What Makes Invesco (IVZ) a Good Business?

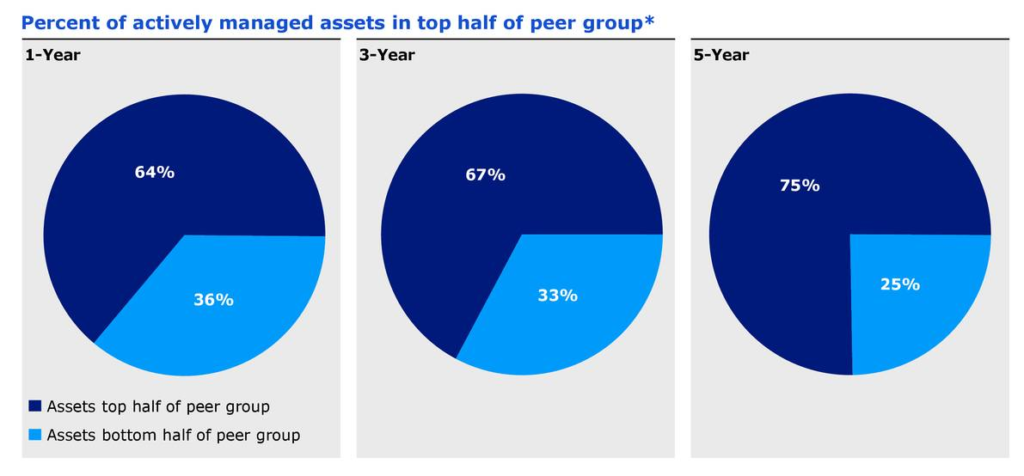

As we are riding a never-ending bull market, Invesco continues to perform like there is no tomorrow. At the end of September 2017, 64%, 67% and 75% of Invesco’s actively managed portfolios were beating their peers on 1, 3 and 5 years basis. In other words, when investors look for performance, they look at Invesco.

Source: IVZ Q3 2017 presentation

The company has been proven resilient after the sale of Atlantic Trust in 2013 and the departure of their all-star portfolio manager Neil Woodford in 2014. Those two events affected the most important metric for any investment firm: assets under management. Despite these two events, IVZ shows a positive AUM growth of 1.9% annualized rate over the past 5 years. Let’s take a deeper look at this strong investing firm.

Revenue

Revenue Graph from Ycharts

As mentioned in my introduction, IVZ shows a strong performance model that enabled it to keep its AUM growing. Revenue are now back to growth territories and the recent acquisitions in the ETFs business will definitely push IVZ to higher level.

What I like about IVZ AUM is that we are not only talking about assets being lifted-up by strong market performance. The company recorded long-term net inflows of $6.3 billion in their latest quarter.

How IVZ fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many incomes seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

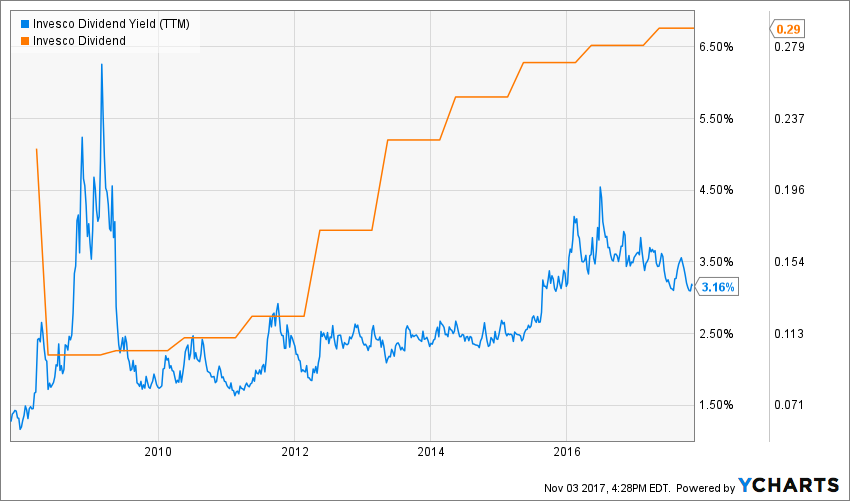

Source: data from Ycharts.

As its dividend keeps increasing, IVZ yield is relatively stable. After offering a low yield of 2.50% for a few years, the company is now even more generous at 3%+. Keep in mind that IVZ stock price surged by almost 30% since the beginning of the year (as at November 6th).

