Summary

- BHP is a pure play in the basic materials sector.

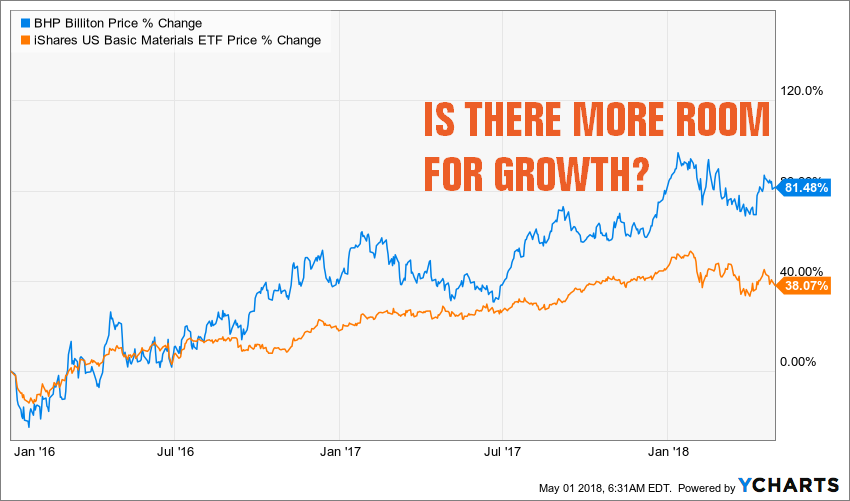

- Since 2016, BHP shares shows twice the ETF’s return.

- Is it time to forget the dividend cut and buy some shares?

As it is the case with the rest of the basic materials sector, BHP Billiton (BHP) saw a strong rebound after 2016. The mining company didn’t only see its shares outperforming the sector, BHP shares show twice the ETF’s return.

Source: Ycharts

Bolstered by strong demand in China and supported by various projects across the globe, BHP is growing full speed ahead. Is it too late to jump on this commodity train? Let’s take a deeper look.

Understanding the Business

BHP is a pure play in the basic materials sector. The company is one of the rare solid dividend payers in this sector due to its highly cyclical nature. You can download the complete list of dividend growing stocks in the basic material sector here.

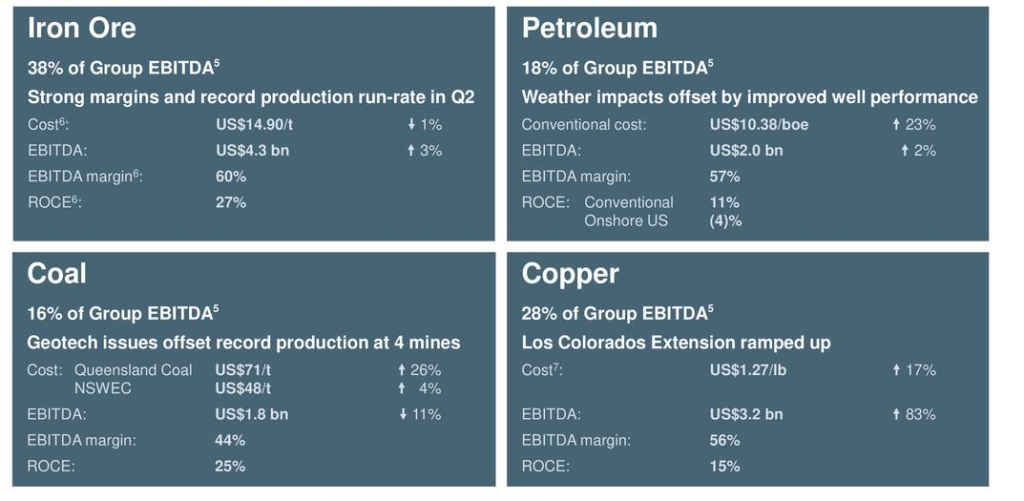

BHP is producing commodities, including iron ore, metallurgical and energy coal, conventional and unconventional oil and gas, copper, aluminium, manganese, uranium, nickel and silver.

Source: BHP Feb 2018 presentation

The company is the world’s largest mining conglomerate. This is a key element when the company hits a resource downturn cycle. Through its size, BHP has built a solid balance sheet and a well diversified asset portfolio going across different commodities across numerous countries.

