Summary

- Physicians Realty Trust evolves in a growing market (healthcare).

- This REIT pays a 6% yield and focuses on quality tenants.

- But where is the dividend growth?

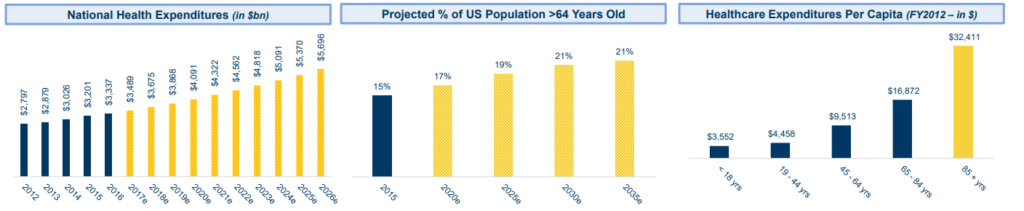

There is no doubt the Healthcare sector is a growth sector for the upcoming decade. As the population ages in the U.S., the amount spent on healthcare will skyrocket. The CMS projects a 63% increase in healthcare expenditures during the next 10 years. DOC is well positioned with its growth-by-acquisition strategy. DOC has focused on tenants’ quality and continuously improving its tenants grade. Between 2015 and 2018, DOC has also reduced the weight of its top 10 tenants from 34% to 27%.

Now that DOC shares have tumbled by almost 20% ytd (-17% as of May 15th), is this 6% yield REIT worth your attention?

Understanding the Business

As the name suggests, DOC is a self-managed healthcare real estate investment trust that acquires, owns, and manages healthcare properties that are leased to physicians, hospitals, and healthcare delivery systems and other healthcare providers. You can download the complete list of solid dividend paying REITs here.

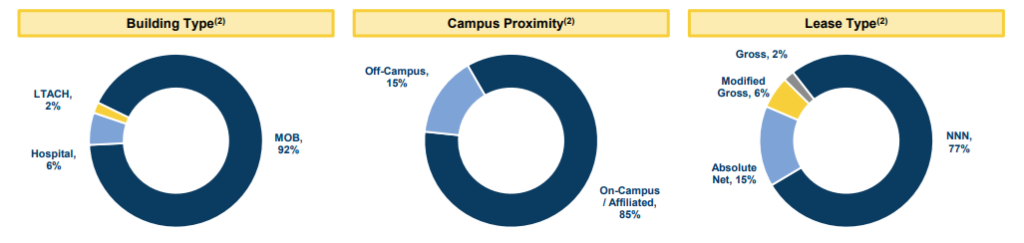

Their properties are likely to be on campus with a hospital or located nearby with partnerships in place. DOC currently manages 280 properties worth about $4.3B. 96.6% are leased with an average contract term of 8.3 years.

Source: DOC investors presentation

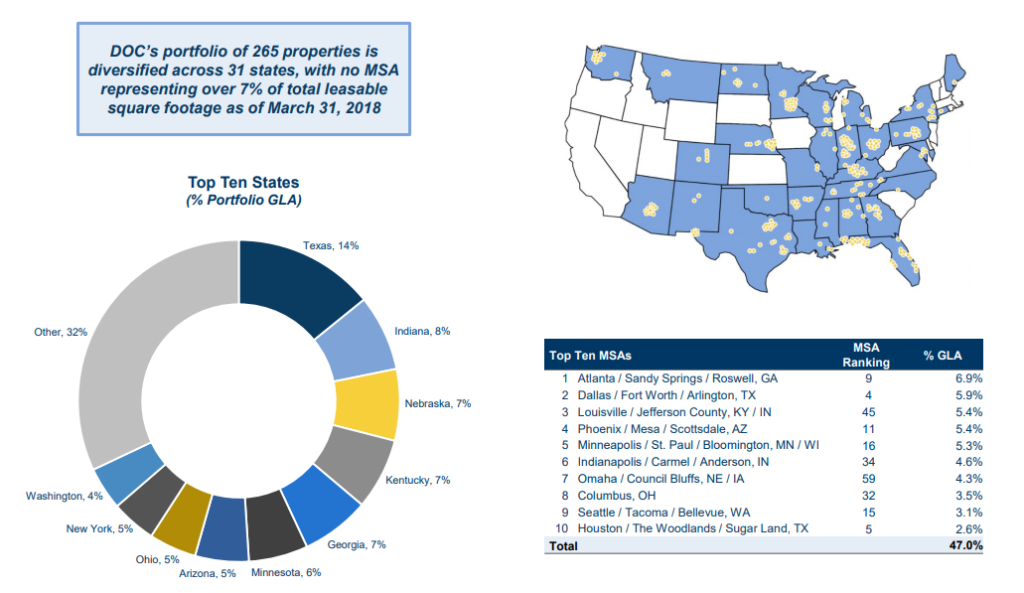

DOC shows a great geographic diversification with properties in 31 states and only one (Texas) representing more than 10% of its portfolio (14%). This enables DOC to reach a maximum population potential without cannibalizing its own offer.

