Summary

AFLAC Incorporated (AFL) is a supplemental insurer with a large presence in Japan, as well as the 50 US states.

Five Year Revenue Growth: 7.6%

EPS Growth: 11%

Five Year Growth of Book Value: 8.4%

Dividend Yield: 3.75%

Five Year Annual Dividend Growth Rate: 17%

Price-to-Book: 8.4

Price-to-Earnings: 1.3

I feel that Aflac may be in value territory, but the company’s exposure to European debt adds a level of risk that is significant, and so if held at all, the company should typically only be held as a smaller part of a diversified dividend stocks portfolio.

Overview

AFLAC Incorporated (NYSE: AFL) is a large international supplemental insurer. They provide cash that can cover all sorts of expenses to those receiving payouts due to illness or deaths. This is supplementary to primary medical insurance which helps cover medical expenses but leaves other expenses without a solution, by covering some of those expenses. This Fortune 500 company was founded in 1955, and has a large presence in Japan and the US. AFLAC stands for the American Family Life Assurance Company.

The company made a big move in Japan in the 1970s by selling insurance for cancers when people were becoming particularly mindful of cancer. Now, according to the 2010 annual report, Aflac insures employees at 89% of the companies on the Tokyo Stock Exchange, and 1 in 4 Japanese households, with a variety of products, including non-cancer related insurance.

Aflac primarily targets places of employment for its insurance products, rather than individuals outside of work. The company offers plans to employers that allow them to provide Aflac insurance as part of their benefits package without paying any cost themselves.

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. An insurance company constantly receives premiums and pays out for losses, so as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. Aflac invests its stored up collection of assets primarily in fixed income securities to receive upwards of $3 billion in annual investment income.

Revenue, Earnings, Book Value, and Metrics

Aflac has had impressive growth over this five year period.

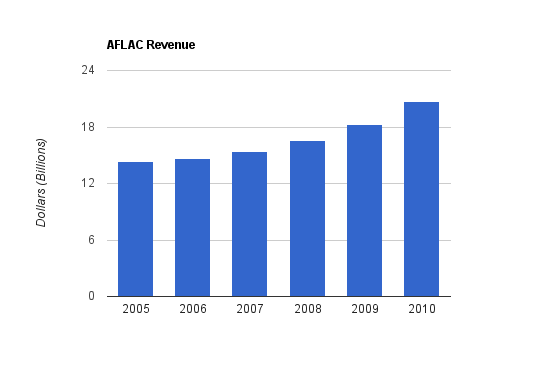

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $20.732 billion |

| 2009 | $18.254 billion |

| 2008 | $16.554 billion |

| 2007 | $15.393 billion |

| 2006 | $14.616 nillion |

| 2005 | $14.363 billion |

Revenue grew at at an average annual rate of 7.6% over this period.

For 2010, of the $20.7 billion in revenue, slightly over $18 billion came from insurance premiums, while slightly over $3 billion came from investment income. And then there was a bit under a half billion dollars worth of impairments, resulting in the $20.7 billion of revenue.

Of the premiums, approximately 75% comes from Japan, while the remaining 25% comes from the US.

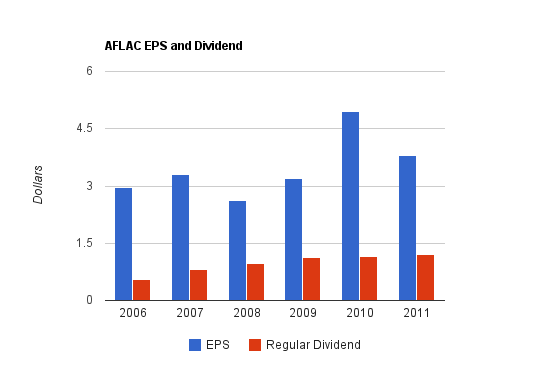

EPS Growth

| Year | EPS |

|---|---|

| 2010 | $4.95 |

| 2009 | $3.19 |

| 2008 | $2.62 |

| 2007 | $3.31 |

| 2006 | $2.95 |

| 2005 | $2.92 |

Earnings Per Share grew at over 11% for this period. For the trailing twelve month period, however, EPS is down to $3.81. Total net income for 2010 was $2.344 billion.

Book Value Growth

| Year | Book Value Per Share |

|---|---|

| 2010 | $23.37 |

| 2009 | $17.94 |

| 2008 | $13.87 |

| 2007 | $17.80 |

| 2006 | $16.62 |

| 2005 | $15.61 |

Aflac grew its book value at 8.4% per year, on average, over this period.

