Summary

- Diageo is a leader in premium spirits industry, it will surf the current economic tailwind.

- Emerging markets start to get some traction as middle class seeks recognitions and claim a higher status through their lifestyle.

- Unfortunately, DEO is overpriced right now.

Investment Thesis

DEO will benefit from the good standing of the current economy. Consumers around the world are optimistic in their future, and they are more willing to spend. DEO enjoys strong pricing power, and its brand portfolios are protected with premium names. Diageo also invests in an important sales team in order boost its product’s popularity at all times. The company will continue to pay a solid 2.50% dividend. Finally, the rising income in emerging markets will eventually lead to additional customers for Diageo and its premium spirits. Unfortunately, the DDM calculation doesn’t justify the current price.

Understanding the Business

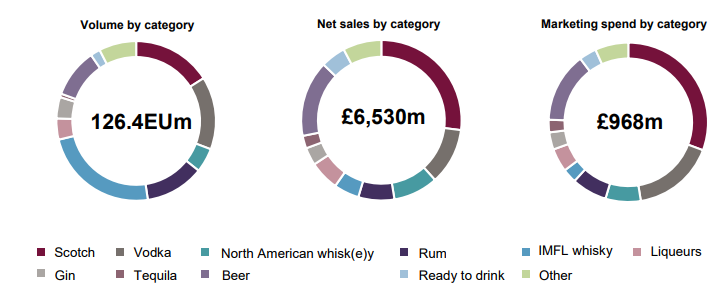

Diageo is another “sinner’s club” dividend stock. The company, based in England, evolved as the result of a massive merger of Grand Metropolitan and Guinness back in 1997. DEO is a global spirits and beer marketer and distributor. Diageo largest products are scotch, beer and vodka. The company manages over 200 brands served in 180 countries. In other words, if you drink alcohol in any form, you have definitely tasted one of Diageo brands. Famous names such as Guinness, Smirnoff, Johnnie Walker, Captain Morgan and Baileys are among a long list of brands owned by Diageo. Here’s an idea of what they sell across the world:

Source: DEO 2017 Annual Report

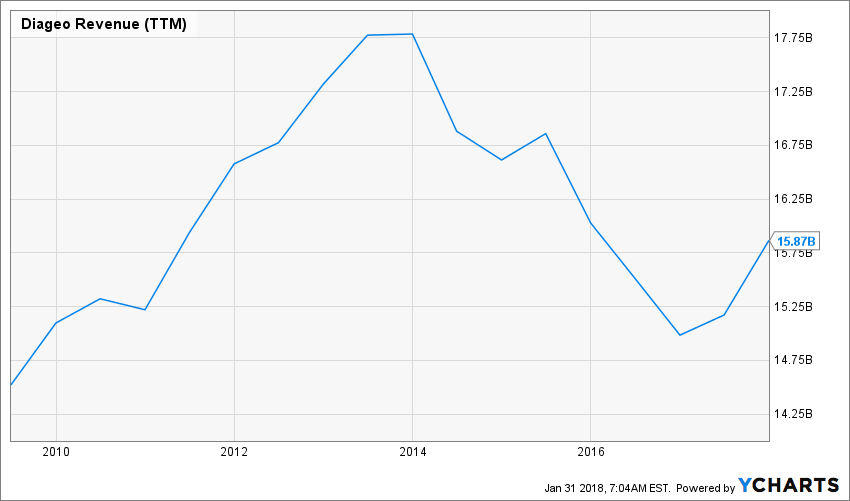

Revenues

Source: Ycharts

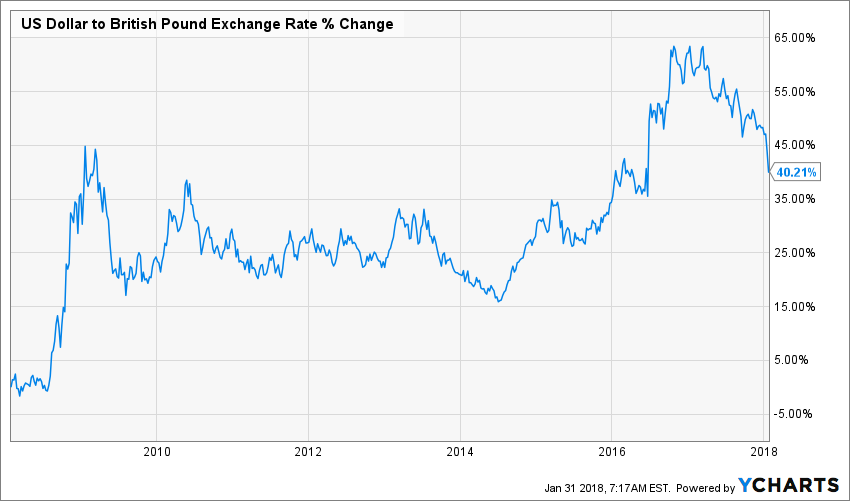

Keep in mind that all graphs are in USD, but the company reports their figures in British pounds. As you can see I the following graph, both currencies had their share of fluctuation over the past 10 years:

Source: Ycharts

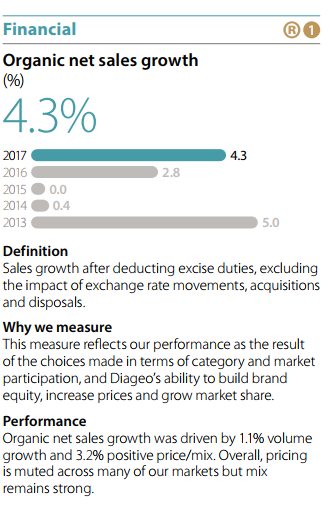

A clearer version of their sales can be found in their 2017 annual report where the company showed strong organic growth last year:

Diageo is not only a leader in the spirit industry, it is also benefiting from premium brands. In a world where your status can be determined by what you drink, owning well-known and pricey brands are a key element against your competitors. DEO protects its market shares through strong branding and enjoys pricing power. With its wide brand portfolio, it has become a great partner in the retail business (bars and restaurants are looking for Diageo’s products).