IVZ meets my 1st investing principles.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

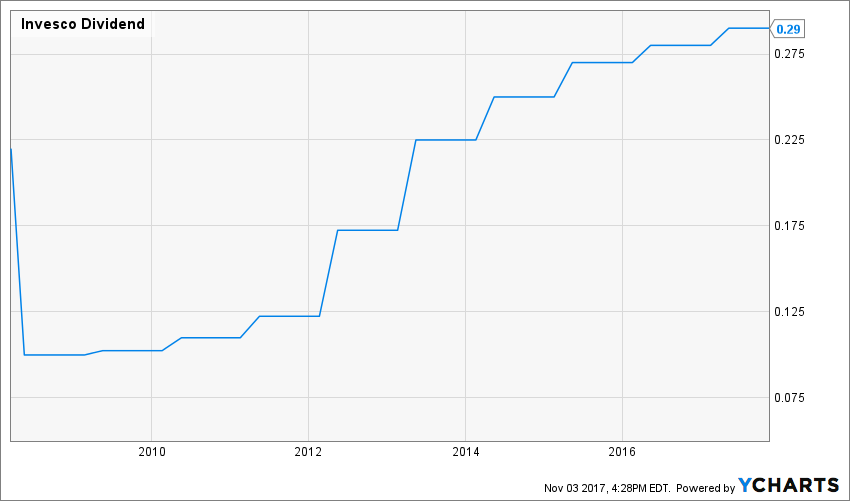

Source: Ycharts

This year, management announced a 3.6% dividend increase. This is not a phenomenal growth, but it is its 8th consecutive years with an increase. This makes it only 2 years apart of appearing on the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

IVZ meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will sustain their dividend growth.

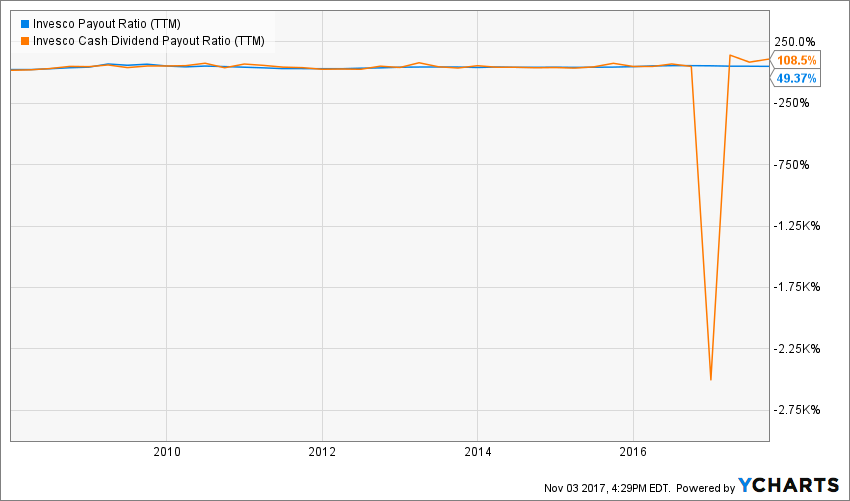

Source: data from Ycharts.

When you look at IVZ payout ratio, everything looks great. At 50%, we can predict many years of dividend growth. However, I understood management’s decision of going with a mediocre increase when I took a deeper look at the cash payout ratio. IVZ maintains little room to pay their dividend with their cash in hand. This is not a problematic situation just yet, but you can expect there won’t be a dividend raise if the market falls (and IVZ revenues and earnings follow).

IVZ meets my 3rd investing principle, but proceed with caution.

Principle #4: The Business Model Ensure Future Growth

Invesco’s business model is mainly from experience and performance. In a world where beating your neighbor is more important than anything, IVZ is doing a marvelous job. IVZ has built a strong brand and its name is synonym of trust and performance. This unique advantage will help the company going through any type of storms coming ahead.

Management is also well aware of the current state in the investing world; the seek for ETFs and other passive products is on. For this reason, IVZ recently acquired ETFs operations from Source and Guggenheim. IVZ is a little bit late in the game compared to my favorite pick in this field, BlackRock (BLK), but will definitely create a growth vector out of the ETF business.

