Summary

- American Water Works operates a small monopoly and sells essential products.

- The water treatment business is highly fragmented.

- There are lots of room for dividend growth in the upcoming years.

What Makes American Water Works (AWK) a Good Business?

American Water Works sell the perfect product: water. This utility company provides regulated and market-based drinking water, wastewater services and other related services to an estimated 15 million people in 47 states and in Ontario, Canada. The best part of it, AWK still has lots of room for growth as its market is highly fragmented in the U.S.:

Source: AWK website

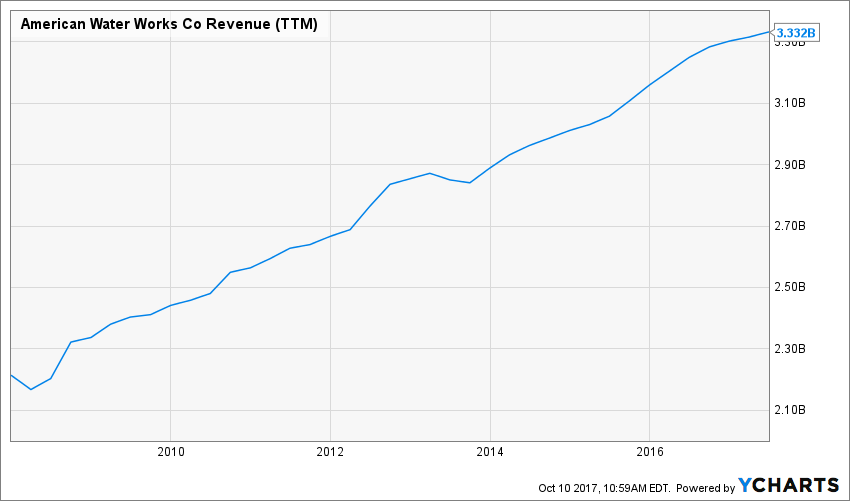

Revenue & Earnings

Revenue Graph from Y-charts

The company is on solid ground to keep up its growth in the upcoming years. Management aims at a 7-10% annualized EPS growth based on regular investments, regulated acquisitions and organic growth.

Source: Ycharts

How AWK fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

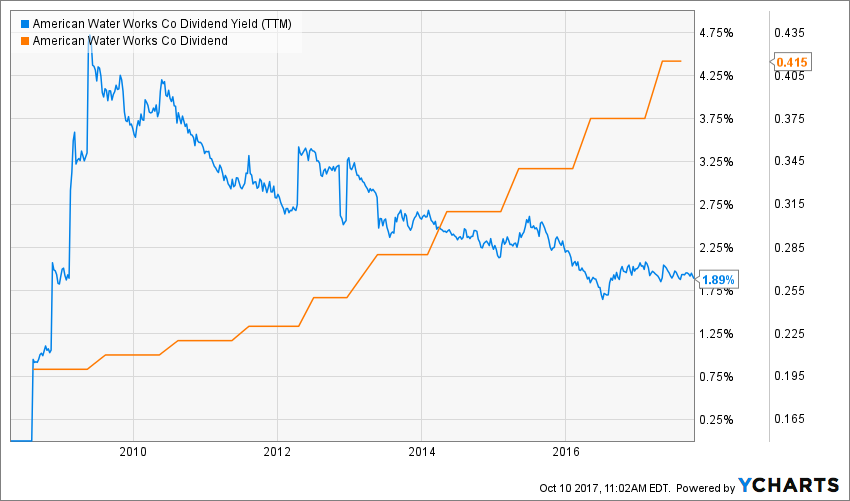

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investors’ rule: I try to avoid most companies with a dividend yield over 5%. Very few investments like this will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly come with dividend growth and this is what I am seeking most.

Source: data from Ycharts.

AWK was once a high yielding stocks but that was right after following the financial crisis. Ever since then, the company has increased its dividend payouts while its yield went ever lower. This is mainly due to the fact that AWK stock price went up by over 125% over the past 5 years (as at October 10th 2017).

