Investment Thesis

What happens when the leader of an industry sees several opportunities knocking on its doors at the same time? The stock surges like there is no tomorrow. Boeing (BA) is the leader in the commercial aircraft industries and benefits from several growth vectors at the moment. Its commercial airplanes division is booming with strong backlog, military expenses are pushing its Defense, Space & Security segment and management came with the idea of offering additional services to its clients securing recurring revenues.

Boeing looks like the perfect stock to hold right now. But what if you missed your flight, is still time to buy another ticket?

Understanding the Business

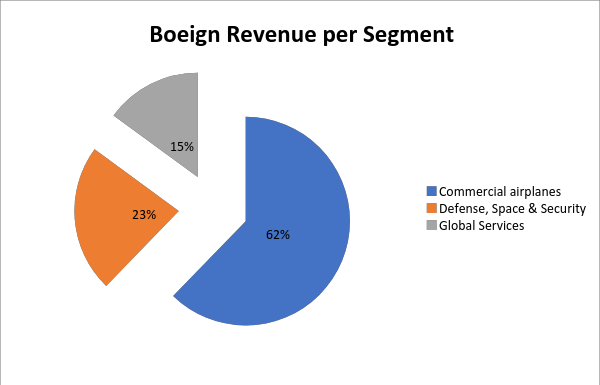

Boeing is well known for its commercial airplanes. The company is divided into 3 segments (% of revenue are coming from BA latest quarter):

Commercial airplanes: this segment counts for about 60% of BA business. In 2016, the company led the industry for a 5th consecutive year for the most deliveries (source annual report 2016).

Defense, Space & Security: this segment counts for about 23% of BA business. Boeing manufactures satellites, military aircrafts and weapons systems. 37% of this division revenue comes from international clients.

Global Services: this is a new segment introduced this quarter and represented 15% of BA business. It is dedicated to providing more agile, cost-effective and streamlined after-market support and services to its commercial clients. BA eyes also the maintenance business and plans to integrate spare parts, modifications, upgrades, and data analytics and other information based services to its offer.

Author’s chart, source BA Q3 2017 presentation

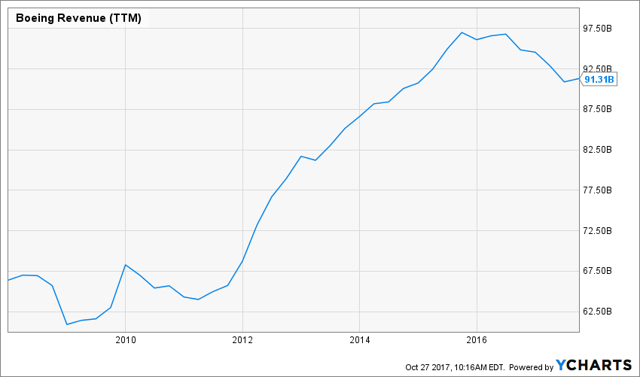

Revenues

Source: Ycharts

Boeing can count on a robust demand for commercial aircraft so support its growth. The company has currently 5,659 airplanes in backlog according to its latest numbers. Management is almost facing a production challenge in order to deliver all those airplanes on time. This is the kind of problems I like.

Its new service is picking-up quickly and it will lead to recurring revenues in the future.

As the defense sectors will be picking-up at the same time based on military budget increase, BA can counts on multiple growth vectors for the future. As Chairman, President and Chief Executive Officer Dennis Muilenburg explained, Boeing’s future looks bright:

“In the third quarter we successfully launched our newest business segment, Boeing Global Services, leveraging our unique One Boeing advantages to offer complete lifecycle support across the commercial, defense and space sectors. We achieved a number of key milestones in the quarter with the delivery of a record 202 commercial airplanes, including 24 737 MAXs as we continue the smooth introduction of that airplane. On the defense side, we booked $6 billion in new orders, including an initial contract award for the Ground Based Strategic Deterrent program and an award from the U.S. Navy for 14 F/A-18 Super Hornet aircraft.”

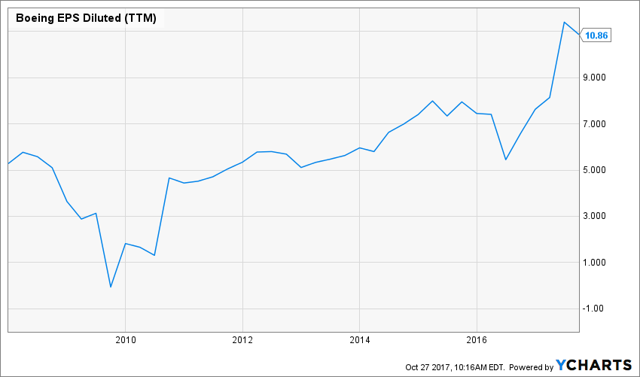

Earnings

Source: Ycharts

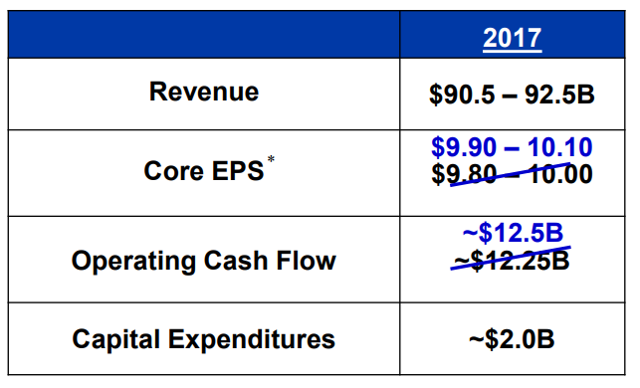

EPS this quarter was lower than Q3 2016 mainly because of a tax adjustment that occurred last year. Management was pumped by its strong quarter and improve its guidance for the rest of the year:

