There are only a few essential steps to achieving financial freedom, yet most people do not take them.

There are only a few essential steps to achieving financial freedom, yet most people do not take them.

This article is going to cover the basics on how to get there, but is also going to focus on one key change in mindset.

Essentially, most of the financial basics will allow you to be financially free in a couple decades or less. To accelerate that timeline, there’s one more kick you can use.

Master this, and you’re set.

What is Financial Freedom?

Being free, financially, means you have enough passive income to support your lifestyle. It could be a frugal lifestyle or a wealthy one; all that matters is that you can maintain it without working.

But an important note is that you can still be working and be financially free, you just don’t have to. Once you don’t need your job anymore, you can still work at it for extra income, and for enrichment. For example, there are physicians on my dividend newsletter. After all that medical school and residency, you can bet they don’t want to retire within 10 years! But they do of course want to be well off and live on their own terms.

Simple math shows that if you have a million dollars (which isn’t all that hard to get), and you extract 4% of it per year (via dividends, rent income, interest, capital gains) and it replenishes itself with better than 4% returns, then you can generate $40,000 in annual income, passively and forever. To get $80,000 instead, you’ll need two million dollars. So if your lifestyle is frugal, you can get by with less than a million saved and invested. For a more luxurious one, you’ll need a few million before you’re financially free.

Therefore, the definition of perpetual financial freedom is that your investments provide you with enough passive income to pay all of your expenses, and this passive income grows at a rate that equals or exceeds the rate of inflation. You never have to touch principle.

So let’s view it as a few different steps:

Step 1) Not Financially Free

You need a job to keep paying your bills. You may have an emergency fund and investments, but basically, your net worth will start decreasing if you lose your job and you can only maintain unemployment for so long.

Step 2) Partially Free

You have a very large pot of savings and investments. Not enough to pay your bills perpetually, but quite a bit. In addition, you have an alternative income stream. If you lost your job, you could keep working for yourself if you had to. Or, you already work for yourself, but you’ve got to keep hustling.

Step 3) Completely Free

You have that million or several million dollar portfolio, meaning that you can extract income from dozens or hundreds of sources to pay your bills, and you never need to work again if you don’t want to. You should still grow yourself and keep your skills relevant, but it’s all for fun at this point. Your wealth should actually grow over time, passively, even if you don’t actively contribute to it anymore.

The Three Variables

Across the full spectrum, from Warren Buffett to a minimum wage worker, wealth folds down to only three variables: income, expenses, and the rate of return on the difference.

Variable 1: Income

To optimize this variable, you either invest in specific types of education to become a highly paid professional, perform excellently at work and get promotions, start your own business that can scale hugely, or build a side income stream onto your existing day job.

Variable 2: Expenses

Optimizing expenses means minimizing them. There are some big wins here, like living in a modest house rather than a large one, keeping costs on automobiles low, living around a good public school system so you can send your kids there rather than to private schools, and traveling smartly rather than falling for tourist traps. Other wins include cutting energy costs, forming healthy habits to avoid unnecessary medical expenses, becoming hands-on around the house or with the car, etc.

Variable 3: Rate of Return

When your income is higher than your expenses, you can save and invest the difference. When this sum of money compounds over years and decades, the exponential rate of return is very meaningful. Someone who sticks to cash and gold won’t have much compounding ability. Likewise, someone who gets into bad habits with stocks and sells out of fear during market bottoms won’t have much compounding ability. The person who invests for the long term in index funds or value stocks has a good system for long-term wealth accumulation. If you take $100,000 and invest it at 6% per year, you only have $320,000 after 20 years. However, if you take the same $100,000 and invest it at 10% per year, you have over $670,000. More than twice as much.

The Basics (You Know These):

To be above average in terms of wealth, there are a series of steps that should be common sense, but generally are not all that common. Let’s get these out of the way before getting to the main point:

Start early.

Try to mitigate student debt by getting a job early and getting scholarships. If you don’t go to college, then obtain a skill set that leads to good work.

Learn the money basics.

Financial education is woefully inadequate in most places. In school you’ll typically learn how to dissect an animal, but not learn almost anything about above-average money management. So you’ll have to step out on your own on this one.

Read Millionaire Teacher, by Andrew Hallam. I’ve communicated with him, and he’s the real deal- an English teacher that became a millionaire in his 30’s through common sense. The book is concise, funny, and useful for a beginner. Regardless of your experience level it’s a solid read, and makes a compelling case for index funds. (This makes an excellent gift for a young adult, or anyone that isn’t particularly interested in picking stocks.)