Growth Vectors

Source: Ycharts

BHP enjoys low cost iron core exploitation in Australia which leads to natural business with China. While the golden years of the world’s second largest economy is behind it, China’s economy remains strong and continues to grow. The demand for iron and other materials will continue to be strong for many years to come. Since BHP owns several assets near this part of the world, it has an important advantage over its competitors.

Another strong advantage BHP has over many other commodities producers is its size. Being big in this industry means that you can offer different commodities coming from various countries. In other words; when it’s not going well in one part of the world (economic, politic, etc.), you can count on another part to support demand. This makes BHP less vulnerable to basic materials cyclical nature. This is also one of the reason why its stocks jumped by 80% over the past 18 months.

As it is often the case with the energy sector (you can download the energy dividend list here), the quality of a company’s assets portfolio managed is crucial for its profitability. BHP has built a large low-cost portfolio of various commodities. This enables the business to go through more challenging periods. Considering the long life of most assets, BHP will show low cost of productions for several years.

Dividend Growth Perspective

When you look at BHP’s dividend history, you realize you haven’t found the Klondike yet. As many companies in the basic material sectors, dividend cuts are often the easy options during cyclical downturns. BHP had to cut its dividend in 2016 following a difficult period in the commodities market. Therefore, we are far from considering BHP to be the next Dividend Achievers.

The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 266 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

With 2 consecutive years with a dividend increase and a yield of 4%+, is it the time to reconsider your investment? After all, the company is on its way to offer the same payout post-dividend cut.

