and 18% respectively. Its semaglutide product, Ozempic, also received FDA approval and should further fuel growth of its diabetes-care line of products. Saxenda, which is a global leader in the anti-obesity market is also showing good growth. Further, Novo Nordisk is also investing to roll out a new generation insulin portfolio.

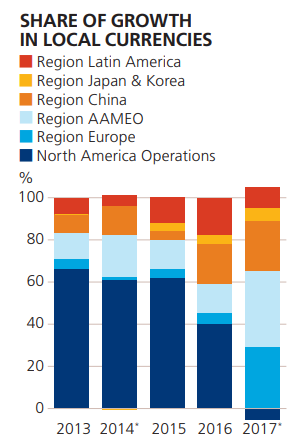

More than 90 years of research and an extensive geographical presence are Novo Nordisk’s other strengths. International operations, which cover more than 190 countries, grew by 5% last year. The company is adopting a ‘market fit’ approach to grow this business. Emerging markets also present a compelling growth opportunity for Novo Nordisk as can be seen from the graph below:

Management expects sales growth of 2%-5% (in local currency) in 2018.

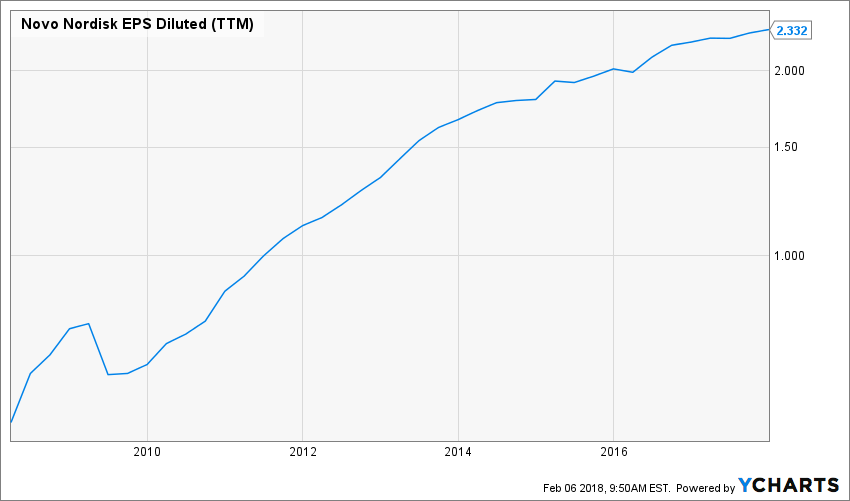

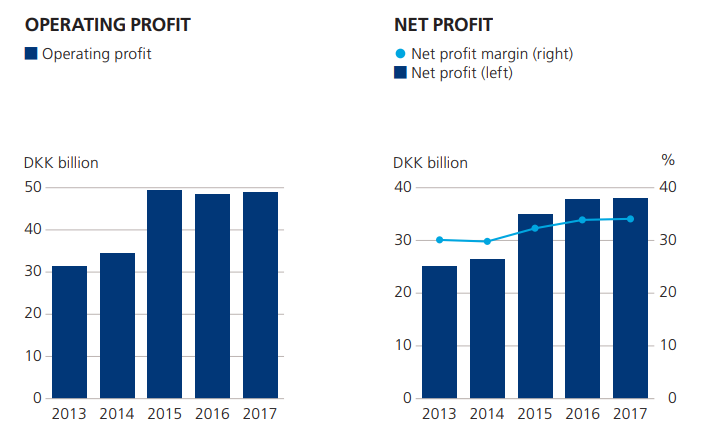

Earnings

Source: Ycharts

The diabetes care and obesity segments accounted for 78% of the total operating profit while the biopharmaceuticals segment constituted the remaining 22%.

Sales and distribution are the biggest cost and accounted for nearly 30% of sales in the most recent quarter.

The company is making investments in additional production capacity and expenses to support the commercialisation efforts for the launch of Ozempic. In addition, Novo Nordisk is also expanding its R&D efforts into other serious chronic diseases with unmet medical needs. It is developing stem cell therapy for type 1 diabetes, and developing a biological medicine in a tablet.

Novo Nordisk is targeting an operating profit growth of 5% on average and expects to convert 90% of its earnings into cash for shareholders. The company is expecting to drive margins through continuous cost control measures and sales growth. It has a strong pipeline of medicines which should further fuel growth.

