The world needs energy to function. The oil & gas industry has been fascinating investors for several decades. I guess this is due to the thrill coming from the next exploration results or an oil boom pushing stocks to record levels.

The oil & gas industry is usually divided into three activities: upstream, midstream and downstream. Companies that are “integrated” are active participants in all 3 activities.

Upstream: This term represents all activities related to exploration and production. This is usually the phase where the commodity price is the most important. Companies will establish their financial projections based on a specific price (or cost) per barrel. Then, they will decide to explore (drill wells) or not depending on the likelihood of profitable operations.

Midstream: Midstream activities include the processing, storing and transporting of oil & gas and their by-products. This is where you will find pipeline related businesses. The transportation and storage activities are usually more stable as they usually operate on long-term contracts with producers.

Downstream: This is the final step of the process including refining (to create gasoline for example) and marketing the product (selling it to the end-customer). Don’t just think about gasoline, but all the other modified products such as liquefied natural gas, heating oil, synthetic rubber, plastics, lubricants, antifreeze, fertilizers and pesticides.

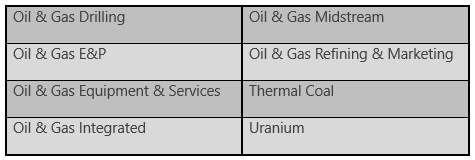

Sub-Sectors (Industries)

Greatest Strengths

Oil & gas stocks will raise passions and attract many investors during bull markets. As the economy grows, demand for such products increases accordingly. Commodity prices go up, profits are skyrocketing, and dividends are generous. The problem is that it rarely stays that way.

The energy sector can generate great returns in your portfolio, but you will be required to follow this sector closely (and hopefully know what you are doing). If you can pick stocks during oil busts (as was the case back in March-April 2020), you will show double-digit (sometimes triple-digit) returns. Since we are not in the “buy and sell quickly” strategy, we rarely like energy stocks at DSR. They generally make unreliable dividend growers.

Greatest Weaknesses

The energy sector is quite volatile and cyclical. This is not exactly the best place to pick dividend growers. Many companies will attract investors with their high yield and generous promises, but they will eventually fail their shareholders. I’ve heard the best and the worst stories coming out of this sector. Therefore, it is crucial to do your homework prior to investing in the Energy sector.

The main problem in this sector is it is capital intensive, and profits often depend on commodity prices. Companies have little to no control over the prices they receive for their oil or natural gas. Therefore, they must spend billions on projects and hope the end price will remain interesting for several years.

Vertically integrated companies (upstream, midstream and downstream) tend to maintain their dividend payments no matter what, but it is still a risky business. For example, BP (BP) had to cut its dividend after a major oil spill. Royal Dutch Shell (RDS.A or RDS.B) and Suncor (SU.TO / SU) also cut their distribution following the oil debacle in 2020.

As technology evolves, our demand for energy stagnates while our production capacity improves. In other words, don’t expect natural gas prices to rise anytime soon. All factors are combined to keep it at a low level.

How to Get The Best of It

The energy sector is the most cyclical of all. If you are courageous enough to ride the roller coaster, you can grab shares at highly depreciated prices every few years. If you would rather stay focused on a dividend growth investing strategy as we do, you must be incredibly picky before investing a penny in this sector.

I prefer pipelines (midstream industry) as the most interesting opportunities in the energy sector. Pipelines are capital intensive and exposed to regulators and potential oil spills, but they also act as toll roads. The world needs energy and pipelines are the ones providing it.

Favorite Picks

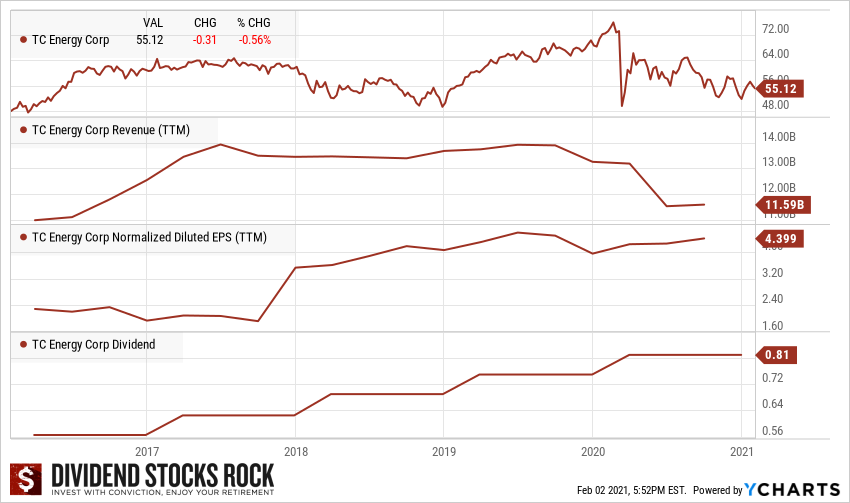

TC Energy (TRP)

- Market cap: 53B

- Yield: 5.80%

- Revenue growth (5yr, annualized): 5.41%

- EPS growth rate (5yr, annualized): 11.66%

- Dividend growth rate (5yr, annualized): 9.34%

Business Model

TC Energy operates as an energy infrastructure company, consisting of pipeline and power generation assets in Canada, the United States, and Mexico. TC Energy’s pipeline network consists of over 92,600 kilometers (57,500 miles) of natural gas pipeline, along with 4,900 kilometers (3,000) miles) from the Keystone Pipeline system. The company also owns or has interests in 11 power generation facilities with a capacity of 6,600 megawatts.

