Generating a reliable income stream from your investments is a priority for many investors, especially those planning for retirement.

While high-yield stocks may seem the easiest way to achieve this, I challenge that assumption and present a smarter alternative: dividend growth investing. This strategy focuses on companies that consistently increase dividends, balancing yield and growth to create long-term wealth.

In this article, we’ll break down the key principles of this concept, exploring why a low-yield, high-dividend-growth strategy can be more effective than chasing high-yield stocks. We’ll also cover the importance of sector diversification, portfolio construction, and withdrawal strategies to ensure a stress-free and sustainable retirement income.

The Yield Trap: What Makes a Dividend Truly Valuable?

Many investors fall into the trap of focusing solely on high-yield stocks—companies that pay large dividends relative to their stock price.

On paper, this seems appealing: invest in a 7% yielding stock, and you earn $70,000 per year on a $1 million portfolio.

However, this strategy comes with significant risks:

- Dividend cuts: High-yield stocks often struggle to maintain payouts, especially if earnings decline. A dividend cut slashes your income and leads to a stock price drop, reducing your capital.

- Low or no growth: Many high-yield stocks are in mature industries with limited growth potential. Without earnings growth, they may struggle to sustain or increase dividends.

- Erosion of purchasing power: If your dividends don’t grow, inflation will eat away at your income in retirement. A stock yielding 7% today but growing at 0% is far riskier than a stock yielding 2% with a 10% annual dividend growth rate.

The Best Guide to Creating a Sustainable Dividend Income at Retirement

This guide is for any investor who wants to create a sustainable income from his/her portfolio. It will be useful during your accumulation phase as you will avoid major mistakes and build a solid portfolio for your retirement. It will be even more useful if you are retired and count on your portfolio to pay the bills.

We all invest with the same goal: having our money working for us.

The Alternative: Dividend Growth Investing

A more sustainable strategy focuses on companies that consistently increase their dividends. Instead of looking for the highest yield, dividend growth investors seek:

- Revenue and earnings growth to support future dividend increases.

- A strong balance sheet to withstand market downturns.

- A proven history of dividend growth, ensuring that payments keep up with or exceed inflation.

This is what I call the Dividend Triangle.

Example: Low-Yield, High-Growth vs. High-Yield, Low-Growth

Let’s compare two companies over a 10-year period:

