Summary

#1 Consolidated Edison is a classic play in the utility sector with growth vectors in the natural gas distribution business.

#2 ED shows 43 consecutive years with a dividend increase making it a dividend aristocrat.

#3 While the company and its dividend are solid, the stock is definitely overvalued.

Over the past 30 days, Consolidated Edison’s (ED) stock has been evolving in red territories. The utility company shows a loss in value of about 10% between December 2017 and January 15th 2018. After a fabulous run in the current bull market, most utilities are slowing down. I think it’s time to take a look at Consolidated Edison to see if the current stock drop is a buy opportunity.

Understanding the Business

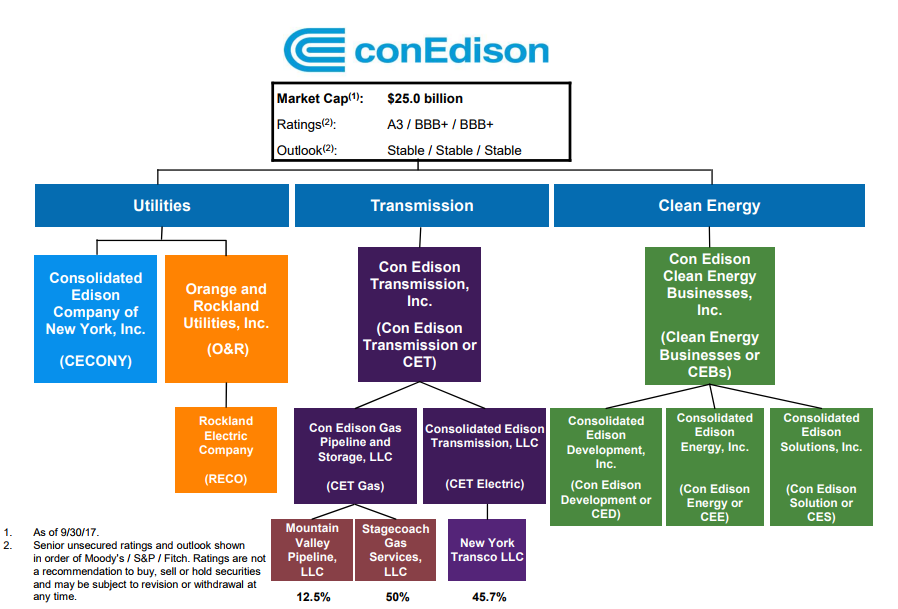

Consolidated Edison is a classic utility company operating in the New York State. It operates under 4 different segments:

Electric (71% of revenue)

Gas (14% of revenue)

Steam (5% of revenue)

Non-Utility (10% of revenue)

November ED presentation

While the chart above shows a whole segment for clean energy, the company generates only 4% of its revenue from this business segment. The core business remains it regulated utilities activities with 93% of its revenues.

Revenues

Source: Ycharts

Utility stocks aren’t the fastest growing companies on earth. They are more of a “hold & get paid steady” type of holdings. Revenue usually grows with regulations pushing energy prices higher. Besides that, ED has little growth vector. Management expects its utility revenues (gas and electric) to increase at a CAGR of 5.5% through 2019.

