Summary

Colgate-Palmolive is a multinational consumer products company with an emphasis on oral care, personal hygiene, and pet nutrition.

-Seven Year Revenue Growth Rate: 6.6%

-Seven Year EPS Growth Rate: 11.5%

-Dividend Yield: 2.52%

-Seven Year Dividend Growth Rate: 13.1%

-Balance Sheet: Moderately Strong

Overall, Colgate-Palmolive has a very strong international position, and a great history of dividend growth, but I view the stock valuation as mediocre. It’s rather richly valued with little margin of safety. I think Colgate stock could make a solid investment if it were to dip into the low $80’s.

Overview

Colgate was founded in 1806 in New York as a soap and candle company. Colgate-Palmolive is now a multinational corporation selling oral hygiene products, soaps, and pet nutrition products. The company currently has a market capitalization of over $44 billion.

Products include Colgate toothpastes and toothbrushes, Palmolive soap, Softsoap, Speed Stick, Irish Spring, and Science Diet, in addition to many more.

Business Segments and Divisions

Colgate-Palmolive consists of two business segments: Oral, Personal, and Home Care, and Pet Nutrition. The company can be understood as consisting of five business divisions, since the Oral, Personal, and Home Care segment is broken down into four geographic regions.

North America

The North American division represents 19% of total company sales.

Latin America

The Latin America division represents 27% of sales.

Europe/South Pacific

The Europe/South Pacific division represents 21% of sales.

Greater Asia/Africa

The Asia/Africa division represents 19% of sales. This has been the largest driver of sales growth.

Hills Pet Nutrition

The Hills Pet Nutrition segment represents 14% of sales. The company hopes to eventually grow this segment geographically.

Breaking the numbers down another way, Oral Care sales represent 43% of total Colgate company worldwide sales, Personal Care sales represent 22% of the total, Home Care sales represent 22% of the total, and Pet Nutrition makes up 13% of the total. Over the past few years, the oral care segment has been the leader in growth.

Revenue, Earnings, Cash Flow, and Margin

The company has an impressive and consistent growth record.

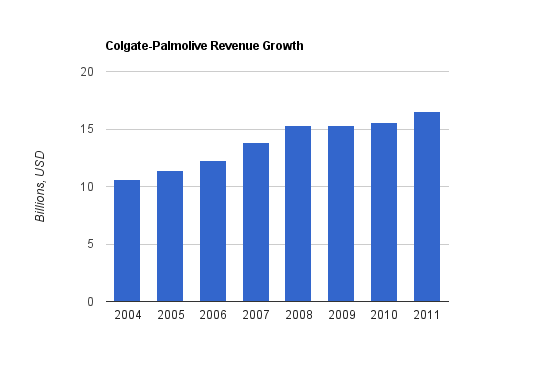

Colgate Palmolive Revenue Growth

| Year | Revenue |

|---|---|

| TTM | $16.54 billion |

| 2010 | $15.56 billion |

| 2009 | $15.33 billion |

| 2008 | $15.33 billion |

| 2007 | $13.79 billion |

| 2006 | $12.24 billion |

| 2005 | $11.40 billion |

| 2004 | $10.58 billion |

The annualized Colgate revenue growth over this period was 6.6%, which is very respectable.

Colgate Palmolive Earnings Growth

| Year | EPS |

|---|---|

| TTM | $4.98 |

| 2010 | $4.31 |

| 2009 | $4.37 |

| 2008 | $3.66 |

| 2007 | $3.20 |

| 2006 | $2.46 |

| 2005 | $2.43 |

| 2004 | $2.33 |

EPS growth over this period was 11.5% annualized, which when combined with the dividend yield over this period, is very good.

Colgate Palmolive Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| 2011 | $3.03 billion | $2.47 billion |

| 2010 | $3.21 billion | $2.66 billion |

| 2009 | $3.28 billion | $2.70 billion |

| 2008 | $2.24 billion | $1.56 billion |

| 2007 | $2.20 billion | $1.62 billion |

| 2006 | $1.82 billion | $1.35 billion |

| 2005 | $1.78 billion | $1.40 billion |

| 2004 | $1.75 billion | $1.41 billion |

Operating cash flow grew by approximately 8.2% over this period, while free cash flow grew by around 8.3%. These are solid growth rates.

