We are entering the most important earnings season of the past 5 years. During the next 2 months, companies will tell us how they fared during the first economic lockdown of the century.

We expect bad news, but we may now have a more clear picture of what’s coming for the rest of the year. Most importantly, U.S. banks started the ceremonies two weeks ago and told us a lot about the state of the economy. Let’s dig into JPMorgan (JPM) results and see how we should adjust our portfolio accordingly.

JPMorgan Business Model

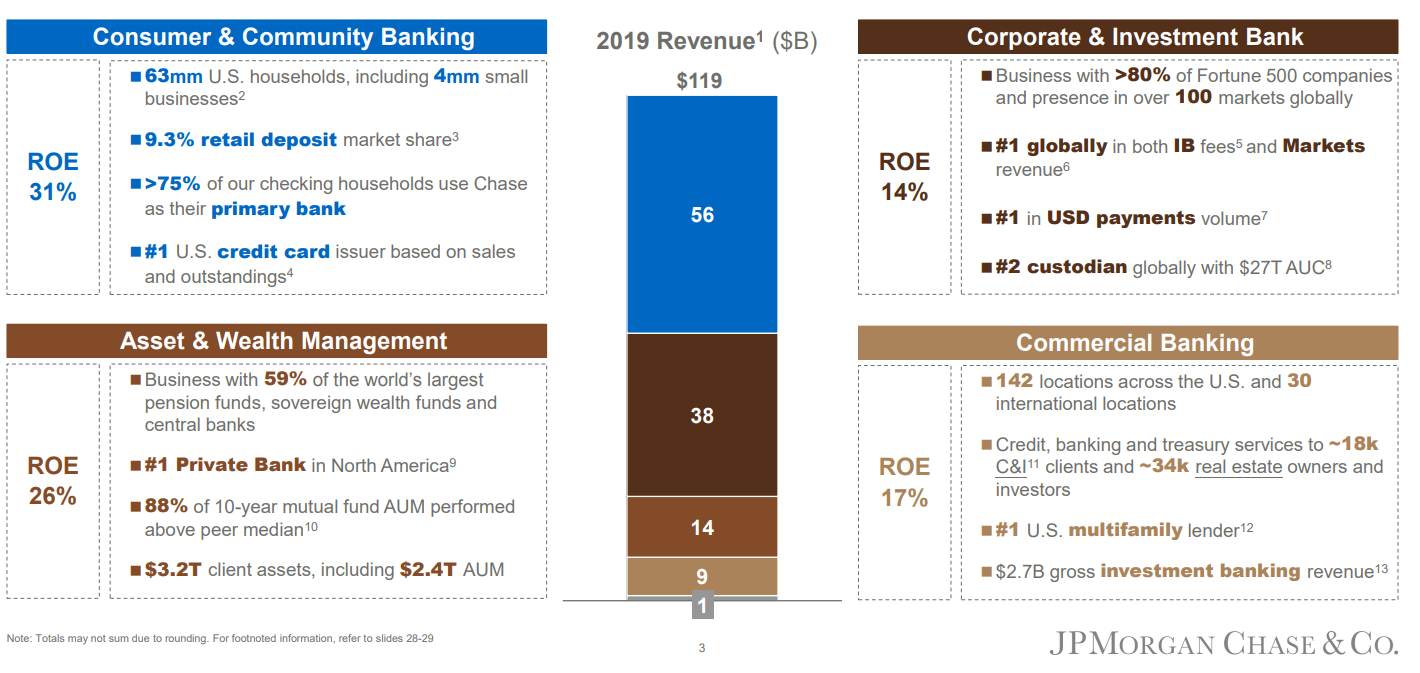

JPMorgan Chase is one of the U.S. largest financial firms with over $2.6 Trillion in assets under management. The company employs over 240,000 people spread across 60 countries. The firm isn’t just a classic savings and loans bank. It offers a wide range of fields such as in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management. The bank is well diversified across all these segments of business, but interest income remains about 50% of its total revenue.

source: JPM 2020 investors overview presentation

JPMorgan Q2 2020 results

Non-GAAP EPS of $1.08, down from $2.82, missed by $0.15.

Revenue of $32.98B, +14.39%, beat by $2.75B.

Dividend of $0.90/share, no increase (don’t expect any this year).

As opposed to Wells Fargo, JPMorgan (JPM) is successfully navigating the pandemic without getting hurt too much. The company even managed double-digit revenue growth (+14%) and beat expectations by $2.75B.

“We earned $4.7B of net income in the second quarter despite building our $8.9B of credit reserves because we generated our highest quarterly revenue ever, which demonstrates the benefit of our diversified global business model,” Dimon said.

Strong results were led by JPM’s diversification. The company enjoyed stronger earnings from their trading and investment banking segments while being more efficient in general across all divisions. Unfortunately, not everything was pinky pink. JPM increased its provision for credit losses by $8.81B (on top of $6.82B last quarter).

“Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy,” said CEO Jamie Dimon.

Dividend Increase and CET1

JPM didn’t touch its dividend and Dimon previously mentioned it could eventually cut it if their situation deteriorates. So far, however, we don’t expect any movement on this issue since JPM shows a CET1 ratio of 12.4% which is well above the minimum requirements. Nonetheless, management announced they would not buy back shares for the time being. Please note that JPM made the calculation for a CET1 ratio including only dividend payment and no further stock repurchases. This number is encouraging for shareholders as the ratio would then go up to 15.5%.