Source: BA Q3 2017 presentation

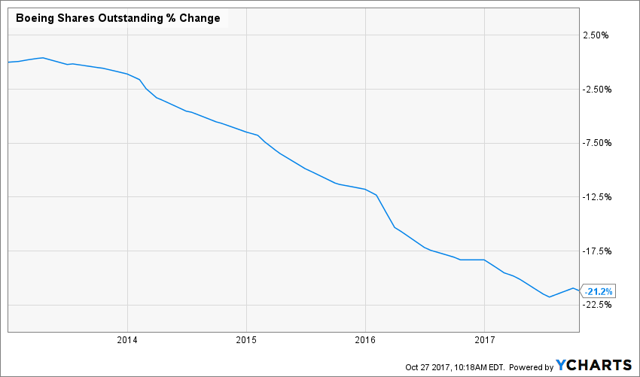

In addition to spend billions in R&D, Boeing has become quite a shareholder friendly stock over the past 5 years. It has a massive share buyback programs in place which enabled management to repurchase over 20% of the outstanding shares in the past 5 years.

Source: Ycharts

Boeing’s generosity doesn’t stop there, it has also a quite aggressive dividend policy in place.

Dividend Growth Perspective

Following the 2008-2009 crisis, Boeing had to take a pause with its dividend growth policy. The dividend remained the same until 2012. Since then, management has been more than generous and the stock is now showing 5 consecutive dividend increases. This make it half way to be part of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

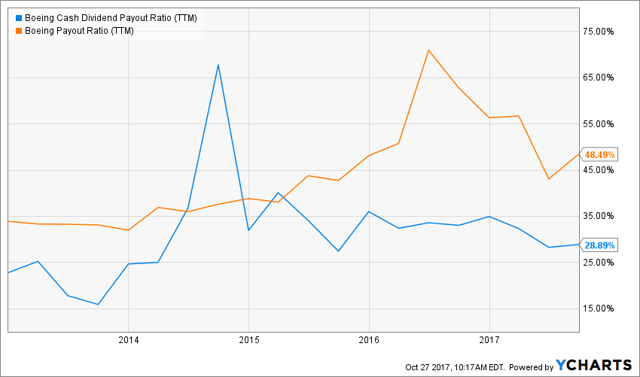

Between 2012 and today, BA dividend growth has been phenomenal. We are talking about a 222.7% increase or a rhythm of 26.40% CAGR. You can’t obviously count the company will maintain such incredible trend. From what I can see, both current payout and future growth are assured for a while.

Source: Ycharts

You would think a company’s payout ratio would be hurt by such impressive growth. Both payout and cash payout ratio are under 50%. This gives enough room for management to continue a high single digit dividend growth policy over the long run. BA meets my 7 dividend growth investing principles.

Potential Downsides

The commercial aerospace is cyclical. While Boeing enjoys the best of both worlds right now (e.g. new orders from emerging markets + replacement demands from U.S. and Europe), both growth vectors will slow down eventually. When this airplane batch will be delivered, new orders might fall short. As the market has been utterly optimistic in regards to BA stock value (+261% over the past 5 years as at October 27th), the stock may fall upon weaker demand.

As production demands increase, another challenge is waiting for management. Once orders start to decline, economy of scale will diminish. Efforts that have been deployed to produce a larger amount of aircrafts will be left with less work.

Valuation

What can you expect from a stock that surged by over 250% over the past 5 years? Is Boeing really going to lift-up to higher level or is it just an icon of this never-ending (but dangerous) bull market? Let’s take a look to see if the current value is justified.

Source: Ycharts

At first glance, we can say that BA is trading at its highest PE level, but it has happened a few times since 2014. Still, I would be cautious about a PE getting close to 24.

I will use the Dividend Discount Model to get an idea of a fair value for BA. I think management will continue a double-digit dividend growth policy for the next 10 years as it will surf on important tailwinds. However, I reduced the growth rate to 6% later on assuming there will be a down cycle in the aircraft industry.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $5.68 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 10.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $509.51 | $335.56 | $248.78 | |

| 10% Premium | $467.05 | $307.59 | $228.05 | |

| Intrinsic Value | $424.59 | $279.63 | $207.32 | |

| 10% Discount | $382.13 | $251.67 | $186.59 | |

| 20% Discount | $339.67 | $223.70 | $165.86 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Interesting enough, there is will room for growth for BA. We are talking here about a potential upside of 8%, but could satisfy many investors in this highly valued market.

Final Thought

I do not hold shares of BA and the idea of looking into this company came from one of my reader (you can always click on my name and send me message; I just love talking about the market!). Overall, I think it’s a very good hold, but at the moment, I’m still a bit uncomfortable with the valuation. The DDM proves me wrong, but I’m having a hard time to jump in an airplane that has already took-off.

Disclaimer: I do not hold BA in my DividendStocksRock portfolios.

Leave a Reply