In choppy markets, the appeal of a reliable, profit-churning bank becomes even clearer—and this underrated bank is built for this moment.

You won’t find any flashy tech or crypto hype here. Just old-school banking done right, with a modern twist: real estate lending, disciplined risk management, and a dividend that keeps climbing.

And if you’re a dividend investor? This one checks all the boxes.

The Foundation of Bank OZK: Lending with Structure and Strategy

Bank OZK isn’t your average regional bank. It’s a lean, focused lending machine with a serious specialty: commercial real estate (CRE). Through its Real Estate Specialties Group (RESG), OZK lends to major development projects in markets like New York City, Miami, and Dallas.

But the bank does more than just big buildings:

-

Consumer banking: Checking, savings, CDs, IRAs, and mortgages.

-

Personal loans: Auto, home equity, and lines of credit.

-

Treasury & wealth services: Business banking, trust and estate planning, and investment management.

-

Digital-first banking: Mobile and online platforms that are clean, efficient, and functional.

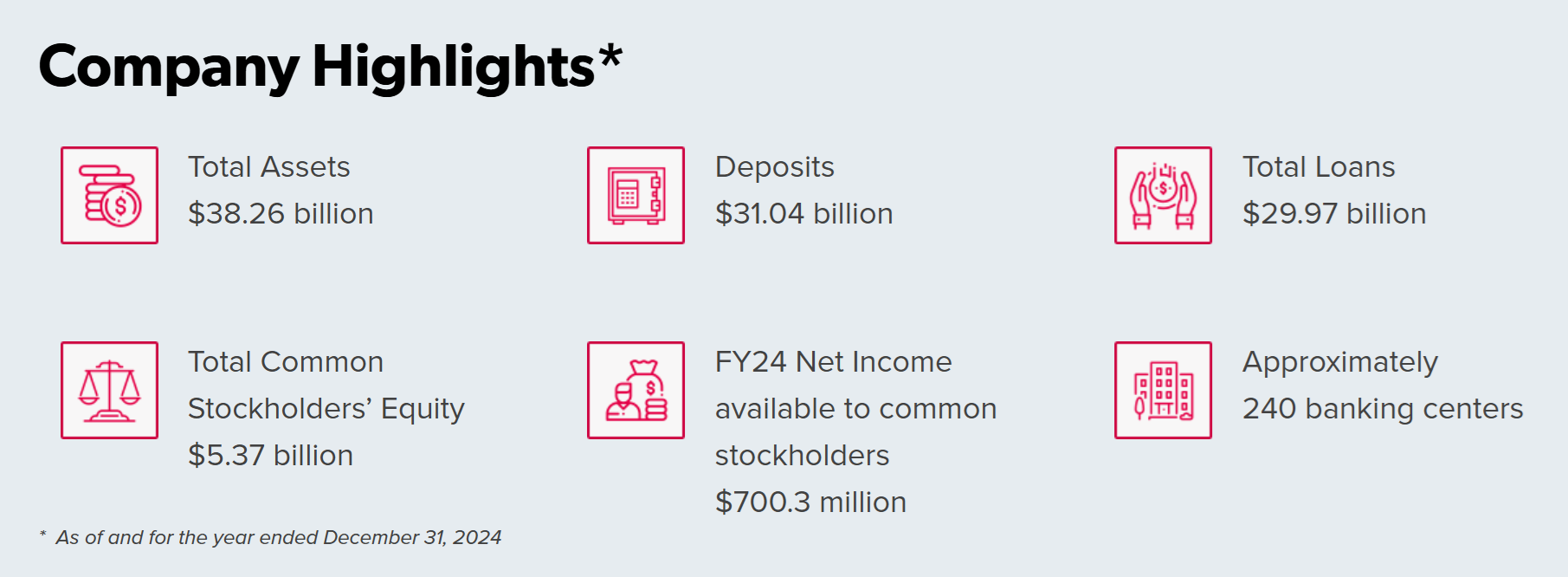

All this is operated through ~240 branches across eight states, with a growing footprint in the Southeast and urban hotbeds like New York and California.