If you ever invest in an individual stock, go to Berkshire Hathaway’s website, and read the annual shareholder letters that Warren Buffett has written. The most successful investor in the world doesn’t write books; he writes annual letters to his investors.

And check out the tutorials on Dividend Stocks, the Dividend Discount Model, and Margins of Safety if you’re planning on ever picking individual stocks. And if you want the complete method, get the Dividend Toolkit.

Earn a good job.

If financial freedom and wealth are valuable to you, it’s key to get a job that pays well. The sciences, engineering, business, or professional paths (doctor, lawyer) are good bets and can be passionate and rewarding careers.

Picking other majors is fine, as long as you keep one thing in mind: college is for exploring but it shouldn’t be aimless, isn’t for everyone, and isn’t something just to do for $100k in student debt. Get a degree for a reason. If you have a job you love that pays moderately well, you can still achieve financial freedom rather quickly. Along these lines, if you enter the workforce without a degree but with an economically useful skill set or your own business, then you can be well-set for a wealthy future by making that a goal.

Learn marketing.

I’m not necessarily talking commercials and sales here; I’m talking persuasion. A fundamental lifelong ability of a top performer is the ability to persuade, motivate, inspire, and guide people to do things.

-Market yourself to a job interviewer. Turn the situation into one where you’re interviewing the company to see if they’re a good fit for you, not the other way around.

-Persuade your supervisor or client to go with your idea. Whether you’re an engineer, business person, lawyer, or anything in between, it’s a fundamentally useful skill to be able to explain your truths concisely and persuasively.

-Use your talents for entrepreneurship, charity, politics, social services, or whatever it is that piques your interest.

Spend less than you earn.

It shouldn’t have to be said, but you need to save a lot of money in order to become financially free. Don’t buy things for show, don’t tie your happiness to your material stuff.

“Give me health and a day, and I’ll make the pomp of Emperors ridiculous.”

-Ralph Waldo Emerson

That’s the one quote I put in the Toolkit. I’ve been asked before what he meant by that as though it’s esoteric, but the man is literally talking about playing around in the forest.

He’s saying go play with your kids, go for a hike, go for a run on the beach, take your significant other out mini golfing, teach yourself a new skill this week, go to the library and read a good book, help out with a charity event, play a sport.

For most people, income is viewed as the amount of money that can be spent. After bills and some basic retirement payments, all the rest is consumed! It’s a constant treadmill of consumerism and work for probably 90+% of people out there.

That doesn’t have to be you if you don’t want it to be. Spend what you need and want, but everything else is a resource. You’re not a person without a plan, where you just spend whatever you get after putting a little bit away. Instead, you know that you can save it up for an awesome opportunity years from now, or retire early, or become financially free. Play chess with your money, not checkers.

Don’t accumulate debt.

Student debt and mortgage debt = acceptable.

Credit card debt = of course not. Pay off your credit cards each month so you pay zero interest.

Save money in the right places.

-Contribute enough to your employer’s 401(k) plan to get full matching.

-Have a large cushion of cash set aside.

-If you’re under the income limit, consider contributing to an IRA.

-Then either put more into your 401(k), or start investing in a taxable account.

Diversify across cash, bonds, equities, and maybe real estate.

Another Key to Achieving Financial Freedom

If you follow those steps, you’ll do okay. You’ll make good money, save a lot of it, get a good rate of return that allows you to be financially comfortable, and eventually financially free, ahead of the curve.

But if you want to kick it up a notch, and it doesn’t matter how old you currently are, here’s another main thing:

Transform your passion from consumption to production.

What I mean by this, is to build or obtain a side income stream. Over the last century or so, developed societies have organized themselves around specialization. People get specialized in one professional area, and then focus on that. If something changes, and they’re no longer needed for that skill, they often don’t know what to do. Industrialization changed the game and led to specialization, and now globalization is changing the game again and highlighting the importance of flexibility.

It’s important to get really good at something. But it’s equally important to be a skilled generalist on the side.

If you have a career that required a very large investment of time and education, requires long hours, and pays very well (lawyer, doctor, executive, chief scientist, business owner), then a second income stream is less relevant. With that scenario, it usually makes more sense to reinvest time into your core work. But if you’ve got another type of job, like an engineer, manager, analyst, tradesman, or another profession, then you likely have a solid paycheck but also ample time on the side. These are good candidates for growing other income streams.

