Summary

Ford Motor Company is the American automaker that avoided bankruptcy during the financial collapse, and recently resumed a dividend.

-Seven Year Revenue and Income Growth: N/A

-Current Dividend Yield: 1.61%

-Balance Sheet Strength: Weak, but improving

Ford is not a dividend growth company; the dividend is small and newly reinstated, and the company’s future faces difficulties. But the company is currently undergoing a transformation, and I believe the company could potentially make a good long-term value pick for investors with tolerance to risk.

This is an interesting company to analyze; I’ve been interested in publishing an analysis on the value of Ford stock for a while and now that the Ford dividend has been reinstated, I have a small excuse to do so.

Overview

Ford Motor Company (NYSE: F) traces its history back to the beginning of the 20th century, when Henry Ford founded the company. The company mass produced the automobile, making it available to the general public. Workers were paid well enough to buy the cars they produced, and transportation across the United States and the world was transformed. It’s now the fifth largest automaker in the world, behind Toyota, GM, Volkswagon, and Hyundai.

The company has been perpetually cyclical, with high operating costs, and so they have booms and busts of profitability. Ford and other American automakers began having large business problems over the last couple of decades, and things collapsed in 2008 as part of the financial crisis.

Of the “Big Three”, General Motors and Chrysler accepted tens of billions of dollars in government bailout money, and also went bankrupt to reorganize. Ford, headed by current Chairman William Ford, did not receive this money, nor did they go bankrupt. Instead, they survived via a large line of credit that they took out before the collapse, and continued operating.

It’s worth noting, however, that Ford was in favor of bailouts. When things were less certain, they were prepared to receive government help. In addition, they supported bailouts of their competitors, due to the fear that if one or both of them collapsed, there would potentially be a systemic collapse of their suppliers, which also supply Ford with parts. Plus, Ford did receive a loan from the Department of Energy to invest in more fuel efficient cars, and they desired a $9 billion line of credit to fall back on from Congress in case things worsened, and they also benefited from the “Cash for Clunkers” government program, as well as a program that provided liquidity for companies when credit markets dried up during the recession. Still, Ford was able to avoid direct necessary bailouts and bankruptcy, and has emerged as a profitable company once again.

Sales and Profit Description

In 2010, Ford sold around 5.3 million vehicles. 2.413 million were to North America, 1.573 million were to Europe, 838 thousand were to Asia/Pacific, and 489 thousand to were to South America.

Around 92% of total revenues were from the automotive operations, while the remaining 8% were from financial services. But in terms of profit, 58% of profits were from the automotive operations and a substantial 42% were from financial services. Ford’s financial services help finance their vehicles to consumers via vehicle loans. So when they sell a vehicle, they generally receive the profit from the vehicle itself as well as interest profits from a loan.

Revenue, Earnings, Cash Flow, and Margins

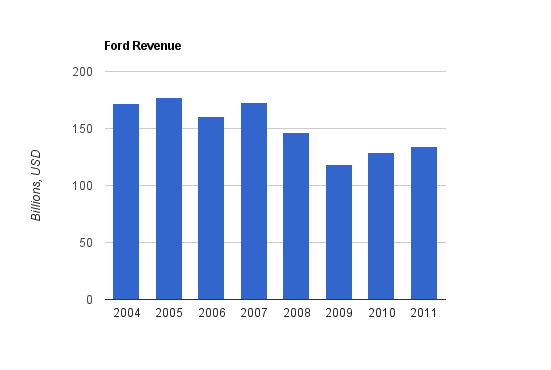

Ford has had declining revenue and profit losses, followed by a rebound.

Ford Revenue

| Year | Revenue |

|---|---|

| TTM | $134.1 billion |

| 2010 | $129.0 billion |

| 2009 | $118.3 billion |

| 2008 | $146.3 billion |

| 2007 | $172.5 billion |

| 2006 | $160.1 billion |

| 2005 | $177.1 billion |

| 2004 | $171.7 billion |

Ford has sold and canceled certain brands and revenue streams. Revenue has rebounded steadily recently.

