Take this quick tour of the different payout ratios. Avoid missing out on great companies and the unpleasant surprise of dividend cuts! Learn what each ratio reveals, and which ones to review.

Generally, a payout ratio shows how much of a company’s profit (income, earnings) it uses to pay its dividend. The simple interpretation: ratio <100% means the company has money for dividends and some extra to invest in its growth; ratio >100% means it’s paying more in dividends than it earns. Be careful! This interpretation is often completely wrong, as shown in Explaining Bad Payout Ratios.

Why use different metrics for payout ratios?

Here are two reasons for using several different payout ratios.

1 – Business models differ a lot between industries.

Companies like pipelines, telcos, REITS, and utilities, invest massively in capital assets to operate and grow. While these capital expenditures (CAPEX) are money spent, they are also investments expected to be profitable. They affect the earnings of such companies much more seriously than, let’s say, restaurants or financial services companies that have much lower CAPEX.

Companies like pipelines, telcos, REITS, and utilities, invest massively in capital assets to operate and grow. While these capital expenditures (CAPEX) are money spent, they are also investments expected to be profitable. They affect the earnings of such companies much more seriously than, let’s say, restaurants or financial services companies that have much lower CAPEX.

2 – Not all payout ratios are created equal.

Let’s take the classic payout ratio. It is calculated based a company’s earnings. Non-cash charges like depreciation and amortization reduce earnings, but they don’t affect how much cash the company has available. Therefore, the earnings-based ratio can erroneously give the impression the company is paying more in dividends than it can afford.

Different payout ratios use different metrics—some that consider CAPEX, non-cash charges, or both—to depict different situations more precisely.

Download our Recession-Proof Portfolio Workbook.

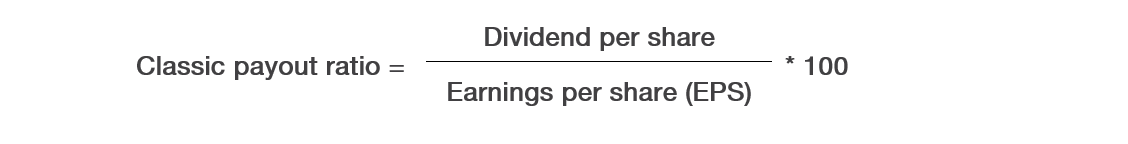

Classic Dividend Payout Ratio

The classic easy-to-understand ratio that is used by most regular corporate entities across many industries.

EPS calculation uses generally accepted accounting principles and doesn’t reflect the cash the company really has available to pay its dividend. Combine this ratio with other metrics during your analysis like, for example, the cash payout ratio, described next.

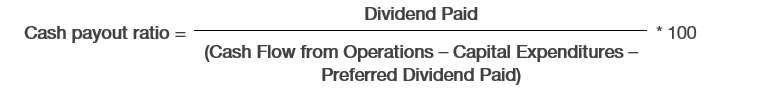

Cash Payout Ratio

This is another ratio commonly used in many industries. It gives a more precise picture of the company’s ability to use its cash resources to pay dividend than the classic ratio.

It’s more complicated to calculate. Capital expenditures (CAPEX) are often financed completely or partially by debt, and therefore don’t always use up cash flow from operations. You must look at how much CAPEX there is in each quarter to determine if the cash payout ratio is high or not.

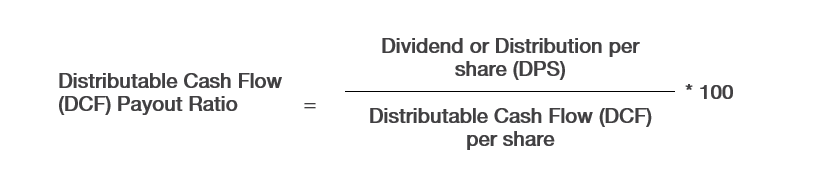

Distributable Cash Flow Payout Ratio

This ratio is often used by pipelines or utilities, who often provide the detailed calculation in their quarterly earnings reports. It’s similar to the cash payout ratio in that it gives a clear picture of how much the company has in cash to pay dividends.

Usually, you can’t calculate the DCF payout ratio yourself or find it on finance websites. Hope that the company provides it in its quarterly earnings reports. It’ll take longer to see the trend over several years.

Download our Recession-Proof Portfolio Workbook.

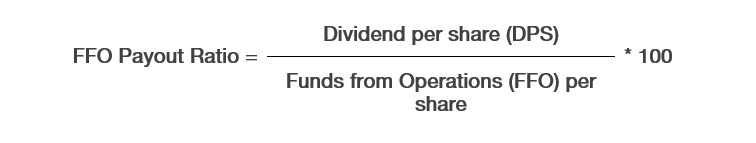

Funds from Operations (FFO) Payout Ratio

Real Estate Income Trusts (REITs) use this ratio. Since REITs have to distribute at least 90% of their net earnings, the classic payout ratio is always at least 90%. This doesn’t reflect reality because REITs have a lot of non-cash charges like depreciation and amortization; they can also have substantial CAPEX as they maintain and expand their property portfolio.

Real Estate Income Trusts (REITs) use this ratio. Since REITs have to distribute at least 90% of their net earnings, the classic payout ratio is always at least 90%. This doesn’t reflect reality because REITs have a lot of non-cash charges like depreciation and amortization; they can also have substantial CAPEX as they maintain and expand their property portfolio.

The FFO payout ratio is more precise for REITs because the FFO calculation considers non-cash charges.

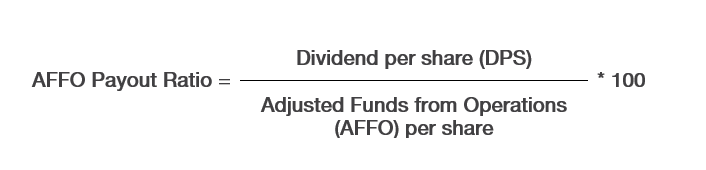

Also used is the Adjusted Funds from Operations (AFFO) payout ratio. Like FFO, the AFFO calculation considers non-cash charges, but also accounts for CAPEX.

Most often, you can’t calculate the FFO or AFFO payout ratio yourself or find it on finance websites. Some companies provide them in their quarterly earnings reports.

More about payout ratios

Analyzing the appropriate ratios is important but there’s more to it than that. Always look at its trend over 5 to 10 years to know what’s usual and what isn’t. Investigate anomalies. And remember, don’t use payout ratios as your first or only criteria. See Use Payout Ratios Wisely.

[…] Also, for some industries, the classic payout ratio is not the best metric to see what is really happening; be mindful to look at the correct metric. For more on that, read Different Payout Ratios – Quick Tour. […]