The Simple Math Behind a Second Income Stream

Let’s say you take home $75k after taxes, and spend $50k of it for expenses on yourself and your family. This leaves $25k for saving and investing each year.

Now, let’s say you find a way to add a $25k side income stream to that, after taxes. Now you’re pulling in an extra $25k net, for $100k total net income. If you keep your expenses the same, then you’ll be able to save and invest that entire extra $25k.

What this means is that your income only increased 33% ($75k to $100k), but your savings amount increased 100% ($25k to $50k). So bringing in that manageable extra income doubled your savings amount and essentially halved the amount of time it will take to achieve financial freedom if you keep this up for a while. Depending on how scalable and effective your income stream is, you could eventually even use it to launch full time into entrepreneurship.

How to Not Burn Out

It’s all a matter of habit forming.

What I’m not recommending is that you work 40 hours at your job and then work for another 20-40 hours a week at something you’re not necessarily fond of, and sacrifice your health, social life, and sanity to do it. The ironic thing about civilization is that we built up all this technology and organization, and yet we work more and have less free time than some hunter-gatherer cultures. So the last thing I’d want to recommend is to be a workaholic above and beyond what most people are.

Instead, the trick is to enjoy that side income stream.

After work and family, most people’s free time consists of television, shopping, aimlessly surfing the internet, and a couple hobbies. I certainly can identify areas in my own days that are not very productive. If you take a chunk of that- not all of it, just a chunk- and convert it from consumption to production, then your life can be richer both literally and metaphorically.

When you’re looking back at your life 10, 20, or 30 years from now, you’re not going to be sad that you missed a few shows or spent less time online or didn’t buy that widget you wanted. The things you’ll find important are: a) that you spent time with family and friends doing fun things and b) that you achieved something different, interesting, and worthwhile.

Here are some examples:

-In my state, volunteer firefighters don’t get paid anything. But in my friend’s state, he works as a part time firefighter in addition to his regular engineering job.

-A co-worker of mine who works as an engineer by day, spent some nights driving emergency vehicles. He doesn’t even need the money anymore, but does it because he loves it.

-Some people start unique business ideas. It doesn’t have to be some venture-capital backed plan to rival Facebook; it just has to be something that you enjoy that can bring in four or five figures or more per year, eventually.

-People have had success making high-quality crafts that they can sell on Etsy or in other places.

-A software engineer does some app design or freelance programming on projects that interest her on certain weeknights and weekends.

-Real estate is a common side business. Buying rental properties or fixing up houses for resale can be lucrative methods for building wealth and generating cash flow if you build a good system for it.

-Maybe you have a useful skill, like playing an instrument or performing well on standardized tests. You can turn this into a tutoring business, or teach some small group classes.

-I’ve had success with both freelancing financial writing for larger sites, and financial writing for this site.

The key here is that the hobby itself is production rather than consumption. Rather than viewing this extra income source as a burden, it’s fun. Even if that means leaving some money on the table- the whole point is fulfillment, not just dollars and numbers.

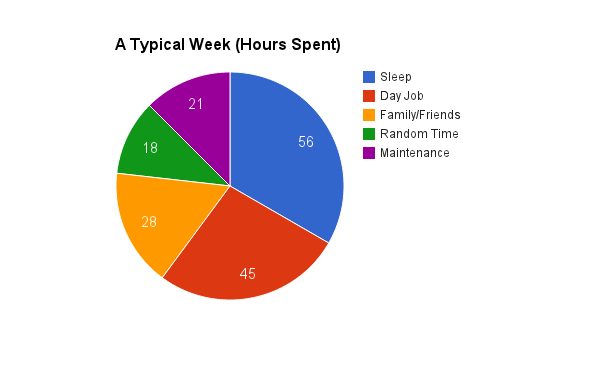

There are 168 hours in a week. A typical person might spend it as follows:

So we’ve got 8 hours/day for sleep, a 45 hour workweek (assuming roughly 9 hours a day, five days a week), a solid 4 hours/day for family or friends, 18 hours of random time per week (web surfing, tv watching, hobbies, gym, random stuff, and this could involve family/friends as well), and 3 hours/day of maintenance, which primarily consists of the frictional and necessary stuff: commuting to work, showering, brushing teeth, cooking, going to the doctor, paying bills, shoveling snow from your drive way, getting dressed in the morning, figuring out what’s wrong with your car, etc.

