Summary

#1 SJM is particularly strong in the breakfast category with peanut butter, coffee and fruit spread strong brands.

#2 The company shows 15 consecutive years with a dividend increase.

#3 Unfortunately, there aren’t enough growth vectors to justify the current valuation.

Investment Thesis

We rarely have the opportunity to pick a losing stock in 2017. It always catches my attention when a dividend growth company is down while the market is surging. Is there a buying opportunity or is it a falling knife? JM Sucker (SJM) shows a strong business model and owns many #1 brands in the food business. The company continues to innovate and aim for additional growth through acquisitions. What’s wrong with the company? Let’s take a deeper look to see is SJM could fit your portfolio.

Understanding the Business

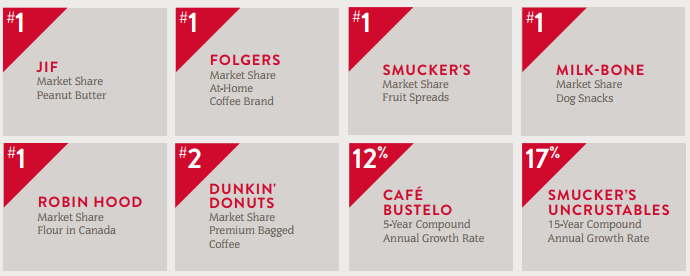

JM Smucker is a packaged food company for both human and pets. The company is particularly strong in the breakfast category their peanut butter (Jif), fruit spreads (Smucker’s) and coffee (Folgers & Dunkin’ Donuts). The business counts many #1 and #2 brands:

Source: 2017 SJM annual report

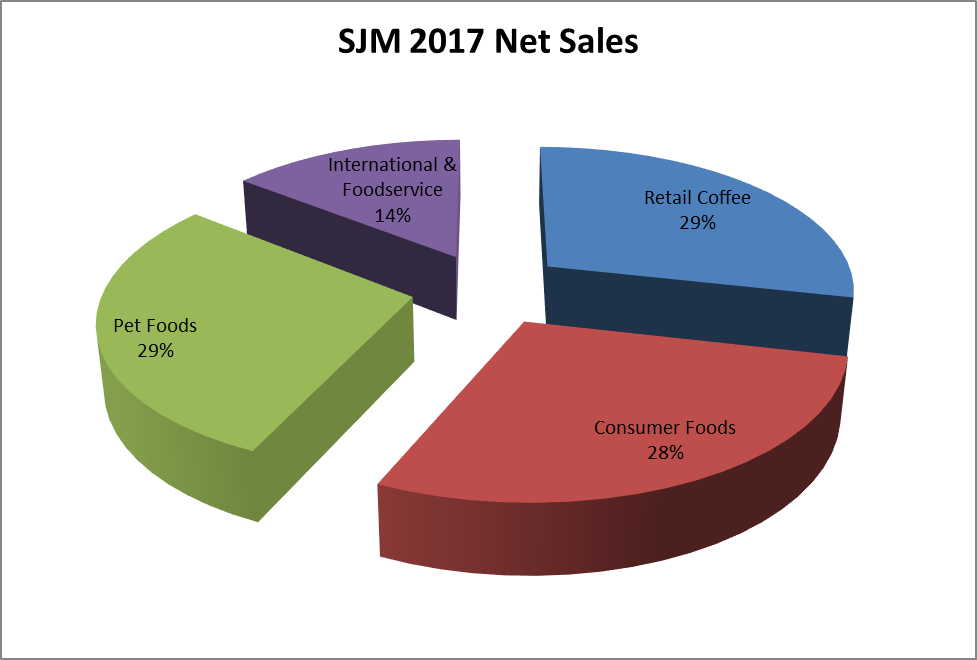

In 2017, the business divisions reported net sales as follow:

Author’s chart, 2017 SJM annual report data

Revenues

Source: Ycharts

SJM bought Big Heart for $6 billion back in 2015. The idea was quite simple; becoming a key player in the pet foods industry. With dominant brands like Milk-Bone and Meow Mix, SJM added a business with a similar pattern (a strong brand in a dominant market).

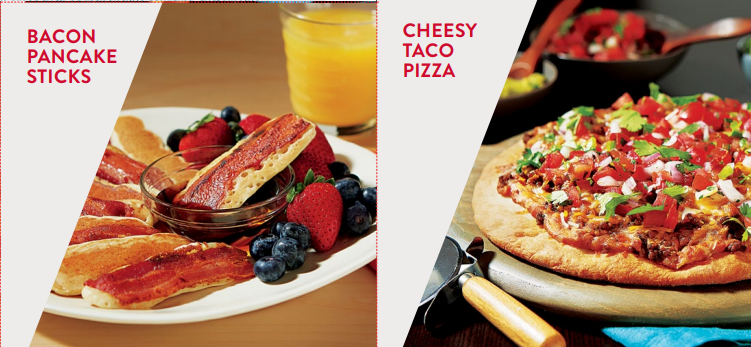

As the taste for coffee at home and peanut butter rises in the U.S., SJM is also well positioned to capture this growth. Management used Jif’s popularity to introduce snack bars, nut butter and powders. Plus, SJM doesn’t slow down on innovation when it comes down to reinvent the food we eat. Among their original foundation, I particularly like the idea of bacon pancake sticks and cheesy taco pizza!

