Summary

Chevron (CVX) is a leading energy company involved in crude oil, natural gas, and other energy production.

-Five year revenue growth: erratic/flat

-Five year earnings growth: 7.7%

-Five year dividend growth: 10%

-Current dividend yield: 2.96%

-Balance Sheet: Very Strong

I consider Chevron a reasonable investment at the current valuation, but would only invest with conservative predictions about oil prices.

Overview

Founded in 1879, Chevron (NYSE: CVX) is currently one of the largest oil and gas companies in the world.

In 2010, Chevron reported a net production of 1.923 million barrels of crude oil and natural gas liquids per day, and 5.040 billion cubic feet of natural gas per day. The proved reserves within the consolidated companies are 4.270 billion barrels of crude oil and natural gas liquids, and 20.755 trillion cubic feet of natural gas.

Businesses

Chevron is divided into a number of different businesses. Some of them are directly profitable while others are supplementary to meeting Chevron’s needs.

As a breakdown for total 2010 earnings of $19.024 billion, $17.677 billion came from upstream projects (exploration, production), $2.478 billion came from downstream projects (refining, marketing, transportation), and ($1.131 billion) was attributable to all other sources. Even among supermajor oil companies, Chevron is particularly focused on upstream projects and therefore is most directly linked to the price of these resources.

Oil Exploration

Chevron extracts oil from locations around the world, including from deepwater wells in the Gulf of Mexico and off of other coasts such as Brazil, from offshore wells in Europe and other locations, and on land from California, Africa, Kazakhstan, and other places.

Natural Gas Exploration

Chevron’s natural gas portfolio stretches across six continents. Chevron has the ability to transport natural gas from production locations to user locations by means of pipelines, liquefied natural gas (LNG), and gas-to-liquid (GTL) technology.

Refining

Chevron has the capability to turn its basic produced resources into finished materials ready for use. Seven refineries make up three-quarters of Chevron’s total fuel refining capability.

Supply and Trading

Chevron’s requirements to get materials from upstream projects to downstream projects is huge. Chevron has to develop and maintain logistics and partners to get products to where they need to be safely and for a low cost. For instance, Chevron markets aviation fuel at more than 875 airports and is the leading marketer of jet fuels in the US.

Marketing

Chevron operates the three brands of Chevron, Texaco, and Caltex to drivers across the world.

Pipelines

Chevron operates and invests in pipelines around the world. Significant projects are located in North America, Asia, and Africa.

Lubricants

Chevron markets lubricants on six continents.

Shipping

Headquarted in California, Chevron Shipping commissioned their first ship in 1895 and now ships crude oil, liquefied gas, and refined products to customers globally.

Chemicals

Chevron’s chemical products are incredibly diverse, with uses in food packaging, electronics, to medicine.

Mining

Chevron operates three coal mines and a Molybdenum mine in the US.

Power

In addition to producing resources for power generation, Chevron directly generates a fair amount of power. Much of the power is derived from natural gas, while some is from wind. Chevron is the largest producer of geothermal energy in the world, with generation of 1,273 megawatts.

Technology

Chevron invests in emerging energy opportunities including solar projects, hydrogen projects, and bio-fuels products.

Revenue, Earnings, Cash Flow, and Metrics

Chevron’s growth was strong until 2009 when the effects from the global recession took a significant chunk out of the revenues and profits of all big oil companies. Oil prices have since rebounded, and Chevron’s earnings have rebounded as well.