What we see from both banks is that auto loans are showing a serious problem. At JPM, 7.4% of all car loans are now on a payment deferral agreement with 89% of them late by less than 30 days. There will be a big slowdown coming from the car industry. Another point to note is JPM’s credit card sales were down by 23%. This links to the recent consumer trends of cutting down expenses and increasing their savings rate.

As the traditional banking business is being driven by huge increases in deposits, shrinking loans, and lower interest rates, having other business segments such as investment banking, wealth management and insurance will help the banks navigate through these troubled waters.

JPM Potential Risks

JPM had a long and impressive dividend increase streak until the financial crisis. At that time, JPM paid a $0.38 quarterly dividend that quickly shrunk to $0.05. Financials have this “gift” to make us believe everything is pinky and shiny when it’s rotten. Therefore, the risk with U.S. banks is always the same; we can’t 100% trust them as they tend to twist the reality. Also, the bank must deal with an ultra-low interest rate environment. This can affect the interest rate spread and therefore, the firm’s margin. The final impact of the covid-19 on the economy remains unknown, but we can expect lots of bankruptcies and write-offs.

JPM Dividend Triangle

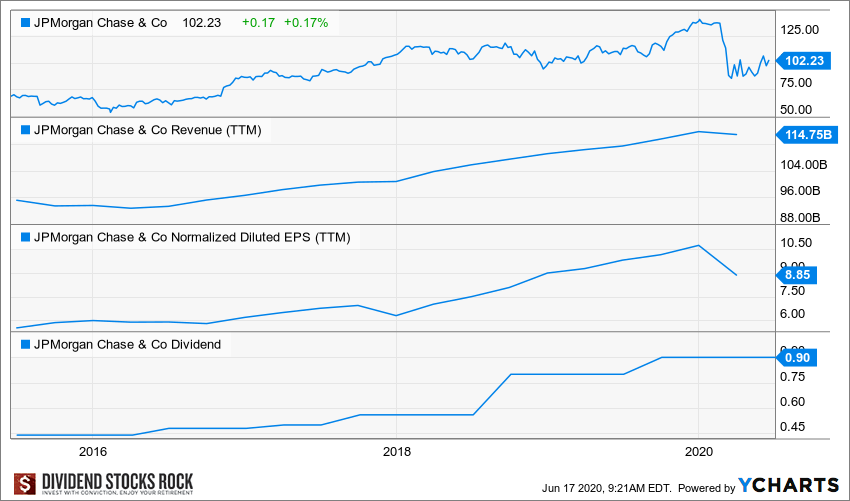

source: Ycharts

A key point in my investing process is to analyse the company’s dividend triangle. This is the combination of revenue, EPS and dividend growth.

The financial crisis put JPM in an impossible situation, and management cut the dividend in 2009. JPM’s first increase since its darkest period happened in 2011 and was followed by eight consecutive increases. As the dividend grew by double-digit CAGR over the past five years, JPM’s stock price more than doubled. This explains the relatively low yield the company shows. We don’t expect the bank to increase its dividend in 2020 and further increases should be smaller for a while. I kept mid-single digit numbers for the dividend discount model (DDM) for now.

Going forward, don’t expect JPM to show a strong dividend triangle in 2021. The bank will have to go through a weak period of earnings before coming back in strength. I don’t expect a dividend increase in the next 12 months either. However, JPM business model is well-diversified and should help the firm to go through the storm.

JPM Valuation

As mentioned in the previous section, I kept my dividend growth rate expectations intact for the DDM calculations. Assuming a mid-single dividend growth rate and a 9% discount rate, we can see JPM is offering a nice margin of safety at the current price:

| Input Descriptions for 15-Cell Matrix | INPUTS | ||||

| Enter Recent Annual Dividend Payment: | $3.60 | ||||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | ||||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | ||||

| Enter Discount Rate: | 9.00% | ||||

| Discount Rate (Horizontal) | |||||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | ||||

| 20% Premium | $209.87 | $140.40 | $105.64 | ||||

| 10% Premium | $192.38 | $128.70 | $96.84 | ||||

| Intrinsic Value | $174.89 | $117.00 | $88.03 | ||||

| 10% Discount | $157.40 | $105.30 | $79.23 | ||||

| 20% Discount | $139.91 | $93.60 | $70.43 | ||||

Please read the Dividend Discount Model limitations to understand this chart.

If you have the chance to grab shares under $100, this could be a solid investment for the coming years.

Final Thought on JPM

The financial crisis of 2008-2010 propelled JPM as one of the most dominant bank in the U.S. landscape. It is now the largest bank in term of deposits, loans and credit card issued. Since then, the bank has built a strong business model and is well diversified. JPM shows a great balance between a core business based on classic banking activities and growth vectors such as wealth management and investment banking. Now that banks face another important challenge with the covid-19, JPM should use its size and scale to survive the crisis and thrive afterward. The bank can use its scale to expand even more, but you will have to be patient. We must go through the current crisis first.

Good stuff