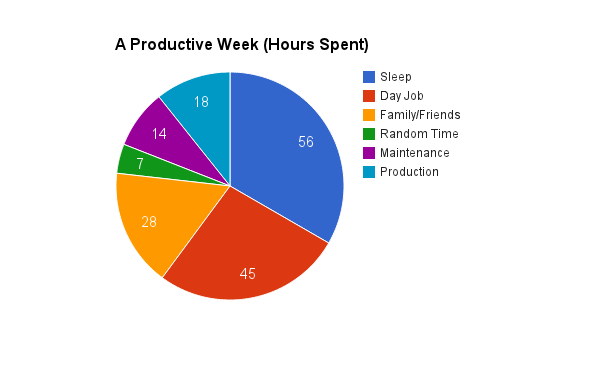

But if you can improve that, you can turn it into something like this:

There’s the same amount of sleep, work, and time for family and friends, but a few other things have been optimized.

First, less time in general was spent on random stuff: fewer tv shows, fewer video games, less web surfing, and so forth.

Second, some things have been mixed to optimize them. It’s the accumulation of a few “productivity hacks” or changes in how things are viewed. Here are some examples:

-Maybe preparing and eating dinner previously was in the maintenance category, but now you view it as family and friend time because you cook a high quality meal with your significant other, or friends, or parents/kids. You use it as a time to improve your knowledge of cooking, to create a real meal.

-Let’s say a hobby of yours is reading, and you also have a 45 minute commute to work. You can optimize this a bit by listening to audio books as you drive instead of music or a talk show. Because it’s the same path every day, you know it by heart and don’t have to worry about directions; you just have to be an observant and safe driver on a path you know like the back of your hand. I wouldn’t recommend a particularly heavy read, but if it’s a light read, this can work. Now, you’ve combined some hobby time and some maintenance time.

-You got in the habit of getting out of bed within 3 minutes of your alarm clock going off, when it used to take 20 minutes through numerous snooze attempts. Those 20 minutes were neither restful sleep nor productive time, and added up to 2 hours and 20 minutes per week or over 120 hours per year. So they were cut out.

-Maybe your ‘production time’ for building a side income involves your husband, wife, or partner, so it’s a joint effort where you’re spending time focusing on making something happen.

By optimizing the example week, 18 hours of productive time were added into the week, which is more than enough time to create a fun and lucrative side income stream to achieve financial freedom.

For example, if your earning power for this side income stream is only $10/hour, you’re still looking at $180/week, $720/month, or $9,360/year of gross side income.

If you can boost that to $25/hour, now you’re looking at $450/week, $1,800/month, or $23,400/year of gross side income.

For some people, there could be a skill that you can scale rather well, or that is nuanced enough that you can charge more for. If you can get $75/hour, then you’ve got a solid $70,200 per year with 18 hours a week of work on something you enjoy.

The details of how you can work your week will vary based on your age, responsibilities, job, partnership status, children, and so forth. But there’s almost certainly a way that you can increase productive time while also enjoying the week more.

The Takeaway

This method is so powerful because it figuratively kills two birds with one stone.

When offered the basic advice to wealth and financial freedom of “earning more, and spending less”, that sounds boring to people. It is generally thought of as a sacrifice, because people want to do things, and they’re being told to do fewer things, or cheaper things.

But by growing a side income as a fun hobby, you’re simultaneously boosting your income and savings rate, and reducing your consumption. Your reason to spend less on a car or television or random stuff, is not that you need to sacrifice and cut back, but rather, that you change your perspective and view many of these things as time sinks that get in the way of doing more interesting things.

In most of our minds, productive things produce money, and unproductive things do not.

However, the definition I personally use for “productive” is that it is something that as an old man, I’ll look back as being happy I did. So getting enough healthy sleep, getting enough exercise, spending time with people, investing in myself through books, watching my favorite movies, working a good job, using free time for enriching or relaxing activities, and producing value for other people to generate extra income, are all productive.

Things that are generally not productive are excessive television, excessive video games, random web surfing, and unproductive maintenance time.

