Summary

- Scana struggled with their nuclear plants and Dominion saw an opportunity.

- This is risky play as Dominion could burn lots of cash on Scana’s business.

- The stock is down, the yield is up, should you buy this dividend growth utility?

Understanding the Business

Dominion Resources changed its name in 2017 (was previously named Dominion Energy). It is one of US largest producers and transporters of energy, with a portfolio of approximately 25,700 megawatts of electric generation, 15,000 miles of natural gas transmission, gathering, storage and distribution pipeline and 6,600 miles of electric transmission and distribution lines.

Most importantly, the company has made a business shift from energy production to distribution over the past decade. It is still an important energy producer, but its distribution business is gradually increasing. D has built a predictable business model with 90% of its revenues coming from regulated operations.

Growth Vectors

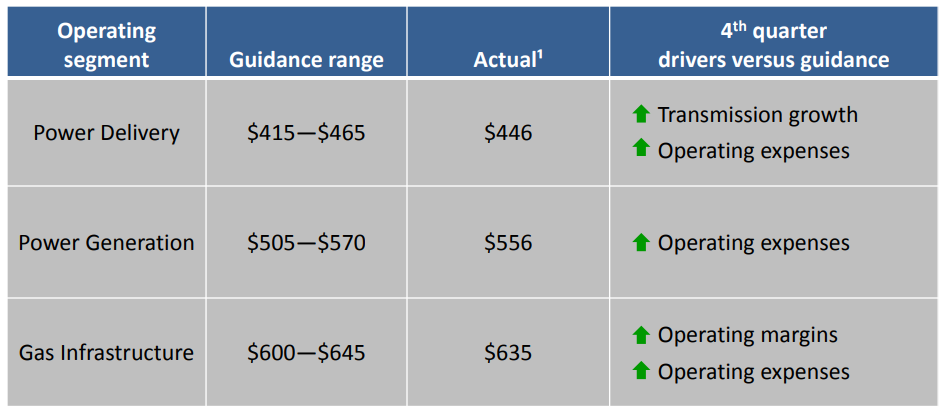

Source: Ycharts

Management expects a 6-8% EPS growth through 2020. This is some great perspectives coming from a stable and predictable business. D can count on various projects to sustain its growth in the upcoming years like Greensville Power Station (combined cycle plant, 73% completed), Cove Point Liquefaction (LNG production, 100% completed) and Atlantic Coast Pipeline.

As it is the case with many utilities, D counts mainly on new projects to generate additional growth. The recent Tax Reform will also give a hand to the EPS boost.

Finally, D has announced an all-stock merger with Scana energy (SCG) at the beginning of 2018. As Scana struggled with new nuclear plants construction and shares plummeted, Dominion saw an opportunity to grow its business. All stock merger will provide 0.669 shares of Dominion Energy for each share of SCANA Corp… in other words; there is a deal if you buy SCG now… unless the deal goes south! I’ll detail why it’s not so simple in the “potential downside” section of this article. Yes, it is THAT bad…

Dividend Growth Perspective

Dominion Resources shows 14 consecutive years with a dividend increase. This make it part of the elite Dividend Achievers list. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

Source: Ycharts

With the recent stock price drop, D’s yield is getting closer to 5%. This make it a very attractive play for income seeking investors. Management confirmed its intention to grow its dividend by 10% annually through 2020. Shareholders can expect a mid-single digit growth rate afterwards as management plans a 5% EPS growth rate post 2020. You will rarely find a stable company paying such growing payouts with an interesting yield. However, you will on have a chance to invest in such company if the deal with Scana doesn’t go sideways…

Potential Downsides

The deal with Scana is not that simple. Dominion tries to acquire a client base but wants off any liabilities Scana may have towards its customers. D is looking at buying a company at a cheap price, but this company has several lawsuits against it. It’s definitely not a slam dunk. Through this deal, Dominion also adds another $7 billion ($6.7) in debts. With rising interest rate, growing debts Telsa Style may not be the smartest moves.

Due to the complexity of this deal and uncertainties around it, I would wait until the situation is settled before making any investments.

Valuation

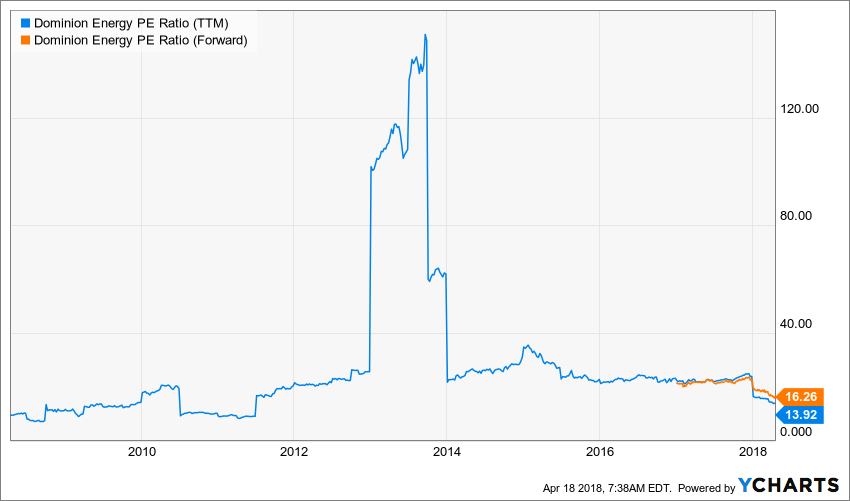

After the recent price drop, D seems like a bargain when you look at its PE ratio. The company hasn’t been trading at such good price for a while:

Source: Ycharts

When I used the DDM to determine D’s fair value, I realized that it was fairly priced before the merger announcement. The stock should trade around $88 and there is definitely a deal now.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $3.34 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $134.06 | $106.34 | $87.91 | |

| 10% Premium | $122.89 | $97.48 | $80.58 | |

| Intrinsic Value | $111.72 | $88.62 | $73.26 | |

| 10% Discount | $100.54 | $79.76 | $65.93 | |

| 20% Discount | $89.37 | $70.89 | $58.61 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

An interesting combination of a sector slump and uncertainties around the Scana merger has created an opportunity to investors. However, the price didn’t drop for nothing; the deal could turn sour and it could get worst for Dominion as well. There is no reward when there is no risk!

Final Thought

Dominion resources show a strong and predictable business model. With a steady investment of $3 billion per year in projects, management make sure to put enough growth on the table. Over the long run, Dominion seems a good investment, but expect additional volatility until the merger deal is closed or abandoned.

Disclaimer: I do not hold D in my DividendStocksRock portfolios.

Leave a Reply