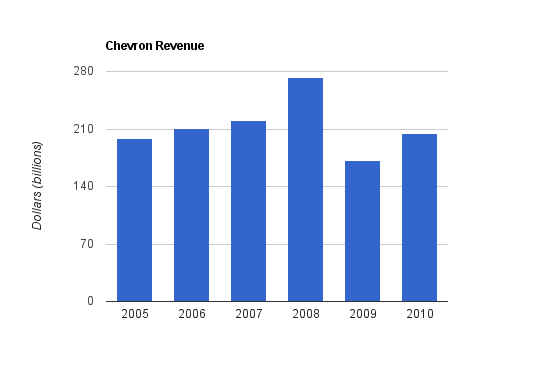

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $204.9 billion |

| 2009 | $171.6 billion |

| 2008 | $273.0 billion |

| 2007 | $220.9 billion |

| 2006 | $210.1 billion |

| 2005 | $198.2 billion |

Revenue growth has been practically non-existent over this five year period, which included a large spike in oil prices followed by the financial crisis and global recession. Revenue over the past 12 months is up to $233 billion due to increased oil prices and improved refining operations.

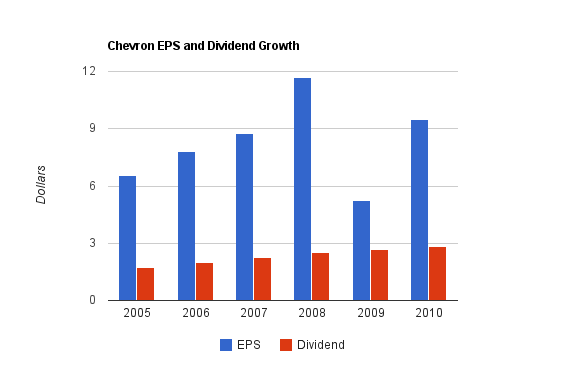

Earnings Growth

| Year | EPS |

|---|---|

| 2010 | $9.48 |

| 2009 | $5.24 |

| 2008 | $11.67 |

| 2007 | $8.77 |

| 2006 | $7.80 |

| 2005 | $6.54 |

Earnings have increased at a rate of 7.7% per year over this period. Over the trailing twelve month period, earnings are up to $11.45, which is a more than 20% increase over 2010.

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $31.4 billion |

| 2009 | $19.4 billion |

| 2008 | $29.6 billion |

| 2007 | $25.0 billion |

| 2006 | $24.3 billion |

| 2005 | $20.1 billion |

Cash flow growth has averaged over 9% annual growth over this period, although like revenue and EPS, the numbers have been erratic. Free cash flow is significantly lower than net income in a given year. For example, in 2010, FCF was only around $13 billion compared to more than $19 billion in net income.

Metrics

Price to Earnings: 9.5

Price to Book: 1.9

Return on Equity: 21%

Dividends

Chevron has increased its dividend every year for more than two decades, and currently offers a 2.96% dividend yield with a payout ratio of under 30%. As far as dividend stocks go, Chevron is among the more reliable ones.

Dividend Growth

| Year | Dividend |

|---|---|

| 2010 | $2.84 |

| 2009 | $2.66 |

| 2008 | $2.53 |

| 2007 | $2.26 |

| 2006 | $2.01 |

| 2005 | $1.75 |

Chevron has grown its dividend by an average of 10% annually over this five-year time period.

In 2011, the company increased its quarterly payout from $0.72 to $0.78, and then in an atypical move, increased the dividend again after only two quarters to $0.81 per quarter.

Balance Sheet

Chevron has one of the strongest balance sheets among its peers with a total debt/equity ratio of only 0.10. The interest coverage ratio is very high, and goodwill is a negligible portion of the balance sheet.

Investment Thesis

When I published my last analysis of Chevron a year ago, the stock was in the low $80’s and I proposed that it was a good value. Now that the stock is nearly $110, I consider it to still be a reasonable investment, but not quite as appealing as it was a year ago. I no longer believe there is considerable upside in oil prices and economic improvement, so growth may no longer be boosted by rising oil prices, or at least not to the extent that they were last year.

Chevron has the strongest balance sheet in an industry primarily composed of strong balance sheets. Debt ratios are superior to its peers. Meanwhile, its valuation is fairly low in an industry full of fairly low valuations. It trades for a mild discount to XOM, which is likely due to earnings having greater volatility. Oil companies have historically had rather low valuations.

