Summary

- Q4 figures give an overview of the company’s satisfying position

- Acquisitions seem to be a winning formula for healthy margins

- While not alarming, uncertainties start to rise on multiple levels

With everything a consumer buys, it’s easy to forget about the “little things”. But those so-called little things, are often essential components to many of our daily tasks. From furniture to car components, passing by flooring and heavy machinery, Leggett & Platt (LEG) really built a name of their own. Now stacking an impressive 47 years of consecutive dividend increase, they are surely on their way to earn this dividend king title. Recent performance is encouraging, translated in higher sales and healthier margins. As an investor, I would gladly take some more time to dig into this stock.

Understanding the Business

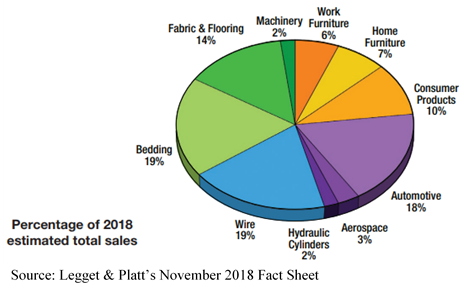

Legget & Platt Inc. started its operations in 1883, in Missouri. The company originally manufactured steel coil bedsprings, a leader in the industry. Today, as needs evolved, LEG conceives and produces a wide variety of components. It is organized into 14 business units, gathered under four major segments; residential products, industrial products, furniture products and specialized products.

Products which can be found in LEG’s businesses vary from bedding components, wires and rods, furniture parts, automotive components, aerospace products and more.

Over the years, the company gathered several patents and trademarks. Many of them are directly resulting of their aggressive acquisition business strategy. Since the 60’s, LEG completed 289 acquisitions to help them grow and diversify their product offer. Their most recent acquisition comes from Elite Comfort Solutions on January 16th. The company is specialized in foam manufacturing for bedding and furniture industry.

As of early 2018, LEG had 130 manufacturing facilities, in addition to various administrative ones. 60% of the manufacturing is done in the US, with the rest spread around the world.

Growth Vectors

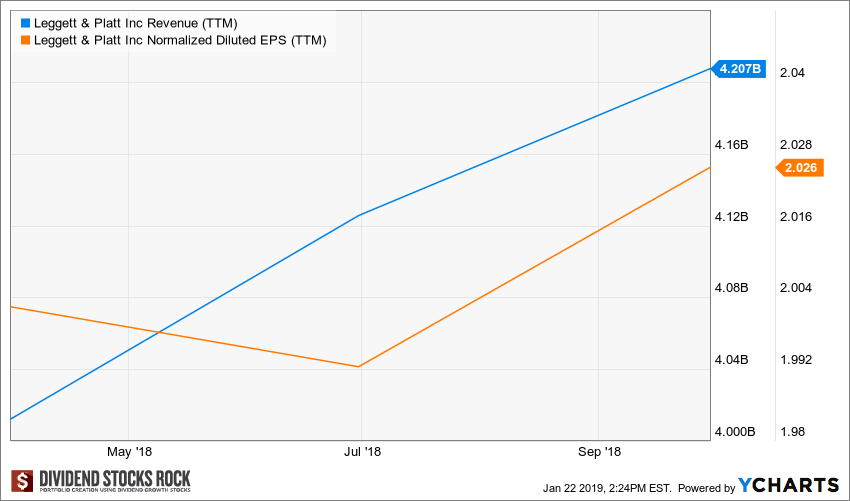

Source: Ycharts

LEG increased their sales number in almost every category. Residential sales grew 6%, industrial products by 22% and specialized products by 10%, while furniture products saw a slight 1% decline. While volume remains very similar to 2017’s exercise, sales price (and therefore, margins) grew in the past few quarters.

In addition to this success, the company finalized ECS acquisition, which in turn added to their bedding and furniture technology. Financed with a mix of cash and debt, ECS 2019’s sales are expected to top nearly $675M. Management also expects double-digit sales growth as well as higher margins, giving a boost to the overall company’s existing margins.

Latest quarter in a flash

On February 4th, the company reported the following results:

- EPS of $0.62, beating estimates by $0.06, a 5% increase from 4Q17

- Revenue of $1.05B, surpassing consensus by $27M

- Dividend of $0.38$/share was declared back in November, for an annualized $1.52 payout

CEO and President, Karl G. Glassman added a few lines on those numbers:

“We are pleased to have delivered 8% sales growth for the full year and 6% sales growth in the fourth quarter. This growth came primarily from new programs and added content in Automotive, market share and content gains in Bedding, strength in Adjustable Bed, and raw-material related price increases.”