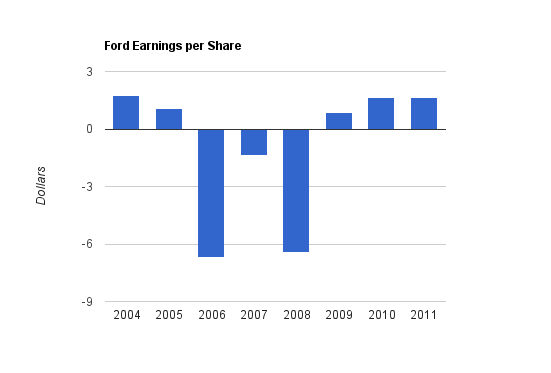

Ford Earnings

| Year | EPS |

|---|---|

| TTM | $1.63 |

| 2010 | $1.66 |

| 2009 | $0.86 |

| 2008 | $-6.46 |

| 2007 | $-1.38 |

| 2006 | $-6.72 |

| 2005 | $1.05 |

| 2004 | $1.73 |

Ford has had highly erratic earnings. They were on the brink of folding during the recession. Ford also reported losses during the recession in the early part of the decade.

Ford Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| TTM | $11.3 billion | $7.0 billion |

| 2010 | $11.5 billion | $7.4 billion |

| 2009 | $16.0 billion | $11.5 billion |

| 2008 | $-0.179 billion | $-6.9 billion |

| 2007 | $17.1 billion | $11.1 billion |

| 2006 | $9.6 billion | $2.8 billion |

| 2005 | $21.7 billion | $14.2 billion |

| 2004 | $24.5 billion | $15.3 billion |

Operating and free cash flow were erratic over this period. Due to the financial arm of Ford, as well as their non-cash costs of depreciation, cash flow is usually a lot larger than net income.

Stock Metrics

Price to Earnings: Around 7-8 (erratic)

Price to Free Cash Flow: Around 6-7 (erratic)

Price to Book: Around 8 (erratic)

Return on Equity: over 100% (due to small book value)

Ford Dividends

The company currently has a dividend yield of 1.61%, and the dividend payout ratio from earnings is around 10-15%.

There’s no use in presenting the usual dividend table, since they only recently started that dividend after terminating it in 2006. From the perspective of management, paying a dividend can provide a price floor for the stock, and can say “We’re here to stay. We’re ahead of our competitors.”

CEO Alan Mulally has stated that, in reinstating the dividend, the plan is to be able to pay it through economic cycles as bad as this previous one was. Mulally has stated that the dividend may be increased, and buybacks are on table, but that it of course depends on numerous variables, and the prime concern is investing in Ford products.

Dividends vs. Dividend Growth

Another reason I analyzed Ford was to provide a strong example regarding the difference between a large company that happens to pay a dividend, and a true dividend-growth company.

Ford has a long, erratic history of dividends. They’ve paid them over time for the most part, but with no promise of regular annual dividend increases, and along with the occasional dividend cut or discontinuation. This isn’t income that can be relied on, and more importantly, it shows the fundamental difficulties of the company over the long term.

In contrast, a company that pays growing dividends each and every year, for decades, shows reliability through recessions. It shows the soundness of their business model, their long-term balance between sales and operating costs, their strong and sustained free cash flows, and more. There’s no such thing as zero risk (some companies with good dividend growth records end up cutting a dividend from time to time), but through diversification and by focusing on dividend growth companies, investing income can be expected to safely grow.

Ford Balance Sheet

The balance sheet is a weak point for Ford, but one needs to go beyond the surface numbers. I’ve seen people make mistaken remarks about the balance sheets of Ford and General Electric, which have around $95 billion and $425 billion of total reported debt, respectively. These numbers are astounding large, (half a trillion in debt…) and can be misconstrued.

The truth is this: for companies like these, most of the debt is part of their financing operations rather than being used for operating purposes, and they specifically utilize this debt. In the case of GE; that’s due to their GE Capital arm which got them into trouble during the financial collapse, and it’s mostly a matter of borrowing money via bonds and then lending it to businesses, kind of like a bank, except that a bank uses deposits. In the case of Ford, it’s due to their profitable financial arm. Rather than having car buyers take out loans from elsewhere, Ford can provide the loans. So like any financial entity, they borrow money at one interest rate, and lend it at a higher interest rate. This comes with its own set of risks (interest rates, consumer credit, etc), but Ford shouldn’t be viewed as relying on roughly $100 billion in debt to keep running. Any bank, when viewed from a debt/equity perspective, looks quantitatively terrible until one understands how they operate; by borrowing money and then lending that money out.

Ford’s automotive debt is around $13 billion, which is down from the over $30 billion it was a few years ago. Ford was able to avoid a direct bailout or bankruptcy by taking on considerable debt; enough to push them to the brink but not over. Compared to the shareholder equity of around $6 billion, this $13 billion is still large, but it’s in the realm of solvency. Their interest payments are under control, and the plan as stated by the CEO is to get automotive debt down to $10 billion within a few years. They could bring the debt down more quickly, but interest rates are currently low, and Ford needs to invest to make sure it has an energy efficient, high quality, technologically advanced, and consolidated/streamlined lineup of vehicles worldwide.

