The Company in a Nutshell

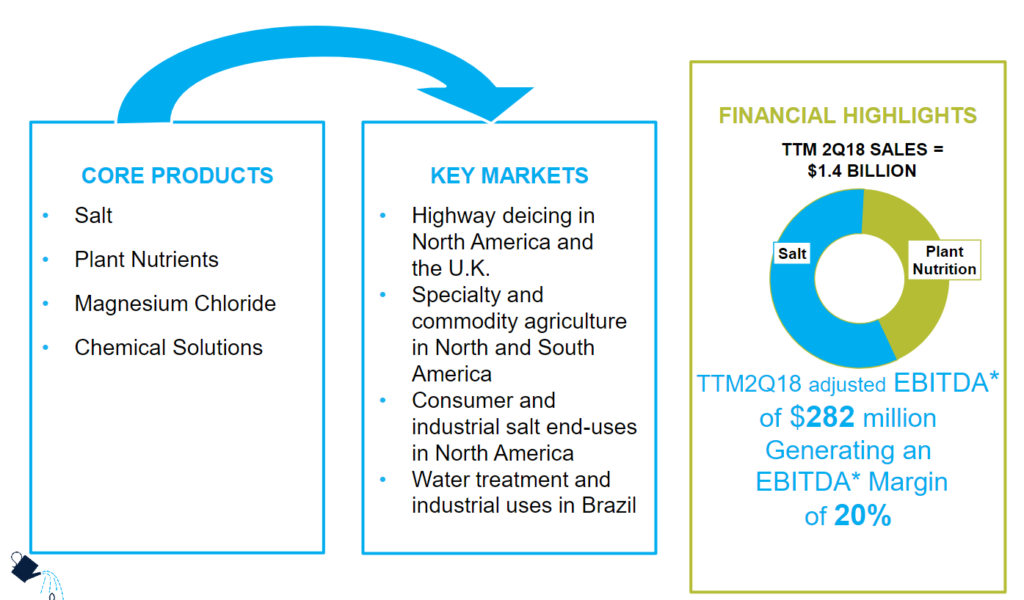

- CMP business model revolves around keeping people safe (de-icing, water treatment), ensuring food growth (crops and nutriments), and culinary/commercial food salt.

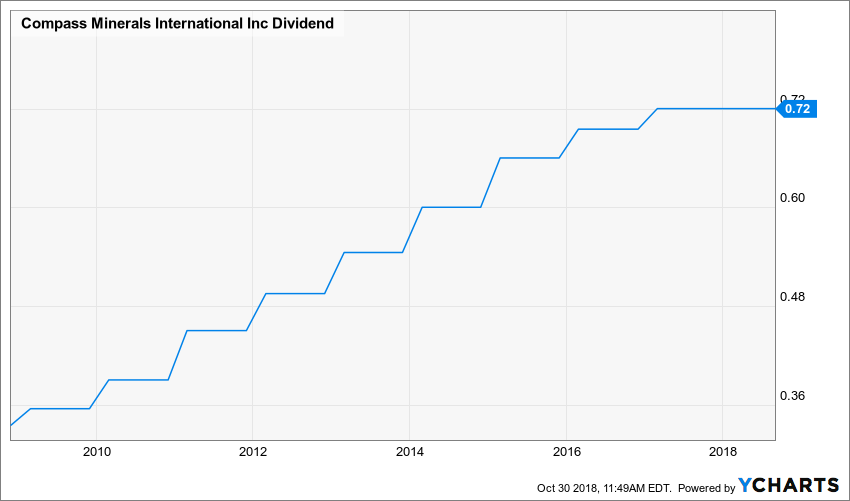

- CMP is part of the dividend achievers, but this may stop shortly.

- Management focuses on growing the business through both organic and acquisitions venues.

