Summary

#1 Revenue increases, but not earnings.

#2 CAH is looking outside its business model to find growth.

#3 The company remains a leader in its market and a Dividend Aristocrat

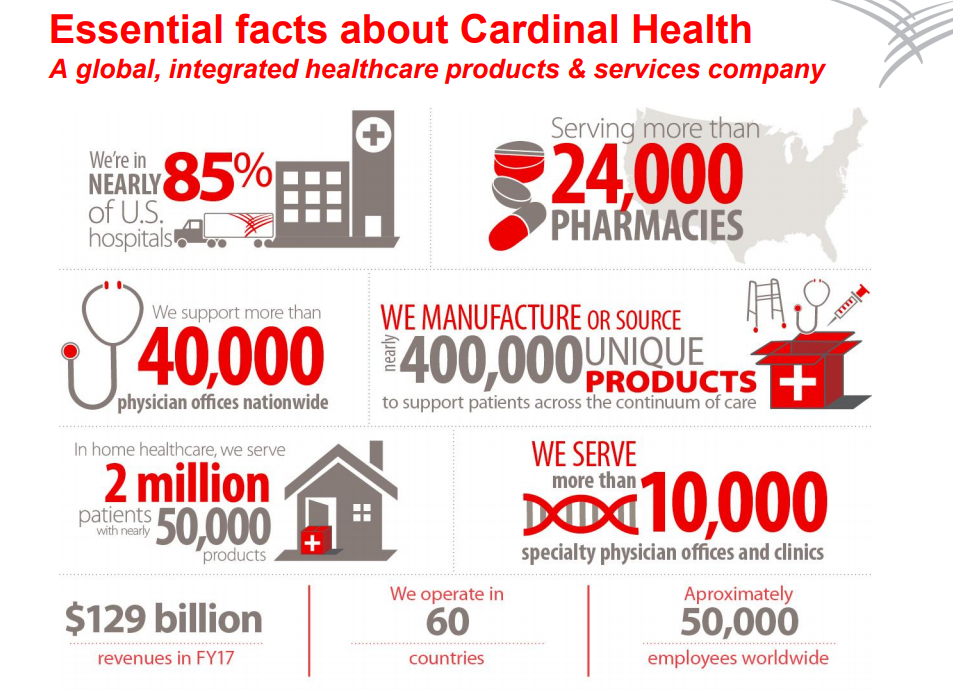

What Makes Cardinal Health (CAH) a Good Business?

Cardinal Health is one of the three leaders in pharmaceutical distribution with AmerisourceBergen (ABC) and Mckesson (MCK). CAH operates under 2 business segments; the Pharmaceutical segment (89% of revenue) distributes branded and generic pharmaceutical, specialty pharmaceutical, over-the-counter healthcare and consumer products and the Medical segment (11% of revenue) distributes a range of medical, surgical and laboratory products, and provides services to hospitals, ambulatory surgery centers, clinical laboratories, and other healthcare providers. CAH operates in 60 countries and is a key player in the healthcare industry.

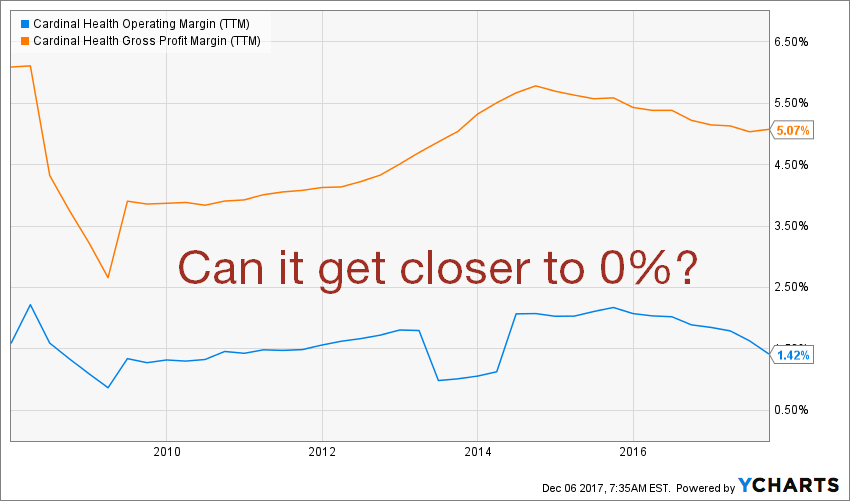

However, this industry is hit by a serious decrease in drug pricing. In a world where margins are already close to 0, the whole business model is put to a serious test.