-

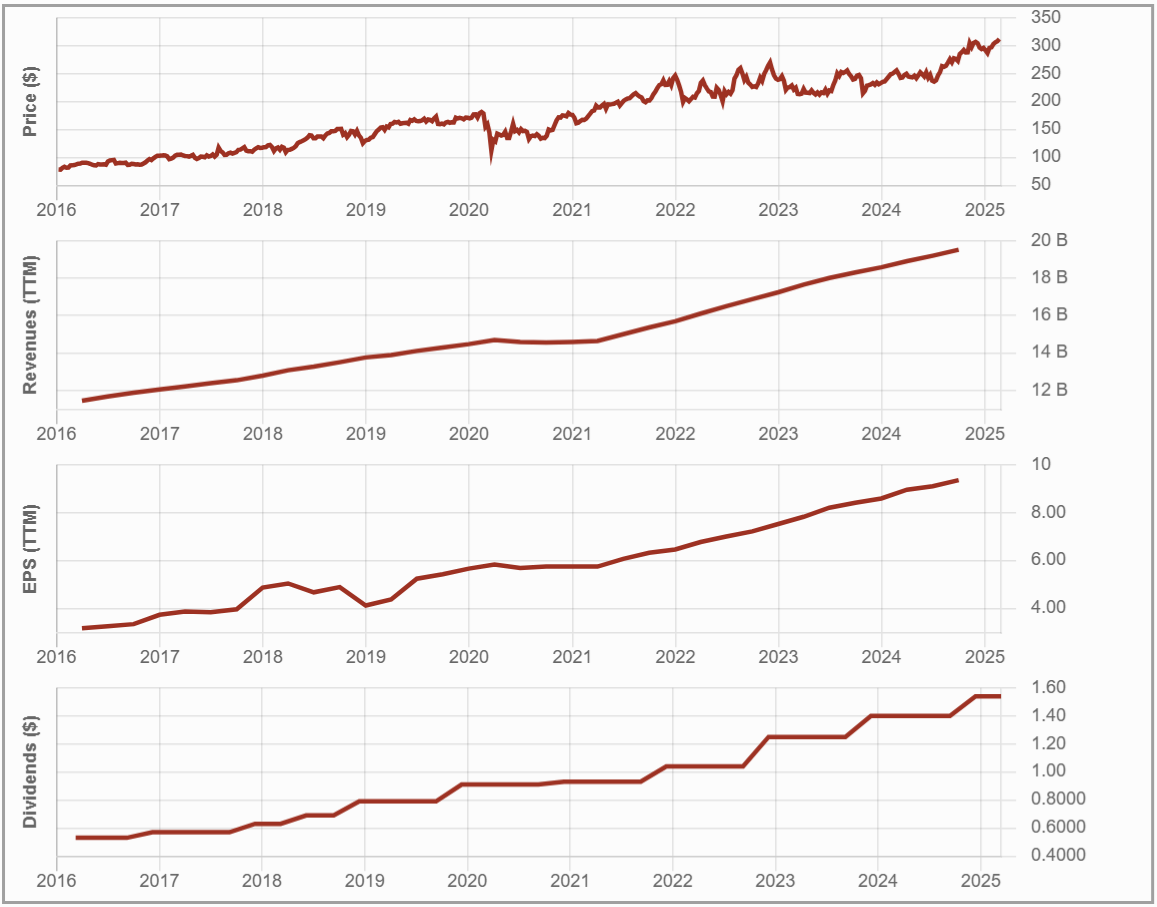

Company A (Low-Yield, High Growth): Automatic Data Processing (ADP)

- Starts with a 2% dividend yield

- Grows its dividend at 12% per year

- Over 10 years, your dividend income triples

-

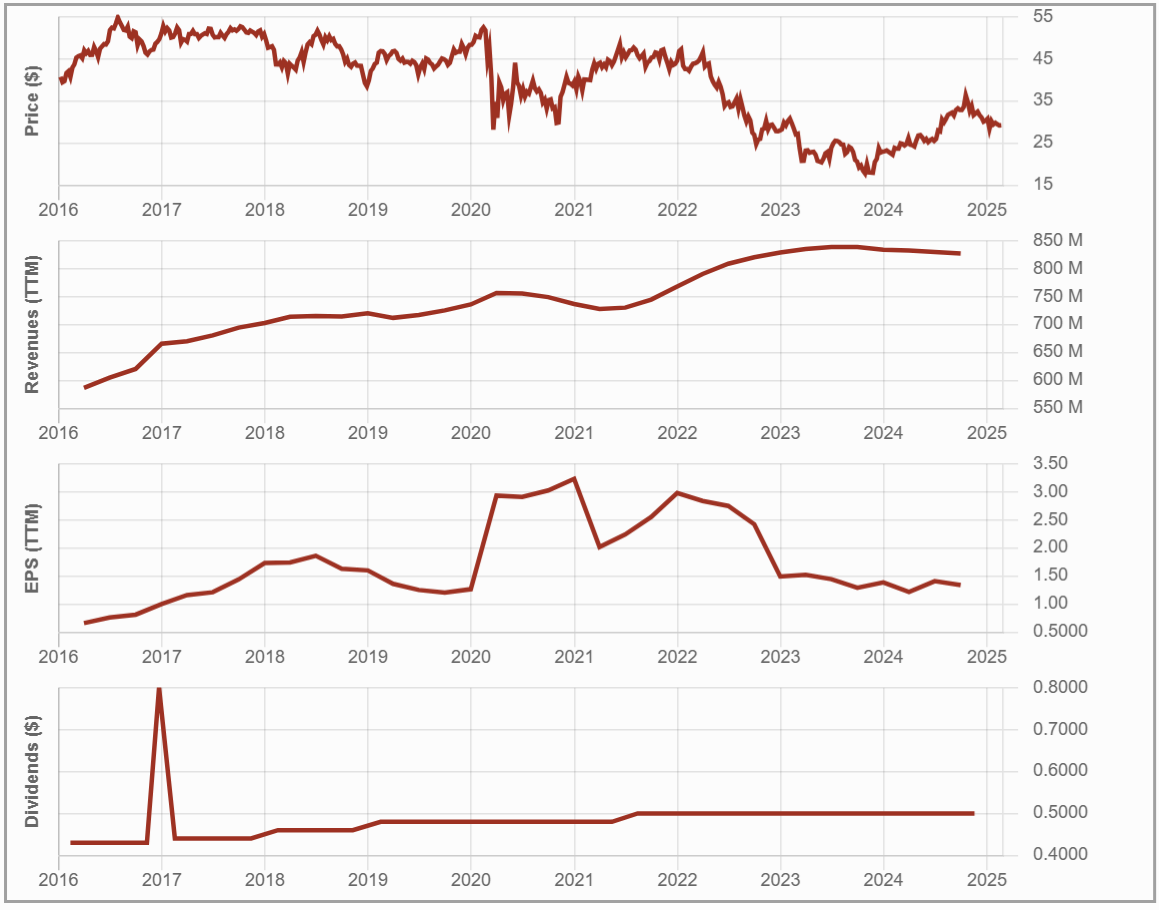

Company B (High-Yield, Low Growth): Highwoods Properties (HIW)

