What Makes Duke Energy (DUK) a Good Business?

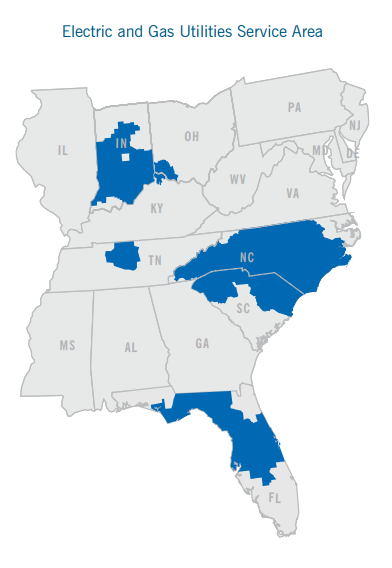

Duke Energy is the 7th largest electric power company in the United States. It provides electric services to 7.5 million retail clients across the Carolinas, the Midwest, and Florida, and natural gas distribution services to 1.6 million clients in Ohio and Kentucky.

Source: DUK fact sheet

The company once had international operations but sold them in 2016. Going forward, DUK plans to focus on generating cleaner energy and building natural gas infrastructure. DUK doesn’t only mention the word “cleaner” for fun; it has retired 40 older coal units, reducing their carbon dioxide emissions by 29% since 2005.

Revenue

Revenue Graph from Ycharts

Besides selling their international assets in 2016, DUK spent $6.7 billion to acquire Piedmont Natural Gas. This transaction should help DUK generate additional synergy as Piedmont was active in Duke’s territories. A 4-6% revenue growth is expected going forward (DUK Q3 presentation).

How DUK fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over my years of trading, I’ve used several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income-seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing besides a constant cash flow to offer its investors. However, high yields hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

After the 2008 crisis, we can clearly see 3 trends:

#1 The dividends kept increasing year after year

#2 DUK stock prices followed a similar trend

#3 DUK dividend yield has slowly reduced down to 3.79%

Duke offers an interesting yield for income seekers while not making unsustainable promises.

DUK meets my 1st investing principles.

Principle#2: Focus on Dividend Growth

Speaking of this, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

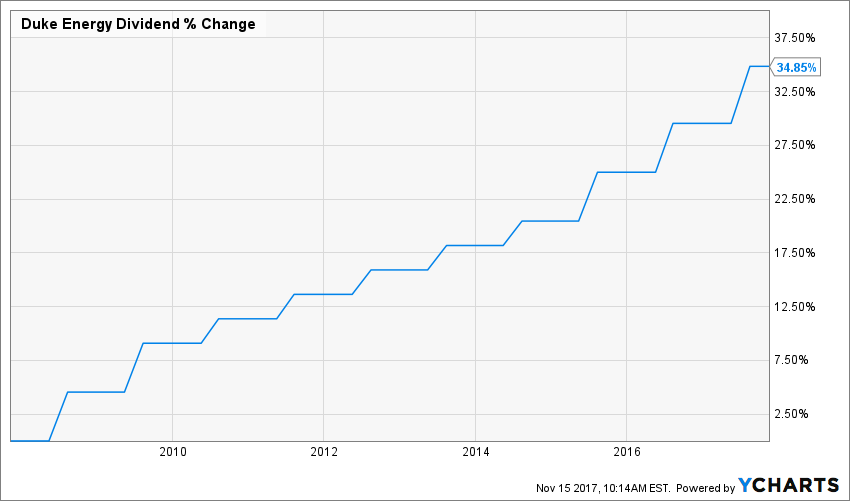

Source: Ycharts

When you look at DUK’s dividend growth in dollars, it looks quite impressive. However, when you put the same graph into a percentage (%) progression, you realize that DUK is offering a steady, but small dividend growth rate. Nonetheless, Duke has successfully increased its payouts for 10 consecutive years. This make it part of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time this article was written, there were 265 companies that have achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

DUK meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what has happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

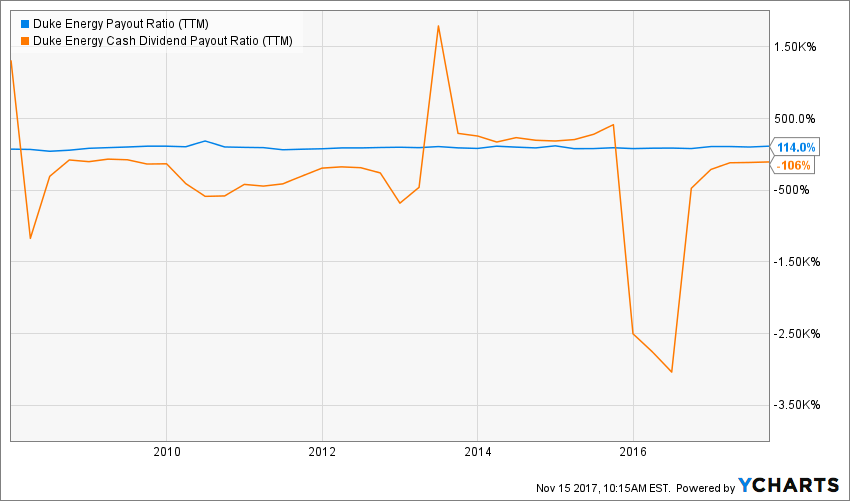

Source: data from Ycharts.