AWK meets my 1st investing principles.

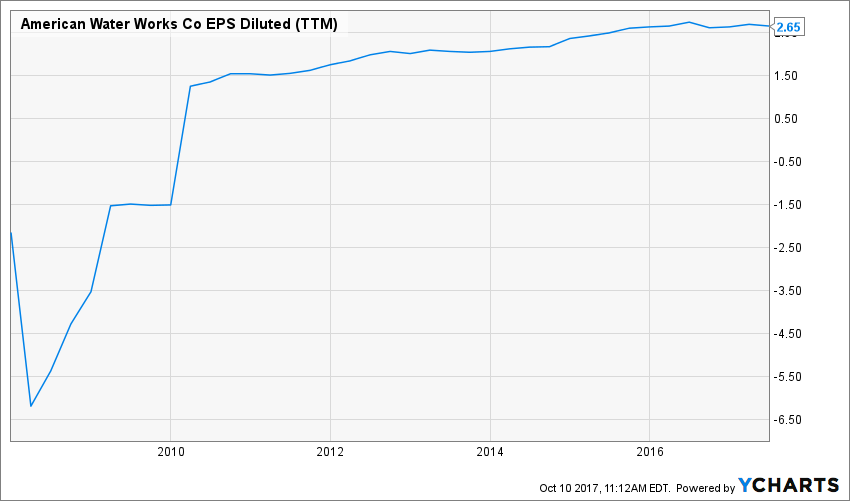

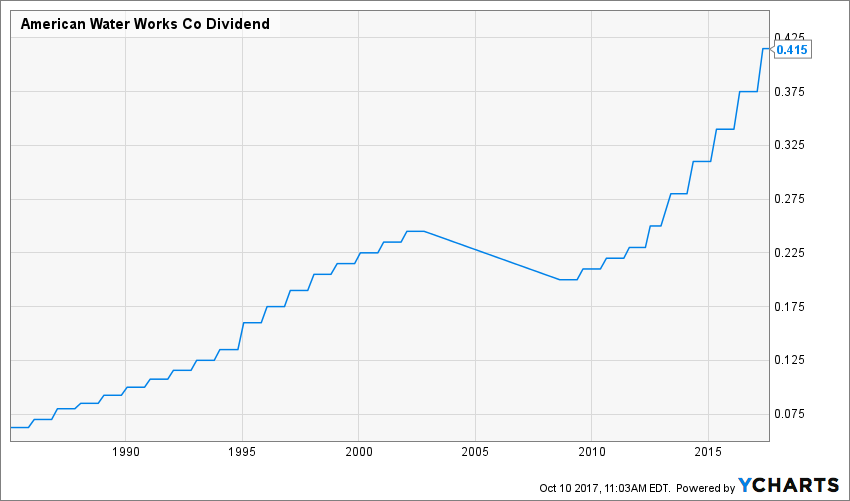

Principle#2: Focus on Dividend Growth

Speaking of which, my second investing principle relates to dividend growth as being the most important metric of all. It proves management’s trust in the company’s future and is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

Source: Ycharts

American Water Works has successfully increased its dividend payments for the pat 8 years. It is only missing 2 more years to become a Dividend Achiever. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

While the company ran into some problems back in the 2000’s the business now seems under control.

AWK meets my 2nd investing principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

