Summary

-Hudson City Bancorp (HCBK), the big bank that didn’t need a bailout, is a conservative savings and loan institution that primarily serves New Jersey, New York, and Connecticut.

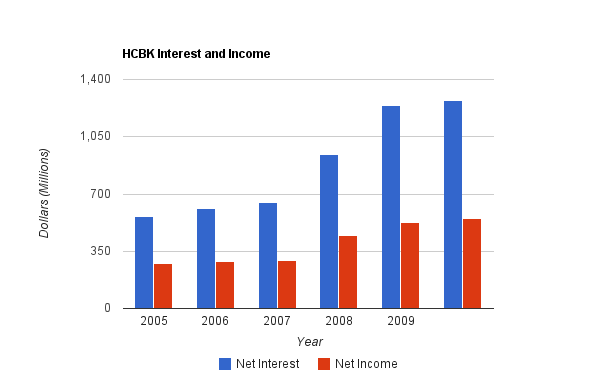

-Net income has grown by an average of 15% annually over the past four years, but in the latest trailing-twelve-month period, growth has stalled.

-Dividend Yield: 4.55%

-Dividend Growth Rate: 19% annualized over the past four years, but less than 2% in the most recent year.

-HCBK has an excellent efficiency ratio of approximately 20%, but a very low net interest margin of approximately 2%.

-With a P/E of less than 12, and a large and safe dividend, I find HCBK to be an appealing buy. Uncertainty regarding the weak lending market and the bank’s low net interest margin has the result of giving patient long-term investors a good entry price. Although interest rate risk is substantial, HCBK is reasonably positioned to handle it with prudent management and a large portfolio of adjustable rate securities.

Overview

Hudson City Bancorp (NASDAQ: HCBK) was founded in 1868 as Hudson City Savings Bank. It went public in 1999, and then in 2005 it held a second stock offering, and has aggressively grown ever since. In 2007 the company was added onto the S&P 500 index.

The bank is known as one of the most efficient and conservative of large banks. Because the company kept to conservative lending policies, not only did it not require a bailout during the 2008 economic crisis like most other large banks did, but it also remained particularly profitable and healthy.

Headquartered in New Jersey, the bank focuses on serving people in New Jersey, New York, and Connecticut, but also has an online branch. Its area of focus including NJ, NY, and CT are some of the highest income places in the country. As of June 2010, 43% of the loan portfolio is for New Jersey, 19% is for New York, 14% is for Connecticut, 4% is for Virginia, 4% is for Illinois, 3% is for Maryland, 3% is for Massachusetts, and 11% is for elsewhere.

Net Interest, Net Income, Equity, and Metrics

The company has experienced tremendous growth over the past decade, but has flattened out over the past year in this difficult financial environment.

Net Interest

| Year | Net Interest |

|---|---|

| TTM | $1,270 million |

| 2009 | $1,243 million |

| 2008 | $942 million |

| 2007 | $647 million |

| 2006 | $613 million |

| 2005 | $562 million |

This represents approximately 17% compounded annual growth over this five year period. This rate should not be expected to continue in the current financial market, and the most recent year has shown the growth to slow to a halt.

Net Income

| Year | Earnings |

|---|---|

| TTM | $552 million |

| 2009 | $527 million |

| 2008 | $446 million |

| 2007 | $296 million |

| 2006 | $289 million |

| 2005 | $276 million |

This amounts to 15% compounded net income growth. The third quarter of 2010 was weak, and analysts are predicting a substantial decline in EPS for 2011.

Assets and Shareholder Equity

| Year | Assets | Shareholder Equity |

|---|---|---|

| Q3 2010 | $60.6 billion | $5.6 billion |

| 2009 | $60.3 billion | $5.3 billion |

| 2008 | $54.1 billion | $4.9 billion |

| 2007 | $44.4 billion | $4.6 billion |

| 2006 | $35.5 billion | $4.9 billion |

| 2005 | $28.1 billion | $5.1 billion |

Total assets have grown by 17% annualized over this period.

Metrics

The efficiency ratio is 20.27% as of Q3 2010, which is excellent. The efficiency ratio is calculated by dividing non-interest expense (employee compensation and various other expenses) by the sum of interest income and non-interest income. The lower the number, the more efficient a bank is in operation.

The net interest margin is 1.97% as of Q3 2010, which is a bit worrying and likely plays a major role in the currently low stock valuation. The net interest margin is the gap between interest rates paid out and interest rates pulled in, adjusted for different amounts of assets and liabilities. A lower number means that an institution is more sensitive to interest rate changes, and HCBK’s is quite low. Their net interest spread is only 1.73%. Despite these low numbers, both the net interest margin and net interest spread fall well within HCBK’s range of reported values between 2005 and 2010.

The equity/assets ratio as of Q3 2010 is 9.28%, up from 8.95% from the same quarter of 2009.

Return on Equity has been approximately 10%.

P/E: 11.8

P/B: 1.28

The book value per share, as of the third quarter of 2010, is $11.40, and $11.08 of this is tangible book value.