Source: Ycharts

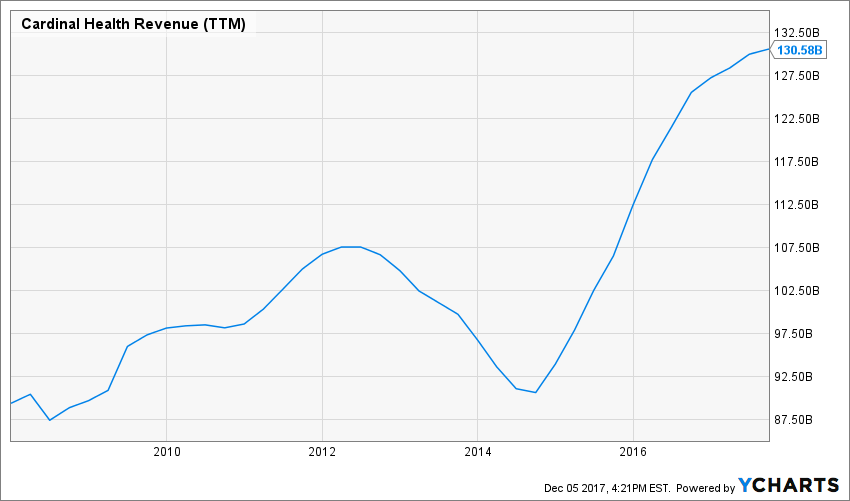

Revenue

Revenue Graph from Ycharts

Cardinal Health benefits from a natural growth coming from the current demographic situation. As the population is aging and insurance covering is increasing, there are more drugs to be distributed across the healthcare network.

The rise of speciality drugs also acts as a growth vector. CAH has combined its generic sourcing operation in a partnership with CVS Health (CVS). I expect CAH revenue to continue growing for another decade as the population ages.

How CAH fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yields here). The reason is simple. When a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly comes with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

CAH has been flying under the radar of many income seekers as it offered a yield under 2% during a good part of the past decade. The recent shift in the industry (cost of generic drugs dropping on price pressure), pushed the stock down by 32% since January 1st, 2016 (as of December 6th). This had the opposite effect of boosting CAH yield over 3%. Yet, keep in mind there is a good reason why the stock is dropping. I’ll get back to it in a moment.

CAH meets my 1st investing principle.