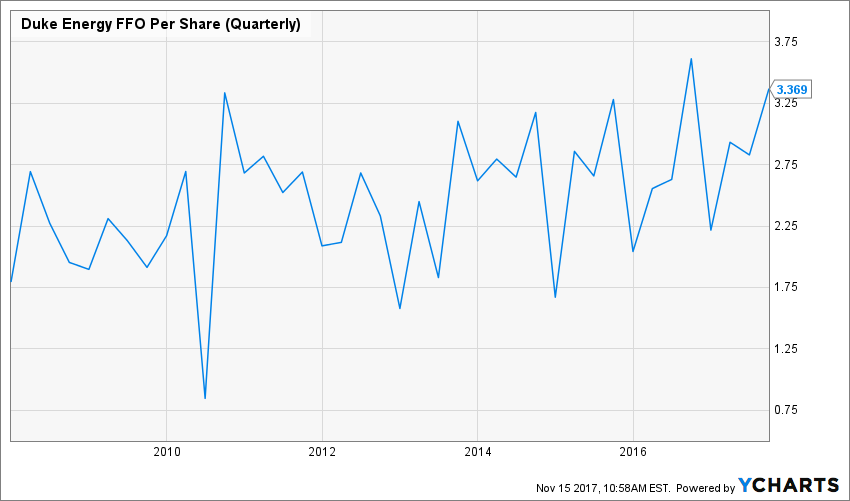

When you look at both the payout and the cash payout ratio, you understand why the company can’t afford to increase its dividend in a more substantial manner. However, using those metrics is not the best way to determine if a utility can or cannot sustain its dividend. You can use the FFO (and in the best word, AFFO) to see if the company generates enough money to pay its distribution:

Source: Ycharts

The company is well positioned to continue paying its dividend and offer a modest increase year after year. The board committed to increase its payout by 4-6% during their latest presentation.

DUK meets my 3rd investing principle.

Principle #4: The Business Model Ensure Future Growth

I like DUK’s focus on what they know best (electricity and natural gas) and the fact that it is the 7th largest utility company in the U.S. I also like its interest in generating cleaner energy and the fact management has allocated an important budget to do it.

Duke shows an impressive $42 billion budget for expenditures for the coming years (2017-2021). Its program focuses on grid modernization, transitioning to a cleaner generation profile, natural gas infrastructure investments and environmental remediation. While this is good news, we are talking about some serious money being invested in the upcoming years.

DUK still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At the Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you need to have some savings set aside. There is a valuation work to be done. In order to achieve this, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Well… a 30 PE ratio isn’t exactly what I’m looking for when I look at a utility. The 12-month forward PE makes more sense closer to 20. It even looks like a deal when I compare DUK forward PE with WEC Energy Group (WEC) and Xcel (XEL).

Digging deeper into this stock valuation, I will use a double-stage dividend discount model. As a dividend growth investor, I would rather see companies as big money making machines and assess their value as such.

Here are the details of my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.56 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $149.52 | $112.14 | $89.71 | |

| 10% Premium | $137.06 | $102.80 | $82.24 | |

| Intrinsic Value | $124.60 | $93.45 | $74.76 | |

| 10% Discount | $112.14 | $84.11 | $67.28 | |

| 20% Discount | $99.68 | $74.76 | $59.81 | |

Source: how to use the Dividend Discount Model

When I look at the DDM, I can tell DUK is trading close to its fair value. I will not shock anyone by saying there is no deal here. However, you are not overpaying for a solid income source either.

DUK meet my 5th investing principle

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is knowing when to buy and sell their holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or does not confirm my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

An investment in a utility stock is usually made on the classic thought of buying a sustainable source of income. This is exactly what is happening with DUK. The company shows a strong business model and a focus on stable revenue sources. You can expect your dividend to growth to be like clockwork. Best of all, your yearly paycheck increase will beat inflation year after year. DUK is a perfect match for any retirement or conservative portfolio.

DUK shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements, and the second part called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

You will rarely see a utility stock being part of a growth portfolio, right? Duke will focus on strengthening its position in its territory and providing cleaner energy. Don’t expect the company to grow through acquisitions in the upcoming year, management has already a full plate here. Therefore, expect DUK to grow steadily and reward you with a stable dividend check each quarter.

DUK is a core holding.

Final Thoughts on DUK – Buy, Hold or Sell?

I’m not overly excited by DUK, but I think it’s a good fit for many income-seeking investors. The business is solid, the dividend payment is sustainable and this situation will remain stable for several years. I personally prefer NextEra (NEE) or WEC Energy Group (WEC), but DUK is definitely a good stock to hold if you are looking for a steady payout.

Disclaimer: I do not hold DUK in my DividendStocksRock portfolios.

Leave a Reply