Metrics

Price to Earnings: 8.4

Price to Book: 1.3

Dividend Growth

Aflac has had decades of consistent dividend growth. The current dividend is 3.75%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.20+ |

| 2010 | $1.14 |

| 2009 | $1.12 |

| 2008 | $0.96 |

| 2007 | $0.80 |

| 2006 | $0.55 |

Aflac has grown the dividend by nearly 17% per year over this period. Some of this was tied to EPS growth, while some of it was tied to increasing payouts. Over the long term, Aflac will be limited to raising the dividend at around the level of EPS growth.

The payout ratio for 2010 was approximately 23%, while the payout ratio is currently around 31%.

share repurchases

Aflac supplements income growth with a mild amount of share repurchases to grow EPS and the dividend at a quicker rate. Over the trailing twelve month period, Aflac paid $533 million in dividends and repurchased approximately $300 million net worth of stock.

Portfolio

Aflac has Yen-denominated and US Dollar-denominated investments from around the world.

Securities Available for Sale:

Of Aflac’s approximately $58 billion portfolio of securities available for sale, a bit over $7 billion is invested in perpetual securities, and most of this is Yen-denominated banks and financial institution investments. The other approximately $51 billion consists of fixed income securities. Of that $51 billion, over $33 billion are Yen-denominated. A bit over half of this $33 billion is invested in Japanese government and agency securities, and the remainder is split between mortgage backed securities, banks, utilities, other corporations, and sovereign/supranational debt. The other portion of the $51 billion is invested in approximately $18 billion worth of US Dollar-denominated fixed income securities, and of this $18 billion, over $8 billion is in corporate debt while the rest is split between mortgage backed securities, utilities, banks, US government debt, and sovereign/supranational debt.

Securities Held to Maturity:

Of Aflac’s approximately $32 billion portfolio of securities held to maturity, all of it is Yen-denominated, and around $12 billion is invested in banks and financial institutions, $6 billion is in utilities, and the remainder is in mortgage backed securities, government, etc.

Portfolio Notes:

-Over $7 billion of the portfolio is invested in sovereign/supranational debt, and most of it is Yen-denominated.

-Approximately $1 billion is currently invested in a combination of Spain and Italy sovereign debt. This is largely unchanged compared to 2010.

-Around $27 billion of the portfolio is invested in banks and financial institutions. The majority is Yen-denominated.

-Approximately $1.5 billion is currently invested in banks and financial institutions of Ireland, Italy, Portugal, and Spain. Compared to 2010, this figure is significantly reduced, as Aflac used to have considerably more invested in financial institutions from these countries, plus over a billion invested in Greek financial institutions which they have closed the position on.

-The exposure of financial institutions to European debt issues spans significantly outside of the banks of the affected countries.

Investment Thesis

Aflac has a notable business model. Rather than targeting individuals, Aflac insurance agents target businesses. Aflac works with employers to give employees the option to purchase Aflac Insurance via payroll deductions, similar to their other benefits. This “cluster-selling” technique keeps costs comparatively low, and gives the company a major competitive price advantage. It creates a win-win situation with employers it does business with.

In addition to having a solid distribution network for its insurance products, Aflac has a strong brand name that is well known in Japan and US, with the duck mascot. The brand is stronger than most other insurers, especially in Japan.

Plus, its insurance is rather resistant to health care reform or other insurance regulation (although not untouched). The company provides supplemental insurance; cash to people when they need it most.

Also, the company has been recognized as one of the “World’s Most Ethical Companies” by Ethisphere Magazine, and also one of the best places to work. It has won similar awards from a variety of sources.

So why the low valuation? The company is trading at under 9 times current earnings, and under 6 times forward earnings. The reason is the portolio’s exposure to European debt; mainly in banks/financial institutions. Aflac is currently restructuring its portfolio to reduce risk, and this is resulting in realized losses. For example, the company closed out a large position in Greek financial institution debt, and reduced positions in certain other European banks. The market is clearly factoring in continued restructuring, and fears that the exposure could be even worse than it appears.

There are factors in Japan as well. The tsunami and nuclear disaster could result in increased claims, including cancer claims. Alternatively, it may strengthen their cancer insurance business. Japanese deregulation has resulted in increased competition, but also allows Aflac to sell its insurance products in more places, and currently sells in banks and post offices.

Aflac’s US exposure is significantly smaller than its Japanese exposure despite being a US-based company. Their brand name and their customer retention rates are not as high in the US as they are in Japan, but the alternative side to this is that there is more growth opportunity.