So if you want to achieve financial freedom earlier, while enjoying everything in your week to a more thorough degree, consider building a side income stream that you enjoy and that allows you to boost your savings amount by 50%, 100%, or more.

photo credit: esther

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? There are too many investing articles contradicting one another. This creates confusion and leaves you with the impression you will not reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook which will give you the actionable tools you need to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build and manage your portfolio through difficult times.

- Enjoy your retirement.

Very good points all around. I have never read or seen such a break down of what needs to be done on the web. This would be an excellent post for a highschool junior and/or senior. I agree, spend less than you earn and invest. It’s not as simple as it sounds but it’s definitely not hard.

Good stuff; I enjoyed reading this one.

Thanks Pey.

Haven’t seen you writing much at SA, so I’m glad to see you around.

Great post!

I agree that forming a side hustle will kill two birds with one stone – increasing income while simultaneously reducing time/desire to consume. My blog is my side hustle, I suppose, and while not really producing a ton of side income, it’s rewarding in many other aspects and definitely forces me to stay on track as I don’t want to let readers (or myself) down. I suppose that’s another benefit!

By the way, what’s your ultimate goal? I don’t know if I’ve ever read what you’re aiming to do. Financial freedom for flexibility? Retiring early?

Best wishes!

Hi Mantra,

Your income/expense reports are definitely a benefit to readers and I can certainly see how they’ll keep you on track.

I have several goals. I guess my “ultimate” goal is to give millions of dollars to effective charitable organizations, but my goal along the way is to continue to increase my financial flexibility and ensure that I can support people who depend on me for it.

I think it’s important to see the world from several perspectives. For example, when I was a child, I was homeless for a while, so I required the help of others. That was seeing the world from one perspective. Now, I’m lucky enough to be financially robust, and I can participate on the other side of that equation and help others. So that’s seeing the world from a second perspective.

Being financially free means you can experience a greater number of things.

Excellent post!

I’m pursuing financial independence and have decided to focus on creating additional income streams for many of the reasons you discussed in the article. I’d much rather have fun building something new that produces a $500 monthly cash flow (with unlimited upside) instead of working for years at a job I don’t enjoy to save up $200,000 to achieve that same $500 monthly cash flow (assuming a 3% yield).

The thing I like about side income is that it accelerates your journey towards FI pretty quickly. If I only made money from salary, and I saved 50% of my salary income then I only have one source of savings. The next one will be my dividend earnings, which unfortunately take some time to grow to a decent amount. If I engaged in a side venture however, earnings 50% of my regular income, and I save all of this money, my savings rate is now equivalent to my salary income. And also, if I get fired, I can essentially live off this side stream of income until I find another job.

“…the definition of perpetual financial freedom is that your investments provide you with enough passive income to pay all of your expenses…”

Just a minor sticking point which pretty much every one gets wrong — the above definition is NOT financial freedom. Your income is still completely reliant on the performance of said investments.

The ONLY way to have true “financial freedom” is to have an enormous amount of CASH, and cash only. Kept, perhaps, in a bank to earn inflation negating interest.

Other than that, well done!

If you put 100% of your assets in cash then you have 100% exposure to inflation and government instability. That’s far too risky for my taste. FDIC insurance protects against decreases in face value but doesn’t protect against decreases in purchasing power.

Being diversified across cash, bonds, property, and dozens or hundreds of companies, provides broader diversification against more numerous scenarios.

I really enjoyed reading your post. It’s fun to find a community of people who think like me. People around me don’t always understand what I do, why I fix goals to increase my income year after year at a rate above inflation, why I want to save a lot and spend less than what I earn, why I want to be debts and mortgage free and why I invest in dividend stocks and index funds to achieve financial freedom. They sometimes think I’m crazy.

They drive luxury cars, they own a condo in Florida, a chalet by a lake and a 500k house and they think I should do the same because I could die tomorrow.

But I could also live until I’m 90 and I don’t want to spend my life working forever even though I like my job.

It took me a while though to understand… Or should I say “admit” that wealth must be built slowly one step at a time. I have read the book “The wealthy barber” when I was thirteen or fourteen years old. I read it again in my twenties and even though I thought that the author advice were good, I still thought somehow that for me things would be different and that I would find a way to become millionnaire very fast… But I didn’t. And now I’m 32 and starting to do what I should have done 15 years ago.

Why are we stupid when we are young? Or maybe it’s just me! :)

I didn’t know about the book the “Millionnaire teacher”. I’ll definitely take the time to read it.

Thank you