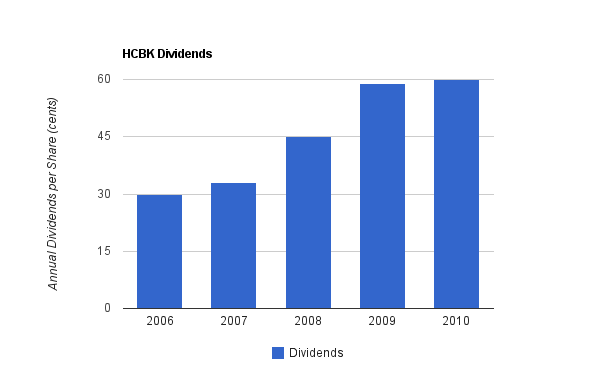

Dividends

HCBK has a slightly erratic, but continually increasing, decade-long history of dividends. They’ve paid a dividend every quarter since going public 10 years ago, and the dividend has never decreased. Their dividend timing is regular, but their frequency and magnitude of increases has been irregular. The current yield is approximately 4.50% with a payout ratio of a little over 50% (and up to 60% during Q3 2010). As can be seen in the chart below, the dividend yield over the past two years has been substantially higher than it was before the financial crisis. This was due to a significant stock price cut combined with higher and higher quarterly dividends.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $0.60 | 4.60% |

| 2009 | $0.59 | 4.50% |

| 2008 | $0.45 | 2.70% |

| 2007 | $0.33 | 2.40% |

| 2006 | $0.30 | 2.30% |

The dividend growth rate over this period was approximately 19%. The most recent increase, however, from 2009 to 2010 was less than 2%. HCBK has paid the same dividend (no growth) for the past seven consecutive quarters.

Investment Thesis

The premise of a bank is that they take in deposits while paying a certain interest rate, and then use that money to get returns from higher interest rate investments in the form of mortgages and securities. HCBK, the bank that didn’t need a bailout, seems to be well-run with a lot of potential for growth. Short-term uncertainty, including mixed analyst views, might be creating a significant buying opportunity.

The bank has an impressive efficiency ratio, at 20%, which is much better than the industry average. Its total deposit value per branch is more than twice the national average of FDIC insured institutions. The bank has over 130 branches and growing, and each branch is staffed with 7-10 employees. They do not issue loans from these branches (loans are brought in through originators), so this is a very simple structure that contributes to their low efficiency ratio. New branches typically break even within the first year, contributing to company growth.

Between 2005 and 2009, assets doubled from $28 billion to over $60 billion, loans doubled from $15 billion to nearly $32 billion, total cash and cash equivalents jumped from approximately $100 million to over $500 million, and meanwhile shareholder equity stayed fairly flat in the ballpark of $5 billion. So the bank has been aggressively growing assets and liabilities.

The bank’s business model is appealing. After taking in money from savings deposits, they originate and purchase first single family mortgage loans through a variety of distribution channels. These loans tend to be considered “jumbo” due to the substantial housing prices and high incomes that are common in the states of NJ, NY, and CT that they primarily operate in.

Hudson requires a down payment of at least 20%, and their average down payment from a borrower is nearly 40%. These numbers show HCBK’s conservative lending policy. They loan money to people that can truly afford the house they are buying, so defaults are statistically low. In addition, when a default occurs, they are buffered from huge losses, because they offered a loan in the ballpark of 60% of the house price and can now use the property to regain substantial value even when housing prices decrease. More than half (69% as of the end of 2009) of the portfolio is fixed-rate.

HCBK also purchases liquid interest-paying securities. As of mid-2010, 80% of their security portfolio has an adjustable rate. This provides the bank with protection when interest rates rise, because their interest returns from these securities will increase. Approximately half of HCBK’s total mortgage-related portfolio (including both loans and securities) has an adjustable interest rate, while the other half is fixed.

Banks, at least the ones that are well-run, have fairly substantial economic moats in the form of switching costs. It takes a lot of hassle for a person to switch banks, because they have to not only transfer all of their money, but change their bank information with their billing companies and their employer. HCBK also offers very competitive loan rates for qualified borrowers, and their impressive efficiency ratio allows them to do this. In addition, 10% of HCBK stock is held by insiders, which aligns company personnel with shareholder interests.

Risks

The principle risk is that of abrupt interest rate changes, and thrift institutions like HCBK are particularly sensitive to them. The bank makes money by encouraging deposits by offering certain interest rates and then using that money to acquire higher interest returns in the form of mortgage lending and the purchase of securities. Changes in interest rates can affect their profitability, and interest rates in the US must eventually rise. HCBK has a particularly low net interest margin of around 2%. Their borrowers have very high credit worthiness, and so the bank offers them very attractive interest rates on mortgages, contributing to the low net interest margin. The bank owns a large amount of adjustable rate securities to help offset their exposure to interest rate changes. 80% of their $27 billion securities portfolio is adjustable rate, and approximately 50% of overall mortgage related assets are adjustable rate. As HCBK’s 2010 Q3 report pointed out, when interest rates eventually rise, the amount of unrealized gains in their securities portfolio will decrease.