Dividend Growth Perspective

While manufacturers such as LEG may not produce exciting and thrilling products for our everyday use, they are compensating by their impressive 47 years of dividend increase. Investors can easily rely on such stock for income purposes.

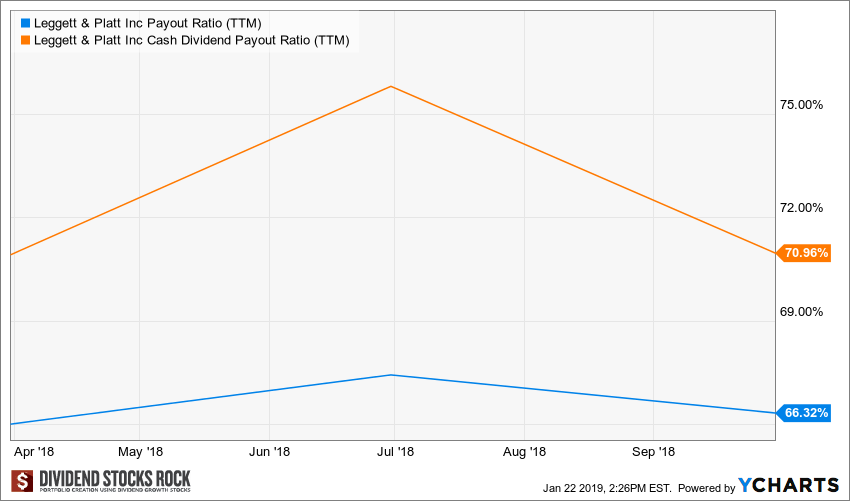

Source: Ycharts

The stock yields around 3.8%, which is surprisingly higher than its peers in the furniture and home furnishing sector. Investors can benefit from defensive stocks like LEG. The manufactured products are much needed in a lot of discretionary goods, which usually delivers higher returns.

Source: Ycharts

Management is committed to the profitability of their business. They intend to use their cash to fund organic growth as well as acquisitions and sustain shareholders returns. In order to make it happen, funds need to be reinvested (or invested in some way) in order to better deliver, which is exactly what the above chart shows.

Potential Downsides

One of the first risks that comes to mind while reading this should be related to acquisitions. While this behavior is not a bad thing in itself, it comes with uncertainties and risks, such as realized synergies and estimated sales. In 2018, LEG acquired 3 businesses; Precision Hydraulic Cylinders along with two smaller geo components operations. This type of growth can be very lucrative, but also value-destructive if things do not go according to plan.

There is also another risk associated with manufacturing, but that is also the case for many industries: costs related to raw materials. Looking closely at the fourth quarter performance, input prices rose, giving a hard time to margins from those categories. Furniture products is one of the most affected, but I wouldn’t be surprised to see the same effect spreading to Industrial or residential products.

Valuation

Looking at the PE chart below, I think this one will be interesting. Share prices have somewhat dropped in the last few weeks, which might translate to a buy opportunity. Let’s assess this one with a dividend discount model.

Source: Ycharts

An annualized dividend payment of $1.52 is used here, along with a 5% flat growth over the long term. Discounted with a 9% rate, it accurately representing the market’s current state.

| Input Descriptions for 15-Cell Matrix | INPUTS | ||

| Enter Recent Annual Dividend Payment: | $1.52 | ||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | ||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | ||

| Enter Discount Rate: | 9.00% | ||

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $63.84 | $47.88 | $38.30 |

| 10% Premium | $58.52 | $43.89 | $35.11 |

| Intrinsic Value | $53.20 | $39.90 | $31.92 |

| 10% Discount | $47.88 | $35.91 | $28.73 |

| 20% Discount | $42.56 | $31.92 | $25.54 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Intrinsic value given by the model is very similar to observed share price, meaning that the stock may actually be adequately priced. While this value does not scream a strong buy, investors may need to take an extra few steps in order to make an investment decision here.

Final Thought

Leggett & Platt built an impressive business over the years. They have placed themselves in a strong position in their industry in order to benefit from diversified sectors, which is key nowadays. Management also diversifies their growth with a mix of organic and acquisition, which seems to have worked very well for them in the past.

For income-seeking investors, I would seriously be investigating more on the company. Yield is interesting and price might just be right for the first time in a while. Just remember that the stock is not intended to grow at full speed either, having reached a mature state many years ago. But with such a business model, surprises are not to be set aside either!

Disclosure: We do not hold LEG in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply