Summary

-Lowe’s (LOW) is a home improvement retailer focusing on Do-It-Yourself and Do-It-For-Me customers and commercial business customers.

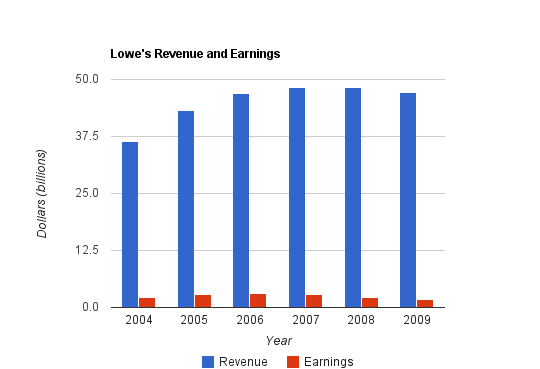

-Revenue growth over the past five years has averaged 5% annually, although much of this growth occurred toward the earlier part of that period.

-Earnings growth has been negative over this period, and cash flow growth was in line with revenue growth.

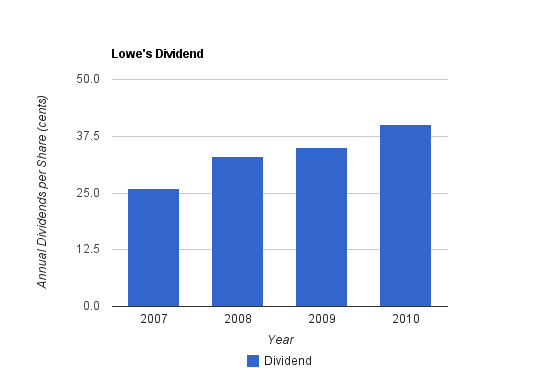

-The dividend yield is currently 1.80%, and the most recent increase was over 20%.

-The company has a very strong balance sheet.

-With a P/E of 18, Lowe’s isn’t exactly cheap. For a margin of safety, I’d suggest targeting a lower cost basis if interested in the stock.

Overview

Lowe’s (NYSE: LOW) is the second largest home improvement retailer in the United States. The company has over 238,000 employees. Despite being the older of the two, Lowe’s is the smaller competitor of Home Depot.

The company operates in all 50 states and Canada, and is opening stores in Mexico. In addition, the company is pursuing a joint venture in Australia.

Revenue, Earnings, Cash Flow, and Metrics

The last couple of years has been difficult for the company. Revenue has remained fairly strong but earnings and cash flow have been hit harder.

Revenue Growth

| Year | Revenue |

|---|---|

| 2009 | $47.220 billion |

| 2008 | $48.230 billion |

| 2007 | $48.283 billion |

| 2006 | $46.927 billion |

| 2005 | $43.243 billion |

| 2004 | $36.464 billion |

Between 2004 and 2009, Lowes has grown revenue by over 5% annually. Most of this growth occurred between 2004 and 2006 with the following years being flat to down due to the recession.

Earnings Growth

| Year | Earnings |

|---|---|

| 2009 | $1.783 billion |

| 2008 | $2.195 billion |

| 2007 | $2.809 billion |

| 2006 | $3.105 billion |

| 2005 | $2.765 billion |

| 2004 | $2.176 billion |

Earnings growth over this period has been negative. 2009 earnings were lower than 2004 earnings.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2009 | $4.054 billion |

| 2008 | $4.122 billion |

| 2007 | $4.347 billion |

| 2006 | $4.504 billion |

| 2005 | $3.842 million |

| 2004 | $3.033 billion |

Over this period, cash flow from operations has grown by an average of 6%. Just like revenue, most of this growth was from 2004 to 2006 and then in more recent years it has been flat to down.

Metrics

Lowes has a return on equity of 10%.

The P/E is currently 18, and P/B is approximately 1.8.

Dividends

Lowes has a long dividend history but only in the past few years has its yield been meaningful. The current dividend yield is approximately 1.80% with a payout ratio of around 30%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $0.40 | 1.70% |

| 2009 | $0.35 | 1.90% |

| 2008 | $0.33 | 1.60% |

| 2007 | $0.26 | 1.00% |

Dividend growth over this period has averaged 16% annually. The most recent increase from $0.09 per share per quarter to $0.11 per share per quarter is a 22% increase, but the increase before that was less than 6%. Note that the dividends presented here are based on the calendar year.

Balance Sheet

Lowe’s has a strong balance sheet with a debt to equity ratio of only 0.30 and a current ratio of over 1.

Investment Thesis

There are multiple effects from the housing crash and the recession. Obviously Lowe’s has been hit by it, but perhaps not as badly as one would expect. Lower home prices, homeowners struggling to stay in their homes, more unemployment, and less certainty about the future are all detrimental to the business of home improvement that Lowe’s operates in. On the other side of the coin, do-it-yourself projects have grown according to the 2009 annual report, and people still have projects they must do to maintain their homes.

The company is large enough to have a powerful distribution network and substantial pricing power, and serves as a one-stop-shop for most home improvement needs. Over the past ten years, the company has more than tripled its total number of stores to 1,725. Their number of new store openings is positive, but has declined during this recession.

In 2009, Lowe’s gained 1% of the market share in their industry. Compared to Home Depot, their larger rival, Lowe’s has a softer, cleaner, and more accessible image. Stores typically have better lighting, have more colorful interiors, and more focus is placed on the personal homeowner. The company’s most recent annual report suggests that the company will invest approximately $350 million to keep stores looking fresh and inviting as they age.

Risks

Lowe’s is a fairly straightforward business, but has some risk. It can be hard to establish a significant economic moat as a retailer, so the company faces heavy competition from Home Depot and others. Lowe’s is also somewhat dependent on a strong economy to perform well financially.

Conclusion and Valuation

In conclusion, LOW might make for a fair investment at the current price. It’s a bit more than I’d personally be willing to pay because I’d prefer a margin of safety and seek a fairly high rate of return. The outlook from management is cautiously optimistic, the number of stores is growing, the balance sheet is strong, the most recent dividend increase was substantial.

If one were to enter this stock at the current time, selling puts might be a decent way to do it. This way, one can take advantage of a potential pullback and possibly get a lower cost basis with the option premium.

Full Disclosure: As of this writing, I have no position in LOW or HD.

You can see my full list of individual holdings here.

Further reading:

The Clorox Company (CLX) Dividend Stock Analysis

Intel Corporation (INTC) Dividend Stock Analysis

Costco Wholesale (COST) Dividend Stock Analysis

Texas Instruments (TXN) Dividend Stock Analysis

Kimberly-Clark (KMB) Dividend Stock Analysis

Another awesome analysis.

I was wondering about another metric that you could use that Buffett loves: the return on total capital. It’s a great measurement of the business’ efficiency (which I know that you know). What do you think? Can you add this to your free analysis in the future. Look at me, eh? Looking for a freebie!

Well done Matt!

Andrew

Excellent analysis Matt!

Personally, Lowe’s dividend yield is a tad low (for my liking) but that’s one of the few drawbacks I see. They’ve been a steady dividend payer, increasing dividends no less since 1962!

My only other concern, which you elluded to, Lowe’s are increasing their number of stores, which is good, but there’s a limit and this market is getting pretty close to being saturated IMO. I guess there’s always the True North, Strong and Free (Canada).

Cheers,

My Own Advisor

Lowes is already in Canada and Mexico (few stores in each, just starting the market) They are also in a joint venture with Woolworths in Australia. Lots of room for expansion!!