Ford’s credit rating is currently slightly under investment grade. It has improved, and a transition to the low end of investment grade is expected to come at some point.

Investment Thesis

The Ford Motor Company is currently undergoing a transformation.

Alan Mullaly was brought on as CEO of Ford in 2006. He was an engineer and executive at Boeing, and he has taken a decisively engineering management style in his reorganization of Ford.

The “Big Three” U.S. automakers were a mess. They owned so many overlapping brands that were competing against each other within the same company, and between companies, for the same market of buyers. From a production standpoint, this is highly inefficient.

Under Mulally, Ford has become far more streamlined. The Ford Motor Company sold Volvo, which it owned. They also sold Land Rover and Jaguar, to Tata Motors. In addition, the company sold off most of its stake in Aston Martin, keeping only a small share, and also sold off most of their stake in Mazda. The company canceled their Mercury brand rather than sell it, after it has operated for several decades. Before Mulally came on board, Ford sold off Hertz car rental as well. Now, most of the focus is on two brands: Ford and Lincoln.

Ford is their larger, more universal brand, and Lincoln is their luxury brand which is currently being strengthened.

Ford has shifted closer to the quote originally attributed to Henry Ford:

Any customer can have a car painted any colour that he wants so long as it is black.

Although once understood literally; it’s now just a description of how fewer, but better, options can go a long way. Rather than have so many overlapping brands including Ford, Lincoln, Mazda, Aston Martin, Volvo, Land Rover, Jaguar, Mercury, and rental cars via Hertz; just focus on Ford and Lincoln. Although Ford products should be targeted to different regions, worldwide technical commonality should be emphasized to keep the number of vehicle platforms and options to a minimal, consolidated, streamlined amount.

Mulally Interview

Here’s a recent interview of Alan Mulally exclusively for Seeking Alpha.

Here are some of the highlighted goals as stated by Mulally in the interview:

-Increase Ford global auto sales from 5.3 million vehicles to over 8 million vehicles by 2016.

-Grow automotive operating margins from around 6% to 8-10%.

-Focus on simplicity and commonality to put 85% of global Ford volume onto just nine platforms. Each platform will have numerous options, such as trim levels or energy systems (petrol, diesel, natural gas, hybrid, electric, etc), but the core platforms are consolidated and common throughout the company.

-Instead of producing fixed operating volume, Ford will continue to allow its production to match demand, so it can more flexibility ride through booms and busts of demand. The aforementioned consolidation and streamlining is key here, as well as the concept of producing vehicles closer to where they are used.

Potential Upside

Overall, I’m in agreement with Ford’s new approach (which it should have been doing all along), and Mulally’s leadership.

The company is only selling approximately half of the number of vehicles annually in America as it was 10 years ago, due to a combination of the recession, lost market share, and the sale of certain car brands. I believe that a substantial increase in car sales is possible over the next several years, especially since the models and brands are more consolidated, manufacturing continues to be streamlined, and small cars are being emphasized by Mulally since that’s where the demand is.

A big fact to consider is that the average age of cars and light trucks on the road is up to 10.8 years, which is a historical record. Total American vehicle sales were around 12.8 million in 2011, which is a small piece of the more than 240 million vehicles on the road in the country. Even if auto sales increased by over a million each year, the average vehicle age won’t be impacted much.

This could act as a tailwind for the company, as consumers that were fearful to purchase a new vehicle, may eventually buy one. It could be viewed as a backlog. In addition, Ford expects 70% of its growth over the next 10 years to come from Asia Pacific and Africa.

Lastly, it’s worth mentioning that Ford’s F-150 has been the best selling truck, and best selling vehicle, in America, for decades.

Risks

Ford has rather large risks. Their automotive business is highly cyclical. Their labor costs (pay, health care, and pensions) are very high, even after the reduction due to effective negotiation. Macro-economic factors could negatively influence the company even if they do most things right. The profit margins from their credit arm are heavily influenced by changing interest rates. There are currency risks, commodity price risks, and so forth.

Lack of Economic Moat

Major car manufacturers should have moats, but in practice they don’t. First of all, there are high barriers to entry in the market, since to produce a safe, efficient, and desired vehicle with enough volume requires significant capital investment. Secondly, cars are major purchases, and customers don’t want to make a mistake. If they had a brand of car they were happy with for years, they’d be very likely to purchase that brand again rather than risk a five-figure purchase with another company.

