McDonald’s Corporation is one of the most well-known companies in the world, and the largest restaurant chain by revenue.

-Seven Year Revenue Growth Rate: 5.1%

-Seven Year EPS Growth Rate: 16.6%

-Seven Year Dividend Growth Rate: 24%

-Current Dividend Yield: 3.16%

-Balance Sheet Strength: Fairly Strong

With a strong and defensive business, decades of consistent dividend growth, and solid debt and cash flow metrics, I calculate that McDonald’s stock is a pretty fair value at under $90/share. The stock price dip for the company so far in 2012 appears to be a decent entry point, based on my estimates.

Overview

McDonald’s Corporation (NYSE: MCD) has been in business since 1940, and has been raising their annual dividend consecutively since the mid 1970’s. The company has restaurants all throughout North and South America, Europe, Australia and Asia, but are only thinly available in the Middle East and Africa. The primary food products they serve are hamburgers, cheeseburgers, chicken meals, french fries, coffee and milkshakes, but they are beginning to offer products like wraps, salads, and smoothies.

McDonald’s serves 68 million customers each day, which is greater than the population of the United Kingdom. As of the end of 2011, the company operates in 119 countries and has more than 33,500 restaurants, with around 80% being franchised or licensed businesses and the other 20% being company-owned.

The franchisee owned restaurants have higher profit margins than the corporate owned restaurants (McDonald’s collects rent and royalties), but the corporate owned restaurants allow McDonald’s to develop new products and new looks and keeps management knowledgeable and well-trained.

In terms of geography, 32% of McDonald’s revenue comes from North America, 40% comes from Europe, and 28% comes from elsewhere. The company targets to have 2,000 restaurants in China by the end of 2013, according to their 2011 annual report.

Ratios

Price to Earnings: 16.5

Price to Free Cash Flow: 20

Price to Book: 6.2

Return on Equity: 38%

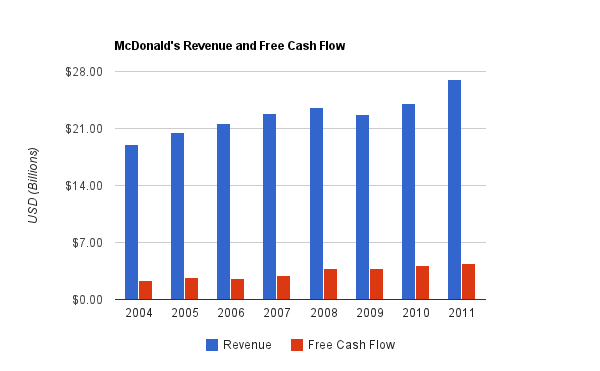

Revenue and Free Cash Flow

(Chart Source: DividendMonk.com)

McDonald’s grew revenue by a rate of 5.1% annually on average over this period, and grew free cash flow by around 9.5% annually on average. These are pretty good growth figures for this size of a company.

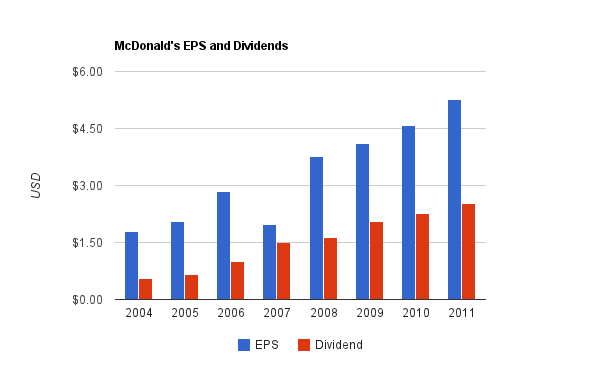

Earnings and Dividends

(Chart Source: DividendMonk.com)

EPS grew by 16.6% annually over this period, and the increase between 2010 and 2011 was 15%. This has been a very strong decade for the company, with the EPS growth coming from a combination of revenue growth, share repurchases, and most importantly, improving profit margins. The net profit margin grew from around 12% in 2004 to over 20% in 2011. This profit margin has stayed at around 20% for over three years now, which is understandable, given that this level of profitability greatly exceeds their peers. (And part of this has to do with the fact that most McDonald’s restaurants are franchises, which offer a higher profit margin for McDonald’s than their company-owned restaurants). Going forward, most of the EPS growth will have to come from revenue growth and share repurchases, because in terms of profit margins, they’re already quite efficient.