Overall, I believe Aflac is in value territory, although an investment in Aflac should not be taken lightly, as the risks are real. Even though only a portion of the portfolio is in European sovereign or financial institution debt, insurance companies like Aflac that require liquidity and conservative capital positions cannot afford to have large swings in their portfolio value, and it can be nearly impossible to predict possible cascading failures of banking systems or economies. Even a minor reduction in investment income results in a major decrease in shareholder earnings, since earnings for Aflac are mostly based on their investment income. A $1 billion+ drop in the value of certain securities can completely overshadow even a good insurance year. Still, for investors that want to be greedy when others are fearful, a well-run, reputable, and growing insurance business that is currently crippled by European debt exposure may be the way to go if some of the worst case situations don’t occur.

Risks

In addition to all the regular risks of the insurance business, including a very competitive environment, regulation, and the commodity nature of their products, Aflac has exposure to Japanese environmental problems, and the European debt situation.

Aflac’s business model provides them with cost advantages over their competitors, but this is only a moderately strong economic advantage, since it’s a model that can potentially be copied by competitors. It is unlike competitive advantages that are due to scale or monopolies which are not easily copied. However, the company also has a considerable brand name, and customer retention is fairly high, since customers lock in fairly low premium rates when they initially purchase the insurance.

Conclusion and Valuation

In conclusion, Aflac holds considerable risk, but the company is reducing portfolio risk at the cost of realizing losses. If their bank debts don’t have the worst possible scenarios, this moderate-term restructuring may provide patient long-term investors with a considerable buying opportunity at the current valuation. But multi-million dollar losses are virtually assured based on current market value, so a low valuation is deserved. Over the last several months, approximately $25 has been cut from the stock price, so the valuation is lower, and an investor can get in at a considerably higher yield compared to what it was before.

Buying under $30 and getting a yield of over 4% may be a good long term move if the stock dips down to that level, but there is considerable risk that even thorough analysis can’t fully take into account, let alone a brief look. Even though AFL trades for low earnings multiples, it’s still trading with a sizable margin above book value. I’d potentially be willing to buy AFL for the riskier side of my portfolio under $30, based on the fundamentally solid business operations, the long history of dividend growth, the solid current dividend yield that is easily covered by earnings, while taking into account the balance sheet exposure to Europe. But I would avoid any large positions.

Full Disclosure: I have no position in AFL at the time of this writing.

You can see my portfolio here.

If you liked this article, consider subscribing to get my articles delivered to your email or reader.

Further Reading:

Harleysville Group (HGIC) Dividend Stock Analysis

Walmart (WMT) Dividend Stock Analysis

Waste Management (WM) Dividend Stock Analysis

Pepsico (PEP) Dividend Stock Analysis

Energy Transfer Equity (ETE) Partnership Analysis

One thing I like to look at with insurance companies is actually the p/e based on operational earnings. You list, along with most people that they are trading at a p/e of about 9. But this earnings multiple takes into effect earnings based on operational earnings plus investment earnings. Looking at the overall earnings of an insurance company can often give off p/e’s that can be abnormally high or low based on what the bond markets are doing at the time. Looking at operational earnings smooths this out to give us a better idea of the direction of the insurance company as a company that sells a product. Aflac has a trailing earnings of $5.99 a share, which gives it a p/e of 5.2 right now which seems absurdly low, even for a company that traditionally trades at a low p/e.

Combine the low valuation with their growing dividend, close a 4% yield, and low payout ratio and Aflac is a very good stock which I have continued to add to my position on as it continues to sink. It is a stock I liked above $50, and one I really liked at $40, and one I am head over heels with in love with at $31.

Great analysis here Matt. Terrific information, as always.

I initiated a position in AFL at $34.74, as you know. I agree that it should be a smaller position in a conservative dividend growth portfolio for the increased risk. I really think the low valuation provides an excellent entry point right now. I think the downside is fairly limited, while the upside is pretty significant. I liked the commend above mine, and liked/loved/fell head over heels around the same points. I would add to my current position at the current levels (10% lower than my cost basis), but I agree completely that it should be a smaller position.

Thanks for your analysis on this one. I really appreciate your point of view.

Hey Matt,

Excellent analysis per usual. I’ve yet to read an article of yours where I do not feel more informed and educated afterward. Could be a lack of knowledge on my part but more likely it’s mastery of the delivering of information on your part.

If I had a nickel for every time someone said “You’re in dividend paying stocks? Why? You have so much time to ride out the volatility!” I’d be able to retire. Personally, I feel investing in companies like Aflac which have great potential but also potential risk is about as risky as I’m willing to go. I like the risk versus reward on AFL and I am of the camp that believes things generally appear more “doom and gloom” than they really are.

Long AFL.

Nice Analysis here. I don’t own any AFL, but I’m considering it. I am concerned about the exposure to european debt, but at some point, the stock fundamentals outside of that begin to outweigh the european debt risk.

Though the current environment isn’t good for insurance companies in general, I think long term, AFLAC will be good bet.