Earnings

Source: Ycharts

Unfortunately, all those strategies to improve revenues didn’t do much on earnings. In fact, over the past 5 years, EPS has increased by a meager 5% (not annualized… total!). With fierce competition in the food industry and limited shelf space, margins get hurt upon multiple promotions and price rebates. Fruit spreads aren’t as popular as they were before leaving SJM with less option for future growth.

Also, the expected synergy with Big Heart acquisition may be smaller than expected. The high price paid for the pet food company weighs an important role in the company’s profitability.

Dividend Growth Perspective

SJM has been a shareholder friend stock for many years. Management has successfully increased its payouts for the past 15 consecutive years. This makes it apart of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

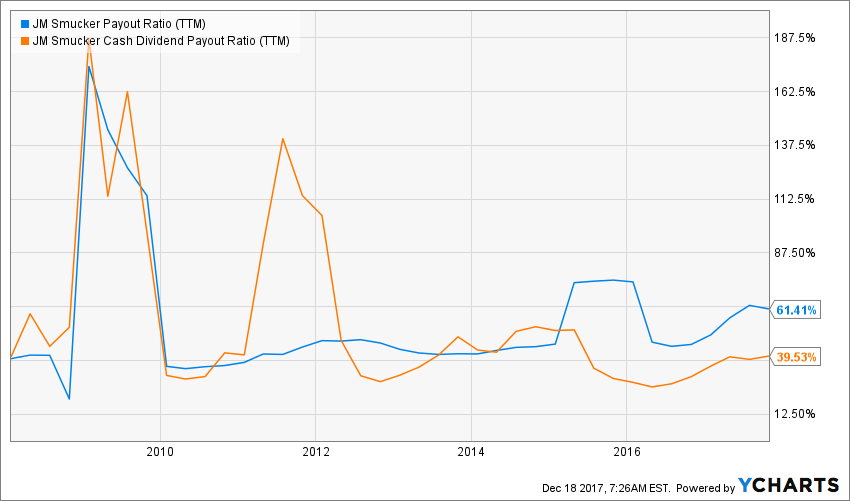

Source: Ycharts

As you can see, there was a lot more movement around the stock price than the dividend payment. Over the past 10 years, SJM shows a dividend CAGR of 10.03%. However, the company is slowing down its growth policy with a CAGR of 8.45% over the past 5 years, 6.85% over the past 3 years including a small 4% increase this year. The fact that management has constantly reduced its guidance over the past 4-5 quarters isn’t a good sign.

Source: Ycharts

Nonetheless, SJM shows payouts ratios well under control. SJM does meet my 7 dividend growth investing principles. However, I would not expect a high single to double-digit dividend growth rate in the future. I think it is more reasonable to expect something in the 5-6% range.

Potential Downsides

When a company advertises pancake-bacon sticks and cheesy tacos pizza, I can tell that my stomach gets excited but not my investors’ instinct. While I enjoy junk food once in a while, I’m part of the healthy movement where I replace beef by lens once in a while. I think SJM is making a mistake by ignoring the healthy food movement and focusing on packaged savory, but yet unhealthy, foods.

Fruit spreads trend will continue to go down while overall competition in the food business will grow stronger. Both will affect SJM bottom lines. I am not worried about the future of the company, but I don’t see incredible strong growth vectors to push the stock at higher prices either.

Valuation

While the stock market will finish the year with a 20%+ growth, SJM will be part of the black sheep with a negative return. The worst part is that the company’s PE doesn’t look cheap either:

Source: Ycharts

I don’t like seeing a classic food company with a solid but mature business model being traded at such a high price. Going further, I’ve used the dividend discount model to see if there is an opportunity for dividend growth investors. While the latest dividend increase was disappointing (4%), I picked a 5% dividend growth rate for the first 10 years and increased it to 6% as a terminal rate. To be honest, I tried to be generous in my valuation to see where it could get as my original calculations were giving me a fair value at $80….

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.12 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $181.89 | $121.68 | $91.56 | |

| 10% Premium | $166.73 | $111.54 | $83.93 | |

| Intrinsic Value | $151.57 | $101.40 | $76.30 | |

| 10% Discount | $136.42 | $91.26 | $68.67 | |

| 20% Discount | $121.26 | $81.12 | $61.04 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Unfortunately, even in a “best case scenario”, SJM isn’t trading at an interesting value. I guess this is the price to pay for 8 years of a bullish market!

Final Thought

I appreciate the dividend and the cash cow behind SJM business model. However, I don’t think there is any upside potential for SJM in 2018. There is an obvious reason why the stock lagged the market in 2017 and I think it will continue going forward.

Disclaimer: I do not hold SJM in my DividendStocksRock portfolios.

I would have to agree with you. It’s quite overvalued for their short term and long term prospects. First time stopping by your blog though. I like the way you organize your information to how I’m used to seeing it on SA. Great job! **added you to my list of blogs to follow

Hey Div Reaper!

There aren’t many interesting food stocks lately. My favorite one is MKC… not exactly a package food business, but this is probably he only one showing growth potential for the upcoming years and that is not too overvalued.

I’m heading to your blog at the moment!

Cheers,

Mike.

I haven’t looked into MKC just yet but I’ll put it on my list and give it a review. Thanks for the hot tip! :)

Monk –

Phenomenal analysis and agree on all fronts. Earnings hasn’t caught up with their business moves and they are still overvalued at the moment. They need to drop over $10 per share for me to re-consider them.

-Lanny

Unfortunately, this will not happen in this crazy market! hahaha!