IVZ still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. To achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

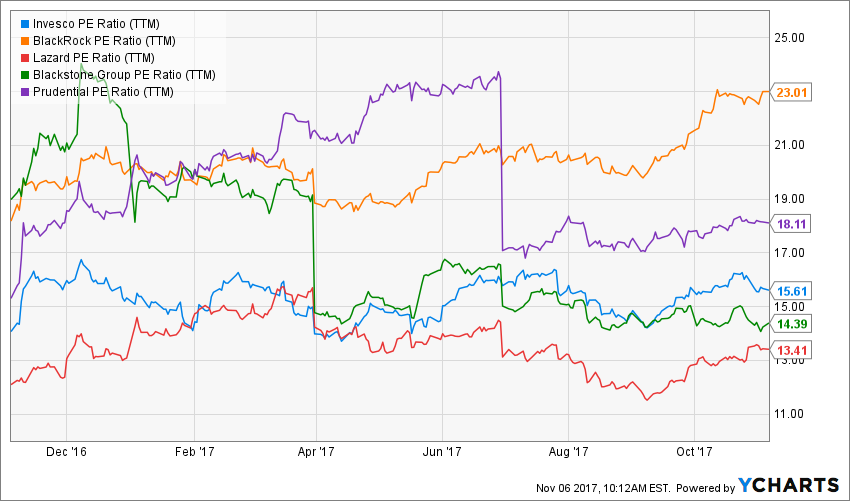

When I look at companies trading under an 18 PE ratio these days, I can’t restrain my smile. But as you can see, lower PE ration in the financial industry is only normal. In fact, when you look at its peer, IVZ isn’t cheap either:

Source: Ycharts

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machine and assess their value as such.

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $1.16 |

| Enter Expected Dividend Growth Rate Years 1-10: | 6.00% |

| Enter Expected Terminal Dividend Growth Rate: | 6.50% |

| Enter Discount Rate: | 10.00% |

Here are the details of my calculations:

| Discount Rate (Horizontal) | |||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $56.84 | $40.66 | $31.68 |

| 10% Premium | $52.10 | $37.28 | $29.04 |

| Intrinsic Value | $47.36 | $33.89 | $26.40 |

| 10% Discount | $42.63 | $30.50 | $23.76 |

| 20% Discount | $37.89 | $27.11 | $21.12 |

Source: how to use the Dividend Discount Model

I’ve used a stronger dividend growth rate than their previous announcement because I believe the market will remain bullish for a while. IVZ is a strong company in the investing world and it will continue to perform well. Therefore, I expect IVZ to post growing revenues and earnings in the future. Their recent move in the ETFs world will also support my thesis. Still, IVZ seems fully valued and even a little expensive at this time.

IVZ doesn’t meet my 5th investing principle with a potential downside of 6%.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

Clients investing with IVZ (not their shareholder, but their clients), do it because Invesco’s portfolio managers have shown they can beat their peer over the long haul. Any downturn in the stock market will reinforce this position as people want to hang out with winners.

I like the way management uses its cash. The company generates over $1 billion in cash flow, but will use most of it to finance its ETFs purchases instead of going overly generous with shareholders (through dividend raise or stock repurchase). I like when management thinks about their business growth first.

A word of caution around Invesco is necessary. While the firm has well performed in the past, this gives no indication it will continue to do so in the future. Also, a shift in regulations forces brokers and advisors to look more carefully at fees and performance. As BlackRock benefits from these regulations changes due to their ETF products, Invesco may lose clients if their performance does not justify their higher fees.

IVZ shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

I tend to classify companies like BlackRock in both categories. There is an important need on the financial markets for ETF products and being a leader in this field gives additional growth perspectives. On the other side, institutional clients don’t tend to switch asset managers lightly. This situation enables investment firms to count on recurring revenues.

Invesco is a little bit late in the ETF game and I think it doesn’t show enough growth vectors to be classified in this part of a portfolio. However, IVZ shows a robust business model and good dividend history.

IVZ is a core holding.

Final Thoughts on IVZ – Buy, Hold or Sell?

While Invesco has been on the roll this year, this is not my favorite investment firms paying a dividend. To be honest, I prefer BlackRock for its leadership position and Lazard for its recession-proof business model linked to its M&A’s and restructuring advisory division. Invesco is a robust company in the financial sector, but I will keep my other positions instead.

Disclaimer: I do not hold IVZ in my DividendStocksRock portfolios.

[…] Monk analyzes Invesco (IVZ) meeting 6 of 7 of his principles. However, read his Final Thoughts for a complete […]