Chevron, like many of the above supermajors, has been continually growing its base of assets in spite of a problematic economy and low energy prices. The following chart shows the approximate growth in assets, liabilities, and consequently, equity.

Expansion

| Year | Total Assets | Total Liabilities | Shareholder Equity |

|---|---|---|---|

| Current | $201.717 billion | $86.064 billion | $115.653 billion |

| 2010 | $171.7 billion | $72.1 billion | $99.6 billion |

| 2009 | $164.6 billion | $72.7 billion | $91.9 billion |

| 2008 | $161.1 billion | $74.5 billion | $86.6 billion |

| 2007 | $148.8 billion | $71.7 billion | $77.1 billion |

| 2006 | $132.6 billion | $63.7 billion | $68.9 billion |

| 2005 | $125.8 billion | $63.1 billion | $62.7 billion |

Shareholder Equity has grown by an average of over 10% annually over this period.

Liquid Natural Gas (LNG) plays a big role in Chevron’s business. Natural gas uses up a lot of volume per unit of energy, and this is acceptable for pipelines, but to transport it to places without pipeline access is not cost effective. Chevron and other companies can now compress it into liquid form, ship it anywhere they want via specialized insulated ships, and then return it to its gas form on arrival.

Energy companies like Chevron face a changing world. Their proven energy reserves are huge, but finite, and increasing environmental concerns and backlash, along with increasingly cost-efficient alternative energy solutions are significant trends to be aware of.

The company has several major projects and new energy findings. The full array can be read on Chevron’s site, but the most notable one to mention is the Gorgon Project, Chevron’s enormous LNG project which is expected to begin producing in 2014. This is a joint venture, of which Chevron is the project lead and holds the largest stake. The gas fields are estimated to contain 40 trillion cubic feet of natural gas, and the project lifetime is expected to last 50 years or so.

Risks

Every company has risks, and big oil companies certainly have their fair share of them. Chevron faces uncertainty in terms of currencies, geopolitics, litigation, and regulation. Litigation is an ever-present risk due to the large scale that a company like Chevron operates at and the drastic effect they have, some for better and some for worse, on communities around the world. I’ve personally known people from several countries that have described first hand the kind of damage the world’s insatiable desire for energy has caused their communities.

The primary risk is that of changing oil prices, which are outside of Chevron’s control and have the largest impact on their profitability. In addition, with rapid increases in the development and deployment of alternative energy sources as time unfolds, Chevron will have to continually invest in the most profitable energy production to remain competitive, and stay nimble despite its gargantuan size. BP reminded investors of yet another risk that is always present in this type of company: catastrophic failures. Chevron engages in deep-sea drilling, which is expensive and difficult technically to do successfully.

Conclusion and Valuation

In conclusion, I am neutral towards CVX stock at the current price of around $110, and I am holding my position. I expect the company to increase profitability over a fairly long period, to continue to increase shareholder equity and quarterly dividends, but not to the extent that it did last year. Although the valuation, with a P/E of under 10 looks attractive, when oil prices are fairly high, there’s the possibility of considerable downside if the world economy were to significantly decline.

If the stock valuation were to decrease, and the dividend yield were to increase to over 3.25%, I’d be potentially interested in purchasing more shares.

Full Disclosure: I own shares of CVX and XOM.

You can see my portfolio here.

Further reading:

Compass Minerals International (CMP) Dividend Stock Analysis

McDonald’s (MCD) Dividend Stock Analysis

Medtronic (MDT) Dividend Stock Analysis

Aflac (AFL) Dividend Stock Analysis

Walmart (WMT) Dividend Stock Analysis

Good post. I prefer Exxon based on bigger size, better FCF and more focused on core operations (seem to invest less then other majors in alternative energy).

I like to base PE on multiple years for cyklicals. Based on five-year average EPS Chevrons PE is 12.

Rather than emphasize the price cycles of a stock, the company