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

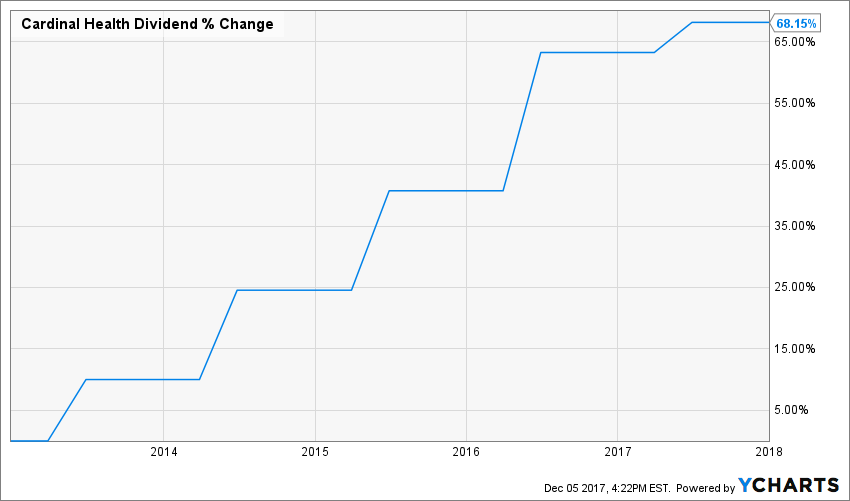

Source: Ycharts

Cardinal Health is part of the elite group of Dividend Aristocrats (25 years + with dividend increases) with 32 consecutive increases. While the past 5 years dividend growth rate is quite impressive (10.95 CAGR), the company only raised it by 3% in 2017. This is a situation that doesn’t worry me for now, but is a good reason to put CAH on the watch list.

CAH meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. This is why it is important to find companies that will be able to sustain their dividend growth.

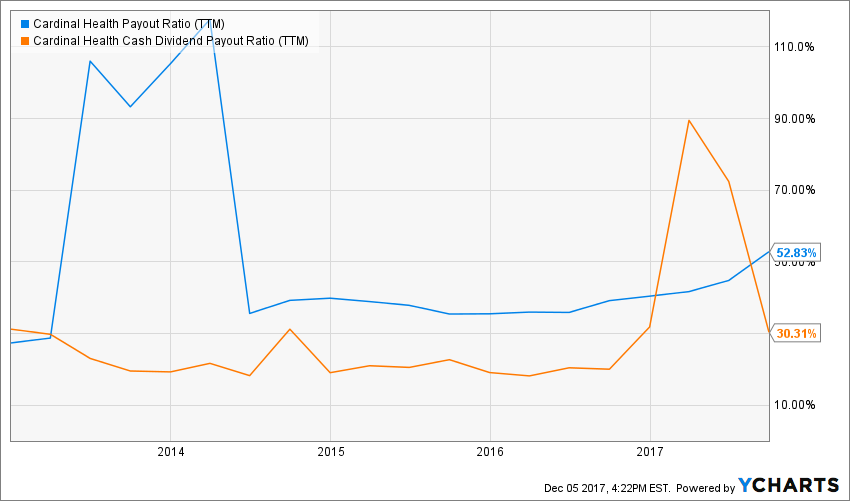

Source: data from Ycharts.

While CAH’s dividend growth has slowed down in 2017, the dividend is far from threatened. With a payout ratio around 50% and a cash payout ratio of 30%, shareholders can expect CAH to maintain its dividend raise streak for many years to come.

CAH meets my 3rd investing principle.

Principle #4: The Business Model Ensures Future Growth

CAH occupies a crucial role in the pharmaceutical business. It is a key element of the healthcare industry. Pharmaceutical wholesalers have built a solid fence around their business model. Thanks to their efficient network and their buying capacity, it is nearly impossible for new competitors to enter this market. ABC, MCK, and CAH dominate this market now and will continue to do so in the future.

This is how each company can generate sustainable earnings and cash flow regardless of their thin margins. We are in a volume game here and no other players are invited to the table.

In order to pursue additional growth, management decided to look outside their pharmaceutical distribution business. CAH recently acquired Medtronic’s Patient Care, Deep Vein Thrombosis, and Nutritional Insufficiency business for $6.1 billion. I am not convinced CAH should take away its focus from pharmaceutical to improve its medical segment revenue. However, if it succeeds, it will definitely be a growth vector for years to come. It’s just that razor-thin industries don’t allow much room for mistakes.