Source: DOC investors presentation

Growth Vectors

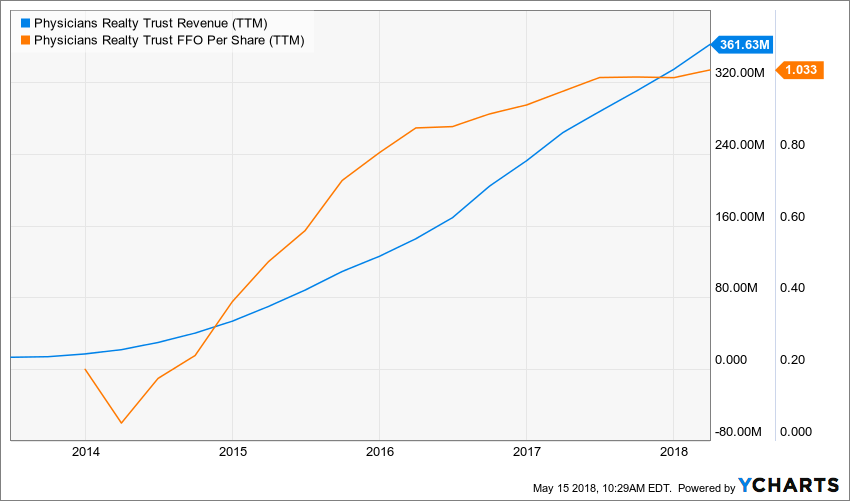

Source: Ycharts

DOC shows an impressive growth profile over the past 5 years. The company quickly positioned its business through various acquisitions while maintaining a healthy balance sheet. Its revenue plainly skyrocketed during that period. DOC will continue to surf on the same tailwind (aging demographic) for another decade.

Source: DOC investors presentation

It’s obvious that DOC wanted to position itself as a leader in this industry. The main advantage with Real Estate is that once DOC builds (or buys) a healthcare property and links it to a hospital, it is very hard for a competitor to build a new one right beside it. This is a first mover advantage in this business and DOC jumped on the occasion.

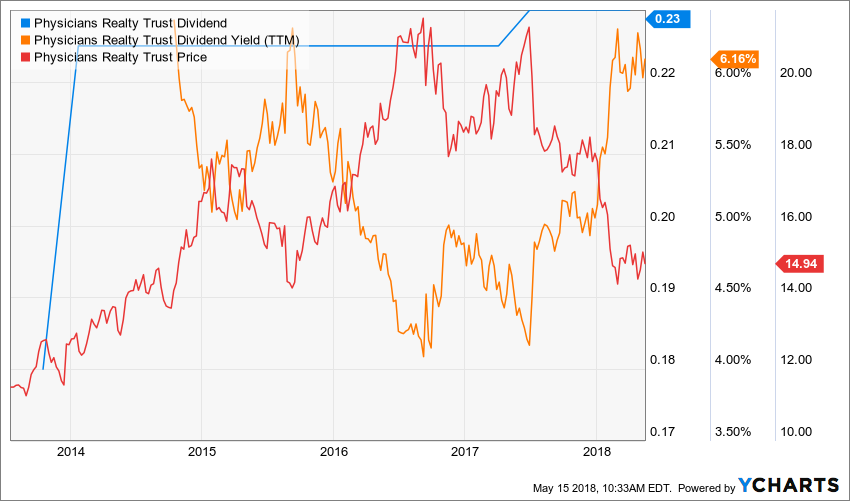

Dividend Growth Perspective

When you look at DOC’s dividend history, you will not be flabbergasted. We are talking about a company that paid its first dividend in 2013 and increased it only once in the past 3 years (+2.22%). We are far from talking about a Dividend Achiever here. You can download complete list of stocks with 10+ year dividend growth here.

Source: Ycharts

We have used a 2% dividend growth rate for our DDM calculation, but keep in mind this doesn’t reflect the current situation. In other words, DOC pays a yield around 6% and this is what you are going to get from this REIT. Don’t expect much else.

Potential Downsides

There are many changes around the healthcare system and it is still unclear on how those modifications will affect businesses evolving in this playground. DOC grew very fast over the past 5 years and now that interest rates are rising, this will affect future profitability. The company currently shows a dividend payout ratio (based on FFO) of about 90%. While the payout is safe due to a healthy business, this doesn’t leave much room for increases. Once debt matures and need to be renewed at a higher rate, the dividend perspectives will not improve. Keep in mind that if your dividend payout doesn’t increase, your buying power shrinks year after year. For your retirement plan, you should consider an inflation rate of 2%. Therefore, any stocks showing less growth perspective are hurting your portfolio and reducing your retirement budget.

Valuation

Now that the stock has dropped by almost 20% in 2018, maybe it’s time to take a second look at DOC fair valuation. Since using the PE ration history isn’t very useful when looking at REITs, we’ll focus on the dividend discount model.

As previously discussed, we used a 2% dividend growth rate to match the inflation. Unfortunately, this is not the case at the moment. Therefore, if DOC can’t show any upside potential now (fair value at $13.41), there is not much appeal to invest in DOC.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $0.92 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 2.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 2.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $18.77 | $16.09 | $14.08 | |

| 10% Premium | $17.20 | $14.75 | $12.90 | |

| Intrinsic Value | $15.64 | $13.41 | $11.73 | |

| 10% Discount | $14.08 | $12.07 | $10.56 | |

| 20% Discount | $12.51 | $10.72 | $9.38 | |

Final Thought

Please read the Dividend Discount Model limitations to fully understand my calculations.

While the sector and tenant profile are interesting, DOC’s dividend perspectives are deceiving. It would become a buy if DOC shows the ability to grow its distribution to match inflation. At this time, there are too much uncertainties around the healthcare industry in the U.S. and DOC doesn’t pay us enough to wait. I understand the 6% yield looks appealing, but it’s nothing if the payment can’t increase in the future. With a 90% FFO payout ratio, there is little room for this scenario.

Disclaimer: I do not hold DOC in my DividendStocksRock portfolios.

Leave a Reply