Investment Thesis

TRP is using large amounts of capital to fuel its growth over the coming years. Its acquisition of the Columbia pipeline and its extension toward Mexico is just an example of what is coming up for TRP. The company will benefit from Mexico’s economic growth (once we get past the coronavirus). I still prefer ENB due to a higher dividend yield and stronger dividend growth commitment, but TRP is definitely a good candidate for long-term investment. The company transport 25% of all Natural Gas in North America and expects to invest massively in its pipeline network in the coming years. As is the case with ENB, make sure to track TRP’s rising debt level. The company keeps its focus on rewarding shareholders with generous dividend increases for the coming years.

In January, new administration Biden rejected the Keystone XL project, leading investors to some doubts towards TC. How did it affect the company? Is TRP dividend still safe? Does it still fit in your portfolio? I’ve reviewed the situation in the video below.

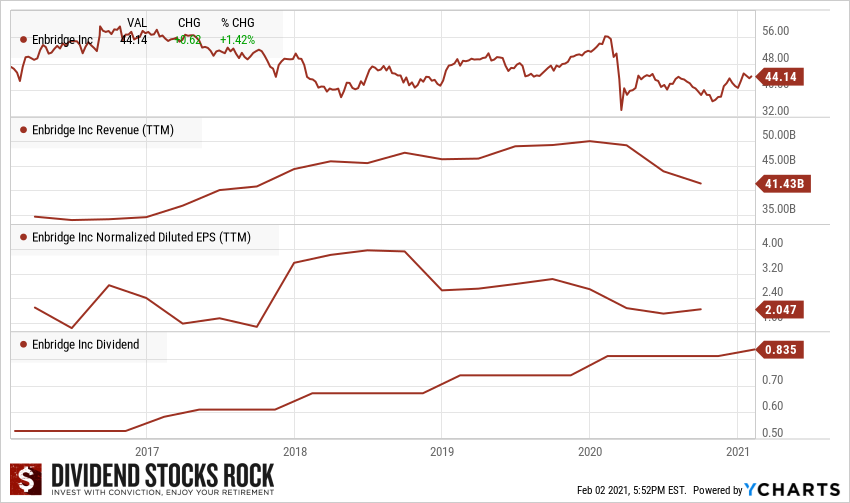

Enbridge (ENB)

- Market cap: 88B

- Yield: 7.43%

- Revenue growth (5yr, annualized): 5.87%

- EPS growth rate (5yr, annualized): 13.93%

- Dividend growth rate (5yr, annualized): 16.09%

Business Model

Enbridge is an energy generation, distribution, and transportation company in the U.S. and Canada. Its pipeline network consists of the Canadian Mainline system, regional oil sands pipelines, and natural gas pipelines. The company also owns and operates a regulated natural gas utility and Canada’s largest natural gas distribution company. Additionally, Enbridge generates renewable and alternative energy with 2,000 megawatts of capacity.

Investment Thesis

ENB’s customers enter into 20-25-year transportation contracts. It is already well-positioned to benefit from the Canadian Oil Sands (as its Mainline covers 70% of Canada’s pipeline network). As production grows, the need for ENB’s pipelines remains strong. After the merger with Spectra, about a third of its business model will come from natural gas transportation. Enbridge has a handful of projects on the table or in development. It must deal with regulators notably for their Line 3 and Line 5 projects. Both projects are slowly but surely developing. The cancellation of the Keystone XL pipeline (TC Energy) secures more business for ENB for its liquid pipelines. ENB has now a “greener” focus with investments toward renewable energy. The stock offers a yield over 7% which makes it a strong candidate for any retirement portfolio. The dividend is safe when you consider ENB’s distributable cash flows.

I also did a video about Enbridge on YouTube. You can refer to it to get my complete analysis of the business and its dividend safety.

Webinar: Where to Invest in 2021?

2,000+ investors saw this webinar already.

- KM: “Amazing webinar! Thanks very much!”

- Cheryl: “With thanks, I’m impressed!”

- Harley: “Thank you for your passion Mike.”

- Roberta: “I’m such a huge fan of DSR! Well done, Mike.”

Hi,

Thanks for new ideas to invest. As both stocks didn’t release their annual reports, so I will wait for it to take a decision.

However, based on 9 months report ENB free cash payout TTM ratio of 162,18% is worrying me and even it might be temporary it is a big hurdle to buy it. But I will keep it in watchlist until situation changes.