Metrics

Price to Earnings: 18.5

Price to Free Cash Flow: 18.5

Price to Book: 17 (due to little equity)

Return on Equity: 90% (due to little equity)

Dividends

Colgate-Palmolive currently yields a moderate 2.52% with substantial dividend growth, and has increased dividends every year for over four consecutive decades (and approaching five), while paying uninterrupted dividends since 1895. The payout ratio is currently a bit under 50% out of either earnings or free cash flow, showing that the dividend is quantitatively safe.

Colgate Palmolive Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $2.27 |

| 2010 | $2.03 |

| 2009 | $1.72 |

| 2008 | $1.56 |

| 2007 | $1.40 |

| 2006 | $1.25 |

| 2005 | $1.11 |

| 2004 | $0.96 |

Divided growth over this period averaged 13.1% per year, on average. The most recent quarterly increase was 9.4%.

How Colgate Palmolive Uses Its Cash

Over the trailing twelve months, CL spent nearly $1.2 billion paying dividends, but spent a bit over $2 billion on share repurchases. This pattern holds true over the last ten years; Colgate has spent more cash on share repurchases than on dividends every year. Over the last ten years, the number of shares outstanding has decreased from 595 to 495, and so the repurchases had an effect on EPS and dividend growth. Acquisitions have made up a fairly small portion of free cash flow usages over the last decade.

What this shows is that Colgate’s free cash flow is genuinely free; it’s spent on shareholders. But what this also shows is that Colgate favors share repurchases over dividends; the yield could be considerably larger in exchange for moderately reduced EPS and dividend growth.

Balance Sheet

Colgate-Palmolive’s balance sheet is somewhat interesting compared to what is normally found in blue-chip consumer products companies.

On one hand, the total debt to equity ratio is nearly 1.8, which is rather high. That’s quite a bit of debt, and it’s one of the reasons that the price to book ratio is so high. In addition, if goodwill is factored out of shareholder equity, there’s not much equity left. Most of the equity consists of goodwill.

On the other hand, the total debt to net income ratio is a bit under 2, which is very reasonable. The interest coverage ratio over 50, which is very high, and means that Colgate’s operating income can cover interest payments more than fifty times over. This is because their interest rates are very low, and their amount of income compared to assets and equity is substantial. Lastly, the existing debt is comfortably structured such that it expires rather evenly over the next several years and onwards.

So in other words, a few of Colgate’s balance sheet metrics are rather poor, but digging a bit more deeply shows that the balance sheet is rather sound. Interest payments are very easily covered, debt is structured nicely, and the company could choose to forgo share repurchases if they were inclined to pay the debt off (which they’re not, since there’s no need). Compared to a peer, Procter and Gamble (PG), Colgate has worse debt/equity metrics, a similar goodwill/equity situation, and superior interest coverage and a superior net income to debt ratio.

Overall, I view Colgate’s balance sheet as moderately strong.

Investment Thesis

Colgate-Palmolive is a very high-quality and diverse international company. Approximately 75% of sales come from outside of North America, and the company defines approximately half of their sales as coming from emerging markets.

The fact that most of the sales of this company come from abroad allows North American investors to participate in the faster growth of some foreign markets. Even among blue-chip American companies that as a group have rather large global exposure, Colgate-Palmolive is ahead of the curve. The company markets their products in over 200 countries and territories, and the Colgate brand has been in Asia for over 50 years and Latin America for over 75 years.

Colgate’s products boast high market shares of their respective markets. For oral care, the company works with dentists around the world to recommend their products, and the same can be said for veterinarians and their pet nutrition products. Oral care in general, tends to receive high brand loyalty, and to a lesser extent, their overall brand strength across most of their products gives them a significant economic advantage. With regards to teeth, maintaining them is rather inexpensive but fixing them is a rather high health care cost, so a few extra dimes or dollars here and there for a familiar brand often go unnoticed. By getting to markets so early, they’ve often been the first mover, the standard.

