A stock that remains on my buy list for November is Nike (NKE). I consider Nike a core holding, because it meets all my investment requirements and it’s a stock that I would hold for a long time, while reviewing it quarterly for good measure. Here’ why.

Nike is a leader in that it sells one of the world’s most iconic brand; it has growth potential in part due to its great exposure to emerging markets such as China; and it has raised its dividend each year since 2003.

Nike is a leader in that it sells one of the world’s most iconic brand; it has growth potential in part due to its great exposure to emerging markets such as China; and it has raised its dividend each year since 2003.

Nike pleased investors during their latest investors’ call on September 29. It expects Q2 revenue growth to be up slightly compared to last year. Despite higher product input costs, NKE anticipates its gross margins will grow approximately 100 basis points from a year ago, reflecting benefits from strategic pricing, improved markdowns, and lower ocean freight rates.

Consecutive quarters of double-digit growth, healthy inventory, and sequential improvement in sales are expected to help NKE begin to move back to higher profitability in China.

Want more great stock ideas? Download our Rock Star list, updated monthly!

Nike Business Model

NIKE designs, markets, and distributes athletic footwear, apparel, equipment and accessories and services for sports and fitness activities. The company operates in North America; Europe, Middle East & Africa (EMEA); Greater China; and Asia Pacific & Latin America (APLA).

It sells a line of equipment and accessories under the NIKE Brand name, including eyewear, timepieces, digital devices, protective equipment, and more. NKE also designs products specifically for the Jordan Brand and Converse. The Jordan Brand designs, distributes and licenses athletic and casual footwear, apparel and accessories predominantly focused on basketball performance and culture using the Jumpman trademark. The Company also designs, distributes, and licenses goods under the Chuck Taylor, All Star, One Star, Star Chevron, and Jack Purcell trademarks.

It sells a line of equipment and accessories under the NIKE Brand name, including eyewear, timepieces, digital devices, protective equipment, and more. NKE also designs products specifically for the Jordan Brand and Converse. The Jordan Brand designs, distributes and licenses athletic and casual footwear, apparel and accessories predominantly focused on basketball performance and culture using the Jumpman trademark. The Company also designs, distributes, and licenses goods under the Chuck Taylor, All Star, One Star, Star Chevron, and Jack Purcell trademarks.

Nike Investment Thesis

Based on brand recognition and brilliant marketing, Nike’s business model is solid. The company enjoys pricing power and a loyal customer base. As some retailers are struggling, they may rely on strong brands such as Nike to keep traffic high in their stores.

NIKE is well-positioned to expand its business in China; this will be its main growth vector for the coming years. The company continues to lead in active footwear and apparel across the globe. It has shifted its focus, like most apparel companies, to direct-to-consumer business to grow margins and improve consumer relationships. It is a super-powered dividend stock and is still very much a growth company.

Nike Last Quarter and Recent Activities

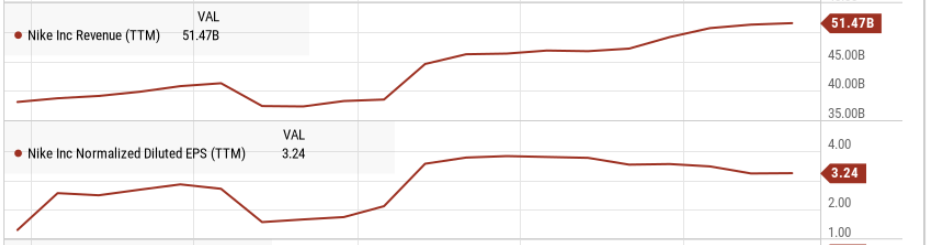

In early October, Nike reported an okay quarter, with revenue up 2% and EPS up 1%; results were partially offset by unfavorable currency translation. NIKE Direct revenues were $5.4B, up 6 % on a currency-neutral basis with growth across all regions. Digital sales were up 2% and wholesale revenue was up 1%, also on a constant currency basis. Good news, Nike decreased its inventory by 10%, down to $8.7B. Unfortunately, revenues for Converse were down 9% to $588M, due to a decline in North America, partially offset by growth in Asia. In the meantime, expenses grew by 5%, mostly driven by higher marketing spending (those shoes won’t sell by themselves!).

Get other stock ideas for all sectors. Download our Rock Star list, updated monthly!

Potential Risks for Nike

NKE is well-established around the world. While there are growth vectors coming from China and emerging markets, the North American and European markets might become stagnant. Ironically, the recent quarters have reported strong growth in North America. NKE has already suffered from store closures, and more recently supply chain issues in the US. We don’t think this will affect Nike’s brand power in the long run.

Nike is known for its affiliation with many stars in the sports industry; sponsorship has been a proven, although expensive, strategy. Finally, supply chain issues have been affecting NKE’s top line and most likely will continue doing so moving forward. We see inflationary pressure impacting NKE’s margin too as revenue increased, but EPS declined.

Dividend Growth Perspective for Nike

NIKE flies under the radar for many dividend growth investors because its yield has not been a stock highlight for the past seven years. However, the dividend payment has almost doubled over the past five years. Nike has been loyal to its shareholders with consecutive dividend increases since 2003. Sports apparel also generates repetitive sales leading to continuous cash flow generation. While management has been on a roll to buy back shares and significantly increase its distribution, both payout and cash payout ratios are well under control at under 50%. For more about payout ratios and interpreting them, see Use Payout Ratios Wisely.

Final Thoughts on this Buy List Stock

A company combining world-wide brand recognition, growth vectors, repeat customers, and a 20-year history of dividend increase is definitely worth a look. NKE’s recent stock price decline makes it an even more attractive. A good candidate for your stock buy list if you’re looking to invest in the consumer discretionary sector.

Leave a Reply