As they get to their 50s or 60s, nearing retirement or already retired, many investors start chasing income and ignoring growth in their portfolio. This might seem logical, but it can spell trouble, and jeopardize their retirement.

You can listen to Mike’s Podcast

If you’re one of these investors, perhaps all you care about is your dividend income, and you’re not concerned about total returns (dividend + stock price appreciation).

I understand the need to know that you’ll have enough income, in the form of dividends, coming in regularly to sustain your lifestyle. I also grasp how simple it would be to have your income needs fulfilled exclusively by dividends; after all, if you need $50,000 per year and you have $1,000,000 invested, build your portfolio to generate a 5% yield in dividends, and you’re done! Nothing else to think about, easy, simple.

This thinking comes from looking at your portfolio as if it were an annuity that you built. An annuity is a contract that fully guarantees that whatever capital you put in it, you’ll receive a 5%, 6%, or 7% yield pretty much forever. But…

Dividends aren’t guaranteed!

A dividend stock portfolio is not a guaranteed annuity. Companies can cut their dividend at any time as they are under no obligation to keep paying dividends. A business paying a dividend is using its extra cash to reward you for your patience and your trust in that business.

Think of it like paying your children an allowance to encourage them to manage their money and appreciate the value of things. What happens if you lose your job, and find yourself struggling to put food on the table? Do you continue to pay their allowance but make them skip breakfast? Of course not. You cut their allowance and use that money for essential spending while you find another job and right the ship. It’s not great and it will upset your children, but it’s better than not doing it.

Similarly, if a company is crumbling under a heavy debt burden, its revenue and profit are falling, and/or its free cash flow is not enough to pay the dividend, cutting the dividend is the responsible thing to do. For retirees though, a dividend cut is at best upsetting, disturbing, and at worst a danger to their quality of life. Also remember that dividend cuts are often accompanied by a drop in the stock price, so investors lose on both dividend income and stock value. Ouch! See Sniff Out Dividend Cuts.

Get great stock ideas in our Rock Stars list!

The risks of high yields

When looking at all the companies that pay high dividend yields, we see that it’s easy to build a high-yield portfolio. However, I would argue that at around 5% yield, it’s getting too high. Why? There’s no free lunch in finance; companies to pay high yields for a reason, and it’s not out of the kindness of their hearts. That’s not how it works on the market.

Companies pay a high yield because the market doesn’t believe in the growth of those businesses. Why does that matter to you if you’re unconcerned with growth?

I’m a business owner. Let me tell you that if my business doesn’t grow constantly and reaches a plateau, it’s stagnating. Plateaus don’t last long; you either come up with new growth vectors to thrive again, or you decline. Do you want a portfolio filled with declining companies?

What usually happens with companies that pay a high yield but fail to find ways to grow? Eventually, they suffer and then suffer some more. It gets to the point where they have no choice but to lay off staff, restructure the organization, and eventually cut the dividend. Dividend money isn’t free, and they need to reallocate that money to make sure that the business can recover and thrive again, or perhaps just to save the business for a few more quarters.

What usually happens with companies that pay a high yield but fail to find ways to grow? Eventually, they suffer and then suffer some more. It gets to the point where they have no choice but to lay off staff, restructure the organization, and eventually cut the dividend. Dividend money isn’t free, and they need to reallocate that money to make sure that the business can recover and thrive again, or perhaps just to save the business for a few more quarters.

Remember AT&T?

AT&T was a dividend aristocrat showing more than 35 consecutive years of dividend increase. You know what happened with AT&T: the stock price fell, and it cut its dividend. Never take dividend income for granted. Chasing income and ignoring growth is a very risky play because when you suffer the dividend cut, you probably also lose stock value.

Get great stock ideas in our Rock Stars list!

What’s an investor in need of income to do?

So, what do you do? Switch your entire portfolio around to only focus on 1% and 2% yielders? Not necessarily. You could build a portfolio with 3% and 4% yielders. That would be a good balance.

If income is your main concern, your attention should not be on the dividend yield, but rather on a set of metrics that show the health of the dividend. This makes sense for all investors regardless of age. You might sacrifice 1% or 2% in yield, but you ensure that:

- The dividend will continue to be paid

- More importantly, the dividend will continue to increase and match inflation. $10,000 today and $10,000 in 15 years won’t last you as long, right? You don’t want to lose your buying power down the road.

I believe the safest way to build a portfolio, even in retirement, is to concentrate on dividend growers and have a sizeable portion of your portfolio in low-yield, high-growth stocks that are thriving. That is my strategy, and I will stick to it for the next 40 years or more. Another reason is that I don’t only invest for myself but for my spouse, my children, and one day my grandchildren. As a result, I’ll keep a long-term investing horizon, even in my 70s or 80s.

Takeaway

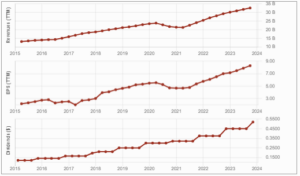

We see that chasing income and ignoring growth can lead to big problems. The key point to spare yourself the pain is to avoid stagnating and declining companies by verifying that the dividend is healthy. Review the dividend triangle, the payout ratio, and the trend of dividend growth to see if it’s accelerating, slowing down, or worse, stagnating. For more details, see Detect Losers and Find Winners with the Dividend Triangle.

Red flags? A company whose management “forgets” to grow its dividend for a year, dividend growth that is slowing down, and a high yield. With these, you’re one step away from a dividend cut and from losing value om top of income. There’s no coming back from this. As always, also track the trend of revenue and EPS to ensure growth vectors exist and work.

It seems like dividends from etfs are a good bet

I still own 1000 shares of T

At one point I owned 2500

Widows and orphans

Hi Mike,

Based on this, do you think BCE’s dividend is in jeopardy of being cut?

If my calculations are correct….

A $1,000,000 portfolio earning a 4% dividend will produce $40,000 in income annually. If that dividend grew at the rate of 10% annually, the income would grow to $178,100 after 15 years. (I use 10% because I believe it is relatively to construct a diversified portfolio that can do much better that that.)

If the inflation rate was 3% annually over those 15 years, $40,000 would have to grow to $62,700 to preserve its buying power. The $178,100 provides a comfortable margin over that for this investor.

A $1,000,000 portfolio earning a 7% dividend it would produce $70,000 annually. If that dividend grew at a rate of 1% annually, the income would grow to $81,300 after 15 years.

If the inflation rate was 3% annually over those 15 years, $70,000 would have to grow to $109,972 to preserve its buying power. The $81,300 is insufficient to maintain the buying power of this investor, putting their retirement at serious risk.

Please clue me in to investments that yield 4% where that dividend grows consistently at 10%/annum?

My experience is that any company that has the growth required to allow dividend payout increases of 10% annually, will have a yield less than 1%.

RBC traditionally yields around 4% but their dividend growth rate is in the 3% range. Alternatively Apple yields just .44% while it’s 5 year dividend growth rate is around 6.6%.

Something else to consider: In the last 12 years, while RBC’s stock price has less than tripled, Apple’s stock has shot up by around 11 times. Looking at dividend returns is only part of the equation. Changes in the value of the underlying asset should also be taken into account when considering returns over time.