Blueprints and Blind Spots: The Bull and Bear Case for Bank OZK

Bull Case: Disciplined Growth and Dividend Consistency

Why should Bank OZK be on your radar (and maybe in your dividend portfolio)?

Because this is a bank that knows exactly what it’s good at—and sticks to it. Its niche in commercial real estate lending has fueled consistent growth in both earnings and deposits. Their underwriting standards are considered among the most conservative in the industry, and that pays off when markets tighten.

Some key stats as of year-end 2024:

-

Loans: $29.97B (+13.3% YoY)

-

Deposits: $31.04B (+13.3% YoY)

-

EPS: $6.117 (TTM, up steadily over 5 years)

And the dividend? Always heading up.

Bank OZK recently raised it again, representing the 31st consecutive quarterly increase. That’s the kind of rhythm dividend investors love.

Bear Case: Risky Real Estate Exposure?

Let’s not sugarcoat it—concentration risk is real here.

OZK heavily relies on commercial real estate. In good times, this delivers strong returns. In downturns, it can sting. While the bank boasts excellent credit quality and low charge-offs, CRE defaults are lumpy and unpredictable.

The other risk: geographic concentration. A slowdown in NYC or Miami could put pressure on earnings.

Lastly, growth ceiling concerns are creeping in. With a focused business model and limited product expansion, OZK may need to acquire or diversify to fuel the next leg of growth.

The Big Picture of Creating a Sustainable Dividend Income at Retirement

Bank OZK is a perfect example of a reliable stock for retirees’ portfolios. But there’s more to it. You need a big picture.

This guide is for any investor who wants to create a sustainable income from his/her portfolio. It will be useful during your accumulation phase as you will avoid major mistakes and build a solid portfolio for your retirement. It will be even more useful if you are retired and count on your portfolio to pay the bills.

We all invest with the same goal: having our money working for us.

Building Momentum While Managing Risk

Bank OZK’s most recent quarterly results, reported in March 2025, highlight a business that continues to outperform expectations with quiet consistency.

Revenue grew 2% year-over-year, while earnings per share (EPS) climbed 4%, reflecting solid margin performance and disciplined expense control. For the full year, net interest income reached a record $1.53 billion—up 6.5% from 2023—thanks to sustained loan and deposit growth.

Credit quality remains strong, with provisions for credit losses dropping to $37.2 million and net charge-offs staying comfortably low.

On the shareholder side, OZK nudged its dividend higher again, now paying $0.43 per share.

Management has signaled continued confidence, forecasting growth in average earning assets and targeting new record highs in net interest income throughout 2025.

Dividend Triangle in Action: A Well-Cemented Growth Story

At Dividend Stocks Rock, we rely on the Dividend Triangle—growth in revenue, earnings, and dividends—to separate the wheat from the yield traps.

Here’s how Bank OZK holds up:

- Revenue: Climbed steadily with strong growth momentum in recent years, even through economic uncertainty.

- Earnings per Share (EPS): EPS has grown like a well-tended real estate portfolio. That’s nearly three times the level it was five years ago, supported by solid margins and disciplined lending.

- Dividend: Now at $0.43/share, with 30+ straight quarters of increases. Not sky-high in yield, but reliable and growing. The payout ratio remains conservative, leaving plenty of room for future hikes.

Steady as Concrete, Built for Dividends

Bank OZK isn’t a flashy fintech, but it doesn’t have to be.

It’s a fundamentally sound bank with a focused model, clean balance sheet, and a track record of sharing profits with shareholders. If you’re looking for a dividend stock that delivers consistent growth without the drama, this one deserves a spot on your watchlist.

Not exciting? Maybe not.

Reliable, growing, and shareholder-friendly? Absolutely.

Turn Your Portfolio into a Retirement Powerhouse

The Dividend Income for Life guide can help you build a resilient, income-generating portfolio designed to weather any market storm.

It will walk you through the proven Dividend Stocks Rock (DSR) methodology—focusing on quality, growth, and sustainability—to create a stream of dividend income you can count on for decades.

Whether in the accumulation phase or nearing retirement, this resource is your roadmap to financial confidence and freedom.

Leave a Reply