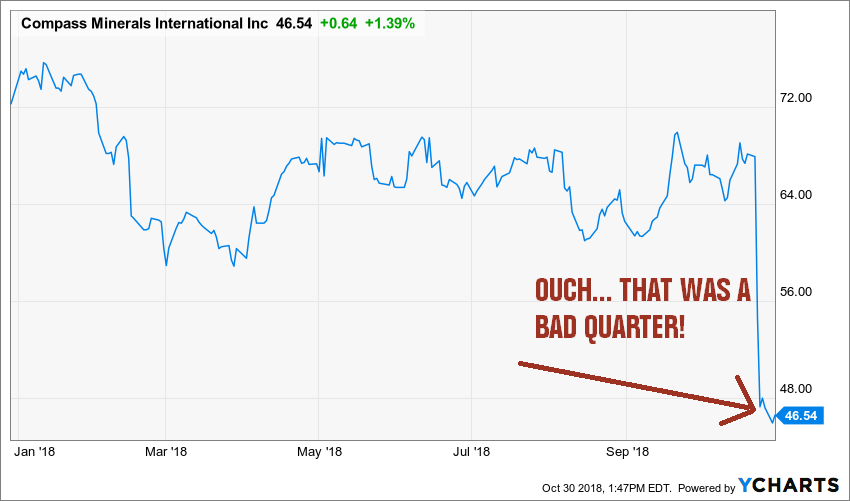

Not too long ago, Compass Minerals (CMP) reported their latest quarter. It had a bomb effect… but not in a good way. In fact, poor mining operation results from their gold salt mine in Ontario tinted the whole quarter. Analysts were quick to drop the ball on this dividend achiever. Let’s dig into the mine to see if it’s worth picking this falling knife…

Source: Ycharts

Business Model

Compass Minerals International Inc’ origins go back to 1844, but its IPO happened in 2003 after several mergers & acquisitions. CMP is associated with the mining industry. It is part of the dividend paying basic material stocks you can find on the market. With a yield now over 6%, this may attract attention of income seeking investors.

It produces minerals, including salt, sulfate of potash, specialty fertilizer, and magnesium chloride. CMP also provides secures records storage in a retired mine in the U.K. Products from Compass Minerals serve a variety of applications in industrial, agricultural, commercial, and consumer markets.

Source: CMP investors presentation

Growth Vectors

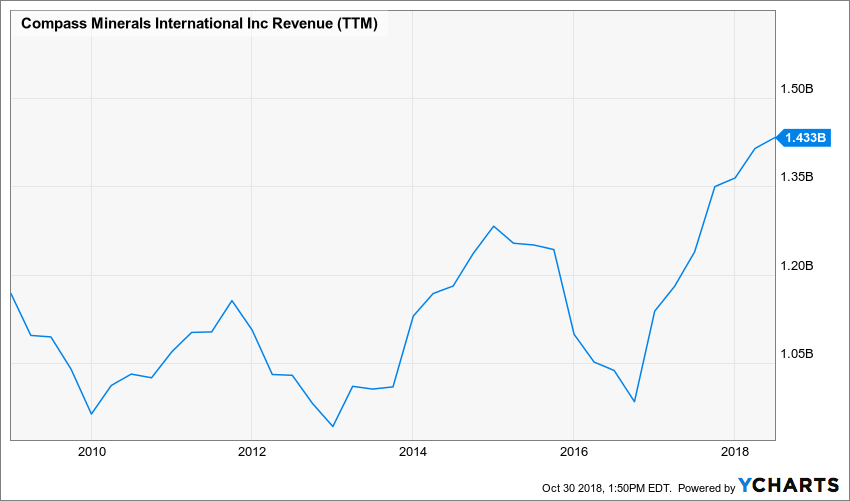

Source: Ycharts

CMP’s main growth vector is demography. With having more people on this planet and having them living longer make greater need for food. Salt and other minerals can be used for various needs around the food industry. The company continuously invest in technology and plants to increase their production capacity in order to meet this growing demand.