Risks

Like any company, CL has risks. Their business is fairly recession-resistant, offering high quality basic products, but they face continual risk from foreign exchange rates, commodity costs, and cheaper product alternatives, as well as strong competition from other top brands including from Procter and Gamble, a larger company. The company spends nearly $2 billion per year on advertising to allow them to maintain or grow their market share.

No single customer represents 10% or more of total sales, and no single supplier or packaging material represents a large percentage of total material requirements of the company.

The place where risks for this kind of company would typically manifest themselves are in the profit margins. Increasing advertising costs and increasing commodity costs can squeeze profit margins and reduce income growth.

Conclusion and Valuation

Currently, I think Colgate-Palmolive is a great company at a mediocre price. The international and specifically emerging market exposure is a major strong point for the company. Over a century of uninterrupted annual dividend payments, and nearly a half century of uninterrupted annual dividend growth, coupled with an interesting but moderately strong balance sheet and leading market positions, make the company very strong in my view.

That being said, I think Colgate company stock is somewhat richly valued. My calculations show that, using a discount rate of 10%, perpetual annual free cash flow growth would have to be 6% annually to justify the current valuation, which doesn’t leave much of a margin of safety. Or, a discount rate of 8% requires only 4% annual FCF growth.

Over the long-term, I think Colgate shares look promising in terms of risk-adjusted growth, but I’d prefer to see the company with a stock valuation closer to $80 for better absolute return prospects.

Full Disclosure: I do not have any position in CL at the time of this writing.

You can see my dividend portfolio here.

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

Good post. Interesting remark there about free cash flow. IMO few aquisitions is a big plus since organic growth is safer and cheaper. Colgate is one of my topcandidates but I agree that the current valuation is a bit high.

FCF figures can be deceptive if much of it is used for acquisitions. It can skew DCF analysis for a company if not taken into account.

I think acquisitions are fine for companies like ITW or DOV that specialize in them, as long as their acquisition costs are taken into account when valuing them.

The charts of CL are just beautiful! Slow and steady climb with a dividend to boot! I only started investing in CL recently, but I’m very bullish on CL. Excellent analysis Monk!

Thanks.

I expect CL to continue their long streak of dividend increases. International exposure provides room for continued sales growth as well.

Wow, investors sure are willing to pay an arm and a leg for Colgate. FCF yield is pretty unappetizing, but pretty much what I’ve come to expect from dividend-paying firms in this environment.

I would have to wonder if the major driver of stock appreciation is not almost entirely related to repurchases. Considering that it operates in businesses that are, to some extent, commoditized, there’s no real potential for major margin growth. The industry as a whole also offers limited growth prospects.

I agree with your analysis entirely. This is one that may provide for a reasonable return in excess of corporate debt yields, but total returns look to be pretty weak. It might be time to hang this one up – continued share repurchases will probably keep CL priced higher than is reasonable for a very long time.

Share repurchases are boosting EPS growth and dividend growth, and therefore driving stock appreciation to an extent.

If I recall from the last earnings call transcript, the question regarding margin expansion was discussed with the CEO. Recently, the company’s gross margins were slightly squeezed between advertising and commodity costs, and management was asked, basically, how their already highly efficient metrics could be improved at all. So that point you brought up regarding margins seems to be on analysts minds as well; that margins are pretty much maximized.

Basically, Colgate’s just got to keep increasing market share internationally, maintain market share domestically, and spend most of its FCF back to shareholders, and returns should be, basically as you said, better than bonds but probably not particularly great at this price.

People I have met who are immigrants tell me that Colgate has a quality reputation for their products overseas. I have always thought this company was too expensive.

One concern I have is the share buybacks. They really haven’t reduced the share count that much at all (the most recent annual report showed a recent year over year increase). The shares are being soaked up by options and preference stock issuance.

Based on your analysis I will pass on this one right now due to valuation.