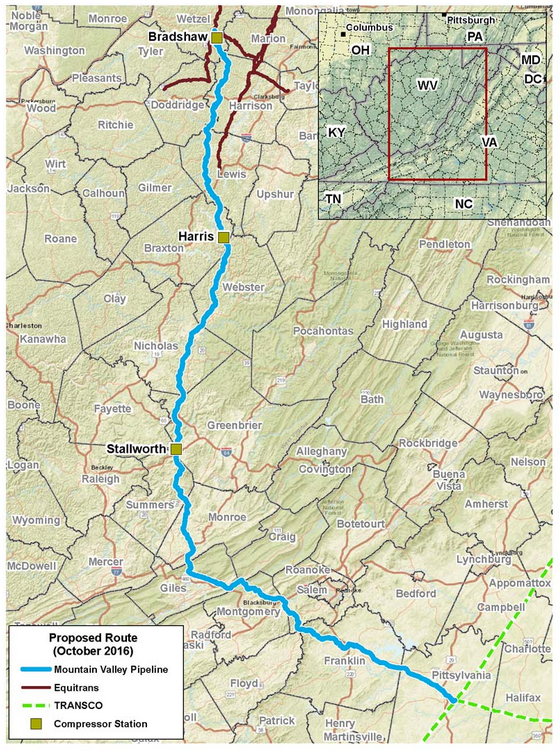

However, it has a 12.5% stake in a 303-mile pipeline called the Mountain Valley Pipeline. The MVP is a joint venture of EQT Midstream Partners (EQM), NextEra Energy (NEE), Con Edison, WGL Midstream and RGC Midstream.

Source: MVP

This natural gas pipeline is expected to start working toward the end of 2018. ED is also another participant in another natural gas pipeline named Stagecoach Gas Service.

Earnings

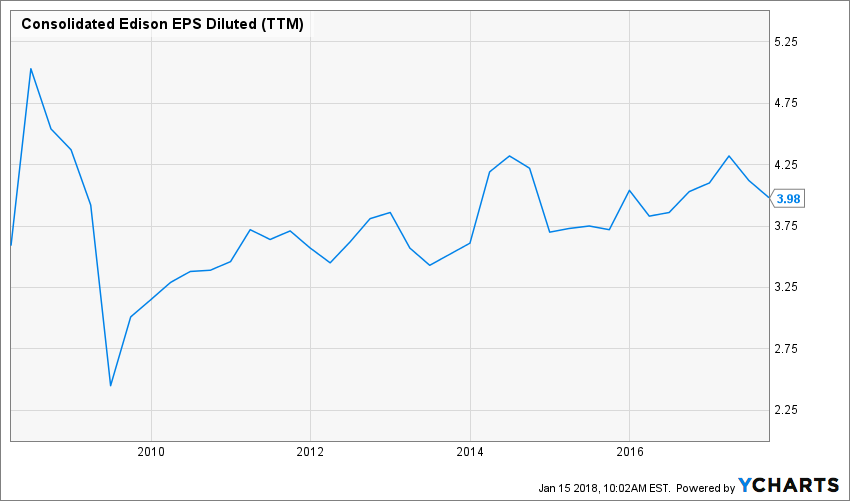

Source: Ycharts

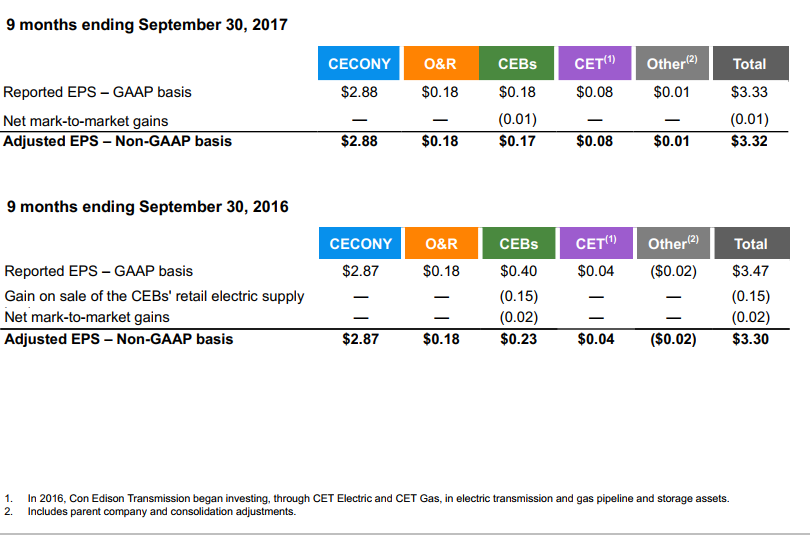

The company has show steady earnings with a small uptrend since 2012. That is because ED is investing in its energy transmission and clean business in order to generate additional growth in the future. As you can see in the next chart, both are yet to become important contributors.