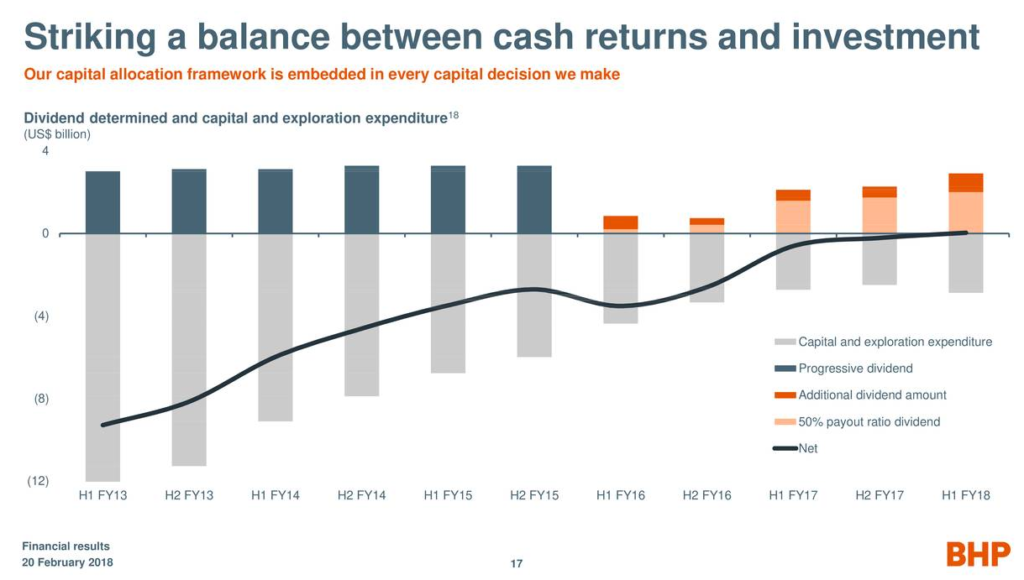

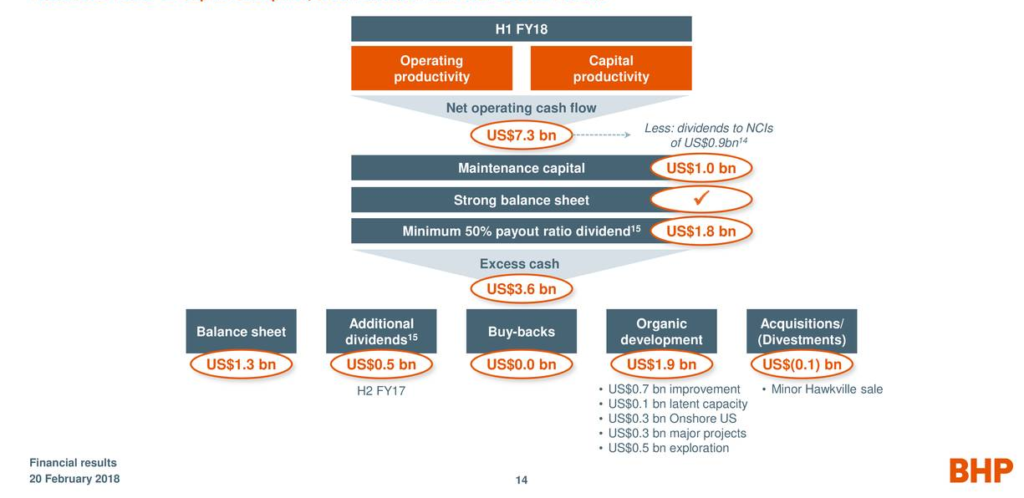

Source: BHP Feb 2018 presentation

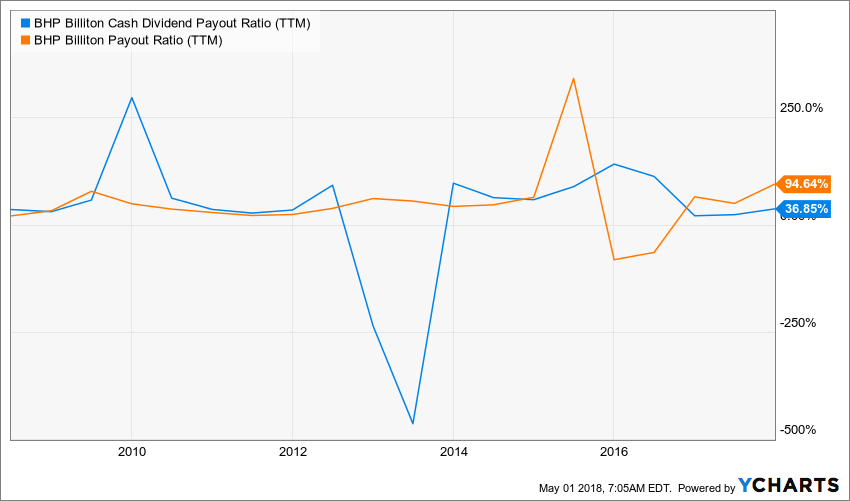

From BHP’s presentation, we can clearly see that the dividend cut was the consequences of several years of capital expenses hurting BHP short-term cash flow to build long-life assets. The company’s financial situation looks better now and the current payout ratio is under control:

Source: Ycharts

However, I would not hope for a strong dividend growth going forward the next decade. In fact, I think it would be safe to expect a low single-digit dividend growth rate as dividend cuts could happen later down the road.

Potential Downsides

It is difficult to predict where a company like BHP will stand in 10 years from now. Chances are that it will be well and generating money since BHP is strong enough to go through an economic recession. With its low costs assets, it can survive poor demand periods. However, it doesn’t mean its dividend can survive the same path.

What happened in China in the 2000’s will not likely never happen again. This should put additional pressure on commodity costs for decades to come. A major weakness that all basic materials companies show is their dependence to a highly cyclical demand. You may be the largest and most diversified mining company, but you are still waiting for others to ask for your product. The problem is that demand is extremely volatile from one year to another.

Finally, with such a ride on the stock market, investors wonder if there is still room for growth on the market for BHP…

Valuation

This leads us to the final part of this report: valuation. BHP’s PE ratio history is quite hectic (what a surprise!):

Source: Ycharts

This doesn’t help us much to determine its fair value. Digging deeper, I’ve used the dividend discount model. I’ve used a 4% growth rate for the first 10 years and reduced it to 3% afterwards. I rather be conservative than overly hyped with this kind of company.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $2.20 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 4.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 3.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $48.91 | $41.81 | $36.49 | |

| 10% Premium | $44.84 | $38.33 | $33.45 | |

| Intrinsic Value | $40.76 | $34.85 | $30.41 | |

| 10% Discount | $36.69 | $31.36 | $27.37 | |

| 20% Discount | $32.61 | $27.88 | $24.33 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

I had to use a 10% discount rate due to the volatility of BHP sector and the fact the board already cut its dividend not too long ago. It’s not really a surprise to see a dividend based valuation model finding poor value in BHP…

Final Thought

In the light of this analysis, I don’t think BHP is a bad company or a bad investment. However, as a dividend growth investor, I find little interest in investing my money in such hectic dividend payer. The yield is interesting at 4% and the payments are sustainable. I understand why an income seeking investor would want to look at BHP. But for my own portfolio, I will pass.

Disclaimer: I do not hold BHP in my DividendStocksRock portfolios.

Leave a Reply