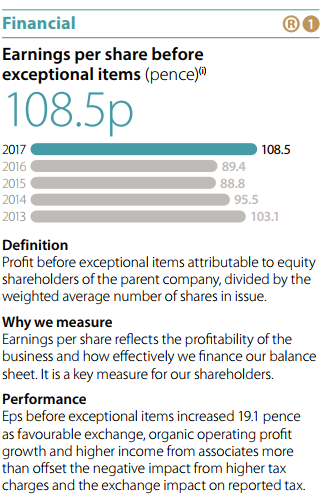

Earnings

Source: Ycharts

Then again, here are the past year’s performance in DEO main currency:

Diageo went through a difficult couple of years where EPS decreased since 2013. Management worked harder to improve their margin and their marketing teams put additional focus on sales. After spending nearly £1 billion in marketing during their latest interim period, DEO is back to solid organic growth.

Source: DEO 2018 interim result presentation

It will be interesting to follow DEO earnings in the upcoming years to see if it was just a temporary rebound, or a new trend. My guess is that the economy will continue to push DEO higher in the future.

Dividend Growth Perspective

Diageo pays dividend twice a year. Unlike most American companies, DEO pays 2 different amounts each year. This explains the roller coaster graph you are about to see:

Source: Ycharts

DEO shows 6 consecutive years with a dividend increase, according to Dividend.com. This makes it 4 years a part of making the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

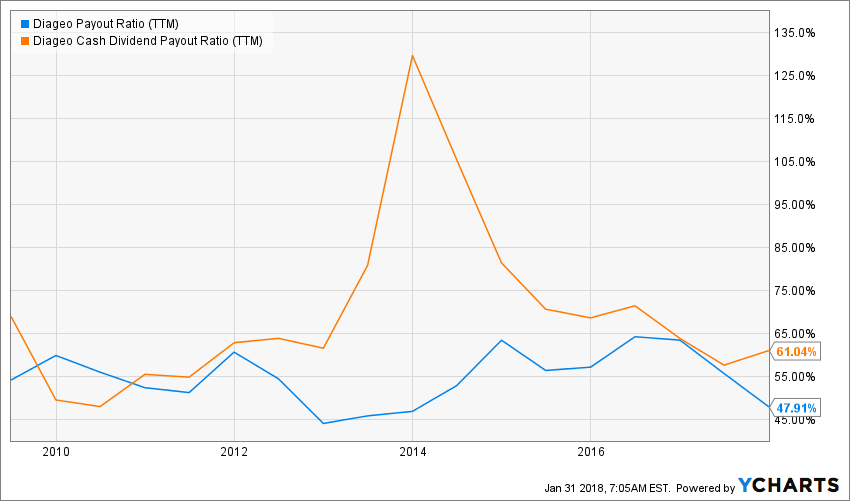

DEO is in a similar position to BUD. Both companies pay semi-annual dividends in another currency. This creates an additional fluctuation in your portfolio. DEO shows a solid dividend growth policy, and a payout ratio under 50%. You can expect additional increases in the years to come… unless DEO makes more acquisitions and slows down its dividend growth policy. If business remains basically the same, we expect DEO to increase its payout by mid-single digits over the upcoming years.

Source: Ycharts

Potential Downsides

The spirit industry is more cyclical than the beer business. Since DEO has a great niche in premium brands, those are more affected during economic downturns. The company is also subject to additional regulations and taxes coming from governments. On one side, people like alcohol, but on the other, some push for stronger regulations. There is always a risk of contamination or fire in its ageing facilities. Finally, as the bulk of DEO expenses is in British pounds, the fact that England is leaving the Euro may create additional volatility in its financial statements.

Valuation

Diageo is a solid company with a solid reputation. Unfortunately for potential new shareholders, DEO stock hasn’t been trading at a discount recently. DEO has jumped by about 34% between January 2016 and January 2018 and most of the gain is due to PE expansion.

Source: Ycharts

Digging deeper, I’ve used the dividend discount model to find a fair price for DEO. I’ve used a 5% dividend growth rate for the first 10 years and increased it to 6% as a terminal rate. DEO is a leader in an industry where brand names mean everything. It will be very difficult for any company to match the Diageo brand recognition (and marketing budget to do so).

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.21 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $187.13 | $125.19 | $94.20 | |

| 10% Premium | $171.54 | $114.76 | $86.35 | |

| Intrinsic Value | $155.94 | $104.32 | $78.50 | |

| 10% Discount | $140.35 | $93.89 | $70.65 | |

| 20% Discount | $124.76 | $83.46 | $62.80 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Unfortunately, DEO is not showing as a screaming buy right now. I obviously don’t think DEO price will fall by more than $30 in 2018 to meet the DDM fair price. However, I highly doubt there is lots of growth potential for a dividend growth investor.

Final Thought

Diageo manages an impressive brand portfolio of spirits and alcohol products. Their names and the money the company keeps spending each year to maintain their standards make it almost impossible for new competitors to enter this market. The upcoming years look bright, but it is already priced in. While Diageo is a solid company, I will wait before I have another glass.

Disclaimer: I do not hold DEO in my DividendStocksRock portfolios.

Some amazing insights here, I own this stock & it seems like you have a much better grasp of the company than I do!

It’s interesting to see how the sales are so well diversified by region. I’m Hopeful that Diegeo will continue to perform for me.