Management looks at the future with a smile as both segments are expected to support ED’s growth for many years. I agree pipeline projects are promising as they are never built without a strong economic demand behind it. Therefore, once they are operational, pipelines translate into a steady cash flow stream.

Dividend Growth Perspective

Consolidated Edison shows a stellar dividend growth sheet. With 43 consecutive years with an increase, ED is part of elite Dividend Aristocrats and Dividend Achievers lists. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

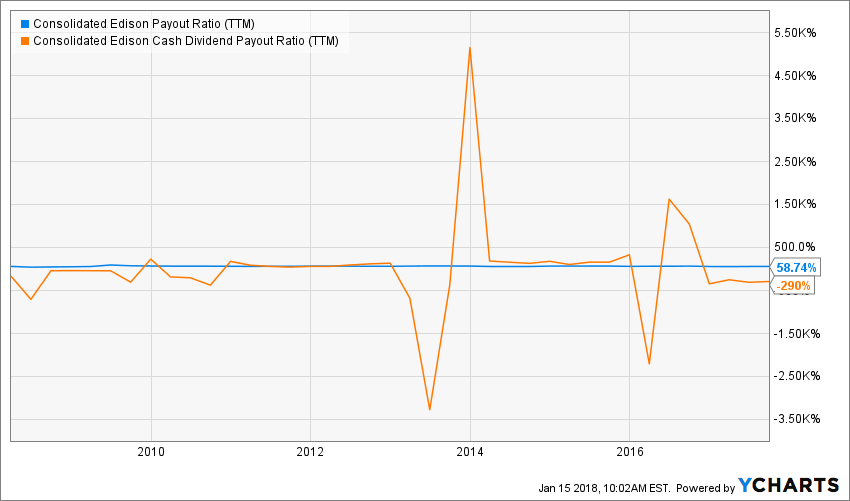

Source: Ycharts

Unfortunately for income seeking investors, ED doesn’t pay a juicy 5%+ yield anymore. After all, ED’s stock price has jumped by 44% over the past 5 years. During the same period, the company increased its payout by 12%… and I’m not writing CAGR… just 12% total.

Source: Ycharts

The problem is that the company’s projects require lots of money and ED can’t afford to share too much wealth with investors. A 3.50% yield is appreciated, but don’t expect much growth in the upcoming years.

Potential Downsides

In my view, the company shows two important downsides. The first one is based on the current valuation. As you will see in the final section of this analysis, ED is clearly overvalued. The latest stock price run has made it vulnerable for additional volatility. The beginning of the year has been particularly painful for ED and I expect more potential losses.

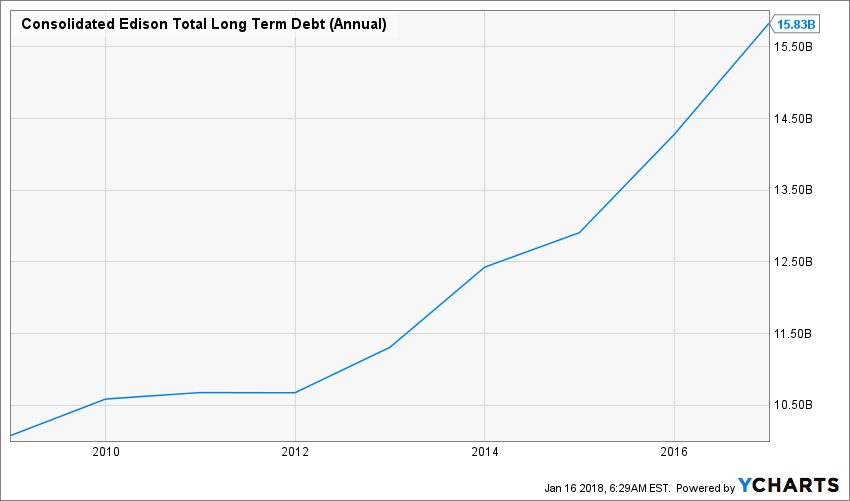

ED has been raising lots of debt in the past 5 years and it may catch up to it now that the interest rates are increasing.