- Starts with a 7% yield

- Grows its dividend at 1% per year

- After 10 years, your dividend income barely increases

Which one would you prefer?

Automatic Data Processing will surpass Highwoods Properties in total income while also benefiting from capital appreciation.

How to Build a Dividend Income for Life Portfolio

To create a sustainable dividend income stream, follow these core principles:

1. Prioritize Dividend Growth Over Yield

A company’s dividend growth rate is a powerful indicator of its financial health. Target companies with at least 5% annual dividend growth, which helps protect your income from inflation and ensures a rising income stream in retirement.

2. Look for a Strong Dividend Triangle

The Dividend Triangle consists of three key factors:

- Revenue growth (ensures the company’s business is expanding)

- Earnings growth (supports continued dividend increases)

- Dividend growth (a sign of financial stability and management confidence)

Companies that excel in all three areas are likelier to sustain and grow their dividends over time.

3. Diversify Across Sectors

No sector is bulletproof. A well-diversified portfolio protects against downturns in specific industries.

4. Avoid Common Pitfalls

- Don’t chase high yields – Stocks with 6-10% yields are often risky and may indicate financial trouble.

- Don’t over-diversify – Holding too many stocks can make managing and monitoring your portfolio hard.

- Don’t time the market – Instead of waiting for the “perfect” time to invest, focus on strong businesses with growing dividends.

Complete Portfolio Example

I have built a complete portfolio example in the Dividend Income for Life Guide that shows you how to make a portfolio with dividend growth stocks that will sustain your lifestyle at retirement.

While this article is condensed, the Guide offers a detailed process with graphs, charts, and concrete examples.

Enter your name and email below to download it for free now.

Withdrawal Strategies: How to Live Off Your Dividends in Retirement

Many retirees worry about drawing down their portfolio too quickly. The Dividend Income for Life Guide approach provides a smoother and more predictable way to generate income without selling stocks during a market downturn.

1. The 4% Dividend Yield Portfolio

One way to avoid selling shares in retirement is to build a portfolio that yields around 4%. If your portfolio generates enough dividend income to cover your living expenses, you won’t need to sell shares when the market is down.

Example:

- $1,000,000 portfolio at a 4% yield = $40,000 in annual income.

- Dividend growth of 6% per year ensures your income keeps up with inflation.

2. The Cash Reserve Strategy

Then, you can keep a cash reserve of 1-3 years’ expenses. This allows you to:

- Withdraw dividends first

- Use cash reserves when needed

- Avoid selling shares at a loss during a market crash

3. Selling Shares Selectively

If you need to supplement your dividend income, focus on selling shares from overvalued positions rather than indiscriminately withdrawing funds.

Example:

- If your portfolio has grown significantly, trim winners like Microsoft or Apple to rebalance your holdings.

- There is a clear order in which you can sell some of your shares to create income without hurting your portfolio. I have detailed it in the Dividend Income for Life Guide.

Why This Strategy Works

A Dividend Income for Life portfolio provides:

✅ Stable and growing income – No need to worry about outliving your money.

✅ Inflation protection – Rising dividends ensure your purchasing power remains intact.

✅ Lower stress – Less reliance on stock price movements, more focus on cash flow.

By prioritizing dividend growth over high yield, maintaining a diversified portfolio, and following a smart withdrawal strategy, you can retire with confidence and financial security.

If you’re serious about creating long-term, stress-free wealth, focus on companies that consistently grow their dividends rather than those that just offer high yields. This strategy will allow you to enjoy rising income for decades to come.

Investing for retirement is about more than just picking high-yield stocks. It’s about building a sustainable, growing income stream that supports your financial goals for life. The Dividend Income for Life Guide provides a blueprint for achieving this, ensuring that your investments continue working for you well into retirement.

If you stick to these principles, you’ll never have to worry about running out of money—because your dividends will keep growing, year after year.