Summary

-Hasbro (HAS) is a major toy and game company with several powerful brands including Transformers, Nerf, G.I. Joe, My Little Pony, and Monopoly.

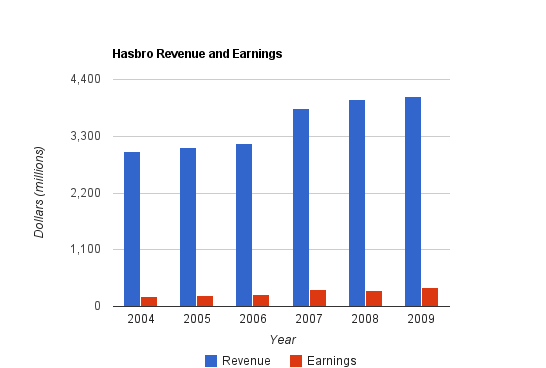

-Revenue growth over the latest five-year period: 6%

-Earnings growth over the latest five-year period: 14%

-Cash flow growth over the latest five-year period has been negative.

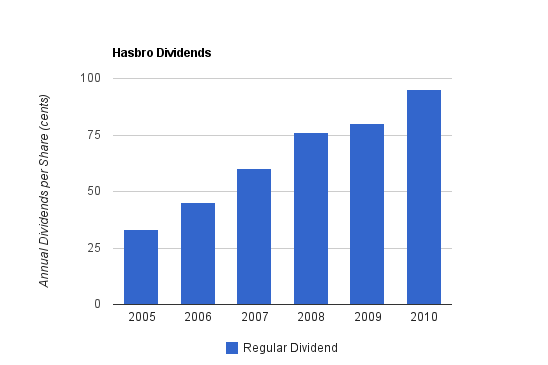

-Dividend Yield: 2.00%

-Dividend Growth Rate: 23%

-The balance sheet is not particularly strong.

-Overall, considering the large economic moat that this company has due to its brands, along with the mediocre growth rate and balance sheet weakness, I find that the company stock is fairly valued and that due to a lack of margin of safety in the stock price, there exist better investment opportunities elsewhere. Still, I would not be surprised to see this company and its stock perform fairly well over the long-term.

Overview

Hasbro (NASDAQ: HAS) is among the largest toy and game companies in the world. Hasbro produces toys, games, and characters that lead to not only physical products, but movies, video games, and electronic media as well.

Major Brands:

Transformers

Avalon Hill

Wizards of the Coast (Magic the Gathering and other trading card games, Dungeons and Dragons and other role-playing games)

G.I. Joe

Playskool

Littlest Pet Shop

My Little Pony

Milton Bradley, Parker Brothers, and other games (Monopoly, Scrabble, Trivial Pursuit, Twister, Battleship, Candy Land, Operation, Cranium, Life, Jenga, Yahtzee, Clue, Risk, etc.)

Nerf

Tonka

Supersoaker

Hasbro is also involved in licensing their brands and characters to other companies, such as Electronic Arts and Universal Pictures, to produce further entertainment products.

Revenue, Earnings, Cash Flow, and Metrics

Hasbro has experienced a fair amount of growth over the last five years.

Revenue Growth

| Year | Revenue |

|---|---|

| 2009 | $4.068 billion |

| 2008 | $4.022 billion |

| 2007 | $3.838 billion |

| 2006 | $3.151 billion |

| 2005 | $3.088 billion |

| 2004 | $2.998 billion |

Over this five-year period, Hasbro has grown revenue by approximately 6% annually. The trailing 12-month revenue as of this writing is approximately $4.1 billion.

Earnings Growth

| Year | Earnings |

|---|---|

| 2009 | $375 million |

| 2008 | $307 million |

| 2007 | $333 million |

| 2006 | $230 million |

| 2005 | $212 million |

| 2004 | $196 million |

This amounts to approximately 14% earnings growth over this five-year period. Trailing 12-month net income is up to $423 million.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2009 | $266 million |

| 2008 | $593 million |

| 2007 | $602 million |

| 2006 | $321 million |

| 2005 | $497 million |

| 2004 | $359 million |

Cash flow growth has been negative over this period due to an abnormally low figure for 2009. The 2009 cash flow figure was low because of a large increase in receivables. Cash flow over the trailing 12-month period is up to $482 million.

Metrics

Hasbro has Return on Equity of 28%. This figure is a bit inflated by their moderately high debt levels. Return on Invested Capital is nearly 15%.

Hasbro stock currently has a P/E of 16.5 and a P/B of over 4.

