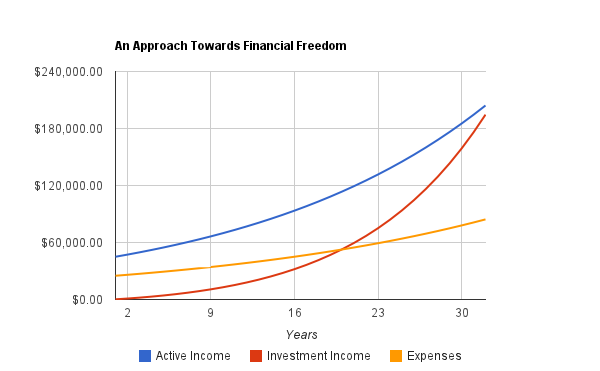

If you had enough passive dividend income and interest or rental income to perpetually support your expenses, and you could direct your creativity and passion to do what you want, how would you spend your time?

When you buy dividend stocks, you get paid dividends, and with enough time, you can build a diversified portfolio that provides you with enough income to support your lifestyle.

When your passive dividend income combined with interest income and other types of passive income exceeds your expenses, you’re financially free. After that, all active income is optional, so you can focus on doing what you want to do, and work on what you want to work on.

Dividend Income is More Reliable than Employment Income

Employment income for most people is a foundation of their personal finance strategy. This is okay at first, but over time, you’ll want to build some other income streams in order to diversify your overall financial position.

-If all of your income comes from a single employment source, then if that source gets shut off, you’re out of luck.

-But, if you have 20 or so companies paying you dividends, and those dividends grow each year at a rate that exceeds inflation, then you’re in pretty good shape. When you combine that dividend income with bond interest, rental income, and your active income sources (employment income, business income, freelancing income, and so forth), then your financial condition becomes quite solid. Once passive streams exceed your expenses, you’re free.

How to Build Dividend Income Over Time

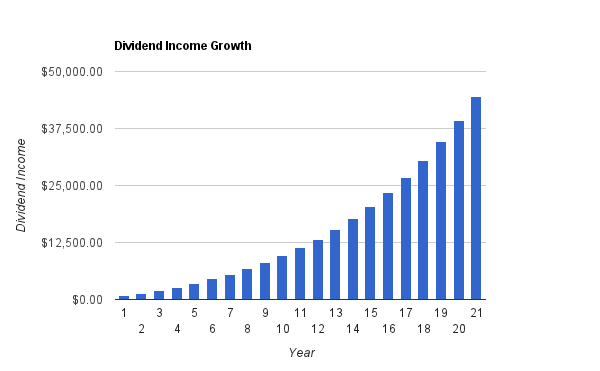

Dividend income isn’t just for retirees, although it does work wonders in retirement. By diligently putting away an extra grand or so each month, as soon as you receive income, then you’ll start to build a fairly substantial dividend portfolio over time.

For example, if you start with a portfolio of $20,000 with a total dividend yield of 4%, and you:

-Add $1,000 per month, and increase this by 5% each year

–Reinvest your dividends

-Get a total rate of return of 10%, either after taxes or in a tax-deferred account

Then your dividend income will grow like this:

It’s never quite that smooth, but income from dividends can grow a lot smoother than stock market returns, because while the market is volatile and does go up and down, there are dozens of businesses that have increased their dividends to shareholders every year for decades straight. When you continually add fresh capital and reinvest dividends, you smooth the growth out even further, and accelerate it.

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? There are too many investing articles contradicting one another. This creates confusion and leaves you with the impression you will not reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook which will give you the actionable tools you need to invest with confidence and reach financial freedom.

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build and manage your portfolio through difficult times.

- Enjoy your retirement.