The Company in a Nutshell

- EPD posted for $38 billion of organic growth projects and $26 billion of major acquisitions since 1998.

- Its integrated system enables EPD to reduce impact of cyclical commodity swings.

- EPD is one of the largest integrated midstream energy companies.

Have you ever dreamed of receiving a bigger pay check quarter after quarter? This is exactly what this company is offering you. And we are not talking about some kind of strange financial scheme. We are talking about a company that has been around since 1998, that has gone through several economic cycles, and kept increasing its dividend each quarter. Enterprise Products Partners (EPD) actually shows 57 consecutive quarters with a dividend increase (October 2018). With a yield close to 6%, this is the type of company you want in your retirement portfolio. Let’s take a deeper look.

Business Model

Enterprise Products Partners LP is a limited partnership which is engaged in transports and processes natural gas, natural gas liquids, crude oil, refined products, and petrochemicals. You can read more about Master Limited Partnerships (MLPs) here.

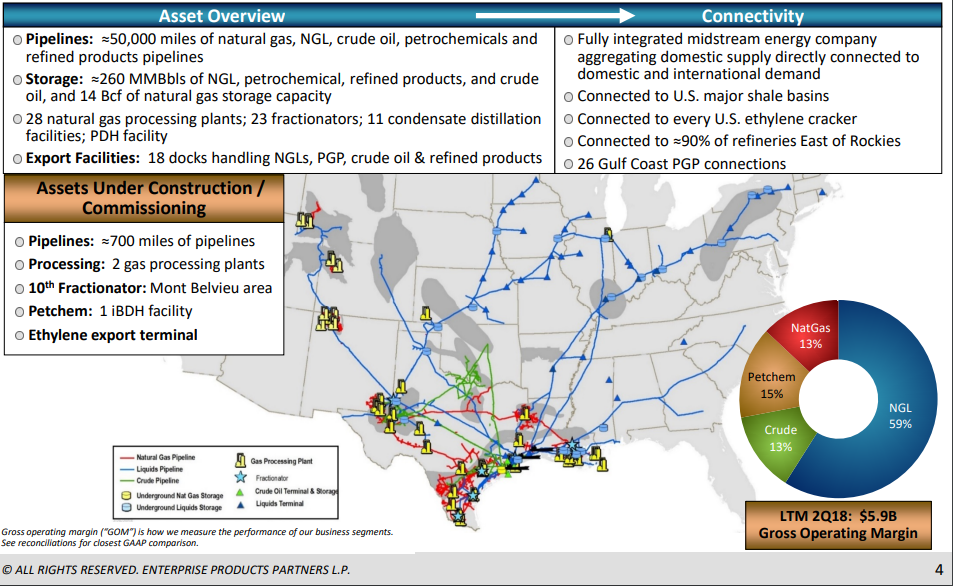

The company has grown its assets from $715M in 1998 (IPO) to over $52B in 2016. Today, EPD manages 50,000 miles of pipelines, 26 natural gas processing plants, 22 NGL and propylene fractionators, 2 import/export terminal, and stores up to 260 million barrels of NGL and 14 billion cubic feet of natural gas storage capacity.

Source EDP investors presentation

Growth Vectors

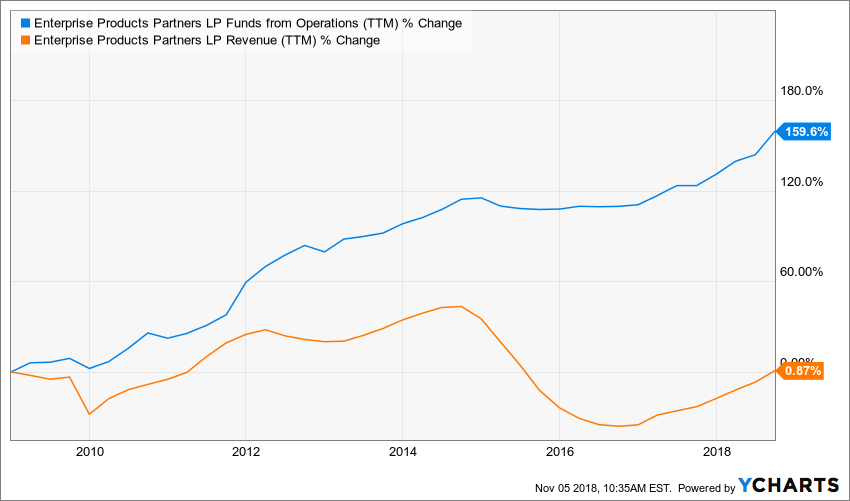

Source: Ycharts

EPD shows a great combination of both organic and growth-by-acquisition strategies. Management has a long track records of successful acquisitions under their belt which helped EPD developing a vertical integration. Since the company is active (and performant) at all stages of the product, it helps minimizing the volatility of the energy sector. After all, EPD can always count on its long-term pipeline contracts as a base for income.

EPD is also continuously growing through its own projects. EPD currently has over $5.5B in projects that are under construction. We are talking about pipelines, processing facilities, fractionator and export terminals. Then again, the company is in line with its vertical integration strategy.