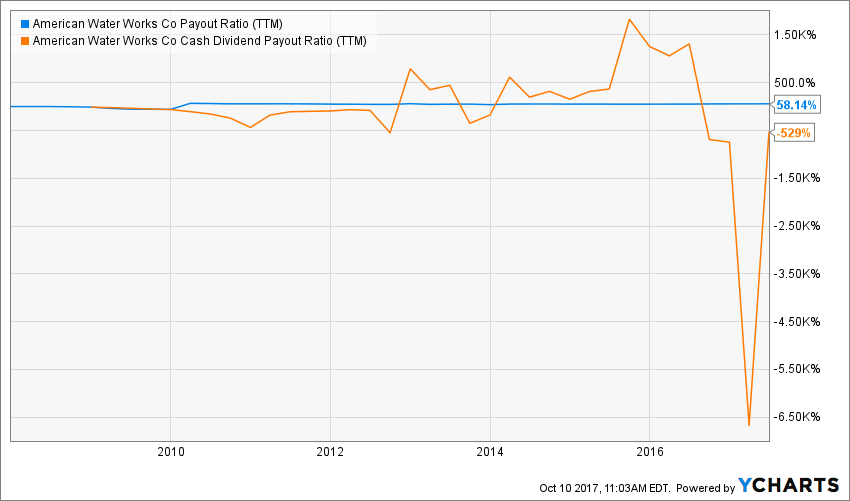

Source: data from Ycharts.

While I respect management commitment to keep its payout ratio between 50% and 60%, its cash payout ratio is all over the place. You would think that a water company would be a strong cash flow business. Unfortunately, AWK has to invest massively in its water pipe network to improve its quality. Such significant CAPEX hurt the business cash flow.

AWK meets my 3rd investing principle… but it is still under watch

Principle #4: The Business Model Ensure Future Growth

AWK business model is quite simple: people need to drink water to live. This situation is not likely to change in the future. The water industry in the U.S. is highly fragmented with many cities struggling with their own water treatment system. Once a company manages a water treatment plan, it operates a small monopoly. As the largest player in this industry, AWK is in a strong position to acquire smaller players and benefit from its expertise and economy of scale. There is no doubt this business will continue to grow in the next decades.

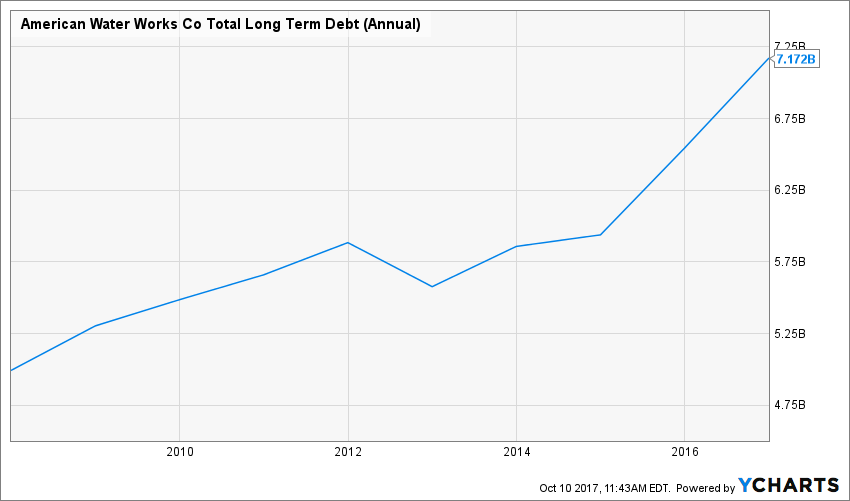

Potential downsides

On a more negative note (because not everything is pink in this world), the investment required to upgrade water connections is more than significant. Expenses to improve the water network could get out of control. As I noted in my 3rd investing principle, the company is bleeding cash to improve this network. Therefore, it has to borrow more money to finance its activities (and dividend payments). Raise of interest rates could hurt AWK profitability has its debt level increased significantly over the past decade.

Source: Ycharts

AWK still shows a strong business model and meets my 4th investing principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