But decades of poor management can erode any company defenses. When sub-par vehicles and inefficient manufacturing processes, are maintained for decades, things eventually break down. A moat can hold competitors away for years, but not decades, if not continually maintained. Ford could one day have a moat, but currently in my view does not.

Reliance on Alan Mulally

Ford is currently viewed as being heavily reliant on Mulally’s leadership. He’s 66 years old, and although he has not announced plans to retire, no one can be sure how long he’ll stick with the company, and whether he’ll be able to get Ford into a good position before he leaves.

Conclusion and Valuation

I believe that as a high risk, high reward investment, Ford is undervalued. The market is uncertain as to how to value Ford, as there is little precedence to do so. With European economic problems, slow American economic improvement, and uncertain global economic conditions, Ford’s highly cyclical operations are observed with skepticism.

Based on the current valuation as the shares trade for around $12.50, with low price-to-earnings and low price-to-free-cash-flow ratios, I believe Ford stock has a substantial margin of safety factored in. My discounted cash flow analysis shows that even if 0% free cash flow growth is assumed going forward, the stock is undervalued. It would take sustained FCF declines, or negatively cyclical declines, in order to make this a poor purchase, in my view. Either reduced profitability from their credit arm, or the possibility of profit losses from another recession, seem to be accounted for by the market in the current stock price. In other words, the concept that this may represent a movement towards a peak in the business cycle, rather than still in the trough, is clearly present in the stock.

Taking into account the various tailwinds that were described, and the transformation and streamlining of the company, as well as macro-economic problems and uncertainties, I think Ford Motor Co stock could potentially make a good long term buy in the low teens. It would, however, be a value play rather than a dividend growth investment, and so would only be suitable for investors with certain goals.

Full Disclosure: At the time of this writing, I have no position in Ford.

You can see my dividend portfolio here.

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Excellent analysis of Ford.

I too dislike how many people – even those on Wall Street – do not consider the difference between debt from operations and debt from financing. Recently, the financing arm has really paid off well – billions in dividends to the firm. Still, the business has to sell cars if its going to make money on the financing.

Based on pure valuation of free cash flows as well as the underlying pent up demand for autos, I went long with OTM options roughly 15 months away from initial entry in the January 2013 contract. Ford certainly does not meet my criteria for a long-term, competitive advantage in the autos space, which was a serious weak spot for me. Given that I’m playing it on a short-term basis, I feel as though I can substitute in pent-up demand for my moat.

I say it’s worth right around $20 per share taking into consideration. At $10 a share (at the time), 50% still wasn’t attractive enough as a margin of safety, so I went with the calls.

Ideally, I’ll pick up shares as they work themselves off the operating leverage. The consistency in platforms is a real game changer for the company. It isn’t exactly a moat. However, I do think it could be. As the recovery from the Japanese earthquake works itself out, and Japanese firms get to full capacity, American producers will have to pick up on the incentives to sell cars. Ford’s cost cutting could definitely place it very well with other domestic automakers in terms of cash incentives, which would be nearly moat worthy.

The Ford Fusion, Focus, and (eventually…maybe?) the Fiesta will age and develop to become top-quality cars just as oil prices start turning away from Ford’s trucks. Everything is there for this to be a good bet. The odds are good, as is the discount. But it is still very much a coin flip – an all or nothing, win it all or lose everything bet. As I’m in it with the options, I’m very much banking on a good year this year – and maybe, just maybe, the chance of a buyback alongside dividends.

Thanks for the comment JT, good insight. Nice mix of long term and short term, fundamental views.

Another options strategy here would be to sell puts. If one wanted to own Ford but with a bit of downward protection, one could sell, for example, Jan 13 puts at a strike price of $12.50. If the stock simply stays flat, or goes up, one gets a nice double digit return, and if it goes lower, one still does better than if they bought the stock outright. But one misses out if the stock goes up substantially.

When I use options, I generally am a writer of them, in order to get in at a more attractive cost basis.

This would have been a lot smarter of a position, at least in the short-term. Correction to the above – the options were either barely OTM or ITM. Ford was at or around $10 a share and I entered the $10 strike.

Looking back, that was at the center of the European blowup…the VIX was soaring. I should have taken advantage of fatter premiums in the near-term by writing rather than buying. I blame that partially on greed – I’m still looking for Ford to rally big when it does due to operating leverage – and partially on inexperience with options. As I’m always on the hunt for deep, deep value, I have a tendency to get caught up in far-flung parts of the investment universe where very few equities are option eligible. My options trades can be few and far between.

I’ll definitely keep that in mind for the next one. The more you know, the more money there is to make! Thanks!

Read the post, thanks for sharing the detail information with the graphs. Keep posting