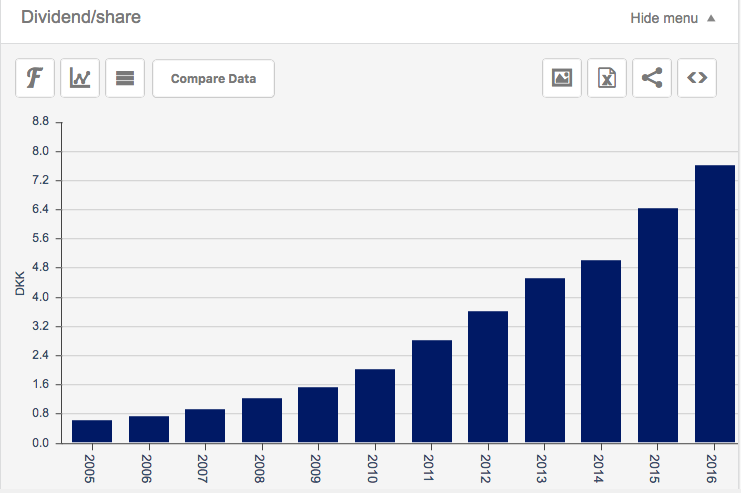

Dividend Growth Perspective

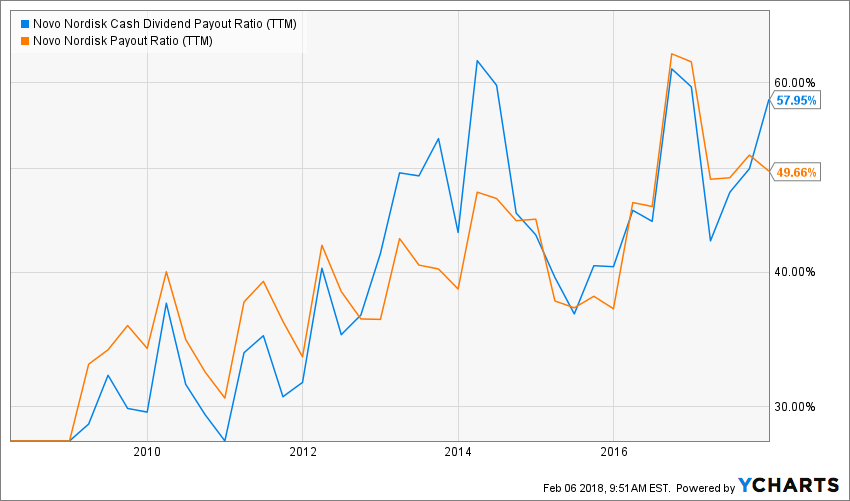

Source: Ycharts

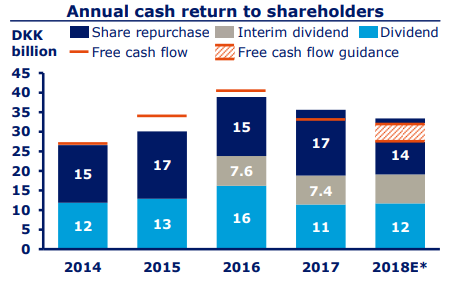

Source: Novo Nordisk

Novo Nordisk is a shareholder friendly company offering a dividend yield of 2.35% along with large share buybacks every year. The company has paid uninterrupted dividends for 20 years in a row. Once you bring NVO’s cash dividend in its currency, you can see that the company could make the Achievers list if it was a U.S. company.

The company’s next payout is expected to increase by 3%, with a reasonable payout ratio of 50% indicating room for further growth.

The company has a good cash balance and management has the flexibility to take on debt in case of any cash shortfalls.

Source: Ycharts

Investors have reasons to be happy as the company also announced a new share repurchase programme of up to DKK 14 billion (US$ 2.24 billion) for the year.

Potential Downsides

Novo Nordisk faces competition from generic drug companies. Teva Pharmaceuticals’ new generic drug poses a big threat to Novo Nordisk’s flagship diabetes drug Victoza, which is one of its biggest brands.

Moreover, U.S. healthcare budgets and prices will continue to remain under pressure as healthcare costs in the country are quite high as compared to other nations. There is tremendous pressure on the healthcare system to lower cost. This might adversely affect sales growth and profitability.

New products from competitors and competition for older drugs also affect volumes and create pricing pressure.

Having a large international presence, Novo Nordisk is also sensitive to currency fluctuation. In fact, the company reported disappointing FY 17 results owing to the fact that almost every currency in the world declined against the Danish krone in 2017.

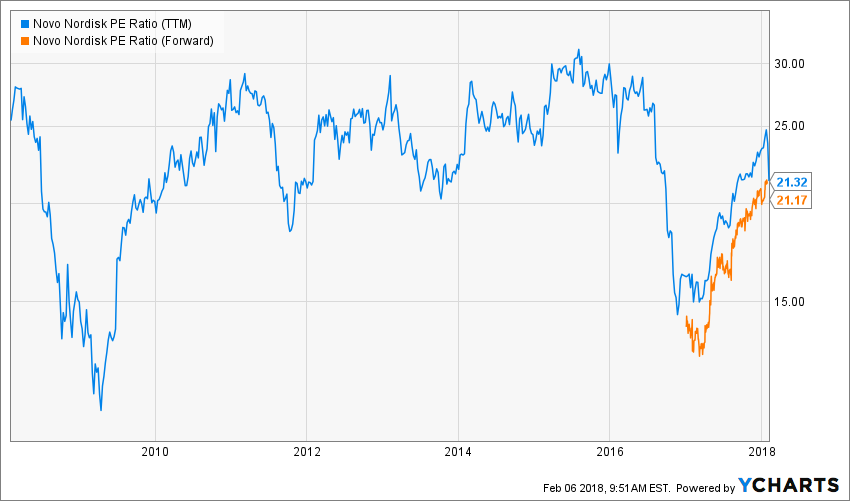

Valuation

Source: Ycharts

NVO is trading at P/E of 19.48x which is lower than the industry average of 29x. Its debt to equity is also lower at 0.03, when compared to the industry median.

Final Thought

The International Diabetes Federation (IDF) estimates that the number of diabetic people will increase to 629 million by 2045 from 425 million today. Novo Nordisk has a huge growth potential as only 6% of the diabetes population is being treated with its products. Even though growth has slowed in recent times, Novo Nordisk remains profitable given its heavy R&D expenditure, expansion into other therapy areas and partnerships. The company has a good long term visibility given its dominant position in the diabetes market. The recent correction offers a good entry point for investors with a long term horizon.

Disclosure: I do not hold NVO in my DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

1.9% dividend with 5% or less growth? No thanks. Rate of inflation pisses on that. Pfizer offers 4% yield with 5 – 8% growth. PFE for me.

For me the magic formula is 4% plus yield and 10% plus growth. If you can’t get that, stay in tech stocks and wait for the next crash to gobble up Div Champion & Challengers at bargain prices.

Mr. Monk – could you add a section that focuses on 4% plus dividend yielders (not MLPs or REITs) ?