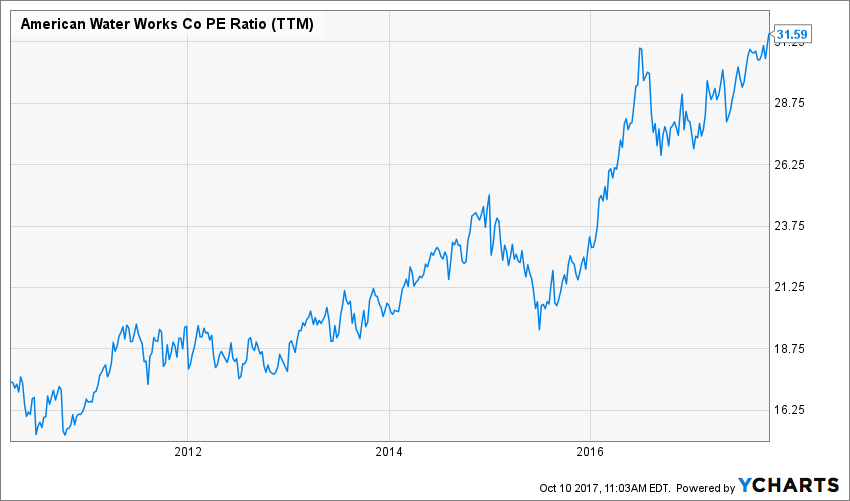

I think the perfect timing to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

Unfortunately, according to the PE valuation, there isn’t any deal with AWK at this price. The company has never traded at a higher multiplier in the past decade.

Digging deeper into this stock valuation, I will use a double stage dividend discount model. As a dividend growth investor, I rather see companies like big money making machine and assess their value as such.

Following the company’s previous dividend growth history, I’ve used an 8% growth rate for the first 10 years and reduced it to 7% afterward. I believe there is lots of room for growth in this market and investors will be rewarded accordingly.

Here are the details of my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.66 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 7.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $233.06 | $116.13 | $77.17 | |

| 10% Premium | $213.64 | $106.45 | $70.74 | |

| Intrinsic Value | $194.22 | $96.78 | $64.31 | |

| 10% Discount | $174.80 | $87.10 | $57.88 | |

| 20% Discount | $155.38 | $77.42 | $51.45 | |

Source: how to use the Dividend Discount Model

In the light of this analysis, I can see that AWK offers some upside potential. The stock value more than doubled over the past 5 years, but the hype around water utilities is not about to finish. There is definitely a little speculation around such pricing, but the industry is promising.

AWK meet my 5th investing principle with a potential upside of 15%

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found that one of the biggest investor struggles is to know when to buy and sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms or not my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

The investment thesis in such company is simple: you are buying shares of a monopoly selling an essential product with repetitive purchases. With a highly fragmented industry and the urgent need for massive investment in water connections, a leader with the size of AWK will find a way to grow its business.

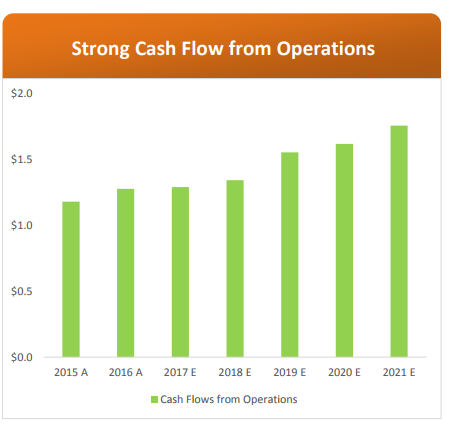

Water needs will continue increase as population grows and there are no substitutes for it. It is also a recession proof business. Finally, AWK is real money making machine with constantly increasing cash flow:

Source: AWK presentation

AWK shows a solid investment thesis and meet my 6th investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

While AWK shows consistent growth pattern due to its business model, I would tend to add a position in a more conservative portfolio. The hype around the water industry may fade at one point and what will remain is a strong dividend payment. In a decade from now, this is the type of company that will pay a higher yield, but with limited stock growth perspective.

AWK is a core holding.

Final Thoughts on AWK – Buy, Hold or Sell?

Overall, I like the business model and the company. I think there will be lots of room in the next decade for growth and the demand for water is indisputable. While the PE valuation seems high, AWK still shows enough dividend growth power under its hood to fuel a higher stock price. AWK is a buy.

Disclaimer: I do not hold AWK in my DividendStocksRock portfolios.

Leave a Reply