Dividends

Hasbro currently has a dividend yield of a bit over 2%, a high dividend growth rate, and a payout ratio of less than 35%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2010 | $0.95 | 2.30% |

| 2009 | $0.80 | 3.00% |

| 2008 | $0.76 | 2.50% |

| 2007 | $0.60 | 2.10% |

| 2006 | $0.45 | 2.00% |

| 2005 | $0.33 | 1.60% |

The five-year average dividend growth rate has averaged over 23%, which is great. The latest increase was 25%. The dividend increases, however, are a bit erratic. Eventually the dividend growth rate will have to decrease to a more sustainable level. With the moderately low payout ratio and the fair company growth, substantial dividend growth should be possible for quite a while.

Balance Sheet

Hasbro has a fairly mediocre balance sheet. The total debt to equity ratio is 1.01, which is a bit high. The quick ratio is 1.70, which is solid. The interest coverage ratio is acceptable at over 8.

Investment Thesis

Hasbro is more than just a toy company; it’s a brand company. Hasbro has many memorable brands which have lasted through generations and which can be converted to various media. This is why, according to management, they put brands at the center of their business model.

Hasbro’s 8 Global Core Brands are G.I. Joe, Littlest Pet Shop, Magic the Gathering, Monopoly, My Little Pony, Nerf, Playskool, and Transformers. According to the most recent annual report, these brands accounted for 17% of Hasbro’s revenue in 2001, 25% of total revenue in 2005, and over 50% in 2009. By strengthening the core brands, Hasbro is setting up substantial, long-lasting sources of cash flow that can withstand all sorts of technology and generational shifts through time. Their games can be played on physical boards or digital boards. Their characters can be sold as action figures or in movies. Hasbro can deliver their brands across various platforms, and all of it complements itself. It builds a cycle of toys selling movies, movies selling video games, and video games and movies selling more toys.

Transformers in particular is a very powerful brand. In 2009, that segment alone brought in nearly $600 million in revenue.

Hasbro has not only their own ideas to benefit from, but ideas from others as well. The company makes strategic partnerships with companies like LucasFilms, Marvel, and Sesame Workshop to ensure that it is delivering the characters and entertainment that people of various ages want.

Hasbro spends nearly $200 million per year on research and development of products and forms of entertainment.

Risks

Hasbro faces currency risk and commodity cost risk. The company is also reliant upon strategic partnership with both companies that they pay royalties to (such as Marvel), and companies that they license their brands to (such as Universal Pictures). These relationships are extremely important to Hasbro both financially and for the strength of their brands. In addition, Transformers currently makes up over 10% of Hasbro’s total revenues, so the continued profitability of that particular brand will have an influence over total Hasbro profitability.

Conclusion and Valuation

In conclusion, although I acknowledge that Hasbro is a great company and might make for a decent investment, I think the margin of safety may be too low to justify an investment at this time. The stock of this company has been on a powerful bull rush for 2 years now, and after all of that I believe it is fairly valued. If the company had a very strong balance sheet, I would likely find the current price more attractive, but due to the mediocre growth rate and less-than-stellar balance sheet strength, I don’t feel that paying the current price is completely justified.

One could make the argument that at the current price, it’s a great company for a good price, and I wouldn’t necessarily disagree. With the growing dividend and the very large economic moat around this company, and barring any major catastrophes, I highly doubt that any long-term investor would be dissatisfied after initiating an investment with Hasbro at this time. In my opinion there are better investments out there, but if one is looking for diversification, then buying a best-in-class dividend-paying toy and game company might not be a bad move.

Full Disclosure:

As of this writing, I have no position in HAS.

You can see my full list of individual holdings here.

Further reading:

Exxon Mobil (XOM) Dividend Stock Analysis

Lowe’s Companies (LOW) Dividend Stock Analysis

The Clorox Company (CLX) Dividend Stock Analysis

Intel Corporation (INTC) Dividend Stock Analysis

I find the toy and entertainment industry kinda like tech, a company has the potential to get run over quickly by a newcomer unless they’re a superpower and have lots of cash flow to constantly evolve (like this one).

HAS might be a play if you really need to diversify but I wouldn’t expect any stock owner to have this one in their top-20.

Happy New Year Matt!

Mark

Great point about HAS being more of a brand company. They are also in a bit of a transition mode where they are trying to leverage these brands by breathing new life into them like with theatrical release movies, for example. They remind me of Marvel from a few years back, in that way (iron man). Of course, that brand was a huge success and MVL ended up being bought by Disney.