The dividend grew by 24% annually over this period, which is extremely high. The most recent increase, from 2011 to 2012, was a bit under 15%. In the future, the dividend growth rate will eventually have to max out at roughly the EPS growth rate to avoid continually increasing the dividend payout ratio from earnings.

The dividend yield is currently 3.16%, and the payout ratio from earnings is around 50%, which is comfortable. The company has increased annual dividends every year since the mid 1970’s.

How McDonald’s Uses Its Free Cash

During 2009, 2010, and 2011, McDonald’s brought in a combined $12.4 billion in free cash flow. They also issued approximately $1.7 billion more in debt than they repaid over this period.

During these three years, the company paid around $7.2 billion in dividends, and spent around $8.8 billion on share repurchases. Less than a billion was spent on acquisitions.

While I’d prefer to see a greater proportion of dividends paid than shares repurchased, it is at least clear that the company consistently and aggressively sends all of its free cash flow back to shareholders.

Balance Sheet

McDonald’s has a reasonably strong balance sheet. The ratio of total debt to equity is around 87%, and the multiple of total debt to net income is around 2.3. The interest coverage ratio is over 17, and goodwill is a rather small portion of total equity.

The total debt to equity is therefore a bit on the higher end, but still comfortable, while their other debt ratios are all superb. I view this as an appropriate use of leverage on a defensive business, since their debt interest is very comfortably covered by income and cash flows, their debt ratios are all solid, and the company is able to borrow at a low interest rate and reinvest it to get better returns.

Investment Thesis

MCD has been selling various investments in order to focus on the McDonald’s brand. They performed an initial public offering of Chipolte Mexican Grill in 2006, sold Boston Market in 2007, and sold Pret A Manger in 2008. The focus has been placed on the McDonald’s brand, which is revitalizing its image and introducing new products. The company has been remodeling their restaurants worldwide to include softer colors and more wood to replace the red and yellow plastic look, and has since remodeled 45% of interiors and 25% of exteriors, according to the 2011 annual report. Many of the remodeled locations had drive-through systems added in order to expand the customer base.

The profit margins of McDonald’s are far and above their competitors, which is evidence of a strong competitive advantage. MCD’s net profit margin is over 20%, which is almost double that of competitors such as Starbucks and Yum! Brands, and considerably higher than businesses like Dunkin Donuts or Wendy’s. Some of this has to do with their heavy focus on franchises; franchises produce better profit margins than company-owned restaurants. But most of this also has to do with superior performance per location; their sales figures per location are considerably above their peers, and their profit margins are quite high even on their company-operated restaurants. Most of the growth of the company is due to organic growth, which results in little goodwill piling up on the balance sheet, and means the free cash flow can be given back to shareholders.

McDonald’s McCafe brand now has 1,500 locations. McCafe can be combined with McDonald’s locations, but also can be put in new areas to enter new markets and reach new people.

I view McDonald’s as a fairly low risk, moderate reward investment. Over the long term, if the company can grow EPS at a high single digit rate with a combination of organic growth and share repurchases, and pays a dividend that yields around 3%, then this would represent pretty good returns that are recession resistant and fairly predictable.

Risks

McDonald’s faces the usual currency, litigation, and geographic catastrophe risks associated with all global businesses. Commodity cost changes have a meaningful impact on profitability as well.

The company has a rather defensive business, as evidenced by their strong performance through the recession and tough global economic times, but they still must continually stay relevant among consumers. The company is in the midst of a considerable modernization program for their restaurants, which shows their ability to identify and change along with trends.

Politics could present a risk, as much of the company’s food materials supplied by farmers are directly or indirectly federally subsidized. The company does have considerable pricing power over its suppliers, though. In addition, food items targeted for potentially contributing to national health problems could face taxes, bans, or simply changing consumer interest, and with McDonald’s visibility, they tend to face a considerable portion of criticism.

Conclusion and Valuation

McDonald’s has several strengths. Their high advertising spending over a very long period has resulted in one of the most valuable brands in the world. Their scale gives them strong pricing power and excellent profit margins, and management has consistently demonstrated strong financial management and success.

Using the dividend discount model with a 10% discount rate, and with dividend growth estimations starting at 12% per year and decreasing to 8% per year over time (compared to the most recent annual dividend increase which was 15%), I estimate that the stock is pretty fairly valued at its current price in the high $80’s. Anything under $90 currently looks quite fair to me as a long term investment for capital appreciation and growth of dividend income.

Full Disclosure: As of this writing, I own shares of MCD.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

[…] Dividend Monk said McD’s looks like fair value under $90. […]