In addition, the bank faces default risk when people can’t afford their homes, but due to its conservative lending practices has shown resilience against defaults. Still, their provision for loan losses quadrupled between 2007 and 2008, and then increased sevenfold in 2009, and then continued increasing at a more moderate pace in 2010. As of the third quarter of 2010, 2.64% of their loans are non-performing loans compared to only 1.66% for the third quarter of 2009.

The continued low interest rates, large government involvement in quantitative easing, soft housing market, and high unemployment, among other reasons, are issues leading to HCBK’s unimpressive third quarter performance. Their ability to grow their business by finding creditworthy borrowers is highly dependent on the health of the economy, and particular in the Northeast where they operate.

Conclusion and Valuation

In conclusion, I find HCBK to be a good value at the current price. The financial environment still isn’t great, and HCBK is avoiding growth strategies until the environment improves. The company is exceptionally well-managed, with its industry-leading quantitative performance, conservative and practical strategy, and down-to-earth CEO. The dividend offers an above average yield and a safe payout ratio, although the future dividend growth rate is difficult to predict. A combination of dividends and eventual company growth should provide a reasonable foreseeable investment return built on a solid financial base.

There is a lot of uncertainty now, but at this valuation, a long-term investor can get a lot of quality for their dollar. Considering the balance of both the pros and the cons, such as the high quality of the bank, the fairly large and sustainable dividend, the low valuation, the slowing growth, and the low net interest margin, I find this stock to be a solid buy. The bank is well-prepared for interest rate changes and will be ready to take advantage of opportunities as the economy improves. I’m interested to see the results of their fourth quarter to be released on January 19 and how potentially unimpressive numbers may affect the stock price.

Full Disclosure:

As of this writing (January 18), I have no position in HCBK. It is on my tentative buy list, but I will not be initiating any position within the next 72 hours.

You can see my full list of individual holdings here.

As an update, I am now a shareholder of HCBK.

Dividend Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Solid analysis as always. Risky sector but I admire managements conservative approach. Who stood outside the CDO and subprime mortgage rush.

Really, really excellent research and presentation.

The stock is down about 7% today after q4.

“Hudson City Bancorp Inc.’s (HCBK) fourth-quarter profit fell 11% as the New Jersey regional bank saw net interest income decline and its loan book showed signs of further deterioration.”

HCBK released their report today. Numbers, as expected, were a bit disappointing. The net interest margin decreased, the efficiency ratio increased, and earnings were comparable to the third quarter. The low interest rate environment is strongly affecting them.

All in all, I was pretty satisfied with the numbers as there were no big surprises. The valuation is such that bad news was factored in, but apparently not enough.

The only thing that troubled me about the report was the line, “Accordingly, we will consider our level of earnings, capital ratios and asset growth in our future decisions regarding dividends.” As a dividend investor, that’s a red flag.

The company did announce a dividend to be paid in February, and it’s the same amount it has been for 7 consecutive quarters now (this will be the 8th at the same level). One can hope that at worst, the dividend fails to grow for some time, but the remark leaves a lot of room for questions regarding the possibility of a future cut.

Based on the 8.5% drop today, HCBK is still on my tentative buy list. The numbers were expected, the dividend remark was not, and the stock price drop was a bit larger than I expected.

Yeah the drop and numbers was kinda excpected, but as i see it was the bigger drop favourble form me but the dividend remark is a big redflag and i will probably take it slow and not jump in the boat right now :/.

It dropped even further now, it really trigger my buy finger now and that i see as a warning flag for myself to be even more calm :)

Yep, dropped another 5% today. Based purely on the numbers and outlook, I feel that the short and mid-term issues present long-term investors a great opportunity here. I’d be completely for it if not for the dividend remark.

Currently I’m just watching. HCBK is still on my tentative buy list, but I might start off with an even smaller investment amount than I had originally intended until I can get more clarity about the dividend.

Hi

Really enjoyed your solid and well thought out analysis as usual. I agree that the banking sector is a really risky sector but i was wondering what your opinion was on Banco Satendar (STD) or if you had ever put any thought into doing a dividend stock analsyis on them

I’ve looked briefly at STD before. From what I’ve looked into, it looks pretty sound to me, and I like their dividend.

I may consider doing a stock analysis on them, but frankly I find it unlikely that I’ll publish one. Doing a legitimate analysis on a large international bank is quite a large undertaking. With so many variables, even teams of analysts have trouble sifting through balance sheets of that size.

I see analysis articles of large banks by individual investors on the web, but they rarely look credible to me. They tend to lack depth, and I don’t want to publish something that I can’t stand by.

A bank like HCBK is much smaller and more streamlined, and a more thorough analysis is possible by people who don’t specialize in, say, international credit and currency risk.

I bought some today, but a little amount. I’m slightly profitable now, haha. Will probably buy some more if it drops further.

HCBK had to cut its dividend:

https://www.hcsbonline.com/documents/pr_04_20_11.pdf

Yep that restructuring was a bit worse than expected, i used the drop and low dollar (Swedish resident) to further invest in it as i still see the value in the company in the long term

Matt,

Do you recommend investing in HCBK today?