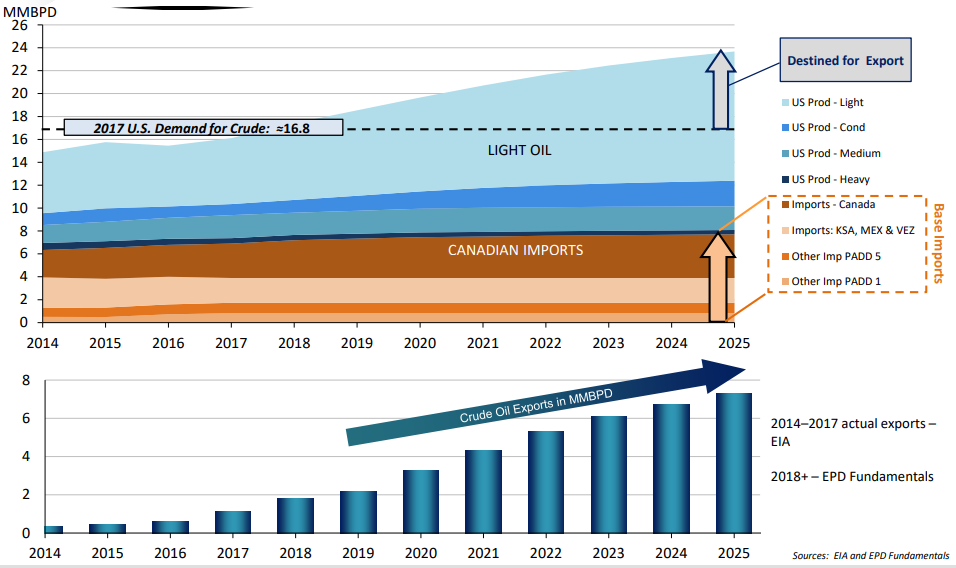

Finally, EPD continues to evolve its business before its too late. The company currently invests in crude oil exportation terminals as management sees this new trend as an opportunity:

This, once again, should help reducing EPD’s business volatility.

Potential Risks

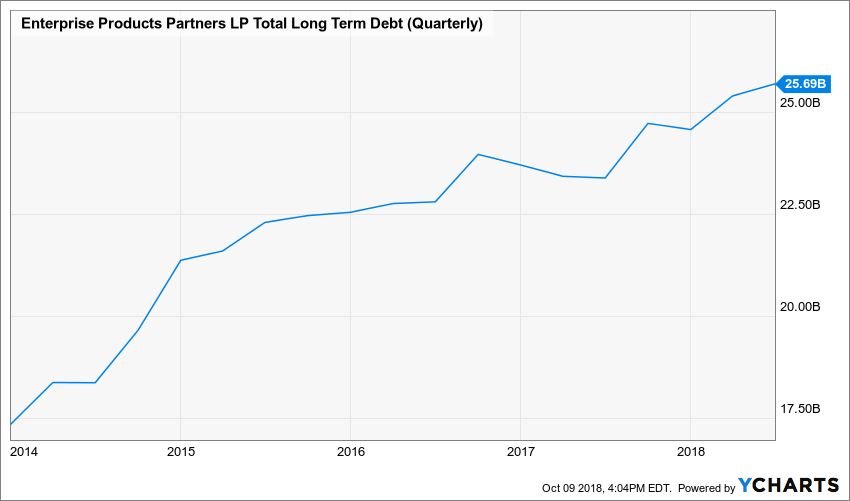

While EPD is a dominant leader in its market, there are lots of competition and everybody keeps investing to become better. Therefore, margins will eventually get smaller. We understand EPD has a strong credit rating, but its debt level is growing very fast. Over the past 5 years, EPD went from $17B in long-term debt (2013) to nearly $26B in 2018. Good credit or not, the company will have to get in “debt repayment mode” sooner or later. EPD growth potential is based on its ability to get new capital. This could cause a problem down the road.

Source: Ycharts

Dividend Growth Perspective

EPD shows an uninterrupted dividend growth streak since its IPO (the first dividend increase happened in 1999). We are looking at a company that went through various economic cycle without leaving their shareholder on the sidewalk. The company will continue to increase its payout by 4-5% going forward.

Source Ycharts.

Management doesn’t raise its distribution just to please shareholders. Its dividend growth policy is well established and EPD sticks to a distribution coverage ratio around 1.50. This is definitely an interesting pick for income seeking investors.

EPD meets our 7 dividend growth investing principles.

Valuation

With a well-established (and proven) business model and such a stellar dividend growth history, we are tempted to get very excited. EPD seems like the textbook definition of a “retirement stock”. This is why it is important to dig a little further to make sure you don’t pay too much for a good company.

To find a fair value, we used the dividend discount model. We decided to remain conservative in our calculations and used a 4% dividend growth rate going further. We determined a discount rate of 10% as EPD shows a high level of debt and in investment in such company isn’t without risk.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.73 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 4.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 4.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $43.13 | $35.94 | $30.81 | |

| 10% Premium | $39.54 | $32.95 | $28.24 | |

| Intrinsic Value | $35.94 | $29.95 | $25.67 | |

| 10% Discount | $32.35 | $26.96 | $23.11 | |

| 20% Discount | $28.75 | $23.96 | $20.54 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

As you can see, the company is currently trading around its fair value. This make it a very good candidate for your portfolio!

Final Thoughts

If you are looking for a continually increasing source of income, you may have found it with EPD. The company shows more than 50 consecutive quarters with a dividend increase (2018). Whiles increased are not phenomenal, they are steady and safe. The management team in place knows where the market is going as EPD was one of the first midstream company to work on a vertical integration. Through its size and impressive efficiency, EPD is a leader in its market and generate solid cash flow. The company’s appetite for growth by acquisition (and organic growth) is known and successful. EPD enjoys one of the strongest balance sheets among its peers with a credit rating of Baa1 / BBB+.

If you made it this far, let’s be honest; you liked what you read. Now it’s time to make sure you don’t miss our next analysis and you subscribe to the Dividend Monk Newsletter by clicking on this link to make sure you don’t.

Disclaimer: We are not long EPD in my Dividend Stocks Rock portfolios.

Featured image source: Pixabay

Leave a Reply