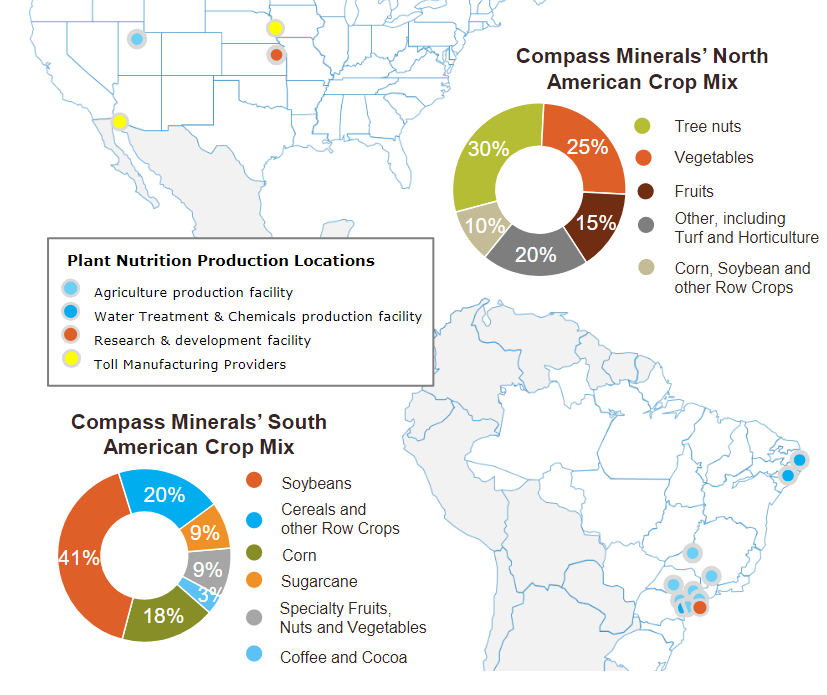

Finally, the company crop product offering is well diversified and targets popular and growing crop such as soybeans. Its presence in South America ensures strong agriculture fundamentals going forward. CMP expect natural price increases across its various segments.

Source: CMP investors presentation

Potential Risks

As we all agree that winter comes back each year, climate changing may affect one of CMP most stable business segment. With global warming, winter in the U.S. and Canada may not be as cold in the upcoming years. Also, CMP share price dropped in October 2018 due to Goderich mine operational issues. Management says its under control, but analysts penalized this bad news severely. This has to be monitored closely in the upcoming quarter.

Dividend Growth Perspective

So far, CMP is still part of the dividend achievers, but things are about to change now. Dividend achievers must show at least 10 consecutive years with a dividend increase. CMP shows 14 years as of October 2018, But we have a feeling this is about to change shortly.

Unfortunately, management has other priorities than raising its dividend going forward. CMP focuses on investing in their existing business (plants, R&D, production etc) and keep cash for potential acquisitions. Then, CMP targets debt repayment along with credit rating improvement. If there is anything left after all this, shareholders may receive a pay check raise. We can’t exactly talk about a dividend growth policy here. The dividend is safe, but we are not convinced by its future growth potential.

Unfortunately, management has other priorities than raising its dividend going forward. CMP focuses on investing in their existing business (plants, R&D, production etc) and keep cash for potential acquisitions. Then, CMP targets debt repayment along with credit rating improvement. If there is anything left after all this, shareholders may receive a pay check raise. We can’t exactly talk about a dividend growth policy here. The dividend is safe, but we are not convinced by its future growth potential.

CMP barely meets our 7 dividend growth investing principles.

Valuation

We first looked at the 10 year PE history to see at which multiple the market usually pays for CMP shares. We can see from this graph that even after the price drop, there is not a clear bargain here:

Source: Ycharts

Then, we used a dividend discount model with two dividend growth rates. We were quite conservative in our approach considering the company hasn’t rose its dividend in 2018 yet. We were actually pleased to see that as a dividend paying machine, CMP may be worth your money:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $2.88 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 4.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $66.46 | $55.54 | $47.74 | |

| 10% Premium | $60.92 | $50.91 | $43.76 | |

| Intrinsic Value | $55.38 | $46.29 | $39.78 | |

| 10% Discount | $49.84 | $41.66 | $35.80 | |

| 20% Discount | $44.30 | $37.03 | $31.83 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Considering the stock now offers a 6% yield and that the business is relatively safe, we think a good entry point could be under $50. However, we would like to see the next quarter before calling the deal. If the company still has problems with their rock salt mine, future dividends and valuation may be affected.

Final Thoughts

Compass Minerals enjoys a strong position in many markets due to its portfolio of cost-advantaged assets. For example, Goderich rock salt mine in Ontario offers lots of potential on top of having access to a deep-water port. This enables CMP to ship de-icing salt to most of its customers at a very cheap price. Highway de-icing is a very stable business as you can count on winter to keep coming back each year. As demand grows, commodity price for this business continues to rise. Demand for industrial and commercial salt will remain strong in the future which enables great price stability for CMP.

As the stock recently fell, it seems a good opportunity to get you hand on a strong dividend payer. Let’s hope management finds a few pennies in the corner of the room to provide shareholders with minimal dividend growth going forward.

If you made it this far, let’s be honest; you liked what you read. Now it’s time to make sure you don’t miss our next analysis and you subscribe to the Dividend Monk Newsletter by clicking on this link to make sure you don’t.

Disclaimer: We do no hold shares of CMP in our Dividend Stocks Rock portfolios.

Leave a Reply