CAH still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

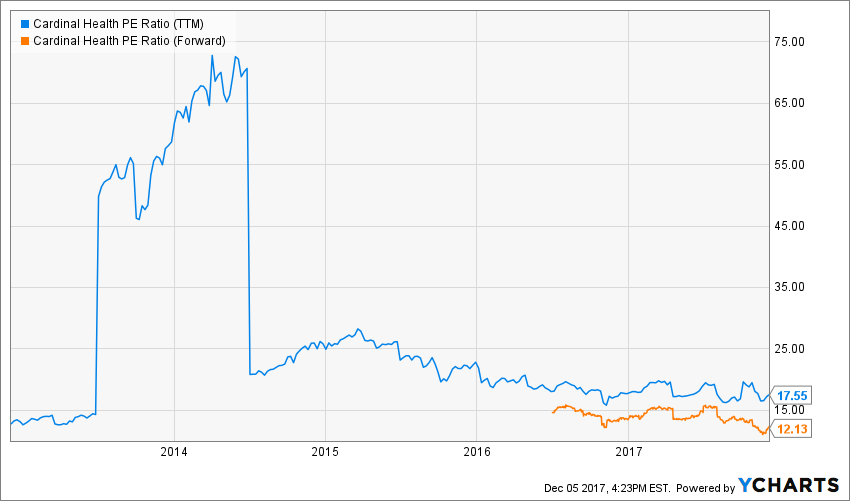

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Considering the overall market, I’d say that a 17.5 PE ratio and a forward PE of 12 looks like a decent deal for me. Now, it’s more a matter of knowing if the market sees something we don’t.

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I see companies like big money making machine and assess their value as such. I decided to go “rough” and use a 5% dividend growth rate for the upcoming 10 years and a 6% afterward. Here are the details of my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.85 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $107.83 | $72.13 | $54.28 | |

| 10% Premium | $98.84 | $66.12 | $49.75 | |

| Intrinsic Value | $89.86 | $60.11 | $45.23 | |

| 10% Discount | $80.87 | $54.10 | $40.71 | |

| 20% Discount | $71.88 | $48.09 | $36.18 | |

Source: how to use the Dividend Discount Model

In the light of my calculation, it appears that CAH trades at fair value. If I had used the past 5 years CAGR, we would have gotten a nice bargain. However, I would rather look toward the future than look back.

CAH meet my 5th investing principle and currently trades at fair value.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective, rule to overcome my emotions when it is time to pull the trigger. My investment decisions are motivated by whether the company confirms my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

Investing in CAH is picking up a stock that has been hit hard during a bullish market. My take on this year is that investors get greedy and look for immediate results. Since CAH is more a long term type of holding and will reward shareholders over the long run, it doesn’t fit the “quick rich trade” many search for in the market. Since CAH is a dominant player in a key sector in the healthcare industry, I don’t see any reason to worry about the dividend payment or future cash flow generation.

I think many downsides have been factored in the price as of now. The market is well aware of the generic price pressure all wholesalers must face. This situation confirms that margins will remain at a minimum for years and earnings growth will be difficult. CAH will have to show other growth vectors at some point in time if it wants to continue raising its dividend.

CAH shows a solid investment thesis and meets my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Cardinal Health evolves in an oligopoly where there is a natural growth coming from the current demographic. However, don’t expect any distributors in any business to come with a major breakthrough that will make their business model explode. For this reason, CAH is a solid dividend payer, but definitely not a growth oriented company.

CAH is a core holding.

Final Thoughts on CAH – Buy, Hold or Sell?

There are lots of changes going around the healthcare industry. Companies like ABC, MCK and CAH are not the only one affected. Pharmacy such as Walgreens Boots Alliance (WBA) and CVS Health (CVS) also have to manage throughout this evolving industry. At the moment, I’m not convinced CAH is a buy. It looks undervalued, but the growth vectors are not obvious enough to become a screaming buy either.

Disclaimer: I do not hold CAH in my DividendStocksRock portfolios.

Great write-up.

I think CAH is a good buy right now, especially for long-term holders.

Might not be a screaming “buy” but perhaps a loud talker “buy” :)

All the uncertainty around healthcare has made some good companies available at good prices.

Hello Nick,

You are right, there are lots of uncertainties around the healthcare industry. What bugs me is the razor thin margins. I’m having a hard time finding such industry attracting. Still, if there are opportunities in this market, they are in the healthcare industry!

Cheers,

Mike