Source: Ychart

This situation will not put the dividend payment in jeopardy, but that’s just another reason to not expecting much growth in the upcoming years.

Finally, the rise of interest rates will also convince parts of income seeking investors to cash their juicy profit in this industry and move back to bonds eventually. This should slow down the hype around this sector and potentially slow down their stock potential for a few years.

Valuation

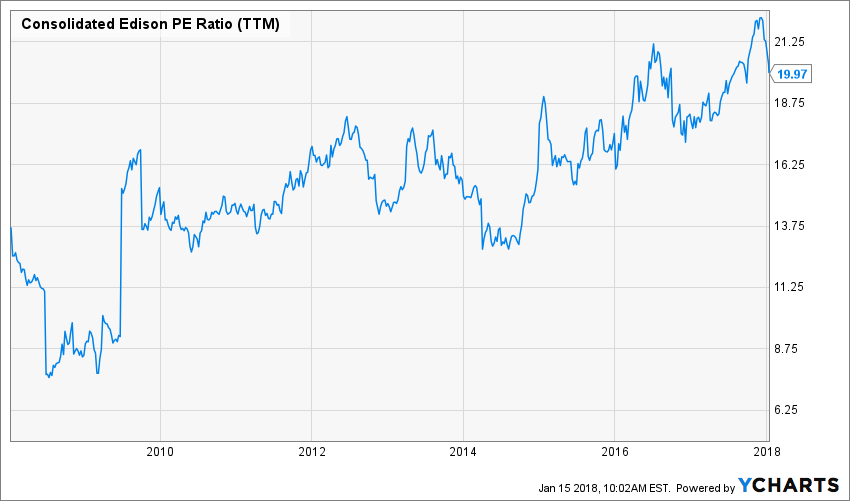

As previously mentioned, ED seems overvalued on all sides. First, the company has never traded at such high multiple:

Source: Ycharts

I know that using the PE ratio for a utility stock could be tricky. After all, the nature of their business requires lots of adjustments to get the real picture of their earnings. However, if you use the same metric for the past 10 years and get the highest points now; it’s a sign of an overhyped stock.

Digging deeper, I used the dividend discount model. I couldn’t use more than a 3% dividend growth rate in this case. After all, ED has increased its dividend by a CAGR of 2.29% over the past 5 years. Therefore, even 3% is a generous figure.

As for the discount rate, I never use under 9%. In this case, even if I use an 8% discount rate, I will get a stock that is highly overvalued.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $2.76 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 3.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $68.23 | $56.86 | $48.73 | |

| 10% Premium | $62.54 | $52.12 | $44.67 | |

| Intrinsic Value | $56.86 | $47.38 | $40.61 | |

| 10% Discount | $51.17 | $42.64 | $36.55 | |

| 20% Discount | $45.48 | $37.90 | $32.49 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

I’m not saying ED’s stock price will drop like a rock. However, I don’t think this is the type of company that fits my 7 dividend growth investing rules.

Final Thought

I understand the need for utility stocks in one’s portfolio. They are steady income generators with some decent yield. However, the fact that the price for most utility stocks jumped along with the current bull market makes them unattractive for new investors at this time. ED is definitely a good example of this situation.

Disclaimer: I do hold NEE in my DividendStocksRock portfolios.

Great article and in depth analysis of ED. I too believe the stock is overvalued – if one was lucky to get on board around 67-68 that was certainly a good move.

How about DUK? Took a hit recently although business model remains sound and stable.

You can read my analysis of DUK here:

https://dividendmonk.com/duke-energy-just-another-strong-utility/

cheers,